Global| Jan 28 2020

Global| Jan 28 2020U.S. Consumer Confidence Stronger than Expected in January

by:Sandy Batten

|in:Economy in Brief

Summary

The Conference Board's Consumer Confidence Index rose a solid 3.4 points (2.7% m/m, 8.1% y/y) to 131.6 (1985=100) in January from an upwardly revised 128.2 in December (initially reported as 126.5). The Action Economics Forecast [...]

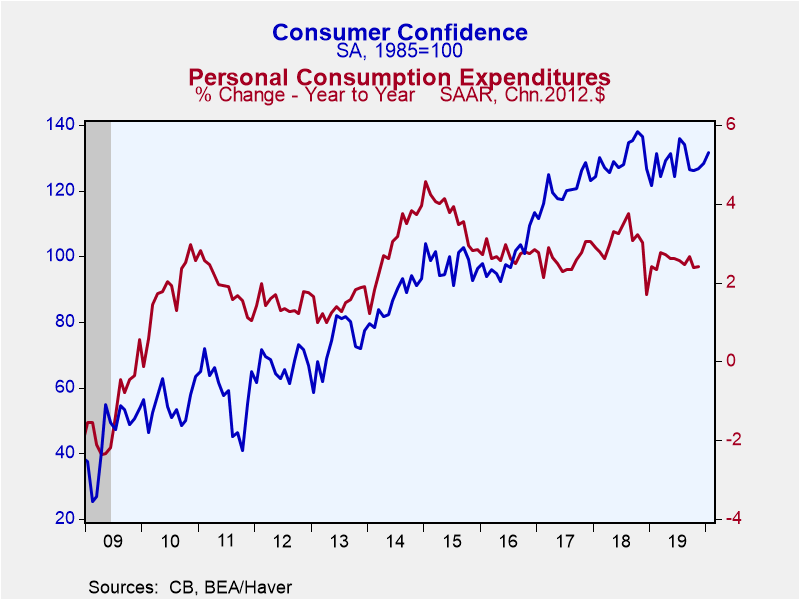

The Conference Board's Consumer Confidence Index rose a solid 3.4 points (2.7% m/m, 8.1% y/y) to 131.6 (1985=100) in January from an upwardly revised 128.2 in December (initially reported as 126.5). The Action Economics Forecast Survey had looked for an increase to 128.0. The January rise was the third consecutive monthly increase and the highest reading since last August. Over the past 20 years, there has been 70% correlation between the level of confidence and the y/y change in real consumer spending.

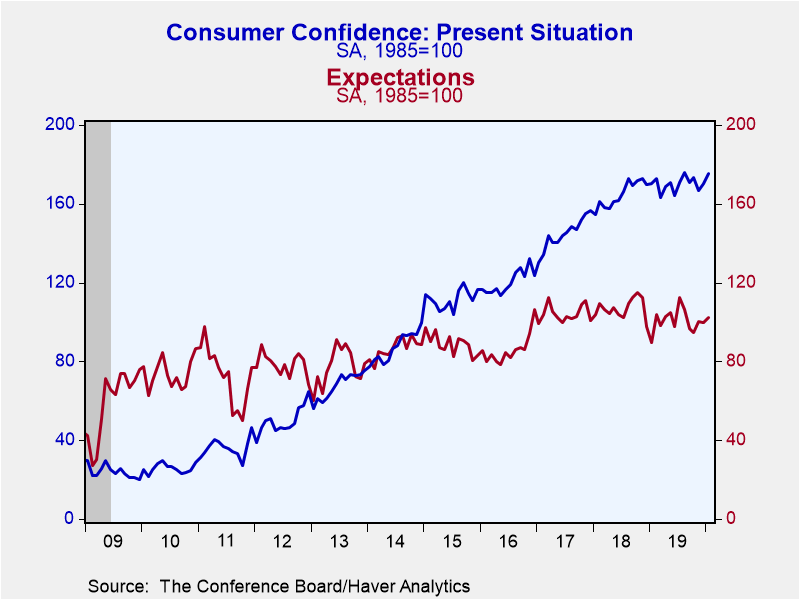

Both components of the headline index improved in January. The present situation index increased 2.8% m/m to 175.3. The expectations index rose 2.5% m/m to 102.5. Both readings were the highest since last August.

