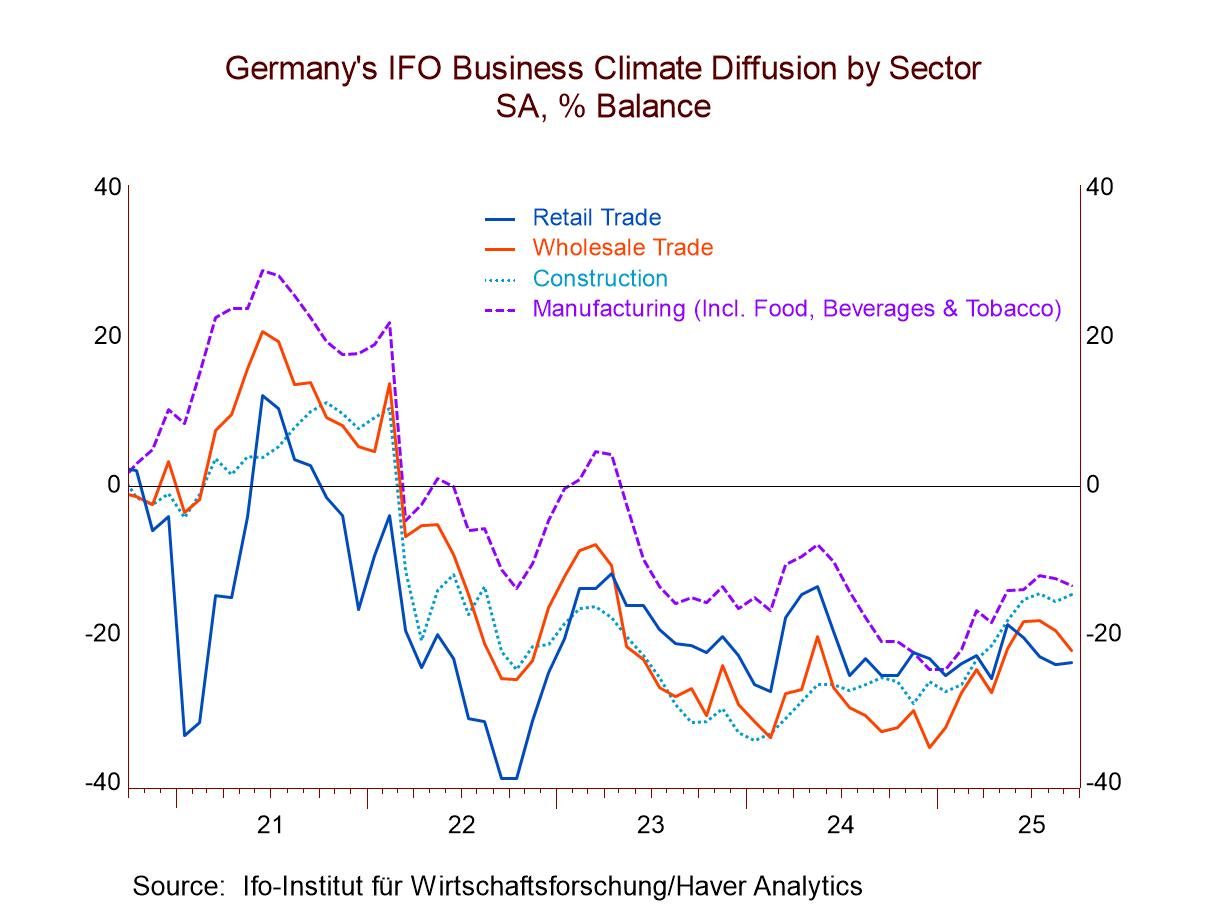

Germany shows signs of withering domestic demand in the face of weaker foreign demand. German exports weakened in August, falling by 0.5% month-to-month. The drop in German exports to the U.S. was being highlighted at a 2.5% month-to-month decline, but its exports to EMU members were down by 2.2% as well and exports to non-EMU members of the EU were lower by 3.1%. In fact, German exports outside the EU area rose by 2.2% largely on exports to China.

