Global| Feb 26 2019

Global| Feb 26 2019U.S. Housing Starts Falter in December; Permits Hold Steady

Summary

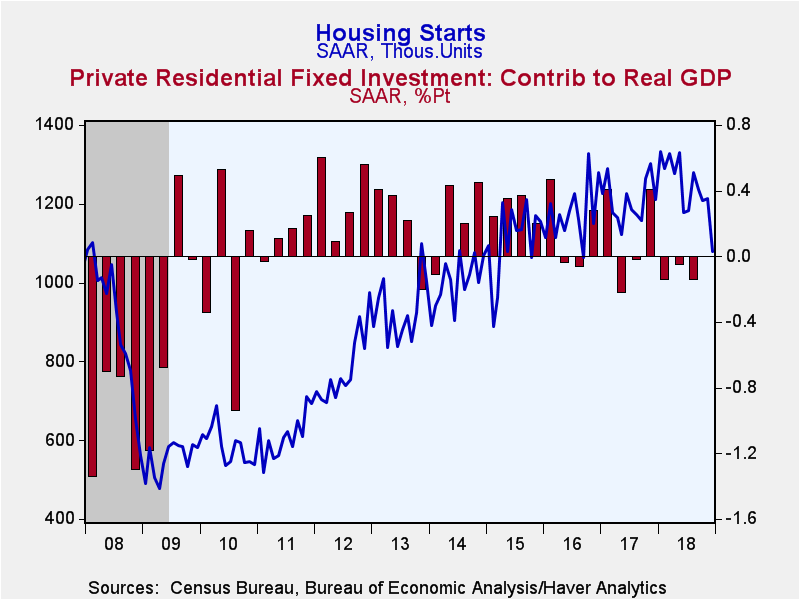

Total housing starts dropped 11.2% (-10.9% year-on-year) during December to a 1.078 million annual rate (AR), its lowest level in 27 months (this report was delayed as a result of the government shutdown). December starts were [...]

Total housing starts dropped 11.2% (-10.9% year-on-year) during December to a 1.078 million annual rate (AR), its lowest level in 27 months (this report was delayed as a result of the government shutdown). December starts were substantially weaker than the 1.252 million expected by the Action Economics Forecast Survey. Moreover, starts for October and November were revised down by a total of 50,000.

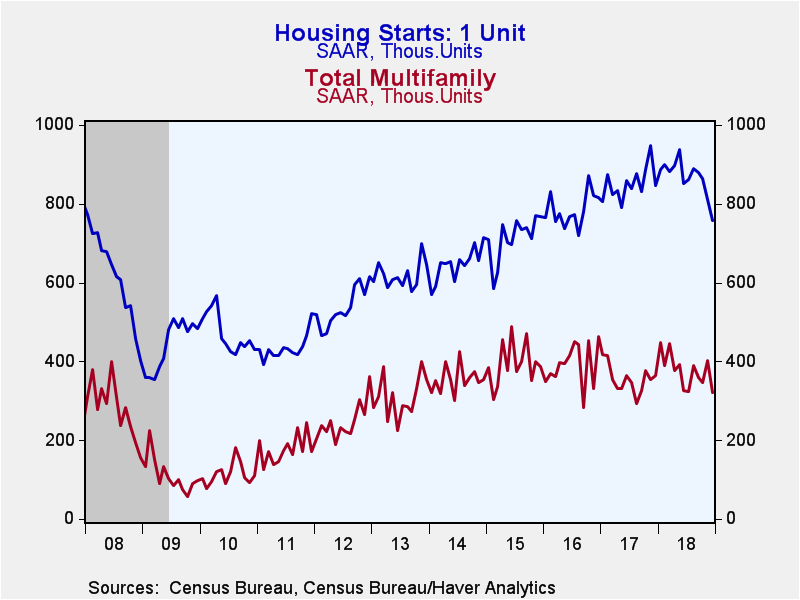

Both single family -6.7% (-10.5% y/y) and multifamily -20.4% (-11.8% y/y) were hit hard in December. Starts fell in every region of the country except the Northeast where they were unchanged (+21.6% y/y). In the West, starts plummeted 26.3% (-39.7% y/y); in the Midwest they dropped 13.2% (-26.5% y/y); while in the South they were down 6.0% (+6.1% y/y). In the Midwest and West housing starts were at their lowest level since early 2015.

