Global| Dec 30 2019

Global| Dec 30 2019U.S. Chicago Business Barometer Rises Again

by:Sandy Batten

|in:Economy in Brief

Summary

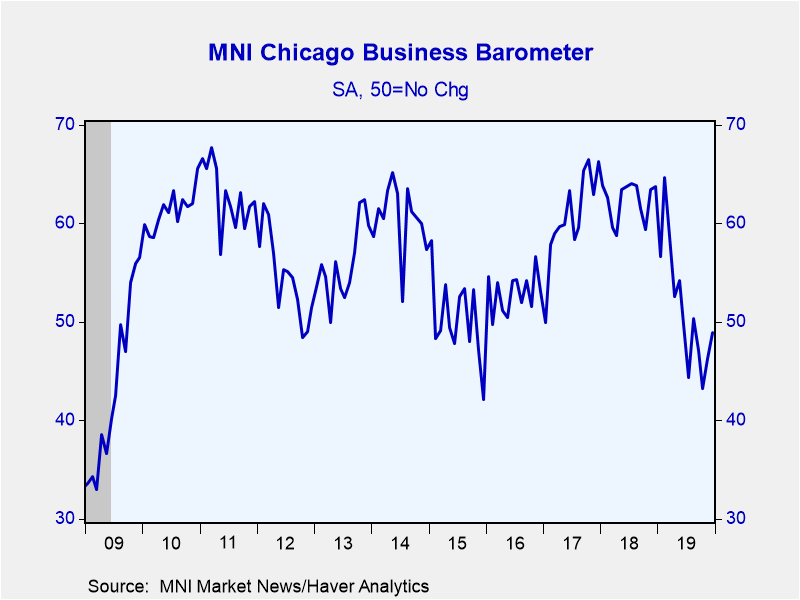

The Chicago Purchasing Managers’ Business Barometer rose more than expected to 48.9 in December from 46.3 in November and 43.2 in October. The October reading had been the lowest level in four years. This index is a diffusion index [...]

The Chicago Purchasing Managers’ Business Barometer rose more than expected to 48.9 in December from 46.3 in November and 43.2 in October. The October reading had been the lowest level in four years. This index is a diffusion index with 50 being the critical level that separates expansion from contraction. So, even with the increase in December, the below-50 reading means that economic activity in the Chicago area continues to contract, just at a slower pace. The Action Economics Forecast Survey expected an increase to 47.7. The Q4 average for the headline index fell to 46.1 from 47.3 in Q3.

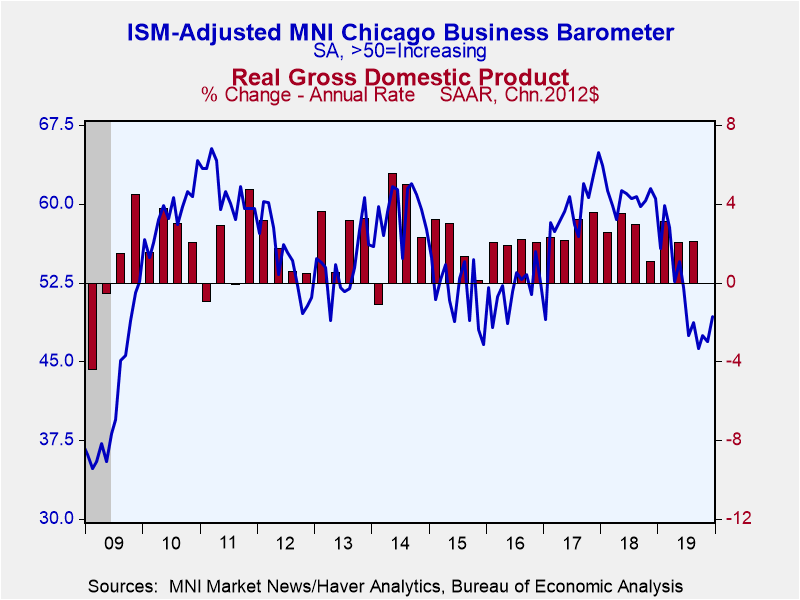

Note that in contrast to the ISM Purchasing Managers’ index, which is constructed as an average of five components, the headline Chicago index is constructed from the answer to a single question. So, Haver Analytics uses the component Chicago subindexes to construct an index using methodology similar to that used to construct the ISM index. This measure rose to 49.3 in December from 46.9 in November. This is the highest reading on this index since June. Over the past 10 years, this constructed Chicago index has an 83% correlation with the national ISM Manufacturing Index, which is scheduled for release on Thursday.

