Global| Apr 30 2019

Global| Apr 30 2019U.S. Chicago Business Barometer Slumped in April

by:Sandy Batten

|in:Economy in Brief

Summary

The Chicago Purchasing Managers Business Barometer fell in April for the second consecutive month--to 52.6 from 58.7 in March and 64.7 in February. This is the lowest reading since January 2017. The Action Economics Forecast Survey [...]

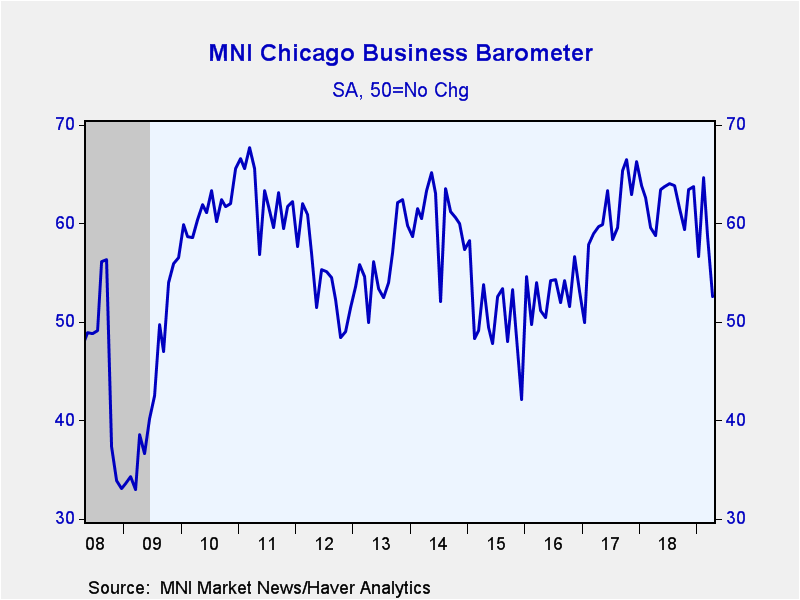

The Chicago Purchasing Managers Business Barometer fell in April for the second consecutive month--to 52.6 from 58.7 in March and 64.7 in February. This is the lowest reading since January 2017. The Action Economics Forecast Survey had looked for a slight increase to 59.0. The Chicago Purchasing Managers figures are diffusion indexes where readings above 50 indicate growth.

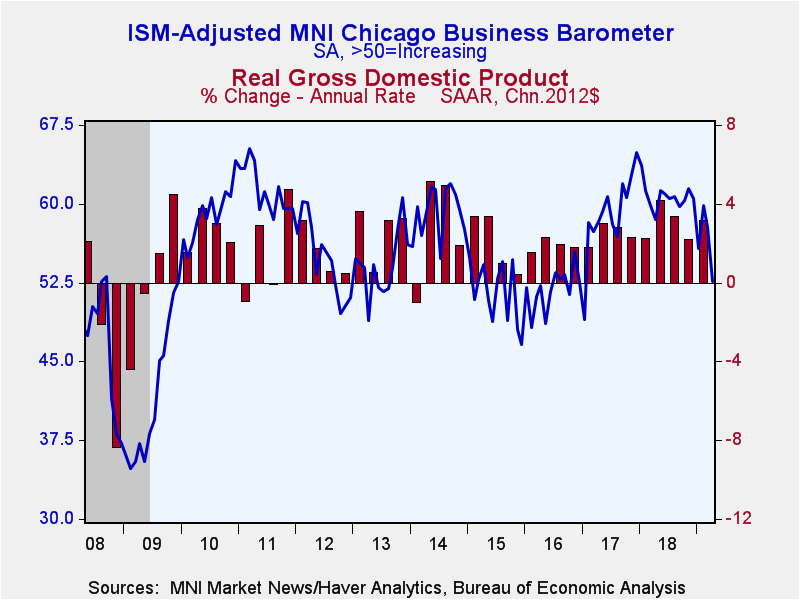

Note that in contrast to the Purchasing Managers' index, which is constructed from five components, the headline Chicago index is constructed from the answer to a single question. So, Haver Analytics uses the component subindexes to construct an index using methodology similar to that used to construct the ISM index. This measure also fell to 52.6 in April from 57.7 in March, also its lowest reading since January 2017. Over the past 15 years, this ISM-adjusted Chicago index has an 83% correlation with the national ISM Manufacturing Index, which is scheduled for release tomorrow.

