FIBER: Industrial Commodity Prices Are Little Changed in Latest Four Weeks

by:Tom Moeller

|in:Economy in Brief

Summary

- Metals prices surge.

- Lumber prices strengthen.

- Crude oil costs decline.

The Industrial Materials Price Index from the Foundation for International Business and Economic Research (FIBER) edged 0.1% higher (-0.4% y/y) during the four weeks ended March 21, 2025. The rate of price improvement, however, slowed considerably from its 1.8% four-week high at the end of February. The level of the index stood at its highest point since the second week of October 2024.

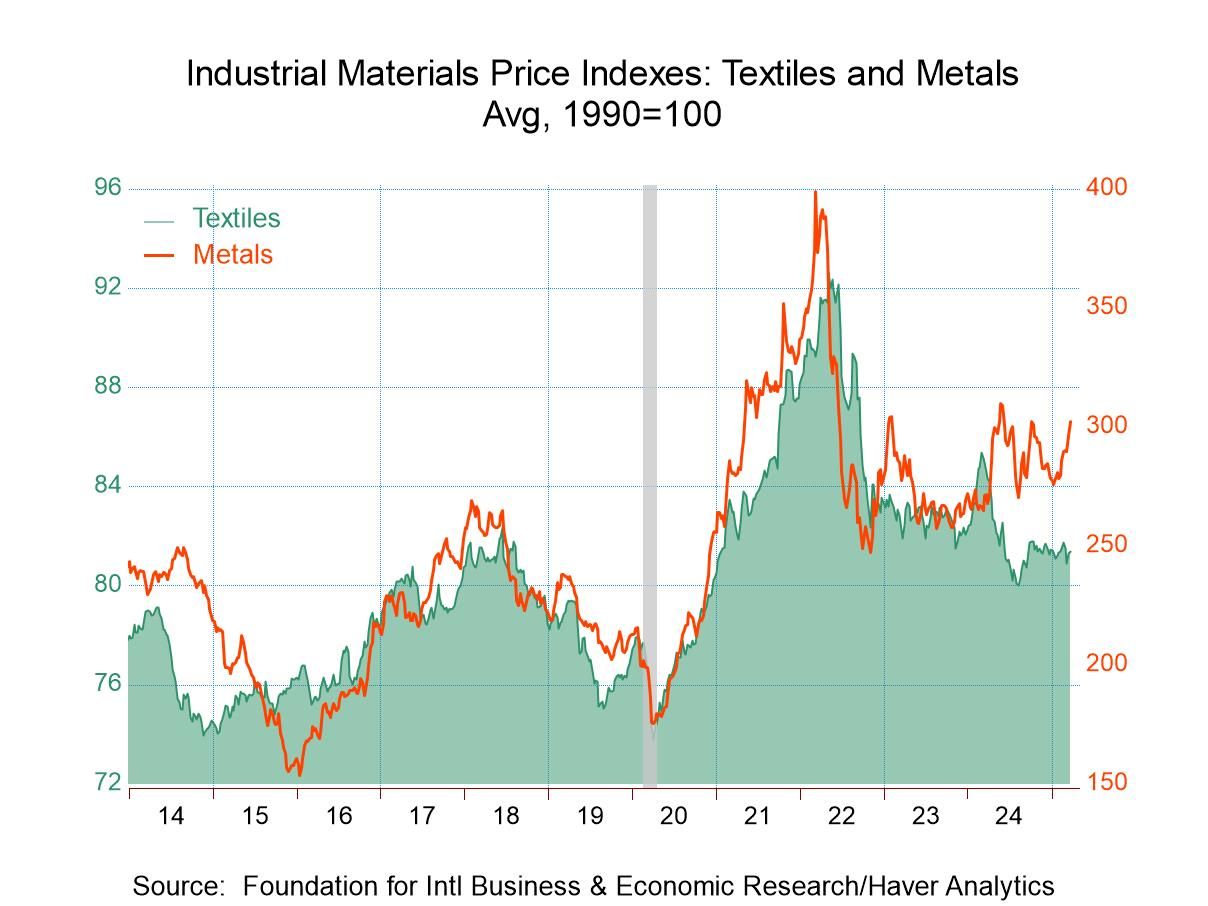

Prices in the Metals group increased 4.3% (11.3% y/y) over the most recent four weeks. Tin prices rose 7.8% (26.5% y/y) in four weeks while lead prices increased 5.6% (0.5% y/y) in four weeks. Steel scrap costs rose 5.0% (-1.6% y/y) in four weeks and copper scrap costs increased 4.8% (10.7% y/y). Zinc prices improved 2.9% in four weeks (17.3% y/y), while aluminum costs edged 0.3% higher (21.0% y/y) in four weeks.

Miscellaneous group prices improved 0.1% during the last four weeks and rose 0.6% y/y. Framing lumber prices jumped 7.5% over the last four weeks and increased 9.1% y/y. The price of natural rubber eased 0.6% (-7.7% y/y) while tallow prices fell 8.3% (+17.9% y/y) in four weeks.

Textile group prices eased 0.4% (-3.7% y/y) during the last four weeks. Burlap costs slipped 0.3% but rose (+13.4% y/y). The cost of cotton fell 2.5% (-27.7% y/y) in the latest four weeks.

Prices in the Crude Oil & Benzene group declined 6.2% (-15.6% y/y) in four weeks. The cost of West Texas Intermediate crude oil slumped 6.2% to $67.37 per barrel and was 17.7% lower y/y. The cost of the petro-chemical benzene, used for making plastics & synthetic fibers, weakened 18.7% (-39.0% y/y) in the last four weeks. Excluding crude oil, the industrial commodity price index rose 0.5% (0.7% y/y) during the last four weeks.

The Foundation for International Business and Economic Research (FIBER) develops economic measurement techniques as applied to business cycles and inflation in the U.S. and other market economies. The commodity price data can be found in Haver's DAILY, WEEKLY, USECON and CMDTY databases.

Tom Moeller

AuthorMore in Author Profile »Prior to joining Haver Analytics in 2000, Mr. Moeller worked as the Economist at Chancellor Capital Management from 1985 to 1999. There, he developed comprehensive economic forecasts and interpreted economic data for equity and fixed income portfolio managers. Also at Chancellor, Mr. Moeller worked as an equity analyst and was responsible for researching and rating companies in the economically sensitive automobile and housing industries for investment in Chancellor’s equity portfolio. Prior to joining Chancellor, Mr. Moeller was an Economist at Citibank from 1979 to 1984. He also analyzed pricing behavior in the metals industry for the Council on Wage and Price Stability in Washington, D.C. In 1999, Mr. Moeller received the award for most accurate forecast from the Forecasters' Club of New York. From 1990 to 1992 he was President of the New York Association for Business Economists. Mr. Moeller earned an M.B.A. in Finance from Fordham University, where he graduated in 1987. He holds a Bachelor of Arts in Economics from George Washington University.

More Economy in Brief

Global| Feb 05 2026

Global| Feb 05 2026Charts of the Week: Balanced Policy, Resilient Data and AI Narratives

by:Andrew Cates