Global| Apr 05 2017

Global| Apr 05 2017PMIs Continue Very Strong Across EMU-What Does It Really Mean?

Summary

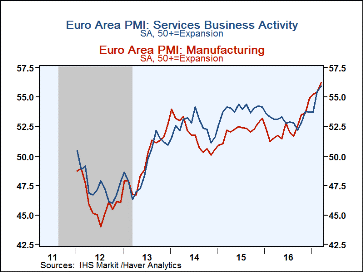

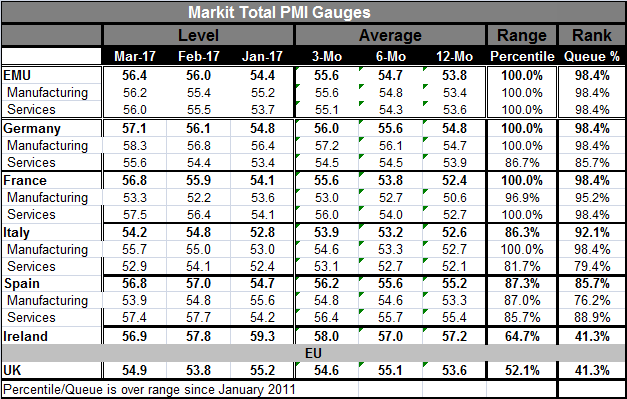

The strength in survey data or 'soft-data economic reports' continues in March as the finalized EMU PMI shows a headline, manufacturing reading and a service sector reading that all are on five-year-plus highs (all of these gauges are [...]

The strength in survey data or 'soft-data economic reports' continues in March as the finalized EMU PMI shows a headline, manufacturing reading and a service sector reading that all are on five-year-plus highs (all of these gauges are 'this high or higher' only 1.6% of the time) over the past five years. In Germany, the services sector is slightly off peak on this horizon. In France, manufacturing is slightly off peak. In Italy, services are off peak. In Spain, both sectors are off peak.

The strength in survey data or 'soft-data economic reports' continues in March as the finalized EMU PMI shows a headline, manufacturing reading and a service sector reading that all are on five-year-plus highs (all of these gauges are 'this high or higher' only 1.6% of the time) over the past five years. In Germany, the services sector is slightly off peak on this horizon. In France, manufacturing is slightly off peak. In Italy, services are off peak. In Spain, both sectors are off peak.

In Ireland, the total index has slipped for the second month in a row and has a 41st percentile standing. In the U.K., the total index is up month-to-month, but March has not made up the entirety of the February slip leaving the total index below its January level and also at its 41st queue percentile standing.

The EMU region is doing well on this gauge. But as we saw yesterday, hard data on retail sales were not so strong. Today the PMI data for the U.K. and Ireland also fall short of EMU area aggregate scores.

U.K. Economy

The U.K. economy swirls amid many cross currents. Importantly, sterling fell sharply in the wake of the Brexit vote giving the U.K. a sudden advantage on the competitiveness front. Now Brexit negotiations are moving ahead or at least the negotiations over having negotiations are taking place. It's like the bell has rung and two heavy-weight fighters are circling one another. For now there is only jousting with verbal abuse no one has yet thrown punch. But that part is coming. The U.K. is experiencing some increase in labor productivity. Despite the past weakness in sterling and the jolt of inflation from rising oil prices, British shop prices fell last month. And demand is holding up well as British vehicle registrations surged logging their biggest rise ever in March.

Elsewhere the Russian and Japanese services sectors have gained pace.

Global context

On balance, there is more improving than backsliding this past month globally as manufacturing gauges in 15 bellwether countries showed monthly manufacturing sector PMI index backtracking in only six of them with only one country (South Korea) showing outright output contraction. Services are less widely reported, but in a sample of seven countries only the U.S. showed slippage in March. The U.S. services (formally nonmanufacturing) report which we can evaluate over a longer timeline ranks the nonmanufacturing sector gauge as having only a 55th percentile standing (better 45% of the time). The Markit gauge, which is only five years long, evaluates the U.S. services sector as having a 32nd percentile queue standing. But on that shortened (Markit) timeline, the U.S. nonmanufacturing ISM has a 46th percentile, standing down very sharply from last month's 88th percentile standing. The ranking is definitely a function of the time span but also look at the difference in standing a 2.4 point drop has on the ranking in one month! This sort of instability makes us unclear where the economy stands. A ranking ought not shed 40 ranking points in one month. In the last 16 years, the nonmanufacturing ISM has fallen more sharply only 14 times. And if there is a real global recovery in place, why would the U.S. services sector backtrack so sharply? It is not a good recovery when it raises more questions than answers.

Revival yes...but how much?

Perhaps those figures serve to highlight what we are seeing in survey data over all. But by the standards of the recovery and these past five years or so, global metrics are looking pretty good. As we saw with EMU retail sales volumes yesterday, retail values for the EMU are back above prerecession levels. But that is a very low bar for success since it implies a gain of about 0.2% per year (not per month) over the past nine years. Clearly conditions are stirring and there is some improvement. Just as clearly we need to pick carefully what the point of reference will be for evaluating incoming data. The best 'XXX' (you fill in the 'X's) in five or six years still may not be very good. You can't measure yourself in inches one day and centimeters the next and think that you are getting any directly useful information without doing some conversions. In economics, the equivalent of those conversions involves using broader periods for evaluation. Notwithstanding that observation, there is evidence of economic improvement. I'm just not sure about the pace. Both the Fed and ECB are grappling with the same issue. Both see improvement and both wonder when the time is ripe for a gear shift. The Fed has already started that process and is contemplating its next shift, but the ECB remains wary.

Prospects...

What we seem to have in play is an economic revival of some sort. And there is some sense of it being in concert involving both the U.S. and Europe. And that observation by itself is encouraging. Having the global business cycle on your side is a big plus when it happens. Still, it is not transcending the soft data in a meaningful way and that is the reason for some ongoing skepticism. And now some of the supporting soft data are getting softer themselves- at least in the U.S. Still, taken in isolation Europe, after all, is not doing anywhere near as well as its queue rankings would have us believe and that is all because of the weak nature of this recovery. It is a poor benchmark to judge any pick up by. Things are getting better, but are they really good enough? Draghi said yesterday that he is becoming surer that policy is right. The backtracking for inflation for the moment has silenced some German criticism. But this situation is in flux. And we have seen to many false dawns in this recovery to think that we can take the first glimmer of sunlight as real and lasting.

Robert Brusca

AuthorMore in Author Profile »Robert A. Brusca is Chief Economist of Fact and Opinion Economics, a consulting firm he founded in Manhattan. He has been an economist on Wall Street for over 25 years. He has visited central banking and large institutional clients in over 30 countries in his career as an economist. Mr. Brusca was a Divisional Research Chief at the Federal Reserve Bank of NY (Chief of the International Financial markets Division), a Fed Watcher at Irving Trust and Chief Economist at Nikko Securities International. He is widely quoted and appears in various media. Mr. Brusca holds an MA and Ph.D. in economics from Michigan State University and a BA in Economics from the University of Michigan. His research pursues his strong interests in non aligned policy economics as well as international economics. FAO Economics’ research targets investors to assist them in making better investment decisions in stocks, bonds and in a variety of international assets. The company does not manage money and has no conflicts in giving economic advice.

More Economy in Brief

Global| Feb 05 2026

Global| Feb 05 2026Charts of the Week: Balanced Policy, Resilient Data and AI Narratives

by:Andrew Cates