Global| Oct 01 2008

Global| Oct 01 2008Very Weak Results for MFG: Europe is Going DOWN!

Summary

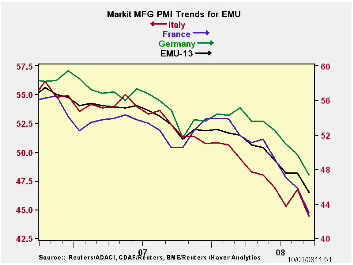

The PMI details for the e-Zone and the UK makes for dismal reading. After a widespread but small rebound in August the various indices all are lower in September. All readings are below the 50% mark except for Greece. The overall EMU [...]

The PMI details for the e-Zone and the UK makes for dismal reading. After a widespread but small rebound in August the various indices all are lower in September. All readings are below the 50% mark except for Greece. The overall EMU reading resides in the bottom 13% of its range of values since early 2000. Germany is relatively stronger in its 30th percentile, awhile France resides in its 4th percentile. The UK is at its weakest point for that same period.

Slow growth and financial turmoil have been slow to grip the e-Zone or at least slow to be revealed. Overnight VDMA’s engineering orders for Germany posted another drop and the UK services sector came up dead flat in Q3. Surprisingly retail sales in Germany rose sharply after two months of drops and auto sales in France rose. Overall the EMU unemployment rate did edge up although Germany has continued to show the number of unemployed still dropping.

There is little in the way of truly mixed data for Europe. For the most part it is simply weak and getting weaker. The spots of strength in the data today seem to be counter point anomalies. With so much weakness elsewhere in key reports as well as in the day’s MFG report from Markit, EMU seems clearly and firmly on the path to economic contraction.

| NTC MFG Indices | |||||||

|---|---|---|---|---|---|---|---|

| Sep-08 | Aug-08 | Jul-08 | 3Mo | 6Mo | 12Mo | Percentile* | |

| Euro Area | 44.97 | 47.55 | 47.38 | 46.63 | 48.40 | 50.37 | 12.1% |

| Germany | 47.36 | 49.68 | 50.90 | 49.31 | 51.28 | 52.55 | 30.5% |

| France | 42.97 | 45.79 | 47.05 | 45.27 | 47.94 | 50.35 | 4.2% |

| Italy | 44.42 | 46.77 | 45.32 | 45.50 | 46.62 | 48.67 | 7.4% |

| Spain | 38.32 | 42.40 | 39.20 | 39.97 | 41.59 | 45.19 | 0.0% |

| Austria | 46.01 | 48.61 | 46.97 | 47.20 | 48.26 | 50.87 | 17.3% |

| Greece | 50.79 | 52.46 | 51.63 | 51.63 | 52.81 | 52.97 | 33.1% |

| Ireland | 43.70 | 44.88 | 43.39 | 43.99 | 44.43 | 46.91 | 2.5% |

| Netherlands | 48.30 | 49.82 | 47.99 | 48.70 | 50.02 | 51.94 | 33.6% |

| European Union | |||||||

| UK | 40.97 | 45.33 | 44.11 | 43.47 | 45.95 | 49.05 | 0.0% |

| *Percentile is over range since March 2000 | |||||||

Robert Brusca

AuthorMore in Author Profile »Robert A. Brusca is Chief Economist of Fact and Opinion Economics, a consulting firm he founded in Manhattan. He has been an economist on Wall Street for over 25 years. He has visited central banking and large institutional clients in over 30 countries in his career as an economist. Mr. Brusca was a Divisional Research Chief at the Federal Reserve Bank of NY (Chief of the International Financial markets Division), a Fed Watcher at Irving Trust and Chief Economist at Nikko Securities International. He is widely quoted and appears in various media. Mr. Brusca holds an MA and Ph.D. in economics from Michigan State University and a BA in Economics from the University of Michigan. His research pursues his strong interests in non aligned policy economics as well as international economics. FAO Economics’ research targets investors to assist them in making better investment decisions in stocks, bonds and in a variety of international assets. The company does not manage money and has no conflicts in giving economic advice.