Global| Feb 26 2019

Global| Feb 26 2019U.S. Consumer Confidence Rebounds

Summary

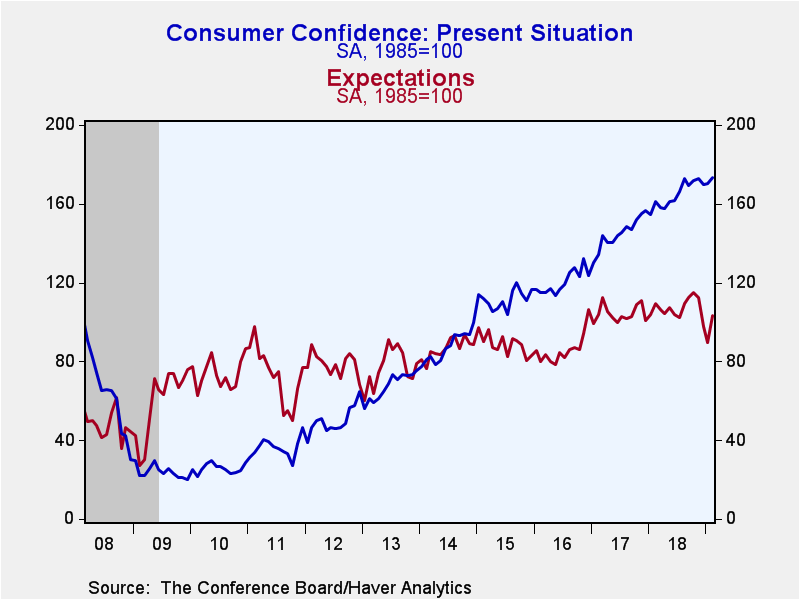

The Conference Board Consumer Confidence Index jumped a great-than-expected 8.0% to 131.4 in February (1.1% year-on-year) reversing January's decline. Still, confidence has fallen 6.5 points from the cycle high touched in October [...]

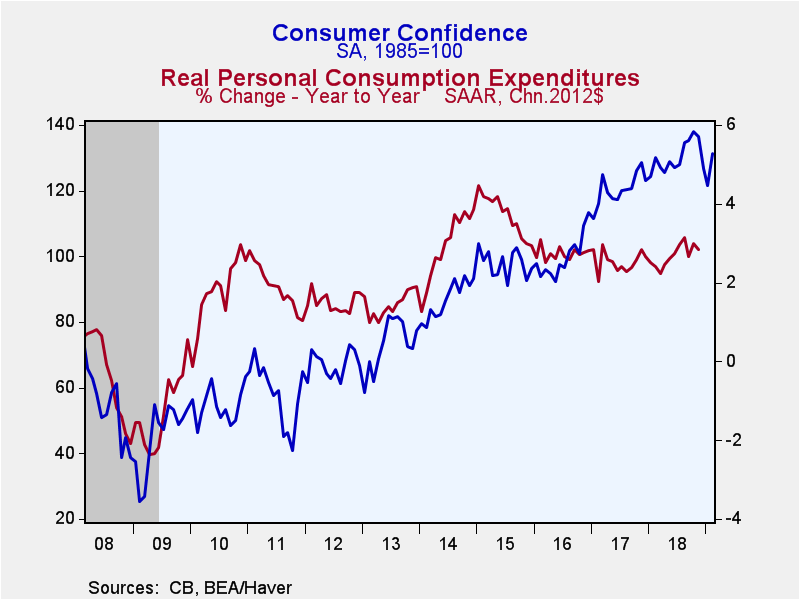

The Conference Board Consumer Confidence Index jumped a great-than-expected 8.0% to 131.4 in February (1.1% year-on-year) reversing January's decline. Still, confidence has fallen 6.5 points from the cycle high touched in October 2018. The Action Economics Forecast Survey expected a reading of 124.8. During the past ten years, there has been a 67% correlation between the level of consumer confidence and the year-on-year change in monthly real consumer spending.

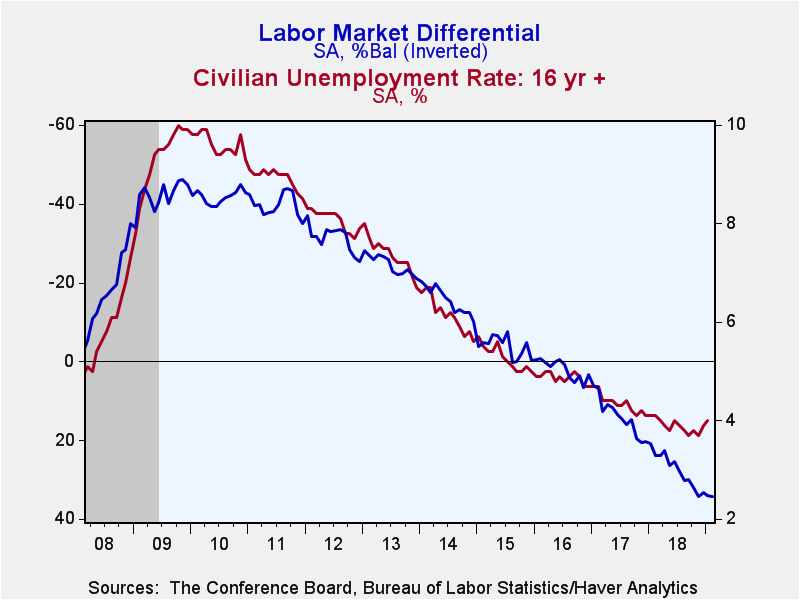

As per January, the expectation component drove the shift in confidence, jumping 15.7% (-5.3% y/y) in February. Meanwhile, views of the present situation continue to improve, up 1.9% (7.6% y/y) to a cycle high 173.5. The labor market differential, representing the difference between respondents indicating jobs are plentiful and those saying jobs are hard to get, also rose to a cycle high 34.3. This series has a 97% correlation with the unemployment rate over the last ten years.

