Global| Oct 17 2012

Global| Oct 17 2012UK Unemployment Snakes Its Way Lower

Summary

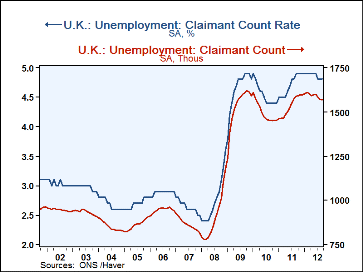

UK unemployment measures have begun to bend lower. The drop in the number of claimants in Sept was unexpected. The unemployment rate is at the lowest level in more than a year as the labor market absorbed record number of workers [...]

UK unemployment measures have begun to bend lower. The drop in the number of claimants in Sept was unexpected. The unemployment rate is at the lowest level in more than a year as the labor market absorbed record number of workers during the Olympics. The unemployment rate, under the definition of the International labor Organization, declined to 7.9 percent in the June-August period from 8.1 percent during March-May.

UK unemployment measures have begun to bend lower. The drop in the number of claimants in Sept was unexpected. The unemployment rate is at the lowest level in more than a year as the labor market absorbed record number of workers during the Olympics. The unemployment rate, under the definition of the International labor Organization, declined to 7.9 percent in the June-August period from 8.1 percent during March-May.

The UK economy has not been giving off many signs of improving behavior so the improved labor market metrics were a bit of a surprise.

Because of the Olympics and some earlier distortions from the Queen’s Jubilee it is unclear how accurate a reading we are getting of the real UK economy. Just today BOE Deputy Governor Tucker was warning banks on their leverage and cautioning that the ‘worst may still lie head’ for them.

The UK is plugged into trading with Europe and that still seems every much laden with risk. But its North America trade should fare better as the US and Canadian economies are doing much better than Europe.

Still the UK continues to be enmeshed in difficult times and is very entangled in European events. Even though the claimant rate and the overall unemployment rates each have dipped, there is no assurance that such a signal is real.

| UK Claimant Count | ||||||

|---|---|---|---|---|---|---|

| Sep 12 | Aug 12 | Jul 12 | 3-mo | 6-mo | 12-Mo | |

| Level in Month | Average in Period | |||||

| U-Rate: Claimants | 4.8 | 4.8 | 4.8 | 4.8 | 4.9 | 4.9 |

| Unemployment % | -- | -- | 7.9 | 8.0 | 8.1 | 8.2 |

| Change in MO | Change over Period | |||||

| Change on 000s | -4.0 | -14.2 | -13.6 | -31.8 | -36.7 | -21.8 |

| u-rate averages are for most recent available | ||||||

| UK (Great Britain) Earnings | ||||||

| All Seas. Adj. | Aug 12 | Jul 12 | Jun 12 | 3-mo | 6-mo | 12-Mo |

| Avg Earnings: All | Level in Month | Average in Period | ||||

| All; Pounds | 473.0 | 471.0 | 471.0 | 470.3 | 467.0 | 465.5 |

| In MFG | 545.0 | 544.0 | 545.0 | 543.3 | 538.5 | 536.1 |

| Change in % | %Change in MO | % Change over period: AR | ||||

| All | 1.7% | 0.0% | 1.7% | 3.5% | 4.8% | 2.2% |

| In MFG | 0.7% | -0.7% | 1.5% | 1.5% | 2.2% | 2.4% |

| Real Earnings % | %Change in MO | % Change over period: AR | ||||

| ALL | 0.5% | -2.1% | 2.4% | 0.8% | 2.8% | -0.4% |

Robert Brusca

AuthorMore in Author Profile »Robert A. Brusca is Chief Economist of Fact and Opinion Economics, a consulting firm he founded in Manhattan. He has been an economist on Wall Street for over 25 years. He has visited central banking and large institutional clients in over 30 countries in his career as an economist. Mr. Brusca was a Divisional Research Chief at the Federal Reserve Bank of NY (Chief of the International Financial markets Division), a Fed Watcher at Irving Trust and Chief Economist at Nikko Securities International. He is widely quoted and appears in various media. Mr. Brusca holds an MA and Ph.D. in economics from Michigan State University and a BA in Economics from the University of Michigan. His research pursues his strong interests in non aligned policy economics as well as international economics. FAO Economics’ research targets investors to assist them in making better investment decisions in stocks, bonds and in a variety of international assets. The company does not manage money and has no conflicts in giving economic advice.