Global| Nov 02 2007

Global| Nov 02 2007PMIs in MFG are All Losing Momentum… but Still Showing Growth

Summary

Is the thrill gone?EMU indexes stand more or less mid range. In October the MFG PMIs are losing momentum. The chart on the left shows the year-over-year percentage drops in the levels of the index for key EMU countries. Although the [...]

Is the thrill gone?EMU indexes stand more or less mid range.

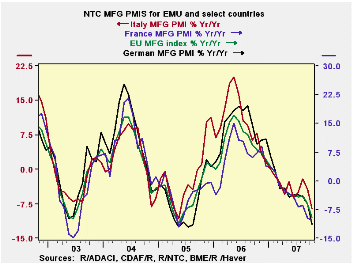

In October the MFG PMIs are losing momentum. The chart on the

left shows the year-over-year percentage drops in the levels of the

index for key EMU countries. Although the various nations are at

different levels in terms of their respective MFG indexes they are all

declining in a very sympathetic bunched fashion.

The big countries - Germany, France, Italy and Spain – all

have indexes clustered just north of their 50 breakeven marks. Spain

has slipped below 50, the breakeven point for expansion/contraction. In

terms of their respective range of values we find France and Spain are

lower in their range percentiles. France’s raw reading of 50.54 is in

the bottom 38 percentile of its range even though that PMI reading is

above 50. The MFG PMI in France has simply tended to be stronger than

in other countries.

Some of the smaller countries (Ireland, Greece, Austria and

the Netherlands) have PMI ratings that are much higher in their

respective ranges with raw PMI scores as high as 56. Greece has a PMI

reading that ranks in the top 79th percentile of its range. Right now,

the small countries of Europe are the ones pressing the advance for MFG

for EMU as a region.

The UK, an EU member but not an EMU member, has a raw PMI

score of 52.93, higher than any large EMU county and a range reading of

68.8% showing that the UK is also strong in its range of values.

| NTC MFG Indexes | ||||||

|---|---|---|---|---|---|---|

| Oct-07 | Sep-07 | 3-Mo | 6-Mo | 12-Mo | Percentile | |

| Euro-13 | 51.52 | 53.21 | 53.02 | 54.09 | 54.96 | 52.2% |

| Germany | 51.67 | 54.87 | 54.17 | 55.44 | 56.67 | 55.2% |

| France | 50.54 | 50.51 | 51.20 | 52.50 | 53.27 | 38.1% |

| Italy | 51.34 | 52.39 | 52.45 | 53.28 | 53.74 | 56.1% |

| Spain | 49.58 | 50.80 | 50.85 | 52.35 | 54.27 | 44.7% |

| Austria | 52.77 | 55.37 | 54.21 | 54.00 | 55.24 | 60.8% |

| Greece | 55.27 | 53.83 | 54.22 | 54.03 | 53.13 | 79.6% |

| Ireland | 52.27 | 54.35 | 53.66 | 53.33 | 52.94 | 67.9% |

| Netherlands | 56.15 | 56.36 | 56.23 | 56.98 | 56.72 | 78.6% |

| EU | ||||||

| UK | 52.93 | 54.73 | 54.54 | 54.75 | 54.21 | 68.8% |

| percentile is over range since March 2000 | ||||||

Robert Brusca

AuthorMore in Author Profile »Robert A. Brusca is Chief Economist of Fact and Opinion Economics, a consulting firm he founded in Manhattan. He has been an economist on Wall Street for over 25 years. He has visited central banking and large institutional clients in over 30 countries in his career as an economist. Mr. Brusca was a Divisional Research Chief at the Federal Reserve Bank of NY (Chief of the International Financial markets Division), a Fed Watcher at Irving Trust and Chief Economist at Nikko Securities International. He is widely quoted and appears in various media. Mr. Brusca holds an MA and Ph.D. in economics from Michigan State University and a BA in Economics from the University of Michigan. His research pursues his strong interests in non aligned policy economics as well as international economics. FAO Economics’ research targets investors to assist them in making better investment decisions in stocks, bonds and in a variety of international assets. The company does not manage money and has no conflicts in giving economic advice.