Global| Dec 23 2019

Global| Dec 23 2019U.S. Durable Goods Orders Dragged Down by Defense Aircraft in November

by:Sandy Batten

|in:Economy in Brief

Summary

The advance reading for November indicated that durable goods orders fell 2.0% m/m (-3.7% y/y) following a 0.2% m/m rise in October, revised down from 0.6%. A 1.5% increase had been expected in the Action Economics Forecast Survey. [...]

The advance reading for November indicated that durable goods orders fell 2.0% m/m (-3.7% y/y) following a 0.2% m/m rise in October, revised down from 0.6%. A 1.5% increase had been expected in the Action Economics Forecast Survey. The primary cause for the unexpected outsized decline was a 72.7% m/m collapse in orders for defense aircraft, which led to a 38.2% m/m drop in overall defense orders. Orders excluding defense rose 0.8% m/m in November following an unchanged reading in October. So, apart from weakness in defense, the report was not as weak as the headline decline indicated.

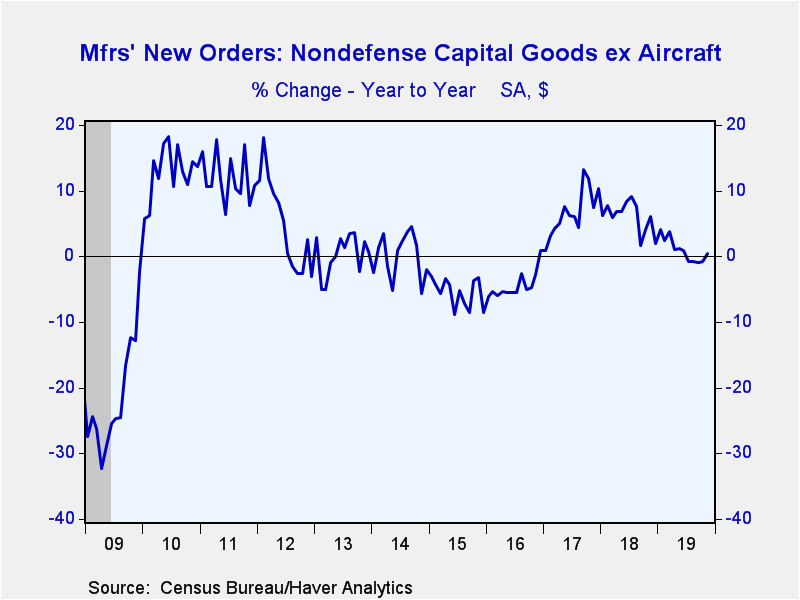

Orders for nondefense capital goods excluding aircraft, a key indicator of business investment plans, edged up 0.1% m/m (0.5% y/y) in November on top of a 1.1% m/m jump in October. Shipments of nondefense capital goods excluding aircraft, a good indicator of current business spending on equipment, fell 0.3% m/m after a downwardly revised 0.7% m/m gain in October. The October/November average of core capital goods shipments is about unchanged from the Q3 average, auguring about unchanged business spending on equipment in Q4 in the NIPAs, but this would be much better than the 3.8% q/q saar decline reported in Q3.

While the collapse in defense aircraft orders dragged down the overall transportation category (-5.9% m/m), orders for motor vehicles and parts actually rebounded, rising 1.9% m/m in November, reflecting the resolution of the GM strike, after having declined significantly each of the previous three months. Of the other major categories, orders for fabricated metals rose 0.4% m/m, orders for computing equipment rose 0.2% m/m, orders for electrical equipment jumped up 2.0% m/m, and other durable goods orders increased 0.2% m/m.

