Global| Feb 26 2019

Global| Feb 26 2019U.S. FHFA House Price Index Rises in December, but Trend Continues to Slow

by:Sandy Batten

|in:Economy in Brief

Summary

The Federal Housing Finance Agency (FHFA) Price Index for house purchases rose 0.3% m/m (5.6% y/y) in December following an unrevised 0.4% m/m (5.8% y/y) increase in November. The slowdown in the y/y rate to 5.6% was a continuation of [...]

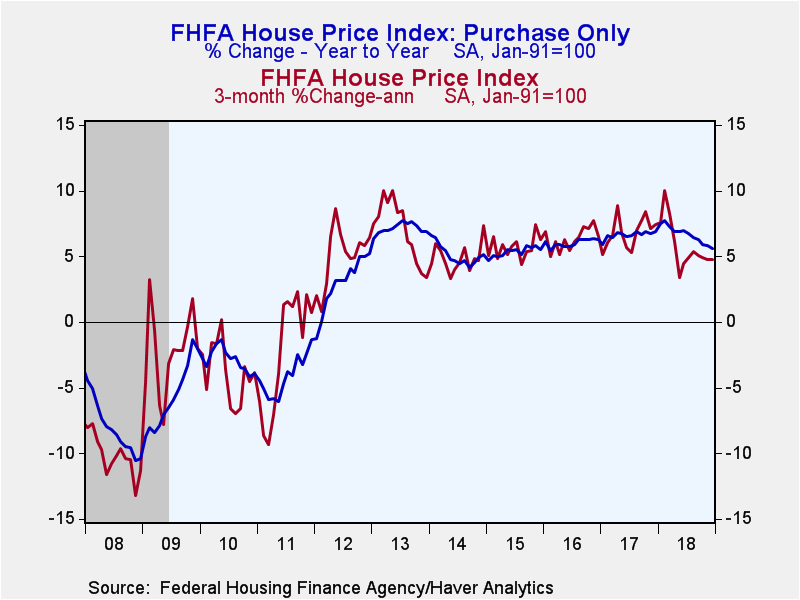

The Federal Housing Finance Agency (FHFA) Price Index for house purchases rose 0.3% m/m (5.6% y/y) in December following an unrevised 0.4% m/m (5.8% y/y) increase in November. The slowdown in the y/y rate to 5.6% was a continuation of the slowing trend in place since early 2018. The y/y rate of advance in February 2018 was 7.7%. The yearly increase in December was the lowest since February 2016. In the most recent six months, the national index has increased at a 4.9% annual rate, down from the recent high of 8.6% at an annual rate in the six months ending in February 2018 but up from 4.4% posted in the six months ending in August 2018. For all of 2018, nationwide prices increased 6.7%, the same increase as in 2017. Across the nine census regions, the pace of price increase for all of 2018 increased in six regions and slowed in the other three.