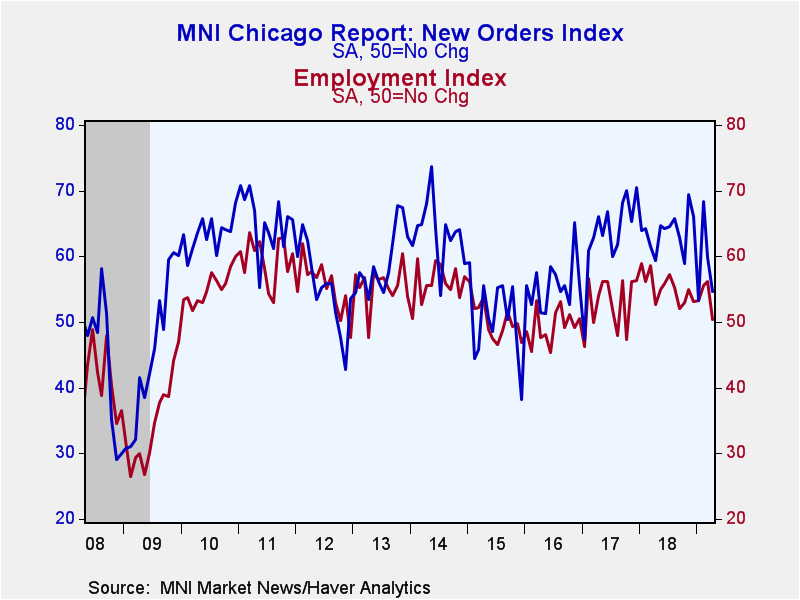

In April, three of the indexes five major components fell. Production plunged to 50.5 from 64.2. The NSA percentage of respondents reporting an increase in production dropped to 28% in April from 42% in March, the lowest reading since January 2017. New orders fell to 54.6 from 59.8, and supplier deliveries slipped to 57.4 from 60.9. In contrast, the order backlogs index climbed back above 50 to 51.2 in April from 44.7 in March, while inventories rose in April--to 49.9 from 47.4--but remained below the critical 50 level.

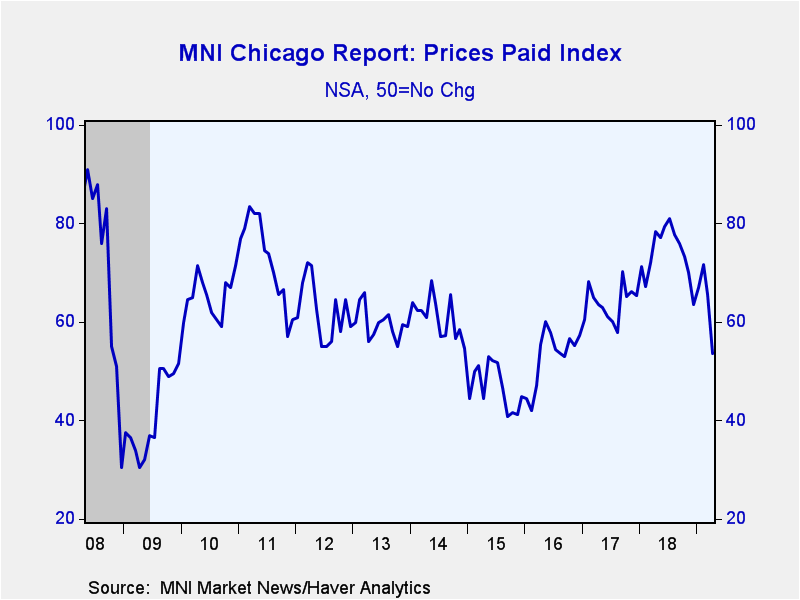

The employment index slumped to 50.4 in April from 56.2. This is its lowest reading since October 2017 and only marginally above 50. And despite the general rise in energy prices during the month, the prices paid index fell sharply to 50.8 in April from 64.5. This is its lowest reading since March 2016

With the drop in the headline index in April, the index starts the second quarter well below the first quarter average, pointing to a meaningful slowdown in manufacturing activity across the Chicago area in Q2.

The MNI Chicago Report is produced by MNI in partnership with ISM-Chicago. The survey covers a sample of over 200 purchasing professionals in the Chicago area with a monthly response rate of about 50%. Summary data are contained in Haver's USECON database, with detail including the ISM-style index in the SURVEYS database. The Action Economics Forecast Survey is available in AS1REPNA.

| Chicago Purchasing Managers Index (%, SA) | Apr | Mar | Feb | Apr '18 | 2018 | 2017 | 2016 |

|---|---|---|---|---|---|---|---|

| General Business Barometer | 52.6 | 58.7 | 64.7 | 58.8 | 62.4 | 60.7 | 53.0 |

| ISM-Adjusted General Business Barometer | 52.6 | 57.7 | 59.8 | 58.5 | 60.7 | 59.0 | 51.9 |

| Production | 50.5 | 64.2 | 67.3 | 60.2 | 64.5 | 64.2 | 54.5 |

| New Orders | 54.6 | 59.8 | 68.4 | 59.4 | 63.8 | 63.6 | 55.6 |

| Order Backlogs | 51.2 | 44.7 | 63.6 | 55.1 | 58.0 | 55.2 | 47.1 |

| Inventories | 49.9 | 47.4 | 47.8 | 54.2 | 55.3 | 54.9 | 47.2 |

| Employment | 50.4 | 56.2 | 55.5 | 52.6 | 55.2 | 52.9 | 49.4 |

| Supplier Deliveries | 57.4 | 60.9 | 60.2 | 66.2 | 64.8 | 59.4 | 52.8 |

| Prices Paid | 50.8 | 64.5 | 71.2 | 74.3 | 74.0 | 64.1 | 53.2 |

Sandy Batten

AuthorMore in Author Profile »Sandy Batten has more than 30 years of experience analyzing industrial economies and financial markets and a wide range of experience across the financial services sector, government, and academia. Before joining Haver Analytics, Sandy was a Vice President and Senior Economist at Citibank; Senior Credit Market Analyst at CDC Investment Management, Managing Director at Bear Stearns, and Executive Director at JPMorgan. In 2008, Sandy was named the most accurate US forecaster by the National Association for Business Economics. He is a member of the New York Forecasters Club, NABE, and the American Economic Association. Prior to his time in the financial services sector, Sandy was a Research Officer at the Federal Reserve Bank of St. Louis, Senior Staff Economist on the President’s Council of Economic Advisors, Deputy Assistant Secretary for Economic Policy at the US Treasury, and Economist at the International Monetary Fund. Sandy has taught economics at St. Louis University, Denison University, and Muskingun College. He has published numerous peer-reviewed articles in a wide range of academic publications. He has a B.A. in economics from the University of Richmond and a M.A. and Ph.D. in economics from The Ohio State University.