The Gulf States, Bahrain, Kuwait, Oman, Qatar, United Arab Emirates and Saudi Arabia have, with the exception of Kuwait, long kept their exchange rates pegged to the dollar. The first chart shows the exchange rates of Qatar and Saudi [...]

Introducing

Louise Curley

in:Our Authors

Publications by Louise Curley

Global| May 05 2008

Global| May 05 2008Appreciation to Come in the Exchange Rates in the Gulf States ???

Global| Apr 29 2008

Global| Apr 29 2008Italian Business Confidence

The latest ISAE (Institute for Studies and Economic Analysis) surveys of confidence among entrepreneurs in Italy continue to show weakness. Even among retailers where confidence has held up fairly well, it declined 4.0% in April from [...]

Global| Apr 28 2008

Global| Apr 28 2008Brazil's Current Account Deficit Widends

Brazil's has been recording a deficit on its current account for the last nine months after having recorded surpluses since 2002. In March the seasonally unadjusted deficit was $4,429 million US$, the largest in the last ten years, as [...]

Global| Apr 28 2008

Global| Apr 28 2008Brazil's Current AccountDeficit Widends

Brazil's has been recording a deficit on its current account for the last nine months after having recorded surpluses since 2002. In March the seasonally unadjusted deficit was $4,429 million US$, the largest in the last ten years, as [...]

Global| Apr 22 2008

Global| Apr 22 2008The European Union: Fourth Quarter Balance of Payments

The 27 countries in the European Union reported a current account deficit of $2.8 billion for the fourth quarter of 2007, a decrease of $18.4 billion from the third quarter. A major factor in the decline was the reduction in the [...]

Global| Apr 21 2008

Global| Apr 21 2008Producer and Consumer Price Inflation in Eastern Europe

Four countries, Russia, Slovenia, Latvia and Estonia in Eastern Europe reported Producer Price Indexes (PPI) today. Except for Estonia where producer price inflation declined by 69 basis points in March, the other countries showed [...]

Global| Apr 15 2008

Global| Apr 15 2008For The ECB Inflation Fears Outweigh Investors' Worries

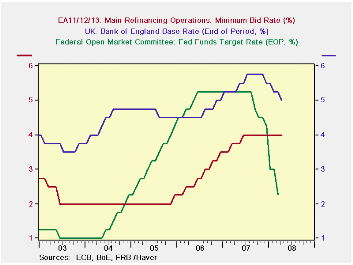

While the central banks in the United States and Great Britain, have been lowering their key interest rates, the European Central Bank (ECB) has held firm at 4%, as can be seen in the first chart.

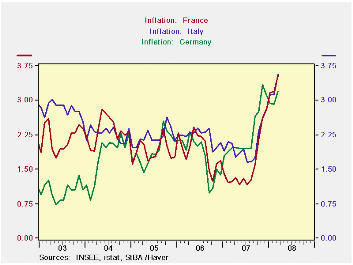

Concern over inflation is being fueled by today's releases of March inflation in Italy and France, both of which exceeded 3.5%. The year to year rate of increase in the Harmonized Index of Consumer Prices in Italy rose 3.57% and, in France, 3.53%. Inflation in March for Germany was released earlier and it was 3.2%. Inflation rates for France, Italy and Germany are shown in the second chart, where the sharp run up in inflation since last September is apparent.

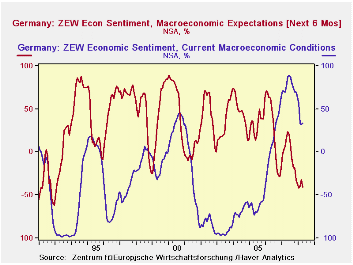

Institutional investors and analysts in the ZEW survey are still relatively comfortable with the present economic conditions--the excess of optimists over pessimists rose slightly in April to 33.2%. They have, however, become much more cautious about the next six months. The excess of pessimists over optimists regarding the next six months rose from 32.0% to 40.7%. This compares with the largest excess of pessimists of 62.2% in December, 1992. The third chart shows percent balances for current and expected conditions since the beginning of the series.

INFLATION AND CONFIDENCE Mar 08 Feb 08 Mar 07 M/M Chg Y/Y 2007 2006 2005 Inflation Y/Y % Chg in HICP Italy 3.57 3.13 2.07 0.44 1.50 2.04 2.22 2.21 France 3.53 23.19 1.23 0.34 1.30 1.61 1.91 1.90 Germany 3.20 2.91 1.98 0.29 1.22 2.28 1.78 1.92 ZEW(% Balance) Apr 08 Mar 08 Apr 07 M/M Chg Y/Y Chg 2007 2006 2005 Current Economic Conditions 33.2 32.1 70.6 1.1 -43.7 75.9 18.3 -61.8 Expectations Next 6 Months -40.7 -32.0 16.5 -8.7 -57.2 -3.0 22.3 34.8  Global| Apr 14 2008

Global| Apr 14 2008Rice Statistics in Haver Databases

Rice is the latest grain to hit the headlines. Prices of corn, wheat and rice are shown in the first chart. The rise in the price of rice is due in part to increasing consumption and in part to the recent, exceptionally cold winter in [...]

Global| Apr 08 2008

Global| Apr 08 2008Japanese Economy Watchers See Improvement In Current Conditions, But Deterioration In Future Conditions

Economy watchers in Japan are people who hold jobs that enable them to gauge present conditions and future prospects in their respective lines of business. Since 2001, there have been some 2050 watchers reporting to the Cabinet [...]

Global| Apr 07 2008

Global| Apr 07 2008German Industrial Production Surprises on the Upside: Warm Weather Boosts Construction Activity

German industrial production rose in February in spite of the disappointing trends in orders and sales noted by Robert Brusca last week. The result, however, is less surprising when one looks at the composition of production. It is [...]

Global| Apr 01 2008

Global| Apr 01 2008Japan: TANKAN Results Show Growing Concerns Among Business

The Bank of Japan's Tankan Survey released today shows growing concerns among large manufacturers and non manufacturers, as can be seen in the first and second charts. The excess of optimists over pessimists among large manufacturers [...]

Global| Mar 31 2008

Global| Mar 31 2008Inflation and Economic Sentiment in the Euro Area

Inflation in the Euro Area continues to climb. The flash estimate for March was released today and reached 3.5%, up from 3.3% in February and the highest level since the creation of the Euro Area in January, 1999. Not surprisingly, [...]

- of78Go to 36 page