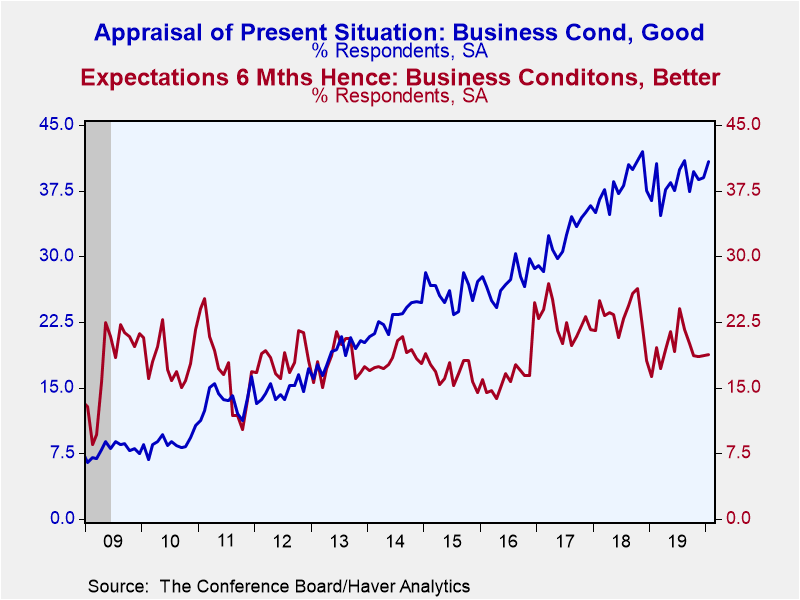

Within the present situation assessment, the share of respondents believing business conditions are good rose for the second consecutive month to 40.8%. Consumers continue to think that the job market is robust with the gap between those thinking jobs are plentiful and those thinking jobs are hard to get widening to 37.4%, just off the August reading of 38.3% which was the highest in the current expansion and the highest since 2000. This robustness should continue to underpin consumer spending. Indeed, consumer spending plans for both homes and major appliances rose in January. In contrast, plans to purchase an automobile slid slightly.

There was little change in the expectations for conditions six months from now. Overall business conditions are expected to be the "same" by 72.8% of respondents in January versus 72.5% in December. However, consumers are becoming less pessimistic. The percent expecting business conditions to worsen in the next six months fell to 8.4% in January from 8.8% December and 11.4% in November.

Inflation expectations remained modest with the inflation rate expected over the next 12 months edging up to 4.5% in January from 4.4% in December. Interest rates are expected to be little changed over the next 12 months (40.6% in January look for no change with percentages expecting increases and decreases each falling). Consumers generally expect equity prices to rise over the coming 12 months with 43.1% expecting an increase while only 22.2% look for a decrease.

The improvement in consumer confidence in January was concentrated in the 55 and over age group with confidence increasing to 135.1 in January from 126.2 in December. The January reading was the second highest in the current expansion. Confidence among those ages 35-54 fell to 125.9 in January from 127.9 in December. Confidence in this group has been generally declining since the middle of 2019. Confidence of those under 35 years old edged up to 134.4 in January from 133.1 in December, remaining well below its cycle peak of 154.0 reached last August.

The Consumer Confidence data are available in Haver's CBDB database. The total indexes appear in USECON, and the market expectations are in AS1REPNA.

| Conference Board (SA, 1985=100) | Jan | Dec | Nov | Jan Y/Y % | 2019 | 2018 | 2017 |

|---|---|---|---|---|---|---|---|

| Consumer Confidence Index | 131.6 | 128.2 | 126.8 | 8.1 | 128.2 | 130.1 | 120.5 |

| Present Situation | 175.3 | 170.5 | 166.6 | 3.0 | 169.8 | 164.8 | 144.8 |

| Expectations | 102.5 | 100.0 | 100.3 | 14.7 | 100.4 | 107.0 | 104.3 |

| Consumer Confidence By Age Group | |||||||

| Under 35 Years | 134.4 | 133.1 | 118.9 | 5.9 | 133.8 | 133.7 | 130.2 |

| Aged 35-54 Years | 125.9 | 127.9 | 124.2 | 2.0 | 130.5 | 132.2 | 123.5 |

| Over 55 Years | 135.1 | 126.2 | 130.8 | 15.7 | 123.8 | 126.3 | 112.9 |

Sandy Batten

AuthorMore in Author Profile »Sandy Batten has more than 30 years of experience analyzing industrial economies and financial markets and a wide range of experience across the financial services sector, government, and academia. Before joining Haver Analytics, Sandy was a Vice President and Senior Economist at Citibank; Senior Credit Market Analyst at CDC Investment Management, Managing Director at Bear Stearns, and Executive Director at JPMorgan. In 2008, Sandy was named the most accurate US forecaster by the National Association for Business Economics. He is a member of the New York Forecasters Club, NABE, and the American Economic Association. Prior to his time in the financial services sector, Sandy was a Research Officer at the Federal Reserve Bank of St. Louis, Senior Staff Economist on the President’s Council of Economic Advisors, Deputy Assistant Secretary for Economic Policy at the US Treasury, and Economist at the International Monetary Fund. Sandy has taught economics at St. Louis University, Denison University, and Muskingun College. He has published numerous peer-reviewed articles in a wide range of academic publications. He has a B.A. in economics from the University of Richmond and a M.A. and Ph.D. in economics from The Ohio State University.

More Economy in Brief

Global| Feb 05 2026

Global| Feb 05 2026Charts of the Week: Balanced Policy, Resilient Data and AI Narratives

by:Andrew Cates