U.S. Empire State Manufacturing Index Improves in April; Expectations Plunge

by:Tom Moeller

|in:Economy in Brief

Summary

- Index recovers piece of March weakening as orders, shipments & jobs edge higher.

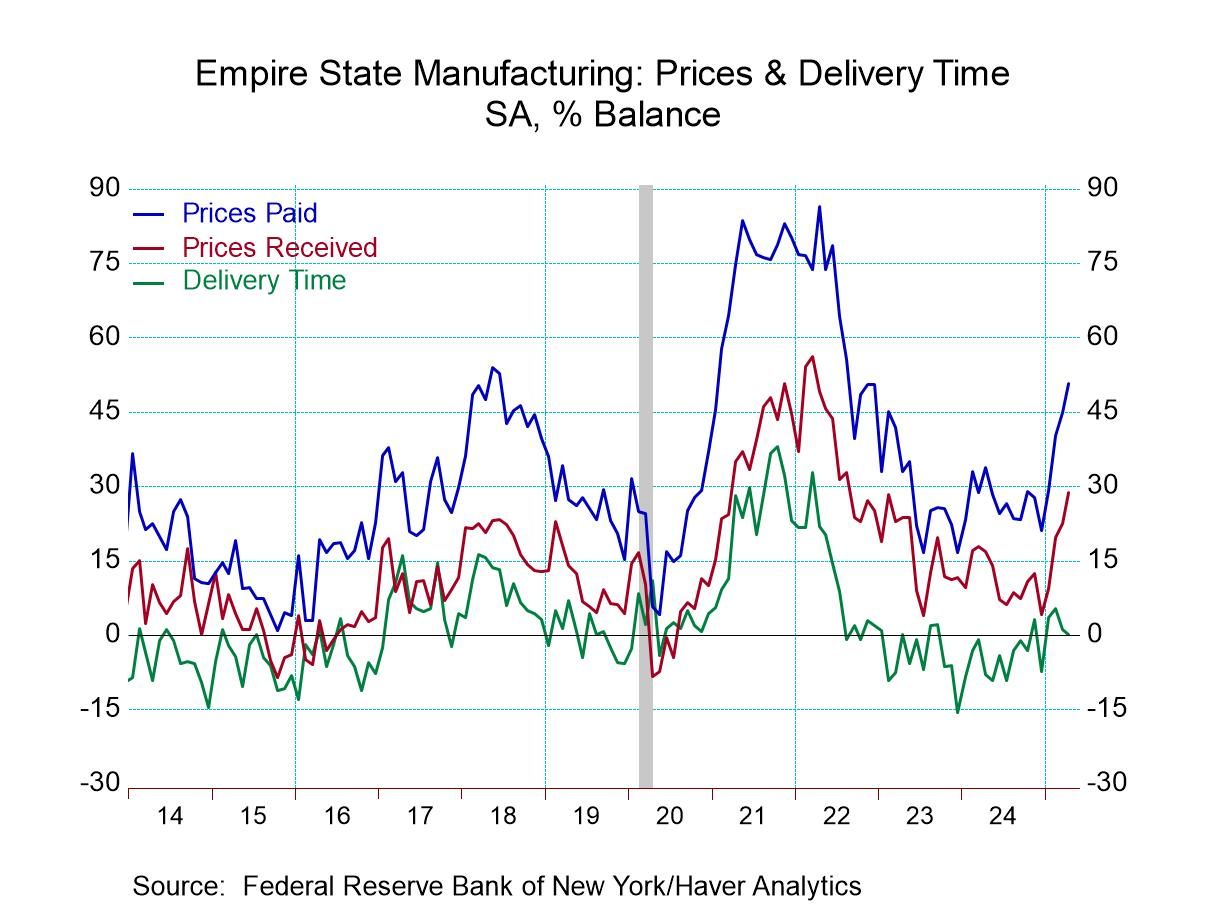

- Pricing measures surge to three-year highs.

- Business expectations plummet.

