Global| Nov 23 2007

Global| Nov 23 2007Services Slip: E-zone PMIs are Weak

Summary

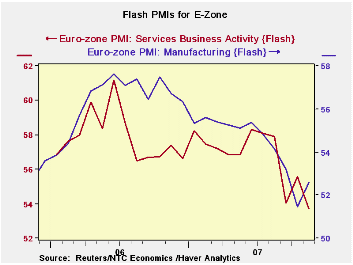

The NTC-Reuter Flash PMIs for November show an unexpected bounce for Manufacturing and slip for Services. Both readings are weak, however. Placed in the past 23-month range (the whole of the life of the services index) services are [...]

The NTC-Reuter Flash PMIs for November show an unexpected

bounce for Manufacturing and slip for Services. Both readings are weak,

however. Placed in the past 23-month range (the whole of the life of

the services index) services are the weakest ever at a reading of

53.72. The MFG index is in the 18.5 percentile of its range for this

period. Although taking MFG back to 1997, we find it resides in the

55th percentile of its much longer range experience. That experience

includes episodes of recession whereas for services and MFG the shorter

comparison does not.

The graph, however, underscores that the peaking and dropping

of the indices dates from super-peaking in 2006 then to a dropping from

a lower plateau in mid 2007. Currently the indices are chopping around

at a much lower level that barely indicates continuing growth (above a

level of 50).

We know that the strong euro is part of the problem, but

interestingly the outlook and slowing has spread though the services

industries just as fast even though MFG is sure to be affected first by

foreign exchange issues. With exports plus imports accounting for 40%

of GDP in some EMU nations it is no wonder that the impact of a strong

currency spreads faster that in the US where the sum is so much smaller.

In Germany the export association says firms can still export

at an exchanger rate to the dollar of 1.50 but Merkel is registering

worry already and orders of all sorts across the Euro Area members are

slowing if not weakening. The NTC indices memorialize and underscore

that Europe is slowing and is well off peak. They tell us more

topically what other indices will hold for us in the months ahead.

While certain groups of exports may be more resilient than others some

line seems to have been crossed that says that a the euro has risen

above a critical level that is taking business prospects down a notch

for some critical mass of companies. In part this means that US-based

firms should benefit form the exact factor that is hurting European

business (FX competitiveness), but due to the weakness in Europe that

the euro strength also engenders, that the amount of benefit will be

limited.

| FLASH Readings | ||

|---|---|---|

| NTC PMIs for the Euro Area 13 | ||

| Manufacturing | Services | |

| Nov-07 | 52.60 | 53.72 |

| Oct-07 | 51.46 | 55.56 |

| Sep-07 | 53.21 | 54.04 |

| Aug-07 | 54.16 | 57.91 |

| Averages | ||

| 3-Mo | 52.42 | 54.44 |

| 6-Mo | 53.61 | 56.28 |

| 12-Mo | 54.56 | 56.74 |

| 23-Mo Range | ||

| High | 57.61 | 61.21 |

| Low | 51.46 | 53.72 |

| % Range | 18.5% | 0.0% |

Robert Brusca

AuthorMore in Author Profile »Robert A. Brusca is Chief Economist of Fact and Opinion Economics, a consulting firm he founded in Manhattan. He has been an economist on Wall Street for over 25 years. He has visited central banking and large institutional clients in over 30 countries in his career as an economist. Mr. Brusca was a Divisional Research Chief at the Federal Reserve Bank of NY (Chief of the International Financial markets Division), a Fed Watcher at Irving Trust and Chief Economist at Nikko Securities International. He is widely quoted and appears in various media. Mr. Brusca holds an MA and Ph.D. in economics from Michigan State University and a BA in Economics from the University of Michigan. His research pursues his strong interests in non aligned policy economics as well as international economics. FAO Economics’ research targets investors to assist them in making better investment decisions in stocks, bonds and in a variety of international assets. The company does not manage money and has no conflicts in giving economic advice.

More Economy in Brief

Global| Feb 05 2026

Global| Feb 05 2026Charts of the Week: Balanced Policy, Resilient Data and AI Narratives

by:Andrew Cates