Global| Dec 24 2019

Global| Dec 24 2019U.S. Gasoline Prices Fell While Crude and Nat Gas Prices Rose

by:Sandy Batten

|in:Economy in Brief

Summary

In the week ended December 23, retail gasoline prices edged down to $2.53 per gallon (+9.1% y/y), the sixth consecutive weekly decrease, from $2.54 per gallon in the previous week. Typically, gasoline prices weaken at this time of [...]

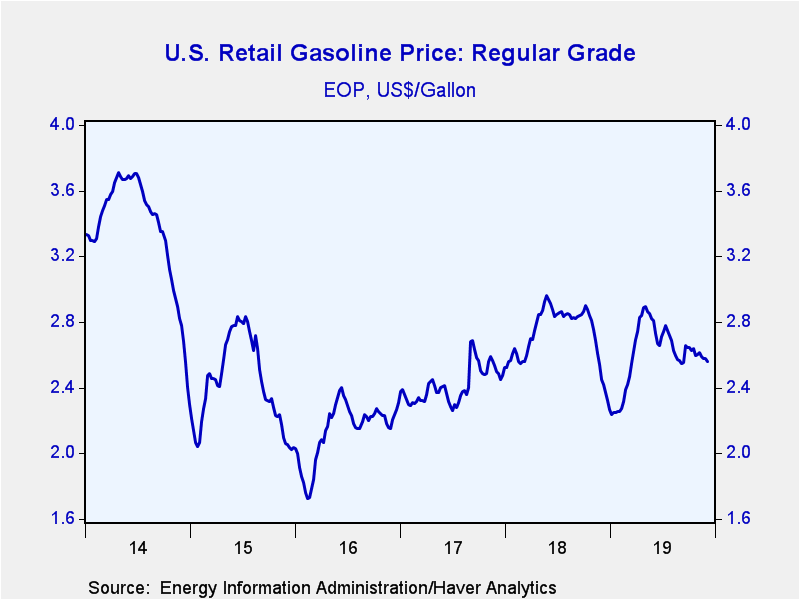

In the week ended December 23, retail gasoline prices edged down to $2.53 per gallon (+9.1% y/y), the sixth consecutive weekly decrease, from $2.54 per gallon in the previous week. Typically, gasoline prices weaken at this time of year; so Haver Analytics adjusts prices for seasonal variation. The seasonally adjusted gasoline price rose to $2.72 per gallon, the eight consecutive weekly increase and the highest price since mid-May, from $2.70 per gallon. The divergence of not seasonally adjusted and seasonally adjusted prices indicates that gasoline prices at the pump have fallen recently but not by as much as they usually do at this time of year.

In the week ended December 20, the West Texas Intermediate crude oil price rose to $60.74 per barrel (+29.6% y/y) from $59.25 per barrel in the previous week. This is the seventh consecutive weekly increase and pushed the price to its highest level since late May. Yesterday, the price was $60.52. Brent crude oil prices also rose to an average of $66.03 per barrel (+17.8% y/y) from $64.39 the previous week. They rose yesterday to $66.47 yesterday.

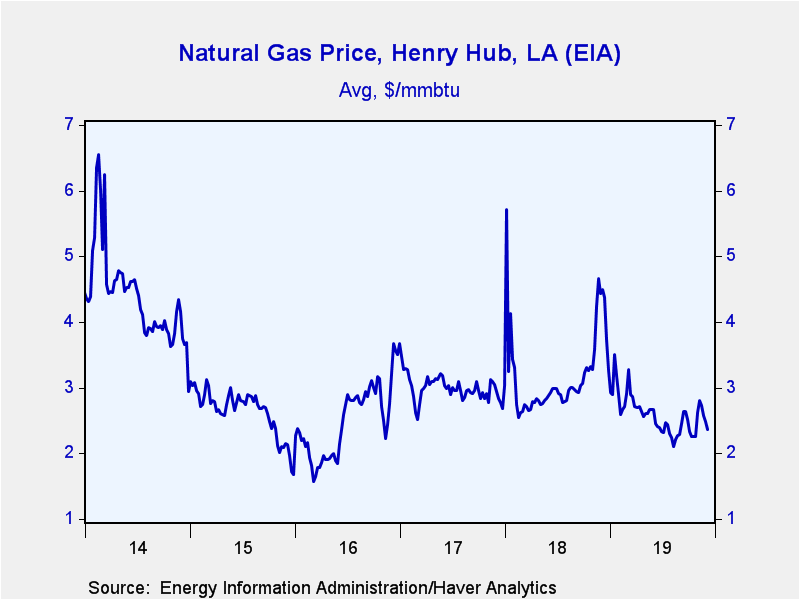

The weekly average price of natural gas prices rose to $2.28/mmbtu (-38.9% y/y) in the week ended December 20 from an average of $2.24/mmbtu in the previous week. This is the first weekly increase in the past six weeks.