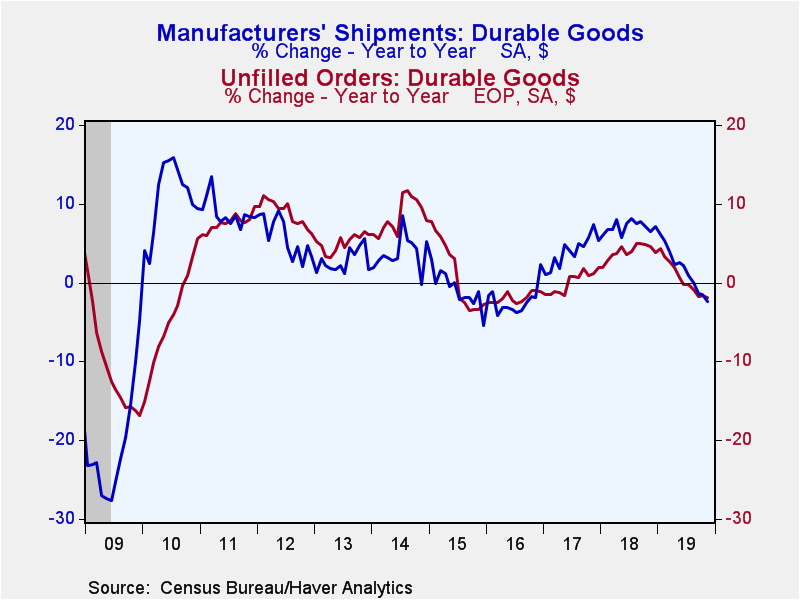

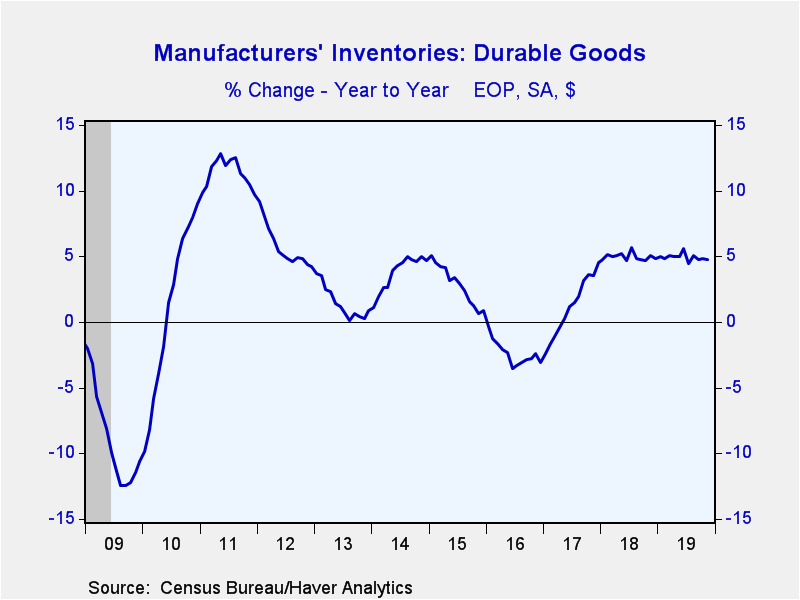

Durable goods shipments edged up 0.1% m/m (-2.4% y/y) in November, but this was the first monthly increase in five months. Shipments excluding defense were also up 0.1% m/m as were shipments excluding transportation. Inventories of durable goods continued to rise, up 0.4% m/m (4.7% y/y) in November, the same monthly gain as in October. Unfilled durable goods orders slipped 0.4% m/m (-1.9% y/y), due mostly to unfilled defense orders (-1.8% m/m). Unfilled orders excluding defense edged down 0.1% m/m, their ninth decline in the past ten months.

The durable goods figures are available in Haver's USECON database. The Action Economics consensus forecast figure is in the AS1REPNA database.

| Durable Goods NAICS Classification | Nov | Oct | Sep | Nov Y/Y | 2018 | 2017 | 2016 |

|---|---|---|---|---|---|---|---|

| New Orders (SA, % chg) | -2.0 | 0.2 | -1.5 | -3.7 | 7.9 | 5.4 | -1.7 |

| Transportation | -5.9 | 0.1 | -3.2 | -10.1 | 9.8 | 3.2 | -0.6 |

| Total Excluding Transportation | 0.0 | 0.3 | -0.6 | -0.3 | 6.9 | 6.5 | -2.3 |

| Nondefense Capital Goods | -1.8 | 2.1 | -3.5 | -5.5 | 5.5 | 9.1 | -5.8 |

| Excluding Aircraft | 0.1 | 1.1 | -0.5 | 0.5 | 6.0 | 6.7 | -4.5 |

| Shipments | 0.1 | -0.1 | -0.7 | -2.4 | 7.1 | 4.0 | -2.3 |

| Unfilled Orders | -0.4 | 0.0 | 0.0 | -1.9 | 3.9 | 1.9 | -1.1 |

| Inventories | 0.4 | 0.4 | 0.5 | 4.7 | 4.8 | 4.5 | -3.0 |

Sandy Batten

AuthorMore in Author Profile »Sandy Batten has more than 30 years of experience analyzing industrial economies and financial markets and a wide range of experience across the financial services sector, government, and academia. Before joining Haver Analytics, Sandy was a Vice President and Senior Economist at Citibank; Senior Credit Market Analyst at CDC Investment Management, Managing Director at Bear Stearns, and Executive Director at JPMorgan. In 2008, Sandy was named the most accurate US forecaster by the National Association for Business Economics. He is a member of the New York Forecasters Club, NABE, and the American Economic Association. Prior to his time in the financial services sector, Sandy was a Research Officer at the Federal Reserve Bank of St. Louis, Senior Staff Economist on the President’s Council of Economic Advisors, Deputy Assistant Secretary for Economic Policy at the US Treasury, and Economist at the International Monetary Fund. Sandy has taught economics at St. Louis University, Denison University, and Muskingun College. He has published numerous peer-reviewed articles in a wide range of academic publications. He has a B.A. in economics from the University of Richmond and a M.A. and Ph.D. in economics from The Ohio State University.