Global| Apr 24 2018

Global| Apr 24 2018U.S. Consumer Confidence Unexpectedly Rose in April

by:Sandy Batten

|in:Economy in Brief

Summary

The Conference Board Consumer Confidence Index rose to 128.7 in April from 127.0 (initially reported as 127.7) in March and was 7.8% higher than a year ago. The Action Economics Forecast Survey had looked for a slight decline in the [...]

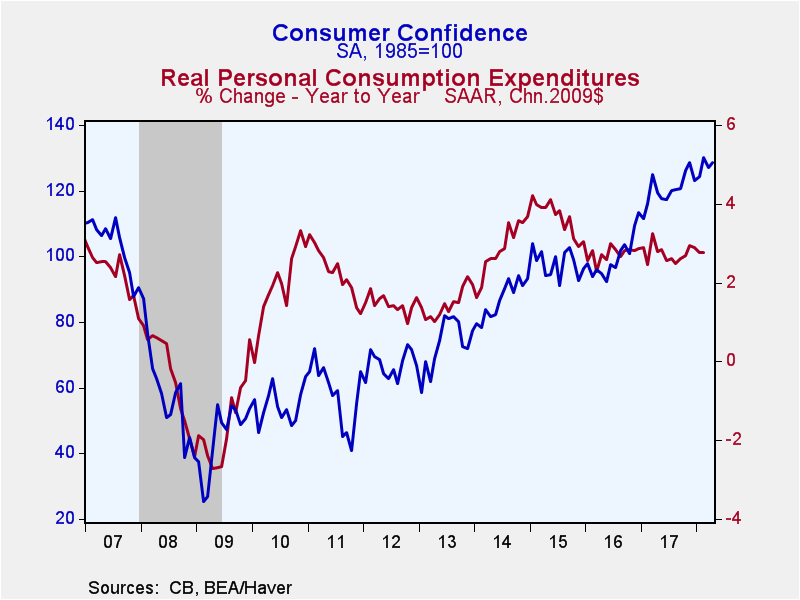

The Conference Board Consumer Confidence Index rose to 128.7 in April from 127.0 (initially reported as 127.7) in March and was 7.8% higher than a year ago. The Action Economics Forecast Survey had looked for a slight decline in the index to 126.0. The indexes in this report are based on 1985=100. During the past 10 years, there has been a 68% correlation between the level of consumer confidence and the y/y change in real PCE.

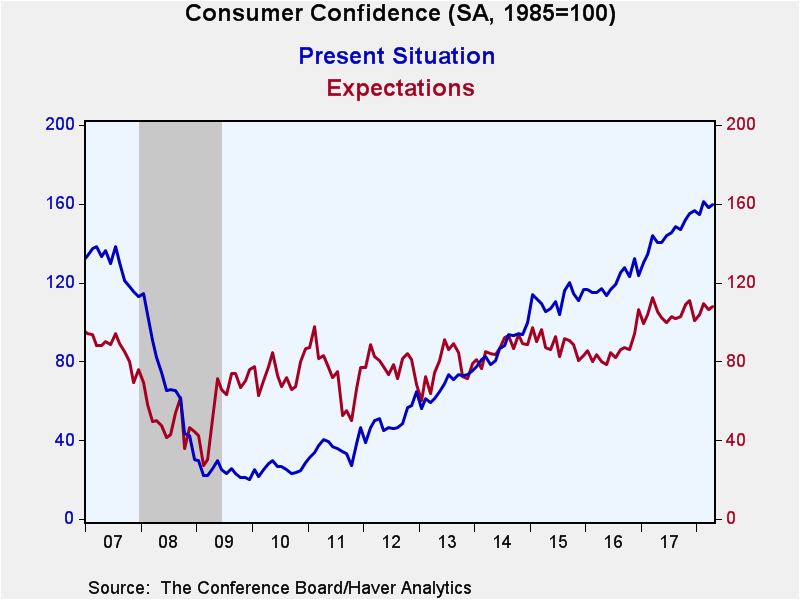

Both components of the overall index rose in April. The present conditions component increased to 159.6 from 158.1 and was 13.8% higher than a year ago. The expectations component rose to 108.1 from 106.2 and was 2.6% above the level a year ago.

The percentage of respondents indicating conditions are "good" slipped to 35.2% in April after having risen to a 17-year high of 37.6% in March. The percentage saying business conditions are "bad" also receded to 11.3% in April from 13.3% in March, meaning that the percentage saying that conditions are "normal" jumped to 53.5% in April from 49.1% in March. Jobs were viewed as "plentiful" by 38.1% of respondents in April, down from 39.5% in March. Jobs were viewed as "hard to get" by 15.2% in April, the lowest since July 2001 apart from 15.1% in February, versus 15.7% in March. The net jobs assessment slipped to +22.9 in April from +23.8 in March, but remains around its highest level since 2001. Over the past 15 years, this differential is 96% inversely related to the unemployment rate.