Exports to the U.S. vs. European trends The German website highlights a large drop in German exports to the U.S. from August 2024, a period over which German exports to the U.S. are off by some 20%. This is a much sharper drop than the German overall result that shows a decline of less than 1% over the past year for total exports. However, on the near-term comparison, German exports to the U.S. seem to be behaving a lot like German exports to its closer European neighbors.

World trade The Baltic dry goods index shows a sharp recovery in world trade volume (in dry goods; excluding tanker volumes) from a dip in early-2025. From early 2025 to date, trade volume readings on the Baltic index are among some of the stronger readings since 2022.

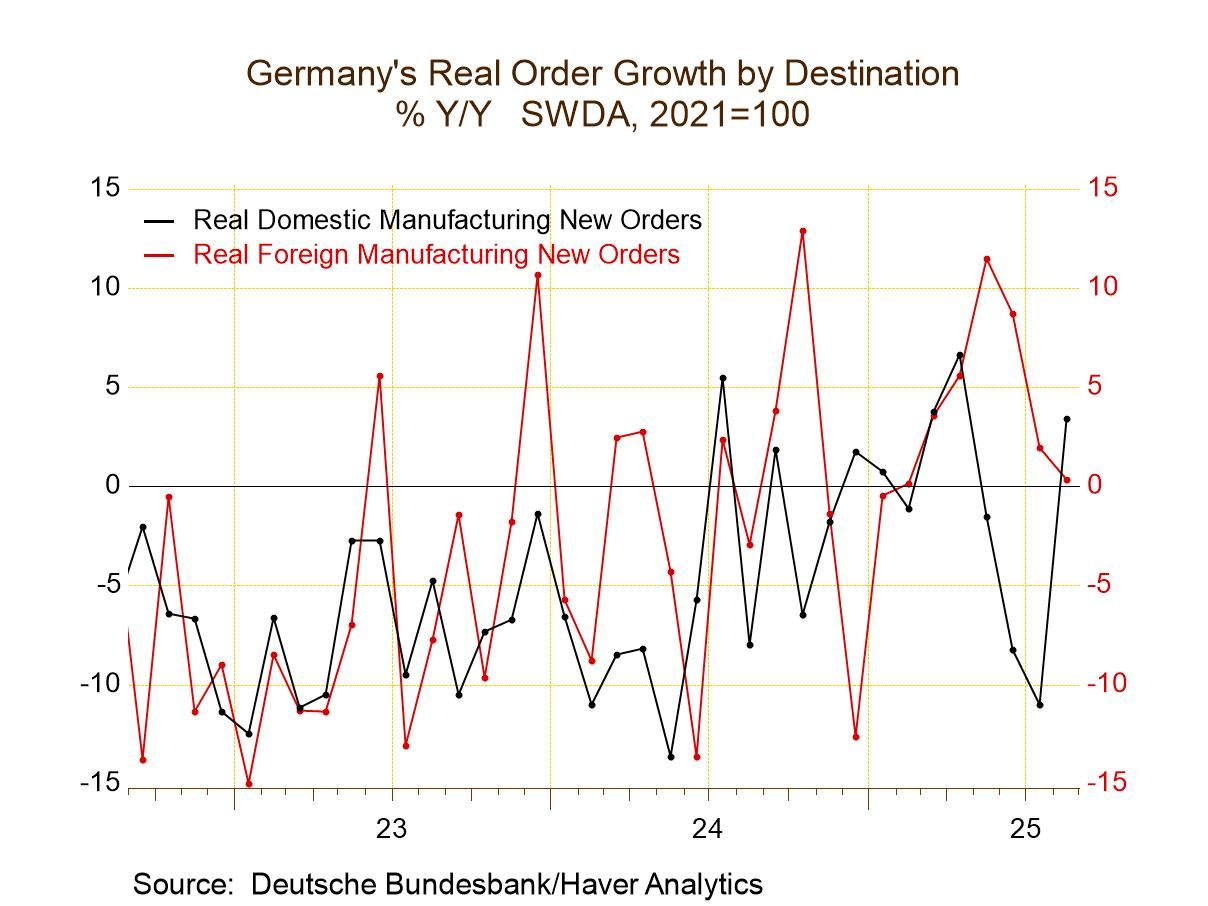

German orders imports, demand German orders data had also flagged weakness in external orders. Overall orders show weakness, but domestic orders remain strong and are accelerating. Still, the recent (August) IP report showed declines on the month and growing output weakness - despite strong domestic real orders. In today’s trade report, we are seeing some weakness in Europe and among the EU’s non-EMU members plus trade weakness with the United States. This is partly compensated for by strength elsewhere and a part of that is German exports finding some demand in China. All the geographical references are up to date through August.