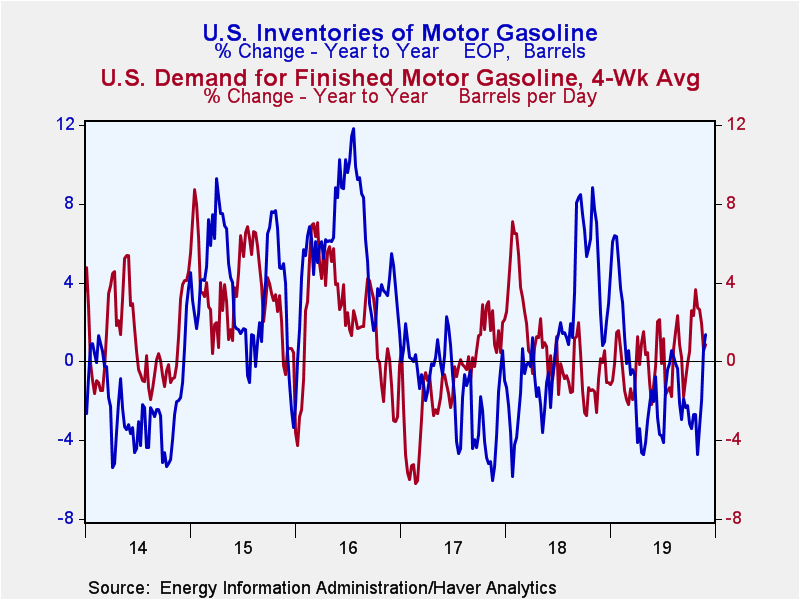

In the four-weeks ending December 13, gasoline demand increased 0.5% y/y but total petroleum product demand declined 2.9% y/y. Gasoline inventories gained 3.1% y/y and inventories of all petroleum products increased 1.9% y/y. Crude oil input to refineries fell 5.1% y/y in the last four weeks.

These data are reported by the U.S. Department of Energy. The price data can be found in Haver's WEEKLY and DAILY databases. Greater detail on prices, as well as the demand, production and inventory data, along with regional breakdowns, are in OILWKLY.

| Weekly Energy Prices | 12/23/19 | 12/16/19 | 12/09/19 | Y/Y % | 2018 | 2017 | 2016 |

|---|---|---|---|---|---|---|---|

| Retail Gasoline ($ per Gallon Regular, Monday Price, End of Period) | 2.53 | 2.54 | 2.56 | 9.1 | 2.27 | 2.47 | 2.31 |

| Light Sweet Crude Oil, WTI ($ per bbl, Previous Week's Average) | 60.74 | 59.25 | 57.64 | 29.6 | 64.95 | 50.87 | 43.22 |

| Natural Gas ($/mmbtu, LA, Previous Week's Average) | 2.28 | 2.24 | 2.37 | -38.9 | 3.18 | 2.99 | 2.51 |

Sandy Batten

AuthorMore in Author Profile »Sandy Batten has more than 30 years of experience analyzing industrial economies and financial markets and a wide range of experience across the financial services sector, government, and academia. Before joining Haver Analytics, Sandy was a Vice President and Senior Economist at Citibank; Senior Credit Market Analyst at CDC Investment Management, Managing Director at Bear Stearns, and Executive Director at JPMorgan. In 2008, Sandy was named the most accurate US forecaster by the National Association for Business Economics. He is a member of the New York Forecasters Club, NABE, and the American Economic Association. Prior to his time in the financial services sector, Sandy was a Research Officer at the Federal Reserve Bank of St. Louis, Senior Staff Economist on the President’s Council of Economic Advisors, Deputy Assistant Secretary for Economic Policy at the US Treasury, and Economist at the International Monetary Fund. Sandy has taught economics at St. Louis University, Denison University, and Muskingun College. He has published numerous peer-reviewed articles in a wide range of academic publications. He has a B.A. in economics from the University of Richmond and a M.A. and Ph.D. in economics from The Ohio State University.