Global| Oct 16 2019

Global| Oct 16 2019U.S. Home Builder Sentiment Posts Solid Gain, Led by South and West

by:Sandy Batten

|in:Economy in Brief

Summary

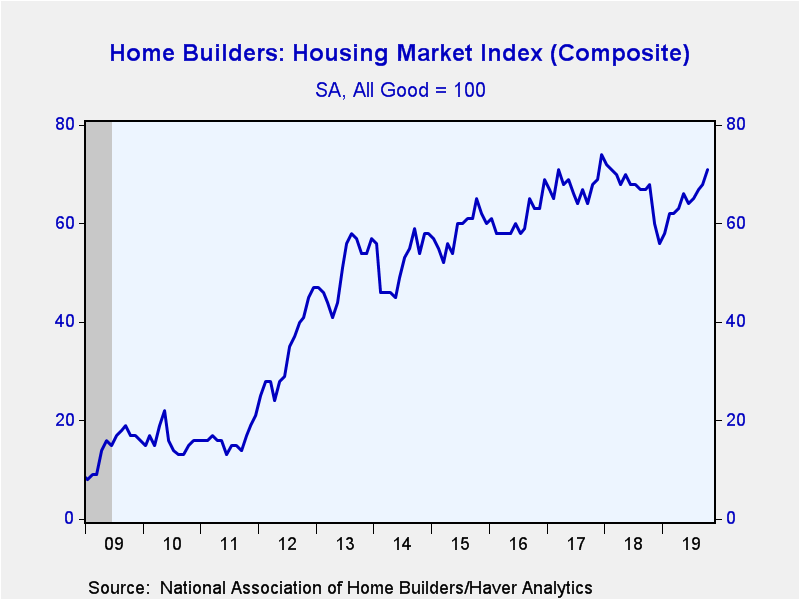

The Composite Housing Market Index from the National Association of Home Builders-Wells Fargo rose for the fourth consecutive month to 71 in October from 68 in September. This is the highest reading since January 2018. The index has [...]

The Composite Housing Market Index from the National Association of Home Builders-Wells Fargo rose for the fourth consecutive month to 71 in October from 68 in September. This is the highest reading since January 2018. The index has risen almost continually throughout 2019 but is still slightly below the most recent peak of 74 reached in December 2017. The NAHB figures are seasonally adjusted. Over the past ten years, there has been a 62% correlation between the y/y change in the home builders index and the y/y change in new plus existing home sales.