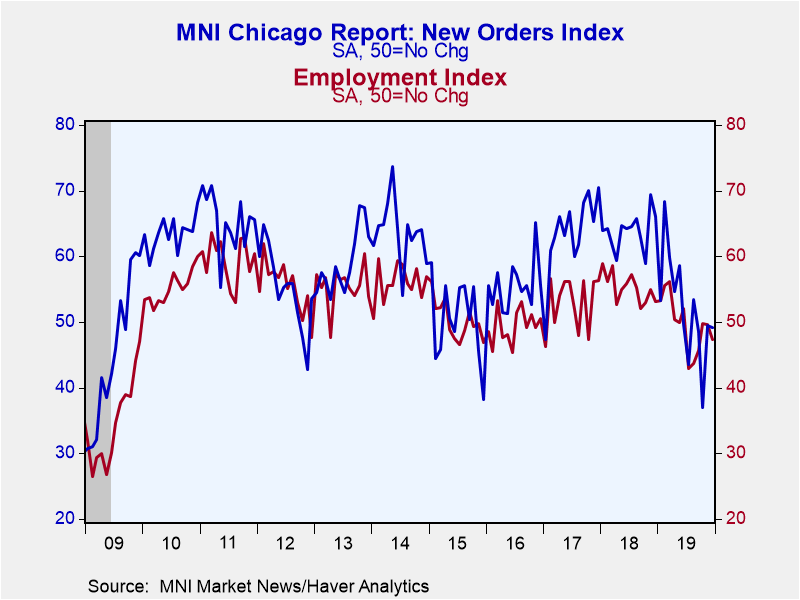

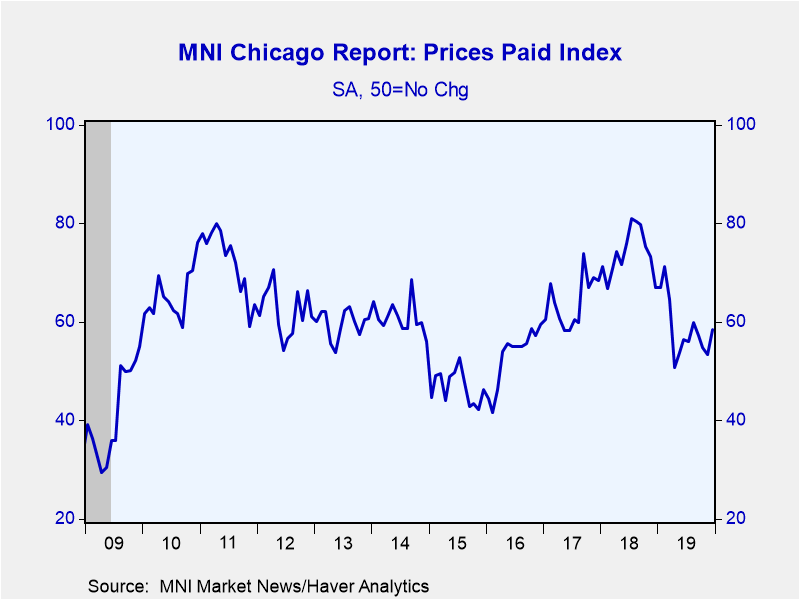

The subindexes generally rose in December from November. The key production index jumped up to 47.2 from 42.3 in November. However, the important new orders index slipped to 49.1 after an outsized surge to 49.4 in November. The employment index also fell to 47.4 in December from 49.6 in November. All of the remaining subindexes rose in December from November. However, except for the supplier deliveries and prices paid subindexes, the others remained below the critical 50 level. So, while most subindexes rose in December, they still point to declines, though at a more modest pace.

The MNI Chicago Report is produced by MNI in partnership with ISM-Chicago. The survey covers a sample of over 200 purchasing professionals in the Chicago area with a usual monthly response rate of about 50%. Summary data are contained in Haver's USECON database, with detail including the ISM-style index in the SURVEYS database. The Action Economics Forecast Survey is available in AS1REPNA.

| Chicago Purchasing Managers Index (%, SA) | Dec | Nov | Oct | Dec '18 | 2018 | 2017 | 2016 |

|---|---|---|---|---|---|---|---|

| General Business Barometer | 46.3 | 43.2 | 47.1 | 63.5 | 62.4 | 60.7 | 53.0 |

| ISM-Adjusted General Business Barometer | 46.9 | 47.5 | 46.2 | 61.5 | 60.7 | 59.0 | 51.9 |

| Production | 42.3 | 46.8 | 40.4 | 63.5 | 64.5 | 64.2 | 54.5 |

| New Orders | 49.4 | 37.0 | 48.5 | 69.4 | 63.8 | 63.6 | 55.6 |

| Order Backlogs | 45.0 | 33.1 | 46.8 | 59.4 | 58.0 | 55.2 | 47.1 |

| Inventories | 43.0 | 47.1 | 41.7 | 53.2 | 55.3 | 54.9 | 47.2 |

| Employment | 49.6 | 49.8 | 45.6 | 55.0 | 55.2 | 52.9 | 49.4 |

| Supplier Deliveries | 50.2 | 56.9 | 54.8 | 66.4 | 64.8 | 59.4 | 52.8 |

| Prices Paid | 53.5 | 54.8 | 57.3 | 73.3 | 74.0 | 64.1 | 53.2 |

Sandy Batten

AuthorMore in Author Profile »Sandy Batten has more than 30 years of experience analyzing industrial economies and financial markets and a wide range of experience across the financial services sector, government, and academia. Before joining Haver Analytics, Sandy was a Vice President and Senior Economist at Citibank; Senior Credit Market Analyst at CDC Investment Management, Managing Director at Bear Stearns, and Executive Director at JPMorgan. In 2008, Sandy was named the most accurate US forecaster by the National Association for Business Economics. He is a member of the New York Forecasters Club, NABE, and the American Economic Association. Prior to his time in the financial services sector, Sandy was a Research Officer at the Federal Reserve Bank of St. Louis, Senior Staff Economist on the President’s Council of Economic Advisors, Deputy Assistant Secretary for Economic Policy at the US Treasury, and Economist at the International Monetary Fund. Sandy has taught economics at St. Louis University, Denison University, and Muskingun College. He has published numerous peer-reviewed articles in a wide range of academic publications. He has a B.A. in economics from the University of Richmond and a M.A. and Ph.D. in economics from The Ohio State University.

More Economy in Brief

Global| Feb 05 2026

Global| Feb 05 2026Charts of the Week: Balanced Policy, Resilient Data and AI Narratives

by:Andrew Cates