Global| Jan 22 2019

Global| Jan 22 2019Philadelphia Fed Nonmanufacturing Business Activity Slumps Again in January

by:Sandy Batten

|in:Economy in Brief

Summary

The Federal Reserve Bank of Philadelphia reported that its Nonmanufacturing Business Index of current conditions at the company level slumped further to -0.2 in January from 6.4 in December and 41.2 in November. 31.3% of respondents [...]

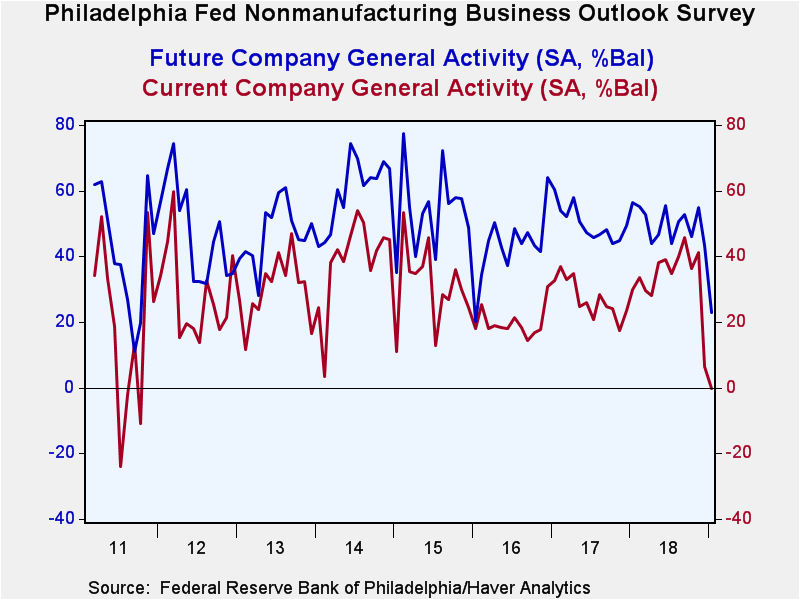

The Federal Reserve Bank of Philadelphia reported that its Nonmanufacturing Business Index of current conditions at the company level slumped further to -0.2 in January from 6.4 in December and 41.2 in November. 31.3% of respondents reported a decline in overall activity in January, the highest reading since July 2015, while only 31.1% reported an increase, the second lowest reading in the history of the series dating back to March 2011 (the lowest reading was in July 2011). This is the first sub-zero reading for the current conditions index since October 2011 and only the fourth in the admittedly short history of the series. The expectations index fell even harder in January than did the current conditions index, dropping to 22.9 from 43.2 in December and 54.9 in November.

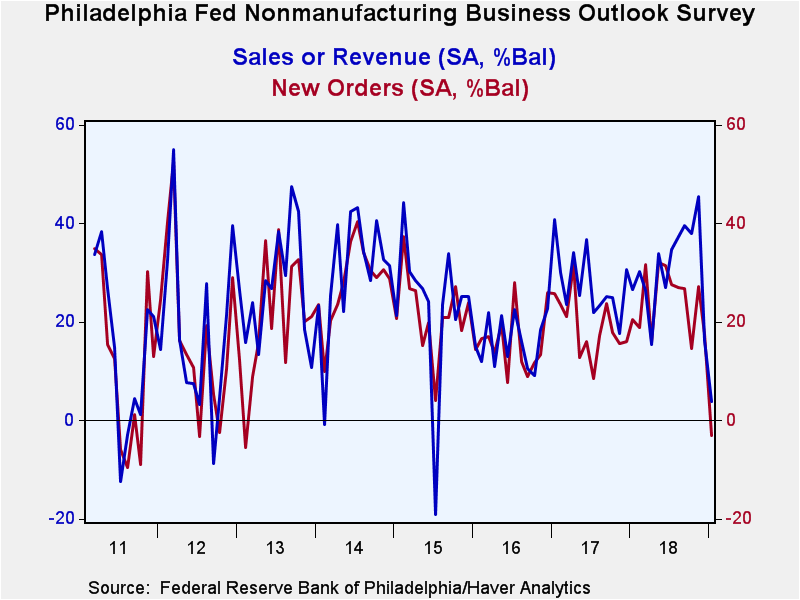

As one would expect given the drop in the general activity index (which is constructed from responses to a separate question, not from components), most activity components weakened considerably in January. New orders slumped to -3.1 from 17.5 in December and 27.3 in November, its first negative reading since February 2013. And sales dropped to 3.9 from 16.3 in December and 45.5 in November, its lowest reading since July 2015.

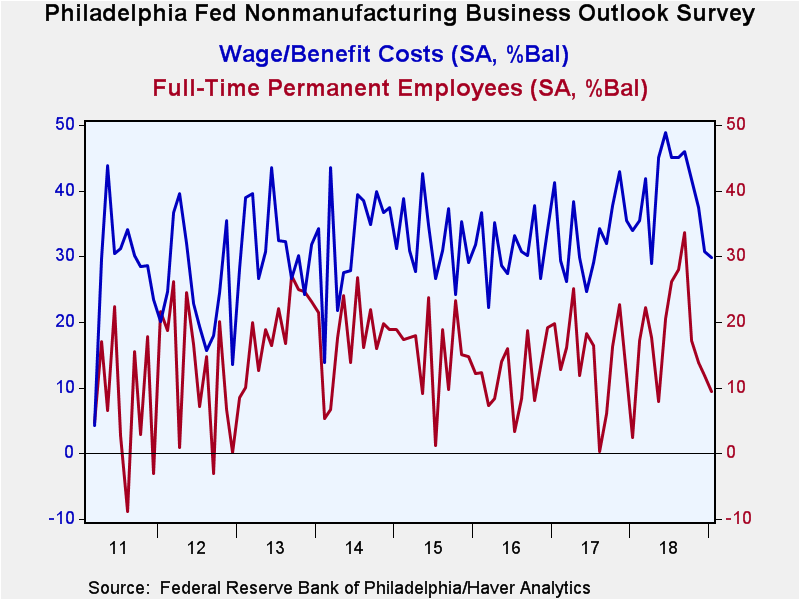

Labor market indicators in the survey did not convey as much weakness as did the activity indicators. The number of full-time employees index fell but only to 9.4 in January from 11.8 in December, indicating that more firms were adding to payrolls. And the wages and benefits index edged down to 29.8 from 30.7, pointing to further wage gains.

