Global| Jan 30 2018

Global| Jan 30 2018U.S. Pending Home Sales Decline Again, Fell to Lowest since Spring 2014

by:Sandy Batten

|in:Economy in Brief

Summary

The National Association of Realtors (NAR) reported that pending home sales fell 2.2% m/m (-9.8% y/y) in December. This was the third consecutive monthly decline and the seventh decline in the past nine months. The December reading [...]

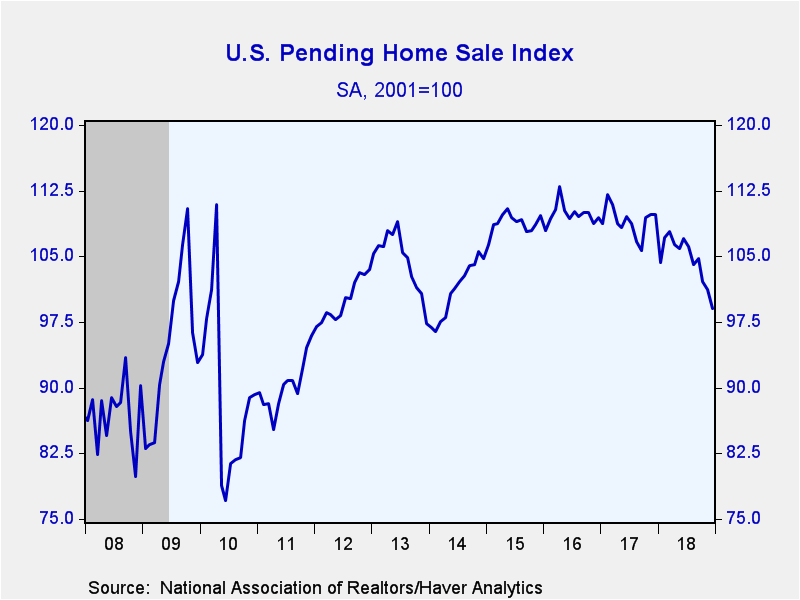

The National Association of Realtors (NAR) reported that pending home sales fell 2.2% m/m (-9.8% y/y) in December. This was the third consecutive monthly decline and the seventh decline in the past nine months. The December reading for the index was 99.0, down 12.4% from the April 2016 peak. This is the lowest reading for the index since April 2014 and was the twelfth consecutive month in which pending sales were lower than a year earlier

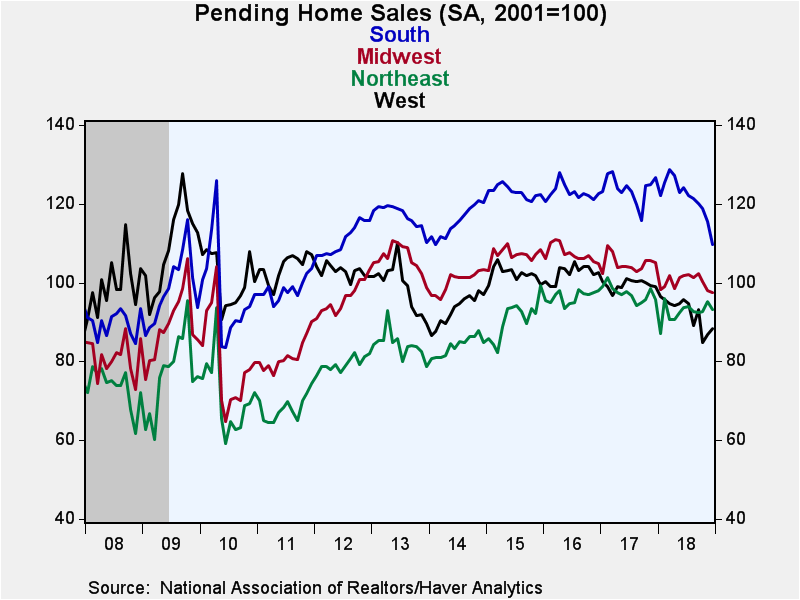

The nationwide decline in pending home sales in December was widespread. Sales plummeted 5.0% m/m (-13.5% y/y) in the South, slipped 2.0% m/m (-2.5%) in the Northeast, and edged down 0.6% m/m (-7.2% y/y) in the Midwest. In contrast, pending sales rose 1.7% m/m (-10.8% y/y) in the West for their second consecutive monthly increase.

The pending home sales index measures sales at the time the contract for an existing home is signed, analogous to the Census Bureau's new home sales data. In contrast, the National Association of Realtors' existing home sales data are recorded when the sale is closed. In developing the pending home sales index, the NAR found that the level of monthly sales contract activity anticipates the level of closed existing home sales in the following two months. The series dates back to 2001, and the data are available in Haver's PREALTOR database.

| Pending Home Sales (SA, 2001=100) | Dec | Nov | Oct | Dec Y/Y % | 2017 | 2016 | 2015 |

|---|---|---|---|---|---|---|---|

| Total | 99.0 | 101.2 | 102.1 | -9.8 | 109.0 | 109.8 | 108.8 |

| Northeast | 93.2 | 95.1 | 92.6 | -2.5 | 97.2 | 96.4 | 90.8 |

| Midwest | 97.5 | 98.1 | 100.4 | -7.2 | 104.8 | 107.4 | 107.1 |

| South | 109.7 | 115.5 | 118.9 | -13.5 | 123.8 | 122.9 | 123.1 |

| West | 88.4 | 86.9 | 84.8 | -10.8 | 99.6 | 102.4 | 102.2 |

Sandy Batten

AuthorMore in Author Profile »Sandy Batten has more than 30 years of experience analyzing industrial economies and financial markets and a wide range of experience across the financial services sector, government, and academia. Before joining Haver Analytics, Sandy was a Vice President and Senior Economist at Citibank; Senior Credit Market Analyst at CDC Investment Management, Managing Director at Bear Stearns, and Executive Director at JPMorgan. In 2008, Sandy was named the most accurate US forecaster by the National Association for Business Economics. He is a member of the New York Forecasters Club, NABE, and the American Economic Association. Prior to his time in the financial services sector, Sandy was a Research Officer at the Federal Reserve Bank of St. Louis, Senior Staff Economist on the President’s Council of Economic Advisors, Deputy Assistant Secretary for Economic Policy at the US Treasury, and Economist at the International Monetary Fund. Sandy has taught economics at St. Louis University, Denison University, and Muskingun College. He has published numerous peer-reviewed articles in a wide range of academic publications. He has a B.A. in economics from the University of Richmond and a M.A. and Ph.D. in economics from The Ohio State University.