Global| Oct 03 2019

Global| Oct 03 2019U.S. ISM Nonmanufacturing and Composite Indexes Erase Last Month's Rise

Summary

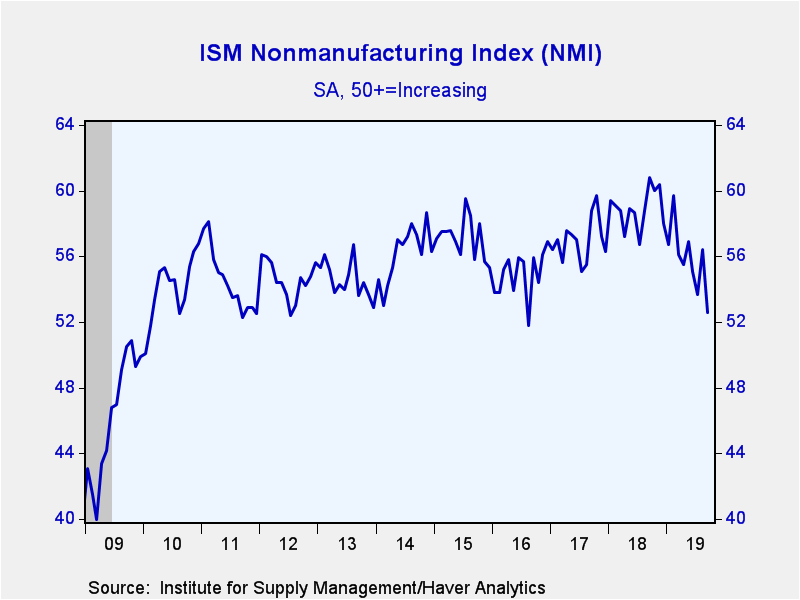

The Composite Index of Nonmanufacturing Sector Activity from the Institute for Supply Management (ISM) fell more than expected to 52.6 during September from 56.4 in August. July's reading was 53.7. September's index is the weakest in [...]

The Composite Index of Nonmanufacturing Sector Activity from the Institute for Supply Management (ISM) fell more than expected to 52.6 during September from 56.4 in August. July's reading was 53.7. September's index is the weakest in three years. The Action Economics Forecast Survey anticipated a decline to 55.1.

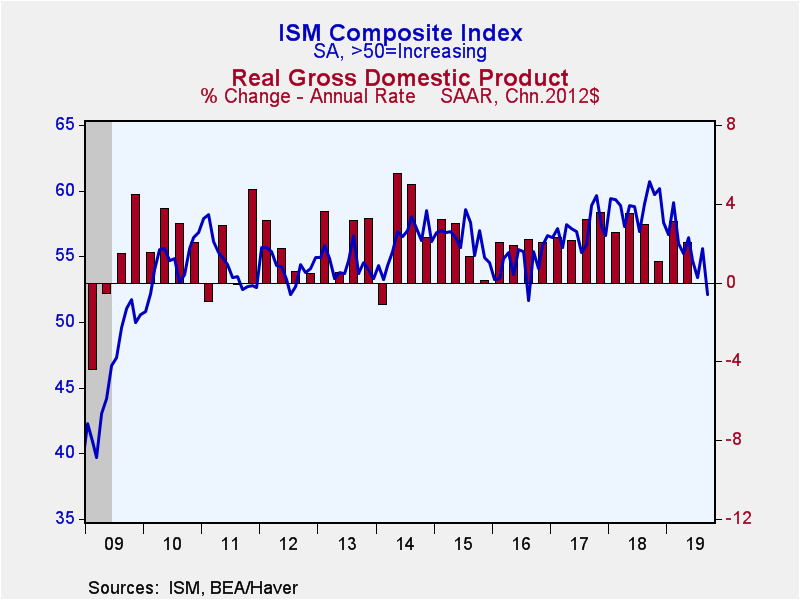

Haver Analytics constructs a composite index combining the nonmanufacturing and the manufacturing ISM, which was released Tuesday. This composite index mirrored the nonmanufacturing index dropping to 52.1 from 55.6 in August also a three-year low.