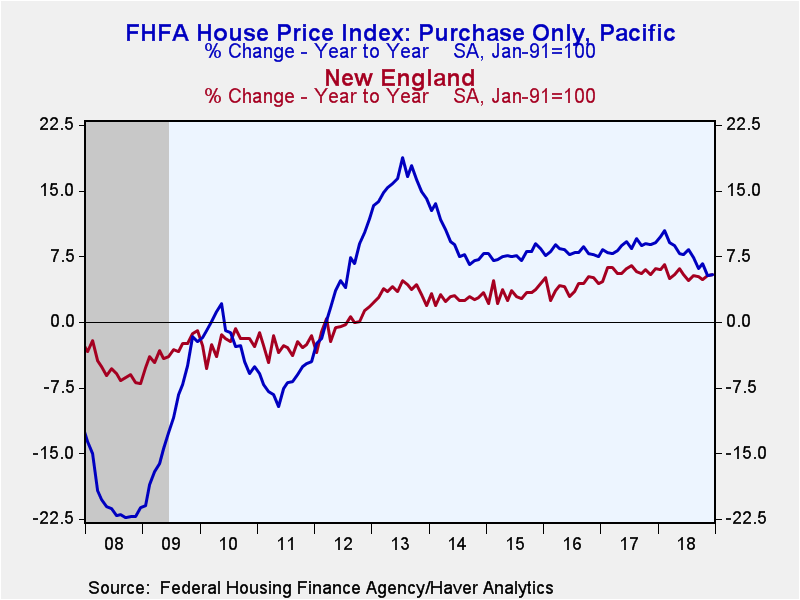

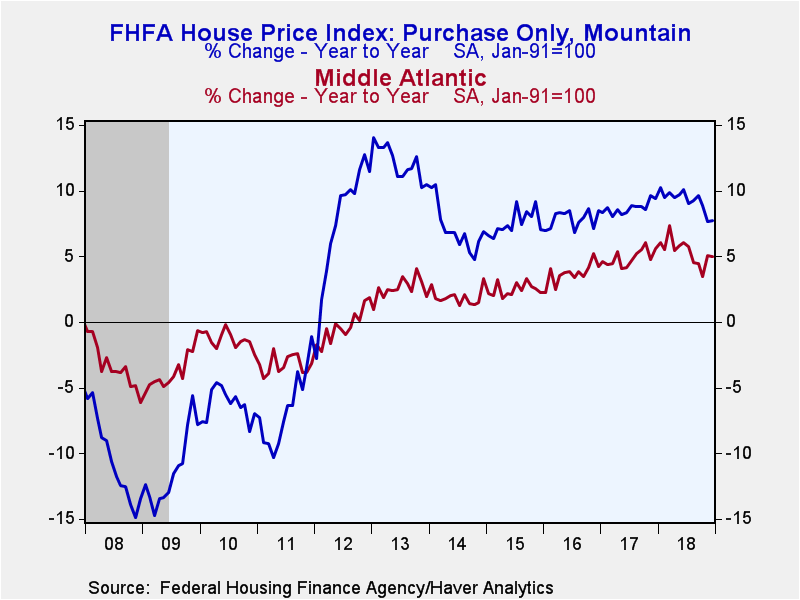

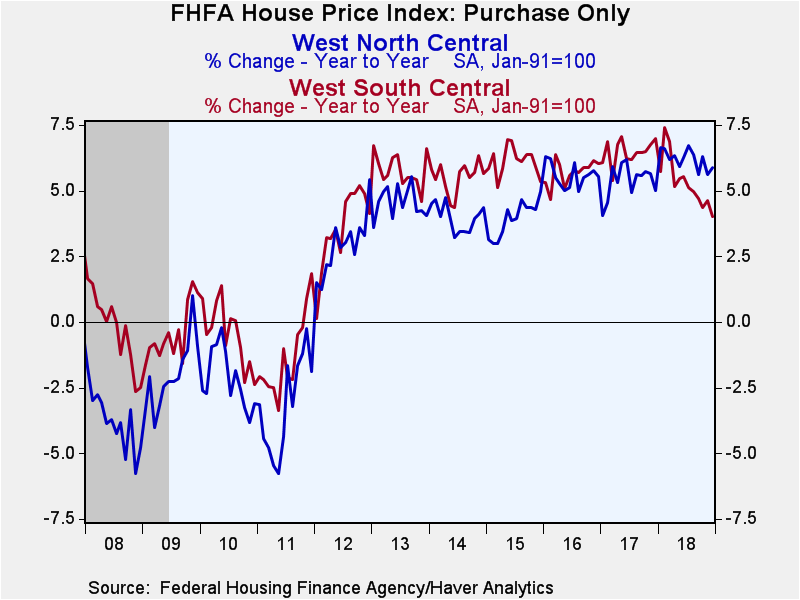

The moderation in prices in the national index during 2018 was generally echoed across the nine major census regions. The most pronounced decelerations have been in the Pacific, Middle Atlantic, and West South Central regions. In December, prices in the Pacific region rose 0.5% m/m (5.4% y/y) and prices in the Middle Atlantic region increased 0.4% m/m (5.0% y/y) while prices in the West South Central region fell 0.2% m/m (+4.0% y/y). Prices also fell in the East South Central region in December, declining 0.3% m/m (+6.2% y/y), but rose in the other seven regions.

From a year ago, prices rose in each of the nine regions in December. The Mountain region experienced the largest increase (7.7% y/y), while the West South Central region experienced the weakest increase (4.0% y/y).