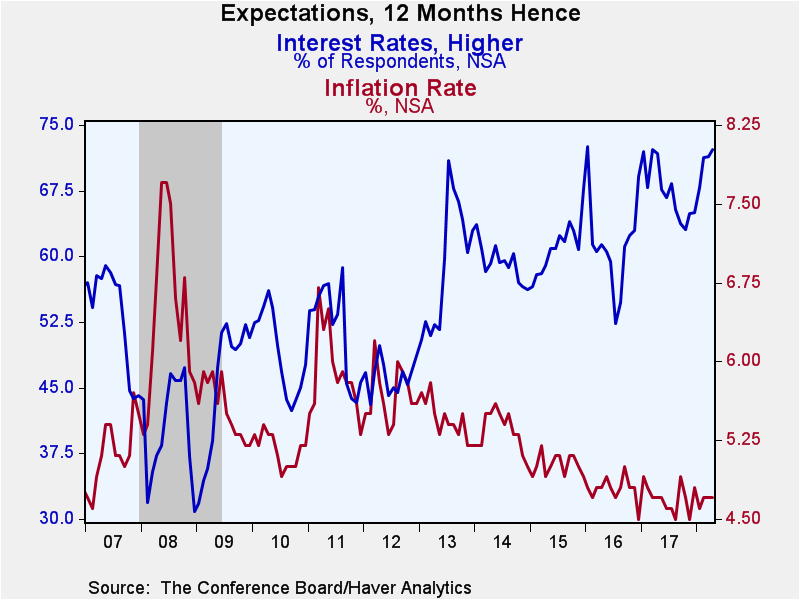

Expectations for the inflation rate in twelve months were unchanged at 4.7%, where they have been for the past two months. These expectations have flattened over the past year but have yet to demonstrate any move up. The percentage expecting higher interest rates over the next twelve months increased further to 72.2% in April, the most since March 2017 and up nearly 10 percentage points over the past six months. Those looking to buy a home in the next six months jumped to 7.8% in April from 6.0% in March, the highest percentage since early 2006 (prior to the financial crisis).

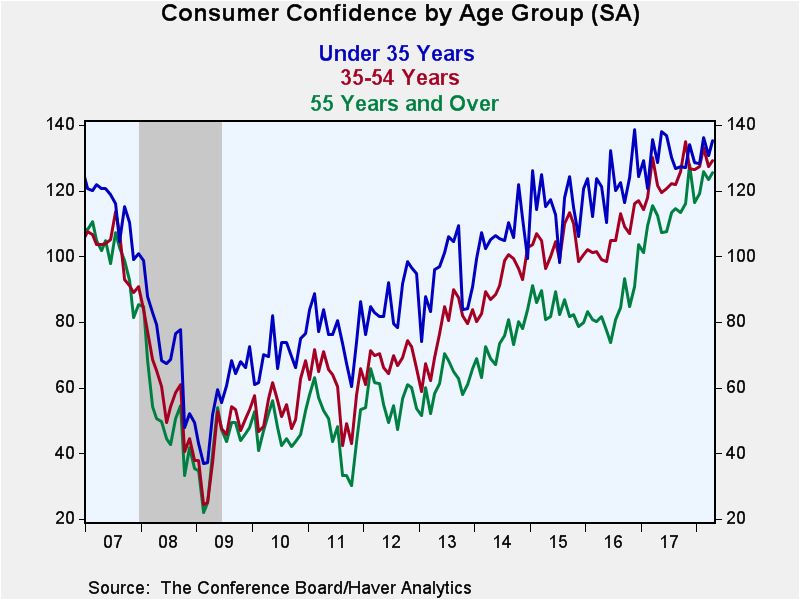

Confidence increased in all three major age groups in April from March. For respondents under 35 years old, confidence jumped up to 135.4 in April from 130.8 in March. For those aged 35-54 years, confidence increased to 129.1 in April from 127.4 in March. And for those over 55 years of age, confidence rose to 125.6 in April from 123.4 in March. While confidence in all three age groups has been trending up, the confidence of the over 55 group has been trending up the fastest.

The Consumer Confidence data is available in Haver's CBDB database. The total indexes appear in USECON, and the market expectations are in AS1REPNA.

| Conference Board (SA, 1985=100) | Apr | Mar | Feb | Y/Y % | 2017 | 2016 | 2015 |

|---|---|---|---|---|---|---|---|

| Consumer Confidence Index | 128.7 | 127.0 | 130.0 | 7.8 | 120.5 | 99.8 | 98.0 |

| Present Situation | 159.6 | 158.1 | 161.2 | 13.8 | 144.8 | 120.3 | 111.7 |

| Expectations | 108.1 | 106.2 | 109.2 | 2.6 | 104.3 | 86.1 | 88.8 |

| Consumer Confidence By Age Group | |||||||

| Under 35 Years | 135.4 | 130.8 | 136.3 | 5.3 | 130.2 | 122.4 | 116.0 |

| Aged 35-54 Years | 129.1 | 127.4 | 133.2 | 6.1 | 123.5 | 106.2 | 103.9 |

| Over 55 Years | 125.6 | 123.4 | 125.9 | 11.6 | 112.9 | 84.6 | 84.1 |

Sandy Batten

AuthorMore in Author Profile »Sandy Batten has more than 30 years of experience analyzing industrial economies and financial markets and a wide range of experience across the financial services sector, government, and academia. Before joining Haver Analytics, Sandy was a Vice President and Senior Economist at Citibank; Senior Credit Market Analyst at CDC Investment Management, Managing Director at Bear Stearns, and Executive Director at JPMorgan. In 2008, Sandy was named the most accurate US forecaster by the National Association for Business Economics. He is a member of the New York Forecasters Club, NABE, and the American Economic Association. Prior to his time in the financial services sector, Sandy was a Research Officer at the Federal Reserve Bank of St. Louis, Senior Staff Economist on the President’s Council of Economic Advisors, Deputy Assistant Secretary for Economic Policy at the US Treasury, and Economist at the International Monetary Fund. Sandy has taught economics at St. Louis University, Denison University, and Muskingun College. He has published numerous peer-reviewed articles in a wide range of academic publications. He has a B.A. in economics from the University of Richmond and a M.A. and Ph.D. in economics from The Ohio State University.

More Economy in Brief

Global| Feb 05 2026

Global| Feb 05 2026Charts of the Week: Balanced Policy, Resilient Data and AI Narratives

by:Andrew Cates