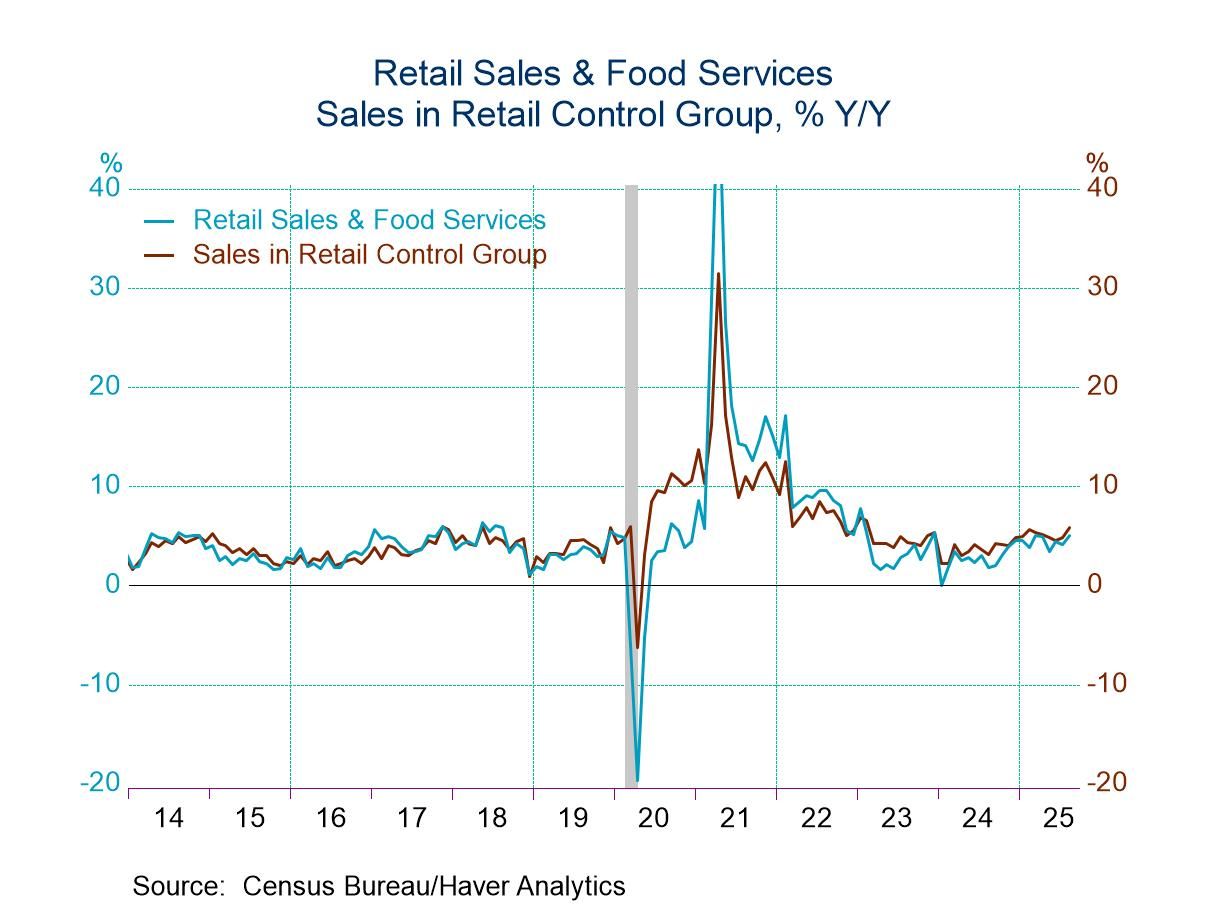

- Nonauto sales strengthen.

- Sales growth in retail control group accelerates.

- Clothing and nonstore sales are notably strong.