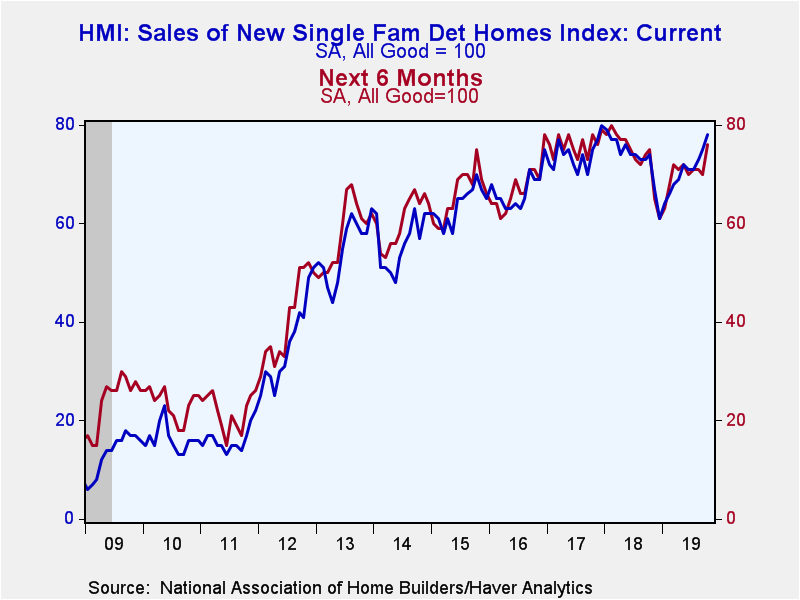

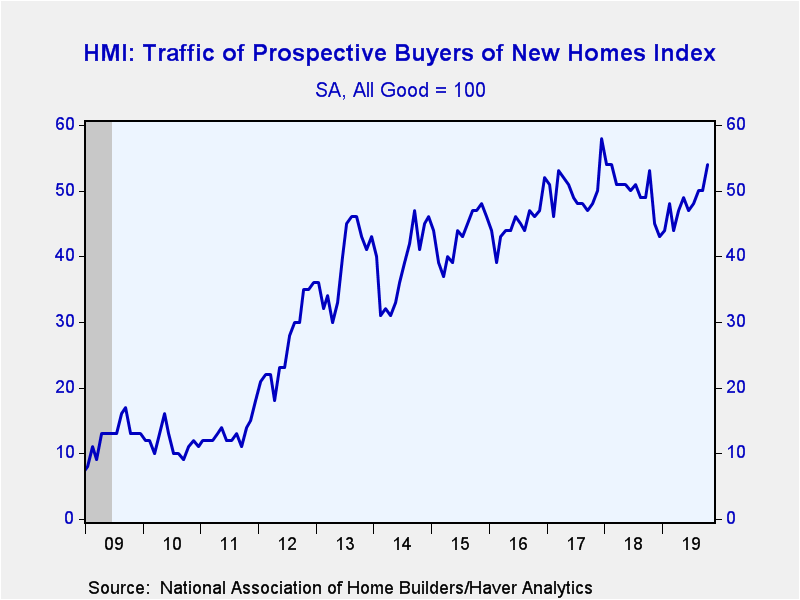

The index of present sales conditions rose to 78 this month from 75 in September, its third consecutive increase and well above the recent low of 61 reached last December. The index of expected conditions in the next six months jumped up to 76 in October from 70 in September, its largest monthly increase since December 2016. The index measuring traffic of prospective buyers rose to 54 in October, the highest reading since February 2018, from 50 in September.

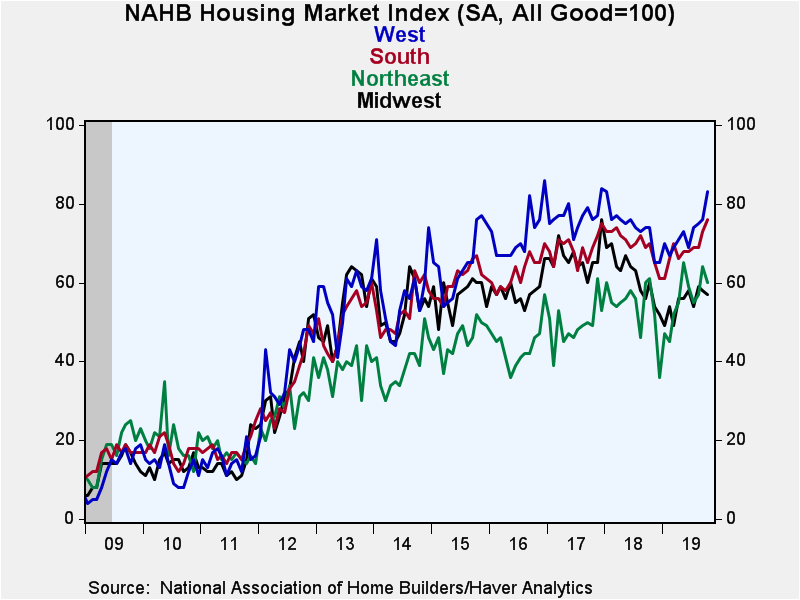

Regional readings showed modest monthly declines in the Northeast and Midwest more than offset by solid monthly increases in the South and West. For the Northeast, the index fell back to 60 in October after an outsized jump to 64 in September. In the Midwest, the index slipped to 57, the second consecutive monthly decline, from 58. In contrast, the index for the South posted its second consecutive solid monthly increase, rising to 76 from 73. This month's reading was the highest since October 2005 and the second highest in the history of the regional series. In the West, the index jumped up 7 points to 83, the largest monthly gain since December 2017 and the highest reading since January 2018.

The NAHB has compiled the Housing Market Index since 1985. It reflects survey questions which ask builders to rate sales and sales expectations as "good," "fair" or "poor" and traffic as "very high," "average" or "very low." The figures are diffusion indexes with values over 50 indicating a predominance of "good"/"very high" readings. In constructing the composite index, the weights assigned to the individual index components are: 0.5920 for single-family detached sales, present time, 0.1358 for single-family detached sales, next six months, and 0.2722 for traffic of prospective buyers. These data are included in Haver's SURVEYS database.

| National Association of Home Builders | Oct | Sep | Aug | Oct'18 | 2018 | 2017 | 2016 |

|---|---|---|---|---|---|---|---|

| Composite Housing Market Index, SA (All Good=100) | 71 | 68 | 67 | 68 | 67 | 68 | 61 |

| Single-Family Sales: Present | 78 | 75 | 73 | 74 | 73 | 74 | 67 |

| Single-Family Sales: Next Six Months | 76 | 70 | 71 | 75 | 74 | 76 | 67 |

| Traffic of Prospective Buyers | 54 | 50 | 50 | 53 | 50 | 50 | 45 |

Sandy Batten

AuthorMore in Author Profile »Sandy Batten has more than 30 years of experience analyzing industrial economies and financial markets and a wide range of experience across the financial services sector, government, and academia. Before joining Haver Analytics, Sandy was a Vice President and Senior Economist at Citibank; Senior Credit Market Analyst at CDC Investment Management, Managing Director at Bear Stearns, and Executive Director at JPMorgan. In 2008, Sandy was named the most accurate US forecaster by the National Association for Business Economics. He is a member of the New York Forecasters Club, NABE, and the American Economic Association. Prior to his time in the financial services sector, Sandy was a Research Officer at the Federal Reserve Bank of St. Louis, Senior Staff Economist on the President’s Council of Economic Advisors, Deputy Assistant Secretary for Economic Policy at the US Treasury, and Economist at the International Monetary Fund. Sandy has taught economics at St. Louis University, Denison University, and Muskingun College. He has published numerous peer-reviewed articles in a wide range of academic publications. He has a B.A. in economics from the University of Richmond and a M.A. and Ph.D. in economics from The Ohio State University.