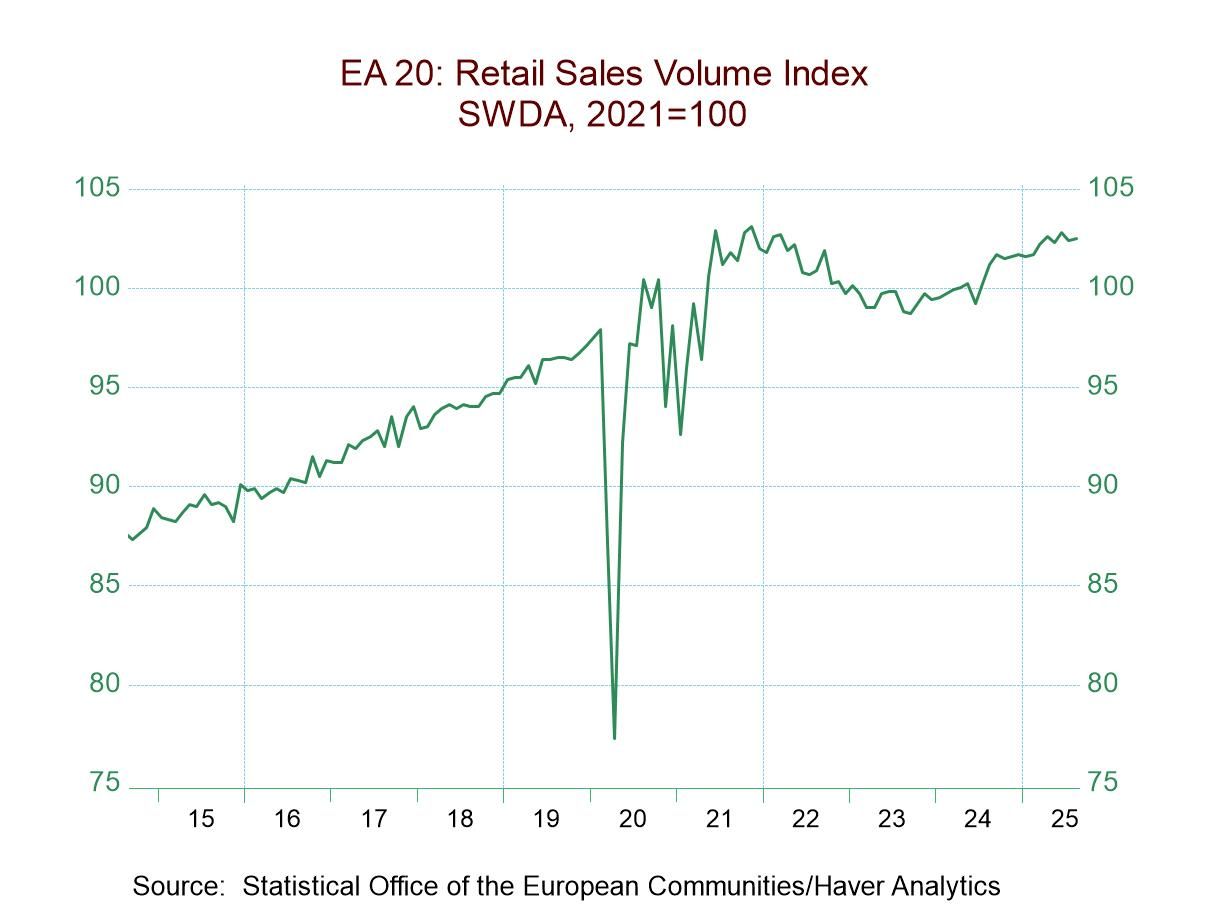

Overall German trade patterns However, German overall trade showing German domestic import strength with real and nominal imports rising solidly and even strongly over 12 months and six months but giving some ground over three months. German nominal and real export trends are showing some growth except over three months but at that, the pace generally is weaker than the pace for imports.

