Global| Nov 01 2007

Global| Nov 01 2007UK Manufacturing Survey Turns Lower

Summary

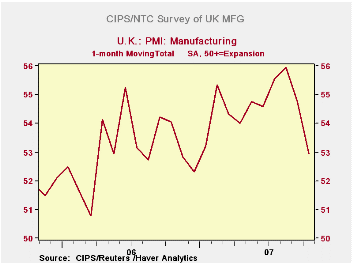

The CIPS/NTC index of MFG for the UK shows a rather rapid downturn is in play. But the index reading at 52.9 is still reasonably upbeat by the historic standards of this survey. While the index is down from a peak of about 56 in [...]

The CIPS/NTC index of MFG for the UK shows a rather rapid downturn is in play. But the index reading at 52.9 is still reasonably upbeat by the historic standards of this survey. While the index is down from a peak of about 56 in August that nearly matches past peaks of around 56 back in 2004, the current reading is still in the 58th percentile of its range - a firm reading and solid location. Still, the table shows that the index has been falling and is now down over 6 months and 12 months even though the fall is rather recent. The depth of the plunge is notable. The two-month 3.03 point drop is the largest change in the index since it rose by 3.03 points in January of this year. We have to go back to May of 2005 to find a larger two-month drop. So despite the reasonably cozy position of the index in its range we should be on the outlook for more weakness given the speed of this drop.

| MFG PMI CIPS/NTC | |||||||

|---|---|---|---|---|---|---|---|

| Monthly readings | Change over: | percentile | |||||

| Oct-07 | Sep-07 | Aug-07 | 3MO | 6MO | 12MO | of range | |

| MFG | 52.93 | 54.73 | 55.96 | -2.61 | -1.07 | -1.12 | 58.4 |

| Range since January 1992 | |||||||

Robert Brusca

AuthorMore in Author Profile »Robert A. Brusca is Chief Economist of Fact and Opinion Economics, a consulting firm he founded in Manhattan. He has been an economist on Wall Street for over 25 years. He has visited central banking and large institutional clients in over 30 countries in his career as an economist. Mr. Brusca was a Divisional Research Chief at the Federal Reserve Bank of NY (Chief of the International Financial markets Division), a Fed Watcher at Irving Trust and Chief Economist at Nikko Securities International. He is widely quoted and appears in various media. Mr. Brusca holds an MA and Ph.D. in economics from Michigan State University and a BA in Economics from the University of Michigan. His research pursues his strong interests in non aligned policy economics as well as international economics. FAO Economics’ research targets investors to assist them in making better investment decisions in stocks, bonds and in a variety of international assets. The company does not manage money and has no conflicts in giving economic advice.

More Economy in Brief

Global| Feb 05 2026

Global| Feb 05 2026Charts of the Week: Balanced Policy, Resilient Data and AI Narratives

by:Andrew Cates