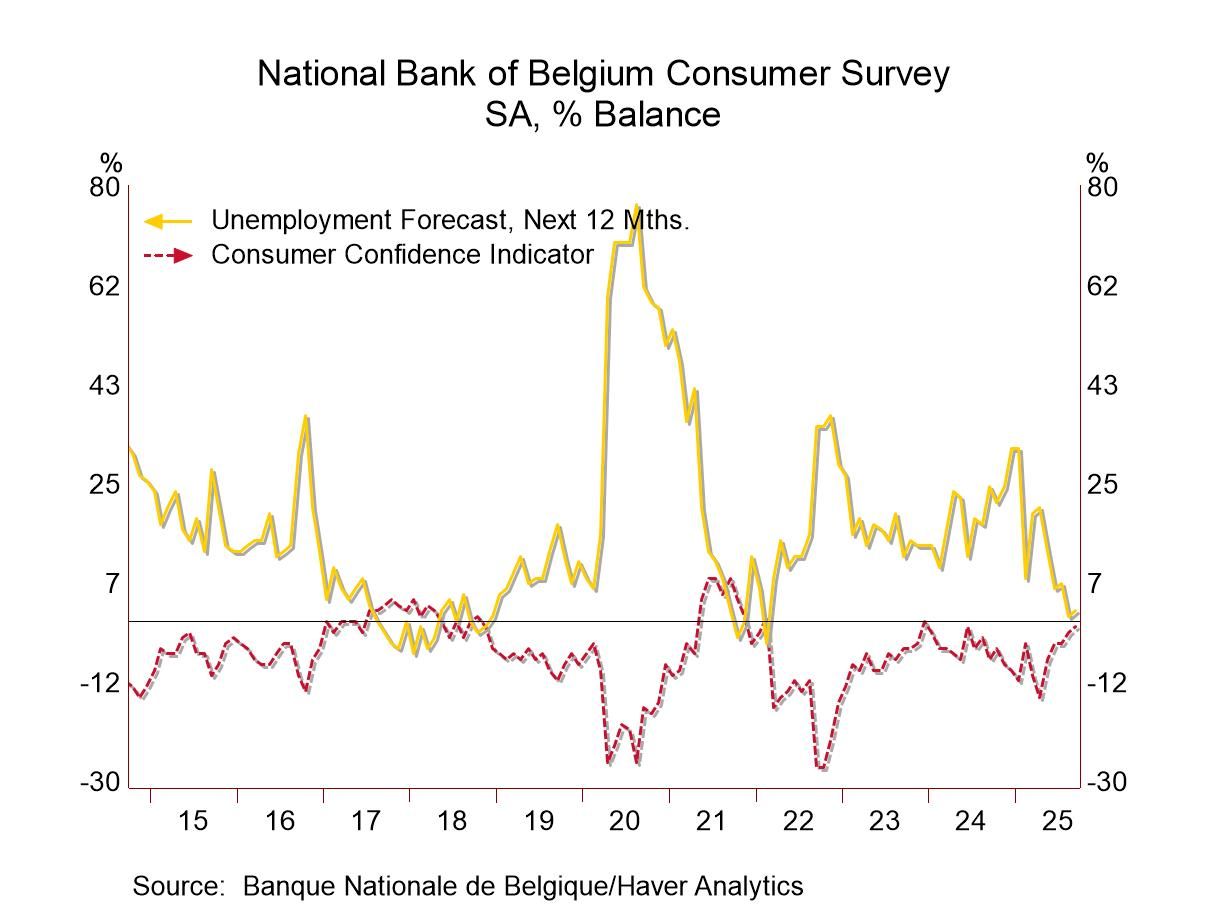

This steady progression is underpinned by a six-month-ago reading of -10 and a 12-month-ago reading of -7. Belgium is an interesting mid-European economy. It is industrialized, it is middle-sized and it's in the middle of the monetary union itself.

When the performance of confidence in Belgium is compared with the European Monetary Union total, we find that there is an average correlation in confidence of 0.56 across seven key economies including the monetary union measure itself. Belgium has a 0.79 correlation with confidence in the Netherlands, 0.69 relationship with France and the 0.76 correlation with the EMU overall, so it's a reasonably consistent bellwether for what's going on in the monetary union. And the correlation is close to 0.5 with Italy and Portugal. Belgium's weakest correlation in the monetary union among these countries is 0.18 with Greece. This suggests to me is that Belgium is a country that's relatively plugged into the activity trend of the monetary union itself.

Belgium’s ranking for consumer confidence at 78.8% on data back to 1991; since January 2020, its consumer index is up by just 5 points, a very shallow gain for such a long period of time – but still a solid and firm ranking.

For the economic situation over the next 12 months, the reading has a ranking at its 17th percentile, substantial steep down from a 40th percentile standing of the past 12 months. That’s not a good sign.

Price trends are slightly elevated on a ranked basis but are falling month-to-month from July to August to September. However, sequentially since 12 months ago, they are on the rise- so the inflation picture is more complicated. Expected inflation (price trend) at a 69th percentile standing for the next 12 months, is down from what is now a 77.9 percentile standing over the previous 12 months.

However, unemployment expectations are mild and falling both short term and sequentially with a low 9 percentile queue standing. That is very good news.

The financial situation of households is little changed on both short- and long-term trends with modest near median ranking for the next- was well as the last-12-months.

The appraisal of the current situation is down a notch in the month and sequentially has eased a bit as well but stands with an 83.2 percentile ranking, one of the highest standings in the table.

Household standings have a high 94.4 percentile standing, the favorability to save at the 74.6 percentile mark.

On balance The Belgian readings are solid and mostly upbeat. Inflation readings show concerns more than fear about what might be happening on the price front. On the whole, the response standings and trends are a positive signal for this country set in the belly of the European Union.

Global

Global