Introducing

Tom Moeller

in:Our Authors

Prior to joining Haver Analytics in 2000, Mr. Moeller worked as the Economist at Chancellor Capital Management from 1985 to 1999. There, he developed comprehensive economic forecasts and interpreted economic data for equity and fixed income portfolio managers. Also at Chancellor, Mr. Moeller worked as an equity analyst and was responsible for researching and rating companies in the economically sensitive automobile and housing industries for investment in Chancellor’s equity portfolio. Prior to joining Chancellor, Mr. Moeller was an Economist at Citibank from 1979 to 1984. He also analyzed pricing behavior in the metals industry for the Council on Wage and Price Stability in Washington, D.C. In 1999, Mr. Moeller received the award for most accurate forecast from the Forecasters' Club of New York. From 1990 to 1992 he was President of the New York Association for Business Economists. Mr. Moeller earned an M.B.A. in Finance from Fordham University, where he graduated in 1987. He holds a Bachelor of Arts in Economics from George Washington University.

Publications by Tom Moeller

- USA| Sep 16 2025

U.S. Retail Sales Show Resilience in August

by:Tom Moeller

|in:Economy in Brief

- USA| Sep 16 2025

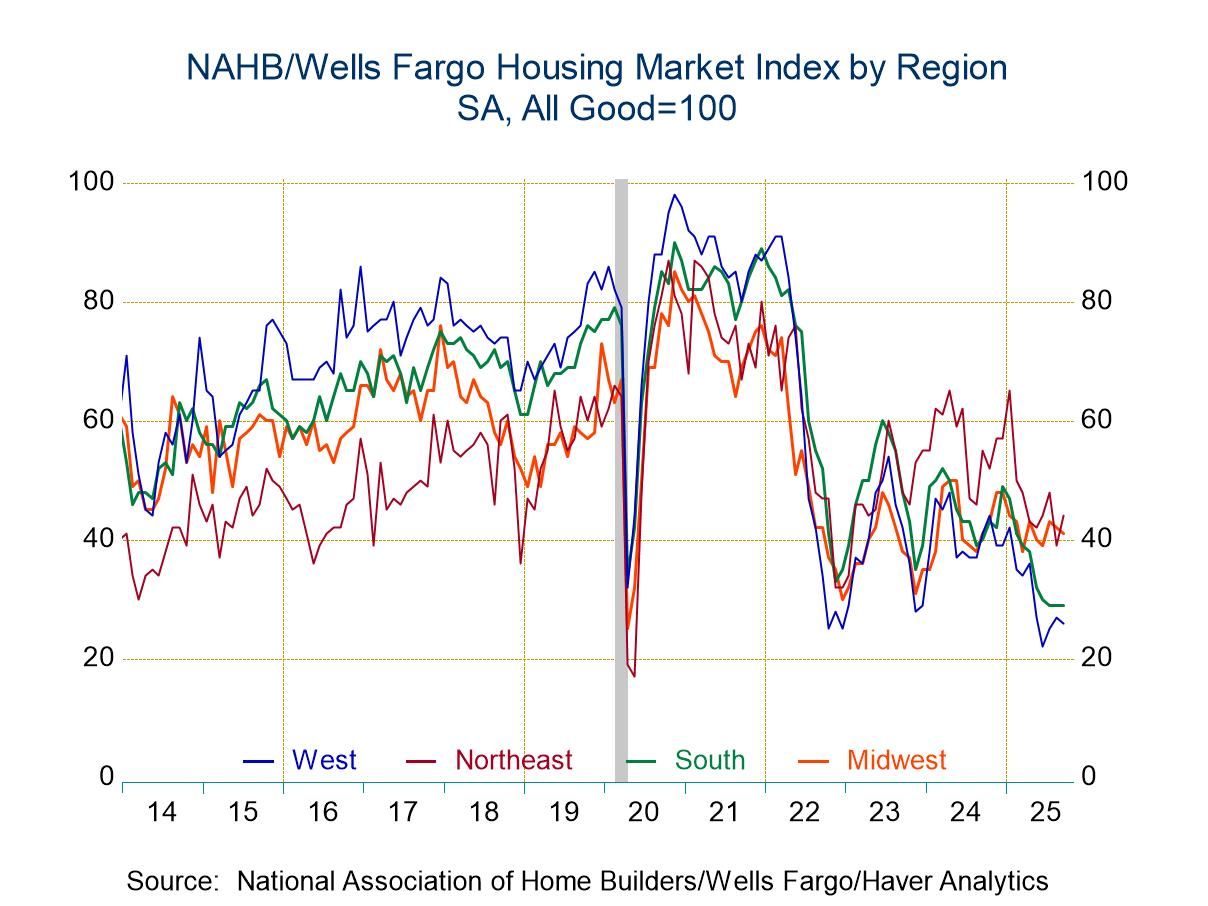

U.S. Home Builders Index Holds Steady in September

- Overall reading remains at lowest level since December 2022.

