Global| Jun 25 2019

Global| Jun 25 2019U.S. FHFA House Price Index Trend Shows Signs of Stabilizing

by:Sandy Batten

|in:Economy in Brief

Summary

The y/y rate of advance in the Federal Housing Finance Agency (FHFA) Price Index for house purchases showed signs of stabilizing in April. The y/y pace had slowed in each month since last June, but in April it picked up (albeit only [...]

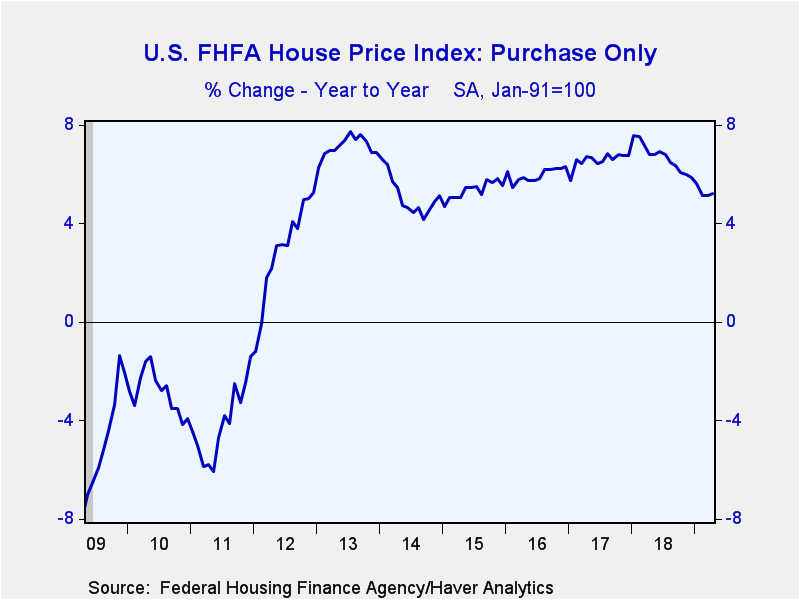

The y/y rate of advance in the Federal Housing Finance Agency (FHFA) Price Index for house purchases showed signs of stabilizing in April. The y/y pace had slowed in each month since last June, but in April it picked up (albeit only slightly) to 5.22% y/y from 5.13% in March and 5.16% in February. In the month of April, the index increased 0.4% m/m versus 0.2% in March. Still, the pace of the annual increase pales in comparison to the recent high of 7.6% y/y reached in January 2018. Over the past six months, nationwide house prices have increased 5.0% at an annual rate.