In the more detailed quarterly report (which obviously is only released four times a year), home prices rose in all 50 states and the District of Columbia between the fourth quarter of 2017 and 2018 with the largest annual increases in Idaho and Nevada. And home prices rose in 98 of the 100 largest metropolitan areas in the U.S over the past four quarters. Annual price increases were the largest in San Francisco-San Mateo-Redwood City, CA (+17.0% y/y) and were the weakest in urban Honolulu, HI (-2.0% y/y).

The FHFA house price index is a weighted purchase-only index that measures average price changes in repeat sales of the same property. An associated quarterly index includes refinancings on the same kinds of properties. The indexes are based on transactions involving conforming, conventional mortgages purchased or securitized by Fannie Mae or Freddie Mac. Only mortgage transactions on single-family properties are included. The FHFA data are available in Haver’s USECON database. The detailed quarterly data are in Haver’s REGIONAL database.

| FHFA U.S. House Price Index, Purchase Only (SA %) |

Dec | Nov | Oct | Dec Y/Y | 2018 | 2017 | 2016 |

|---|---|---|---|---|---|---|---|

| Total | 0.3 | 0.4 | 0.4 | 5.6 | 6.7 | 6.7 | 6.1 |

| New England | 0.8 | 0.3 | 0.8 | 5.4 | 5.4 | 5.9 | 4.1 |

| Middle Atlantic | 0.4 | 1.5 | -0.1 | 5.0 | 5.4 | 4.9 | 3.7 |

| East North Central | 0.2 | -0.3 | 0.6 | 5.2 | 6.5 | 6.1 | 5.4 |

| West North Central | 0.4 | -0.1 | 1.2 | 5.9 | 6.2 | 5.4 | 5.6 |

| South Atlantic | 0.4 | 1.0 | -0.3 | 6.3 | 7.2 | 7.0 | 7.0 |

| East South Central | -0.3 | 0.8 | 0.9 | 6.2 | 6.1 | 5.9 | 5.1 |

| West South Central | -0.2 | 1.0 | 0.2 | 4.0 | 5.3 | 6.5 | 5.8 |

| Mountain | 0.6 | 0.1 | 0.2 | 7.7 | 9.2 | 8.8 | 7.9 |

| Pacific | 0.5 | -0.4 | 1.1 | 5.4 | 7.7 | 8.7 | 8.0 |

New England: Maine, New Hampshire, Vermont,

Massachusetts, Rhode Island and Connecticut.

Middle Atlantic: New York, New Jersey and Pennsylvania.

East North Central: Michigan, Wisconsin, Illinois, Indiana and Ohio.

West North Central: North Dakota, South Dakota, Minnesota, Nebraska,

Iowa, Kansas and Missouri.

South Atlantic: Delaware, Maryland, D.C., Virginia, West Virginia,

North Carolina, South Carolina, Georgia and Florida.

East South Central: Kentucky, Tennessee, Mississippi and Alabama.

West South Central: Oklahoma, Arkansas, Texas and Louisiana.

Mountain: Montana, Idaho, Wyoming, Nevada, Utah, Colorado, Arizona and

New Mexico.

Pacific: Alaska, California, Hawaii, Oregon, Washington.

Sandy Batten

AuthorMore in Author Profile »Sandy Batten has more than 30 years of experience analyzing industrial economies and financial markets and a wide range of experience across the financial services sector, government, and academia. Before joining Haver Analytics, Sandy was a Vice President and Senior Economist at Citibank; Senior Credit Market Analyst at CDC Investment Management, Managing Director at Bear Stearns, and Executive Director at JPMorgan. In 2008, Sandy was named the most accurate US forecaster by the National Association for Business Economics. He is a member of the New York Forecasters Club, NABE, and the American Economic Association. Prior to his time in the financial services sector, Sandy was a Research Officer at the Federal Reserve Bank of St. Louis, Senior Staff Economist on the President’s Council of Economic Advisors, Deputy Assistant Secretary for Economic Policy at the US Treasury, and Economist at the International Monetary Fund. Sandy has taught economics at St. Louis University, Denison University, and Muskingun College. He has published numerous peer-reviewed articles in a wide range of academic publications. He has a B.A. in economics from the University of Richmond and a M.A. and Ph.D. in economics from The Ohio State University.