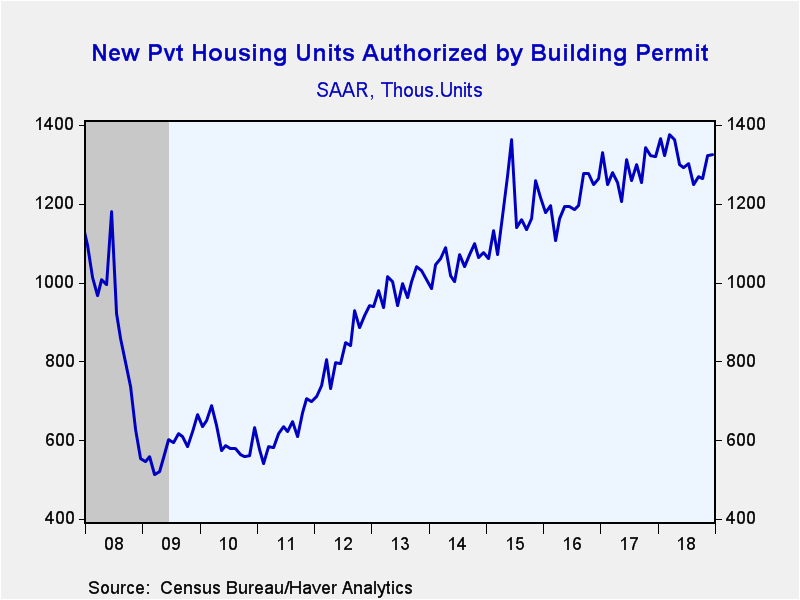

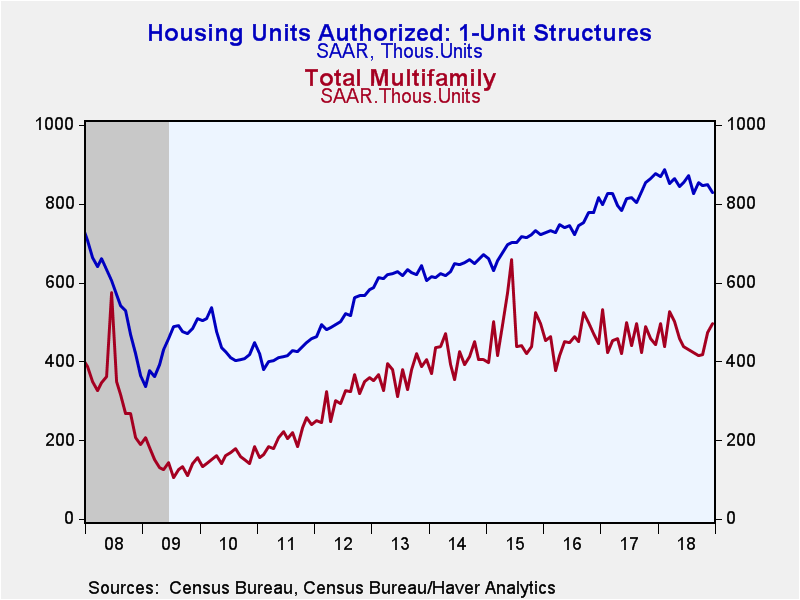

Building permits edged up 0.3% (0.5% y/y) to 1.326 million in December after a slightly-downwardly revised 4.5% gain in November. A 2.2% decline in single-family permits (-5.5% y/y) was offset by the 4.9% rise in multi-family (12.2% y/y).

The housing starts and permits figures can be found in Haver's USECON database. The expectations figure is contained in the AS1REPNA database.

| Housing Starts (000s, SAAR) | Dec | Nov | Oct | Dec Y/Y % | 2018 | 2017 | 2016 |

|---|---|---|---|---|---|---|---|

| Total | 1,078 | 1,214 | 1,209 | -10.9 | 1,245 | 1,208 | 1,177 |

| Single-Family | 758 | 812 | 863 | -10.5 | 868 | 852 | 785 |

| Multi-Family | 320 | 402 | 346 | -11.8 | 376 | 356 | 393 |

| Starts By Region | |||||||

| Northeast | 107 | 107 | 91 | 21.6 | 110 | 111 | 116 |

| Midwest | 125 | 144 | 186 | -26.5 | 170 | 180 | 185 |

| South | 630 | 670 | 592 | 6.1 | 630 | 603 | 585 |

| West | 216 | 293 | 340 | -39.7 | 335 | 314 | 292 |

| Building Permits | 1,326 | 1,322 | 1,265 | 0.5 | 1,313 | 1,286 | 1,206 |

Gerald D. Cohen

AuthorMore in Author Profile »Gerald Cohen provides strategic vision and leadership of the translational economic research and policy initiatives at the Kenan Institute of Private Enterprise.

He has worked in both the public and private sectors focusing on the intersection between financial markets and economic fundamentals. He was a Senior Economist at Haver Analytics from January 2019 to February 2021. During the Obama Administration Gerald was Deputy Assistant Secretary for Macroeconomic Analysis at the U.S. Department of Treasury where he helped formulate and evaluate the impact of policy proposals on the U.S. economy. Prior to Treasury, he co-managed a global macro fund at Ziff Brothers Investments.

Gerald holds a bachelor’s of science from the Massachusetts Institute of Technology and a Ph.D. in Economics from Harvard University and is a contributing author to 30-Second Money as well as a co-author of Political Cycles and the Macroeconomy.