Global| Sep 08 2016

Global| Sep 08 2016U.S. Initial Claims for Unemployment Insurance Edge Lower

by:Sandy Batten

|in:Economy in Brief

Summary

Initial unemployment insurance claims edged down to 259,000 (-5.8% y/y) in the week ending September 3 from an unrevised 263,000 in the week ended August 27. The four-week moving average also eased to 261,250 from 263,000 (also [...]

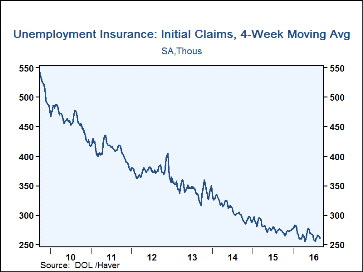

Initial unemployment insurance claims edged down to 259,000 (-5.8% y/y) in the week ending September 3 from an unrevised 263,000 in the week ended August 27. The four-week moving average also eased to 261,250 from 263,000 (also unrevised) previously. The Action Economics Forecast Survey expected 262,000 claims in the latest week. During the last ten years, there has been a 75% correlation between the level of claims and the monthly change in nonfarm payrolls.

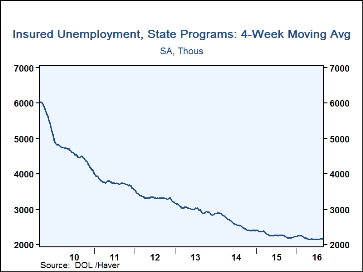

Continuing claims for jobless benefits fell to 2.144 million (-5.2% y/y) in the week ended August 27 from a downwardly revised 2.151 million in the prior week. The four-week moving average fell to 2.154 million, near a four-decade low.

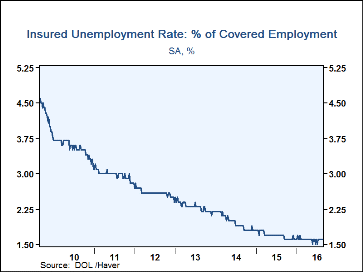

The insured rate of unemployment held steady at 1.6%, near the lowest level since 2000.

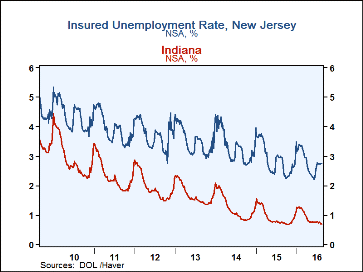

Insured rates of unemployment across states continue to be quite disparate. The state data are not seasonally adjusted and are reported with a two-week lag. For the week ended August 20, the lowest rates were in South Dakota (0.33%), Nebraska (0.42%), North Carolina (0.64%), and Utah (0.64%). The highest rates were found in New Jersey (2.74%), Connecticut (2.71%), and Alaska (2.64%).

Data on weekly unemployment insurance are contained in Haver's WEEKLY database and they are summarized monthly in USECON. Data for individual states are in REGIONW. The expectations figure is from the Action Economics survey, carried in the AS1REPNA database.

| Unemployment Insurance (000s) | 09/3/2016 | 08/27/16 | 08/20/16 | Y/Y % | 2015 | 2014 | 2013 |

|---|---|---|---|---|---|---|---|

| Initial Claims | 259 | 263 | 261 | -5.8 | 277 | 307 | 342 |

| Continuing Claims | -- | 2,144 | 2,151 | -5.2 | 2,268 | 2,607 | 2,978 |

| Insured Unemployment Rate (%) | -- | 1.6 | 1.6 |

1.6 |

1.7 | 2.0 | 2.3 |

Sandy Batten

AuthorMore in Author Profile »Sandy Batten has more than 30 years of experience analyzing industrial economies and financial markets and a wide range of experience across the financial services sector, government, and academia. Before joining Haver Analytics, Sandy was a Vice President and Senior Economist at Citibank; Senior Credit Market Analyst at CDC Investment Management, Managing Director at Bear Stearns, and Executive Director at JPMorgan. In 2008, Sandy was named the most accurate US forecaster by the National Association for Business Economics. He is a member of the New York Forecasters Club, NABE, and the American Economic Association. Prior to his time in the financial services sector, Sandy was a Research Officer at the Federal Reserve Bank of St. Louis, Senior Staff Economist on the President’s Council of Economic Advisors, Deputy Assistant Secretary for Economic Policy at the US Treasury, and Economist at the International Monetary Fund. Sandy has taught economics at St. Louis University, Denison University, and Muskingun College. He has published numerous peer-reviewed articles in a wide range of academic publications. He has a B.A. in economics from the University of Richmond and a M.A. and Ph.D. in economics from The Ohio State University.