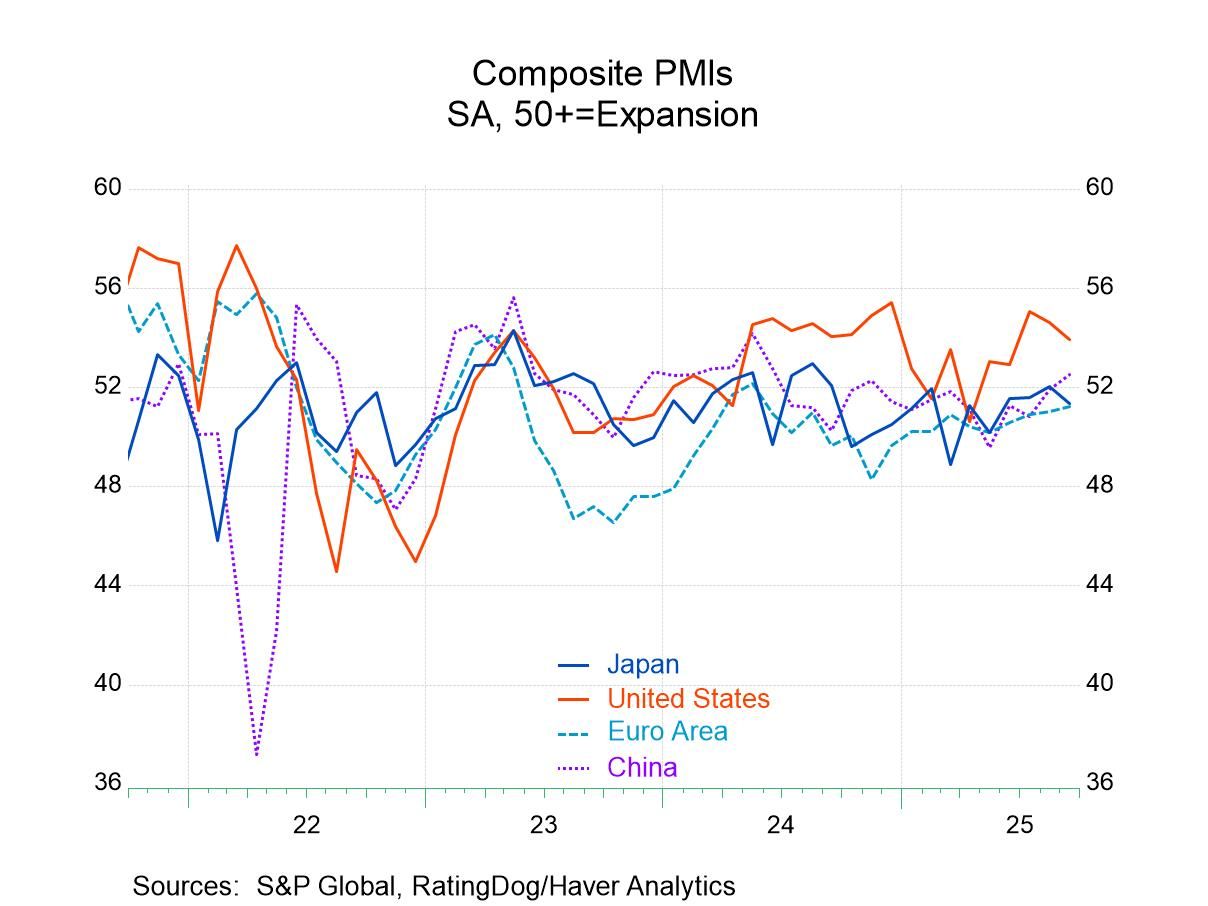

Global

Global