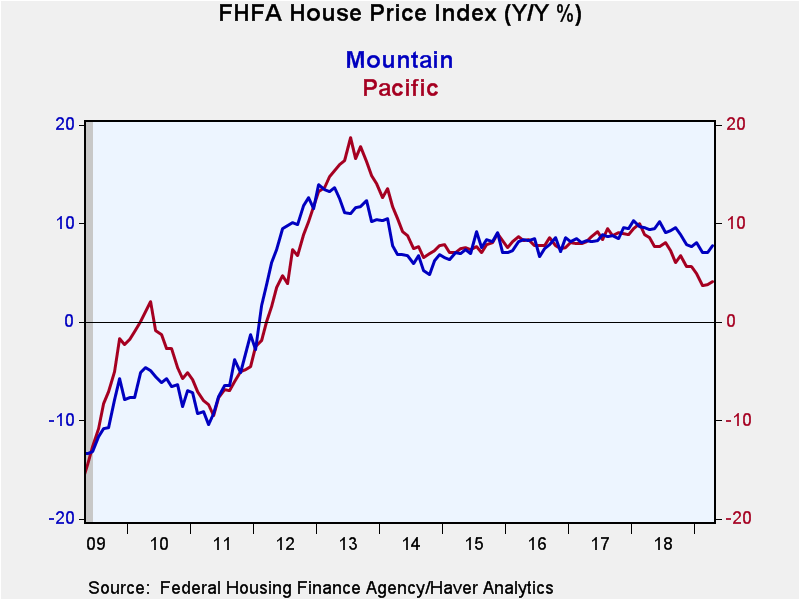

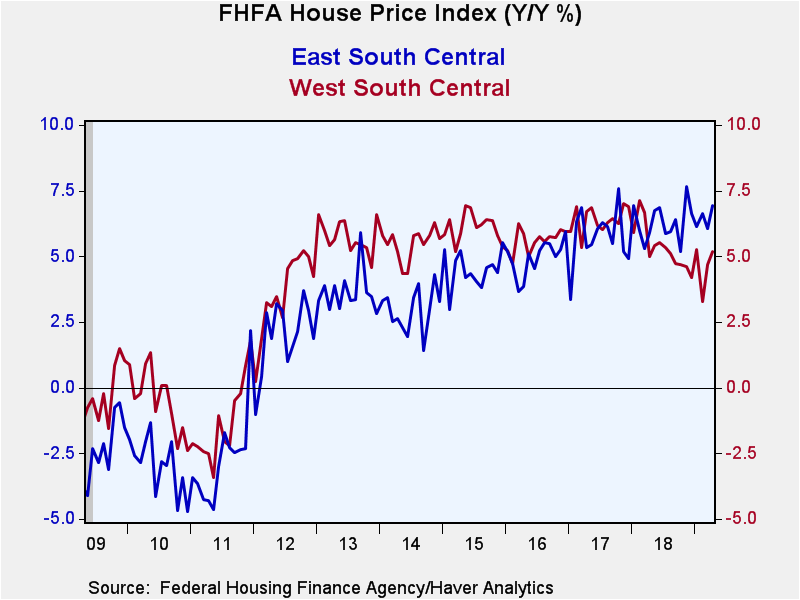

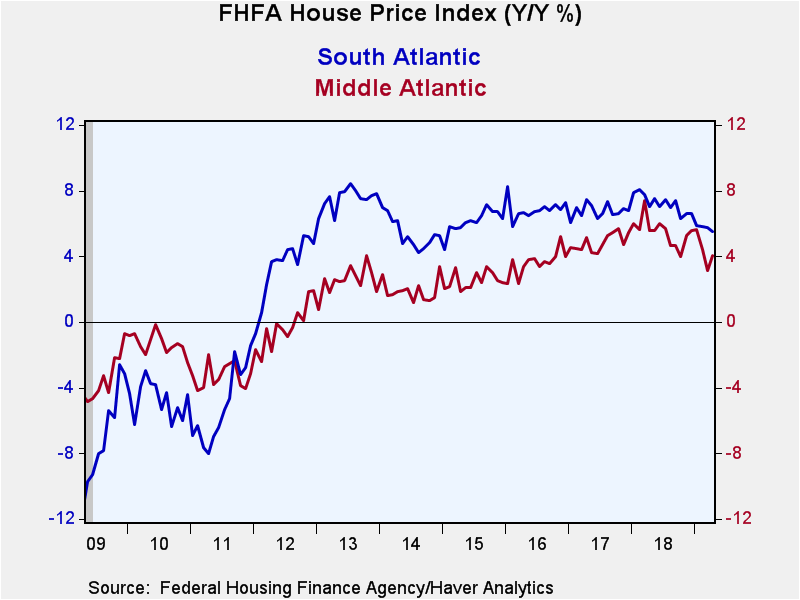

For the nine census division, the seasonally adjusted monthly change in house prices in April ranged from -0.6% m/m in West North Central region to +1.2% m/m in the Mountain region. House prices in April also declined in the Middle Atlantic region (-0.1% m/m). Prices rose in the other seven regions, with the 1.1% m/m rise in prices in the East South Central region coming in a close second to the jump in the Mountain region.

House prices in April were higher than a year ago in each region, led by a 7.8% y/y advance in the Mountain region. Prices in the Middle Atlantic region posted the most modest annual increase, rising 4.0% over the past year.