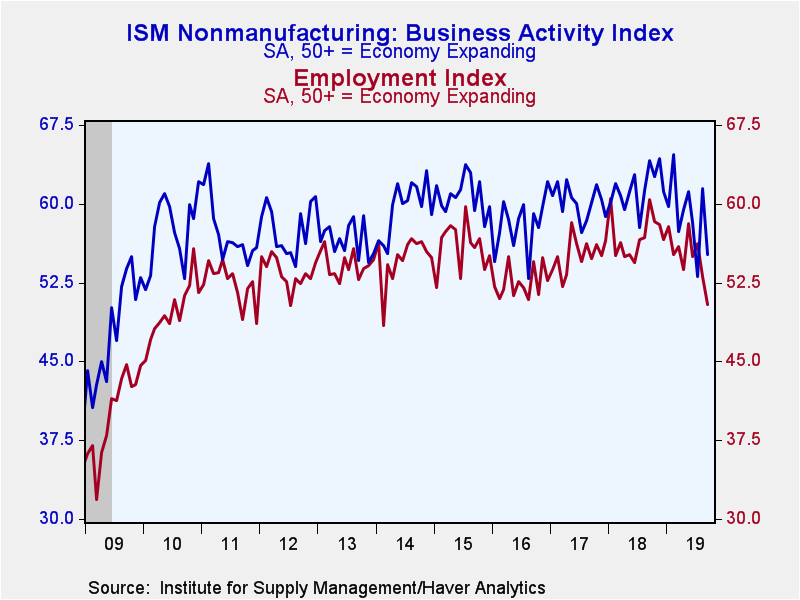

Three out of four of the component indexes for the nonmanufacturing sector declined meaningfully, led by a 6.6 point drop in the new orders measure followed closely by a 6.3 fall in business activity. While employment declined by less -- 2.7 points -- at 50.4 it is now hovering close the 50-growth level, and is at its lowest level since early 2014. This was the result of a four-and-a-half year high of 19% of respondents indicating they were reducing employment, meanwhile only 21% of firms said they were increasing employment (these numbers are not seasonally adjusted). The only positive contribution to the headline was a touch slower supplier deliveries, though this data is also not seasonally adjusted.

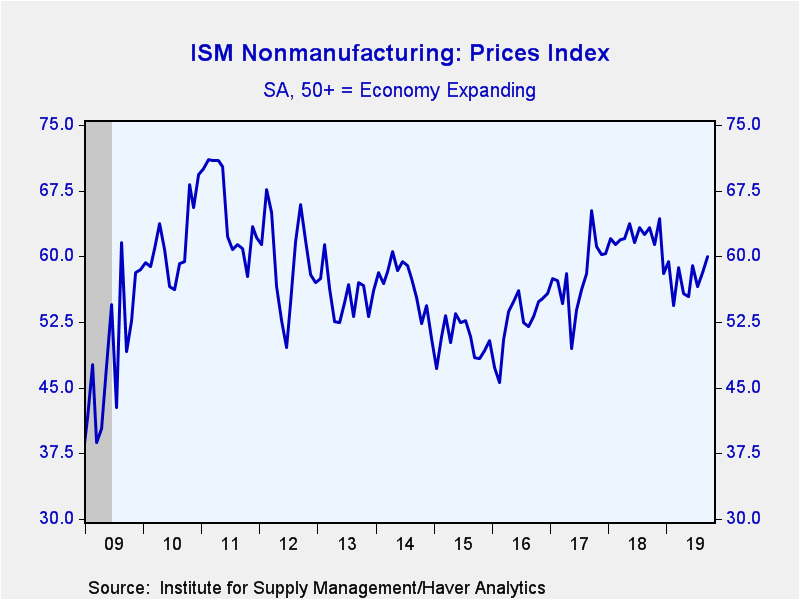

The prices index continued its rise up 1.8 points to 60.0, its highest reading since November 2018. Twenty-four percent of respondents indicated they were raising prices, up from 20%, while just 6% lowered prices, unchanged since July (these numbers are not seasonally adjusted).

Of note, the export orders index, which is not included in the nonmanufacturing composite, rose to 52.0 in September from August's 50.5. Meanwhile, imports declined to 49.0, the lower end of the range it's been for the last three years. Order backlogs rebounded to 54.0 from August's two-and-half year low of 49.0. All of these series are not seasonally adjusted making month-to-month comparisons difficult.

The ISM figures are available in Haver's USECON database, with additional detail in the SURVEYS database. The expectations figure from Action Economics is in the AS1REPNA database.

| ISM Nonmanufacturing Survey (SA) | Sep | Aug | Jul | Sep'18 | 2018 | 2017 | 2016 |

|---|---|---|---|---|---|---|---|

| Composite Diffusion Index | 52.6 | 56.4 | 53.7 | 60.8 | 58.9 | 57.0 | 54.9 |

| Business Activity | 55.2 | 61.5 | 53.1 | 64.1 | 61.5 | 60.2 | 58.0 |

| New Orders | 53.7 | 60.3 | 54.1 | 61.5 | 61.3 | 59.3 | 57.6 |

| Employment | 50.4 | 53.1 | 56.2 | 60.4 | 56.9 | 55.1 | 52.5 |

| Supplier Deliveries (NSA) | 51.0 | 50.5 | 51.5 | 57.0 | 55.8 | 53.2 | 51.5 |

| Prices Index | 60.0 | 58.2 | 56.5 | 63.3 | 62.1 | 57.6 | 52.6 |

| ISM Mfg + Nonmfg Composite (SA) | 52.1 | 55.6 | 53.4 | 60.7 | 58.9 | 57.0 | 54.6 |

Gerald D. Cohen

AuthorMore in Author Profile »Gerald Cohen provides strategic vision and leadership of the translational economic research and policy initiatives at the Kenan Institute of Private Enterprise.

He has worked in both the public and private sectors focusing on the intersection between financial markets and economic fundamentals. He was a Senior Economist at Haver Analytics from January 2019 to February 2021. During the Obama Administration Gerald was Deputy Assistant Secretary for Macroeconomic Analysis at the U.S. Department of Treasury where he helped formulate and evaluate the impact of policy proposals on the U.S. economy. Prior to Treasury, he co-managed a global macro fund at Ziff Brothers Investments.

Gerald holds a bachelor’s of science from the Massachusetts Institute of Technology and a Ph.D. in Economics from Harvard University and is a contributing author to 30-Second Money as well as a co-author of Political Cycles and the Macroeconomy.

More Economy in Brief

Global| Feb 05 2026

Global| Feb 05 2026Charts of the Week: Balanced Policy, Resilient Data and AI Narratives

by:Andrew Cates