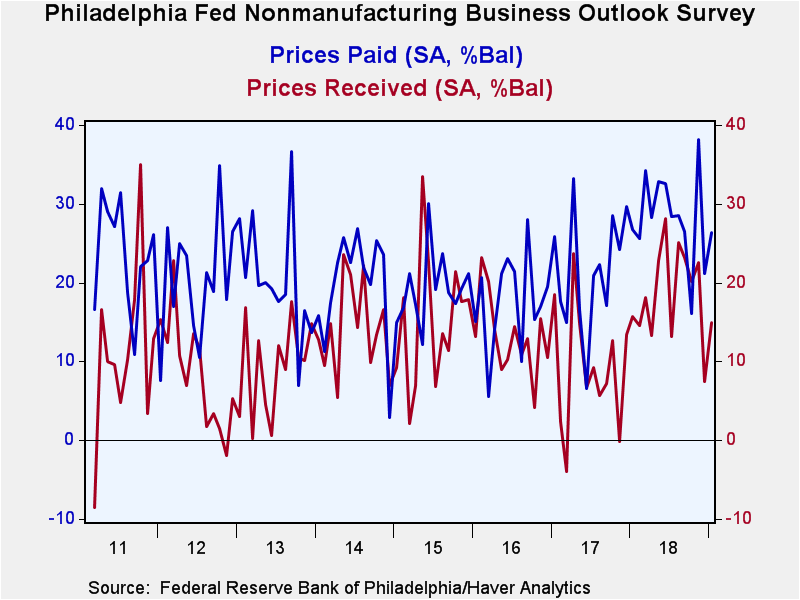

The index of prices paid in January rose to 26.3, reversing some of its sharp drop to 21.2 in December from 38.1 in November. The prices received index also rebounded in January, rising to 14.9 after a sharp drop to 7.5 in December.

The index for capital spending on equipment and software fell for the second consecutive month in January to 18.8, while the capital expenditures for facilities index increased to 17.9 in January from 14.3 in December.

The Philadelphia Fed figures are diffusion indexes which are calculated by subtracting the percent of respondents reporting poorer business conditions from those reporting improvement. So, readings above zero indicate more positive than negative responses. These indexes have a good correlation with growth in the series covered. The data are available in Haver's SURVEYS database.

| Federal Reserve Bank of Philadelphia: Nonmanufacturing Business Outlook Survey (Diffusion Index, SA) | Jan | Dec | Nov | Jan'18 | 2018 | 2017 | 2016 |

|---|---|---|---|---|---|---|---|

| General Activity - Company | -0.2 | 6.4 | 41.2 | 30.0 | 33.6 | 27.3 | 19.7 |

| New Orders | -3.1 | 17.5 | 27.3 | 20.6 | 24.3 | 19.2 | 15.8 |

| Sales or Revenue | 3.9 | 16.3 | 45.5 | 26.7 | 30.9 | 27.9 | 16.1 |

| Inventories | 6.5 | 7.8 | 6.4 | -1.8 | 5.2 | 3.8 | 4.3 |

| Number of Full-Time Permanent Employees | 9.4 | 11.8 | 13.8 | 2.4 | 18.2 | 14.8 | 11.7 |

| Prices Paid | 26.3 | 21.2 | 38.1 | 26.8 | 28.3 | 21.4 | 17.6 |

| Wage & Benefit Costs | 29.8 | 30.7 | 37.5 | 33.9 | 40.0 | 33.4 | 31.2 |

| Expected General Activity - Company | 22.9 | 43.2 | 54.9 | 56.4 | 50.2 | 50.1 | 43.2 |

Sandy Batten

AuthorMore in Author Profile »Sandy Batten has more than 30 years of experience analyzing industrial economies and financial markets and a wide range of experience across the financial services sector, government, and academia. Before joining Haver Analytics, Sandy was a Vice President and Senior Economist at Citibank; Senior Credit Market Analyst at CDC Investment Management, Managing Director at Bear Stearns, and Executive Director at JPMorgan. In 2008, Sandy was named the most accurate US forecaster by the National Association for Business Economics. He is a member of the New York Forecasters Club, NABE, and the American Economic Association. Prior to his time in the financial services sector, Sandy was a Research Officer at the Federal Reserve Bank of St. Louis, Senior Staff Economist on the President’s Council of Economic Advisors, Deputy Assistant Secretary for Economic Policy at the US Treasury, and Economist at the International Monetary Fund. Sandy has taught economics at St. Louis University, Denison University, and Muskingun College. He has published numerous peer-reviewed articles in a wide range of academic publications. He has a B.A. in economics from the University of Richmond and a M.A. and Ph.D. in economics from The Ohio State University.

More Economy in Brief

Global| Feb 05 2026

Global| Feb 05 2026Charts of the Week: Balanced Policy, Resilient Data and AI Narratives

by:Andrew Cates