The General Business Conditions Index from the Federal Reserve Bank of New York rose to -8.1 this month from –20.0 in March. The Action Economics Forecast Survey expected a reading of -12.0 for April. The percentage of respondents reporting an improvement in business conditions rose to 27.1% in April from 19.0% in March while the percentage reporting a decrease eased to 35.1% from 39.1%. The survey responses were collected between April 2 and April 9.

The headline index reflects the answer to a single question concerning the state of economic activity. Haver Analytics calculates a composite index from the five major components, which is comparable to the ISM manufacturing index. The reading rose to 49.3 this month from 48.7 in March, both remaining below 50 which is the breakeven point between expansion and contraction. The index is the average of five diffusion indexes: new orders, shipments, employment, supplier deliveries and inventories with equal weights (20% each).

Increases in the new orders and shipments indexes led the component improvement in April. The new orders index rose to -8.8 after falling to -14.9 in March. A lessened 27.4% of respondents reported increases in orders and a lessened 36.2% indicated declines. The shipments index rose to -2.9 from -8.5, but remained below the November high of +21.4. A slightly lessened 23.2% of respondents reported increases, while a fewer 26.1% indicated shipments declines. Unfilled orders improved to 4.1, its highest level in three years, after falling to -2.0 in March. The inventories index declined to 7.4 this month after rising to 13.3 in March. The delivery times index held steady after falling to 1.0, suggesting no wait for product delivery.

The employment index improved to -2.6 this month after easing to -4.1 in March. A higher 12.1% of respondents reported an increase in employment while a greater 14.7% reported a decline. The average workweek index declined to -9.1 from -2.5 in March. It was the highest reading in three months.

Inflation indicators strengthened in April. The prices paid index surged to 50.8, its highest reading in just under three years, from 44.9 in March. Fifty-five percent of respondents reported paying higher prices last month versus 45.9% in March while a greater 4.1% reported paying lower prices. The prices received index rose to 28.7, the highest level in over two years, from 22.4 in February. A greater 32.8% received higher prices while a steady 4.1% paid lower prices.

Firms were notably less optimistic that business conditions would continue to improve in the months ahead. The future business activity index plunged to a near-record low of -7.4 after falling to +12.7 in March. A greatly reduced 35.0% of respondents expected conditions to improve over the next six months, down from 53.3% in January. Expected growth in orders, shipments, inventories & order backlogs each fell versus January. The employment reading fell to its lowest point in two years and the hours worked reading plunged into negative territory. The expected prices paid index continued strong, rising to its highest point in roughly three years, while prices received also strengthened. Capital spending plans weakened sharply.

The headline index reflects the answer to only one question concerning general business conditions and is not calculated from the components. The indexes in this report are diffusion indexes and measure the percentage of respondents indicating an increase minus the percentage indicating a decrease with zero separating expansion from contraction.

The New York Fed survey data are contained in Haver’s SURVEYS database. The expectations series is in Haver’s AS1REPNA database.

Tom Moeller

AuthorMore in Author Profile »Prior to joining Haver Analytics in 2000, Mr. Moeller worked as the Economist at Chancellor Capital Management from 1985 to 1999. There, he developed comprehensive economic forecasts and interpreted economic data for equity and fixed income portfolio managers. Also at Chancellor, Mr. Moeller worked as an equity analyst and was responsible for researching and rating companies in the economically sensitive automobile and housing industries for investment in Chancellor’s equity portfolio. Prior to joining Chancellor, Mr. Moeller was an Economist at Citibank from 1979 to 1984. He also analyzed pricing behavior in the metals industry for the Council on Wage and Price Stability in Washington, D.C. In 1999, Mr. Moeller received the award for most accurate forecast from the Forecasters' Club of New York. From 1990 to 1992 he was President of the New York Association for Business Economists. Mr. Moeller earned an M.B.A. in Finance from Fordham University, where he graduated in 1987. He holds a Bachelor of Arts in Economics from George Washington University.

Global

Global