Global| Mar 21 2018

Global| Mar 21 2018Spain's Trade Trends and Performance Deteriorate

Summary

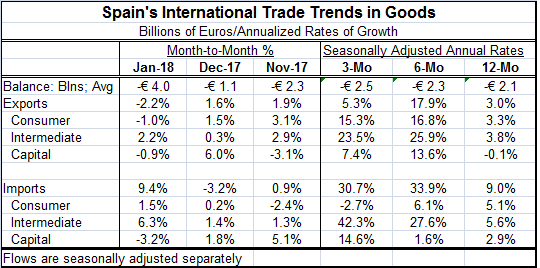

Spain's trade deficit widened to 4.0 billion euros in January from 1.1 billion euros in December/ Exports fell by 2.2% m/m as imports jumped by 9.4% m/m driving the deficit higher. Spanish data are hard handicap because of their [...]

Spain's trade deficit widened to 4.0 billion euros in January from 1.1 billion euros in December/ Exports fell by 2.2% m/m as imports jumped by 9.4% m/m driving the deficit higher.

Spain's trade deficit widened to 4.0 billion euros in January from 1.1 billion euros in December/ Exports fell by 2.2% m/m as imports jumped by 9.4% m/m driving the deficit higher.

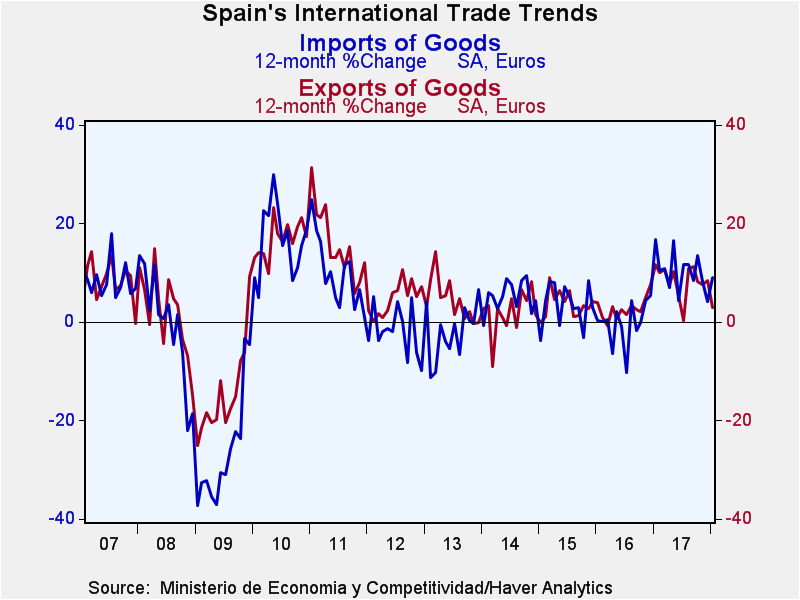

Spanish data are hard handicap because of their volatility. Even when the series are seasonally adjusted (as are the data in the table), a good deal of variability remains. Variability means that changes in trends will be hard to detect. Spanish data show more variability for imports than for exports. Since September 2014, the six-month standard deviation of year-on-year import growth has exceeded the same measure for exports. However, on a relative basis, exports are currently more variable relative to their history than are imports. So there is a good bit of intrigue about what these flows are up to since there is so much ‘noise' in the various time series.

On the import side, part of the volatility is due to the inflation impact of oil prices and other commodities that have gyrated in this recovery and have been rising over the past few months.

By sector, Spanish capital goods exports and imports generally are the most volatile trade flows. Recently for imports capital goods have become the most volatile while for exports intermediate goods have become the most volatile. In both cases, this is for relative volatility when we compare the volatility of each flow to its respective history.

Spain's trade patterns show some of the same weaknesses we see in other European countries. There is weakness in consumer goods imports that casts some doubt on the strength of domestic demand. Germany, for example, the juggernaut economy of Europe, has exports making up half of its GDP. Germany lives off and depends on demand for its goods in overseas economies rather than from its own consumers- and that is unusual.

In Spain, consumer goods imports log a negative growth rate over three months and post only a 5.1% nominal gain over 12 months. But the 12-month growth rate is trending lower. Exports have weaker year-on-year growth than imports, but over shorter horizon export flows show more growth than they do over 12 months. The same is true of imports except, of course, for consumer goods.

Spain's economy has been performing well. GDP growth has been above the 3% mark. And while Spanish price trends have flared, inflation has been steadily moving lower. Spain's retail sector continues to lag badly and is nowhere near to its past cycle highs. Year-over-year real retail sales in Spain declined from late-2007 onward ‘in the recovery' until mid-2012 when they stabilized. From 2014 real sales in Spain have been growing but the growth rate has been steadily decaying. There is a hint of resurgence in sales in late-2017 and early-2018. These difficulties with getting domestic demand on track are clear in the import patterns and not surprising given a still-high rate of Spanish unemployment.

Spain's trade deterioration is largely on the back of surging intermediate goods imports and strong capital goods imports. Spain is not living beyond its means by importing consumer goods. Its capital goods imports should make the economy stronger while the role played by oil in pushing intermediate goods imports higher should be limited by supply coming out of the U.S. that will push rising oil prices back down. There is still some geopolitical risk to all this, as is always the case with oil. Specifically, if the U.S. does not continue to endorse the Iran deal, Iranian oil might be blocked from the market again and that could send global oil prices higher and keep the value of Spain's imports elevated. That remains a risk beyond Spain's control. Also beyond Spain's control, is that its trade position has been hurt by a slowing and a decline in consumer goods exports as well as a slowing and decline in capital goods exports. Foreign demand appears to be weakening. There has been some rise in the foreign exchange value of the euro.

There is still a good deal of variability in Spain's trade flows and plenty of room for surprises to emerge from developing trends. Spain's elevated unemployment rate explains why the consumer sector has been so slow to come around. But steady consumption brings steady growth to an economy and Spain lacks that stabilizing influence. Meanwhile, the EU continues to grapple with its Brexit strategy. Spain itself still has unfinished business in stabilizing Catalonia. And to the east, Italy one of the lager economics in the EMU, is having its own political difficulties. Despite some impressive economic performance, Spain continues to face challenges and key uncertainties.

Robert Brusca

AuthorMore in Author Profile »Robert A. Brusca is Chief Economist of Fact and Opinion Economics, a consulting firm he founded in Manhattan. He has been an economist on Wall Street for over 25 years. He has visited central banking and large institutional clients in over 30 countries in his career as an economist. Mr. Brusca was a Divisional Research Chief at the Federal Reserve Bank of NY (Chief of the International Financial markets Division), a Fed Watcher at Irving Trust and Chief Economist at Nikko Securities International. He is widely quoted and appears in various media. Mr. Brusca holds an MA and Ph.D. in economics from Michigan State University and a BA in Economics from the University of Michigan. His research pursues his strong interests in non aligned policy economics as well as international economics. FAO Economics’ research targets investors to assist them in making better investment decisions in stocks, bonds and in a variety of international assets. The company does not manage money and has no conflicts in giving economic advice.

More Economy in Brief

Global| Feb 05 2026

Global| Feb 05 2026Charts of the Week: Balanced Policy, Resilient Data and AI Narratives

by:Andrew Cates