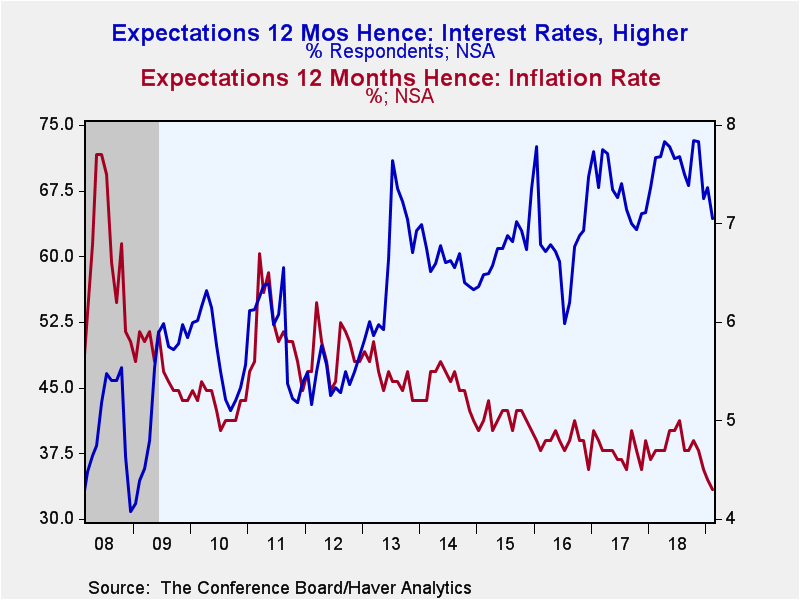

The expected inflation rate in twelve months declined to 4.3%, the lowest reading since 2004 and down from the 5.0% registered last July. The share of respondents planning on buying a new home in six-months decreased to 5.5% in February from 7.2%, this is the low end of the range we've seen for the last three years. Meanwhile, those planning on buying a major appliance slid to 47.2%, the lowest level since early 2015. In December 2017, this indicator hit a cycle high 59.3%

Confidence rose for all demographic groups. While confidence for those under 35 is close to its November cycle high, confidence for the other age groups remains below the previous peak,

The Consumer Confidence data are available in Haver's CBDB database. The total indexes, which are indexed to 1985=100, appear in USECON, and the market expectations are in AS1REPNA.

The Semiannual Monetary Policy Report to the Congress from Fed Chairman Jerome H. Powell is available here.

| Conference Board (SA, 1985=100) | Feb | Jan | Dec | Feb Y/Y % | 2018 | 2017 | 2016 |

|---|---|---|---|---|---|---|---|

| Consumer Confidence Index | 131.4 | 121.7 | 126.6 | 1.1 | 130.1 | 120.5 | 99.8 |

| Present Situation | 173.5 | 170.2 | 169.9 | 7.6 | 164.8 | 144.8 | 120.3 |

| Expectations | 103.4 | 89.4 | 97.7 | -5.3 | 107.0 | 104.3 | 86.1 |

| Consumer Confidence By Age Group | |||||||

| Under 35 Years | 141.0 | 126.9 | 129.5 | 3.4 | 133.7 | 130.2 | 122.4 |

| Aged 35-54 Years | 133.5 | 123.4 | 135.9 | 0.2 | 132.2 | 123.5 | 106.2 |

| Over 55 Years | 127.0 | 117.4 | 117.2 | 0.9 | 126.3 | 112.9 | 84.6 |

Gerald D. Cohen

AuthorMore in Author Profile »Gerald Cohen provides strategic vision and leadership of the translational economic research and policy initiatives at the Kenan Institute of Private Enterprise.

He has worked in both the public and private sectors focusing on the intersection between financial markets and economic fundamentals. He was a Senior Economist at Haver Analytics from January 2019 to February 2021. During the Obama Administration Gerald was Deputy Assistant Secretary for Macroeconomic Analysis at the U.S. Department of Treasury where he helped formulate and evaluate the impact of policy proposals on the U.S. economy. Prior to Treasury, he co-managed a global macro fund at Ziff Brothers Investments.

Gerald holds a bachelor’s of science from the Massachusetts Institute of Technology and a Ph.D. in Economics from Harvard University and is a contributing author to 30-Second Money as well as a co-author of Political Cycles and the Macroeconomy.

More Economy in Brief

Global| Feb 05 2026

Global| Feb 05 2026Charts of the Week: Balanced Policy, Resilient Data and AI Narratives

by:Andrew Cates