The FHFA house price index is a weighted purchase-only index that measures average price changes in repeat sales of the same property. An associated quarterly index includes refinancings on the same kinds of properties. The indexes are based on transactions involving conforming, conventional mortgages purchased or securitized by Fannie Mae or Freddie Mac. Only mortgage transactions on single-family properties are included. The FHFA data are available in Haver's USECON database.

| FHFA U.S. House Price Index, Purchase Only (SA %) |

Apr | Mar | Feb | Jan | Apr Y/Y | 2018 | 2017 | 2016 |

|---|---|---|---|---|---|---|---|---|

| Total | 0.4 | 0.2 | 0.4 | 0.5 | 5.2 | 6.7 | 6.6 | 6.0 |

| New England | 0.6 | -0.7 | 1.4 | -0.6 | 4.5 | 5.5 | 5.8 | 4.1 |

| Middle Atlantic | -0.1 | 0.6 | -0.5 | 0.8 | 4.0 | 5.5 | 4.9 | 3.6 |

| East North Central | 0.4 | -0.6 | 1.0 | 0.9 | 4.9 | 6.5 | 6.0 | 5.3 |

| West North Central | -0.6 | 1.4 | 0.2 | 0.5 | 5.0 | 6.2 | 5.4 | 5.6 |

| South Atlantic | 0.1 | 0.2 | 0.7 | 0.5 | 5.5 | 7.2 | 6.8 | 6.9 |

| East South Central | 1.1 | -0.5 | 1.0 | 0.1 | 6.9 | 6.3 | 5.8 | 5.0 |

| West South Central | 0.5 | 0.4 | 0.3 | 0.6 | 5.2 | 5.4 | 6.5 | 5.7 |

| Mountain | 1.2 | 0.6 | -0.1 | 1.1 | 7.8 | 9.3 | 8.6 | 7.8 |

| Pacific | 0.6 | 0.0 | 0.2 | 0.3 | 4.1 | 7.7 | 8.6 | 8.0 |

New England: Maine, New Hampshire, Vermont,

Massachusetts, Rhode Island and Connecticut.

Middle Atlantic: New York, New Jersey and Pennsylvania.

East North Central: Michigan, Wisconsin, Illinois, Indiana and Ohio.

West North Central: North Dakota, South Dakota, Minnesota, Nebraska,

Iowa, Kansas and Missouri.

South Atlantic: Delaware, Maryland, D.C., Virginia, West Virginia,

North Carolina, South Carolina, Georgia and Florida.

East South Central: Kentucky, Tennessee, Mississippi and Alabama.

West South Central: Oklahoma, Arkansas, Texas and Louisiana.

Mountain: Montana, Idaho, Wyoming, Nevada, Utah, Colorado, Arizona and

New Mexico.

Pacific: Alaska, California, Hawaii, Oregon, Washington.

Sandy Batten

AuthorMore in Author Profile »Sandy Batten has more than 30 years of experience analyzing industrial economies and financial markets and a wide range of experience across the financial services sector, government, and academia. Before joining Haver Analytics, Sandy was a Vice President and Senior Economist at Citibank; Senior Credit Market Analyst at CDC Investment Management, Managing Director at Bear Stearns, and Executive Director at JPMorgan. In 2008, Sandy was named the most accurate US forecaster by the National Association for Business Economics. He is a member of the New York Forecasters Club, NABE, and the American Economic Association. Prior to his time in the financial services sector, Sandy was a Research Officer at the Federal Reserve Bank of St. Louis, Senior Staff Economist on the President’s Council of Economic Advisors, Deputy Assistant Secretary for Economic Policy at the US Treasury, and Economist at the International Monetary Fund. Sandy has taught economics at St. Louis University, Denison University, and Muskingun College. He has published numerous peer-reviewed articles in a wide range of academic publications. He has a B.A. in economics from the University of Richmond and a M.A. and Ph.D. in economics from The Ohio State University.