- Expectations rise; current sales steady and traffic eases.

- Higher Northeast activity offsets weakness in other regions.

by:Tom Moeller

|in:Economy in Brief

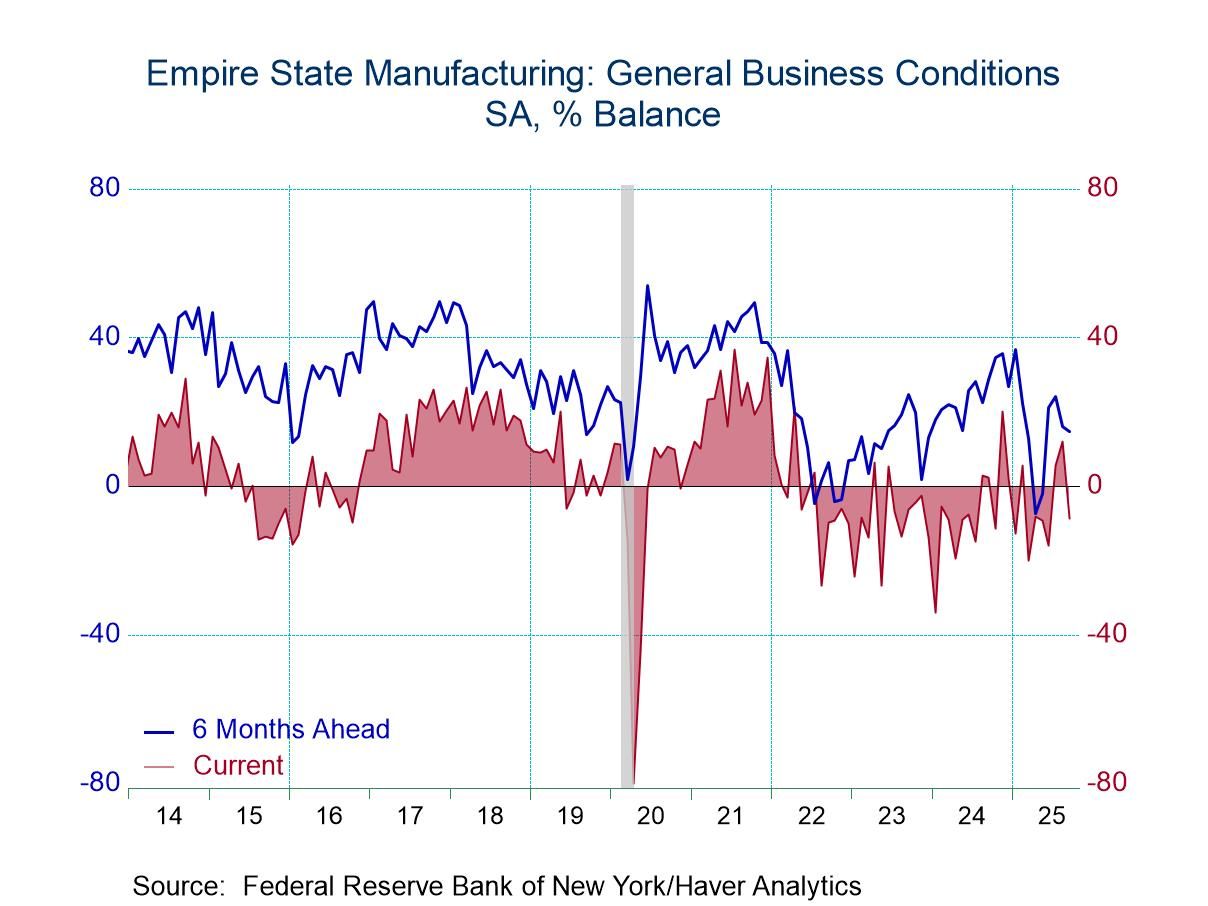

- First negative reading logged in three months.

- New orders & employment decline.

- Prices paid & received weaken.

- Six-month outlook ahead dims.

by:Tom Moeller

|in:Economy in Brief

- USA| Sep 12 2025

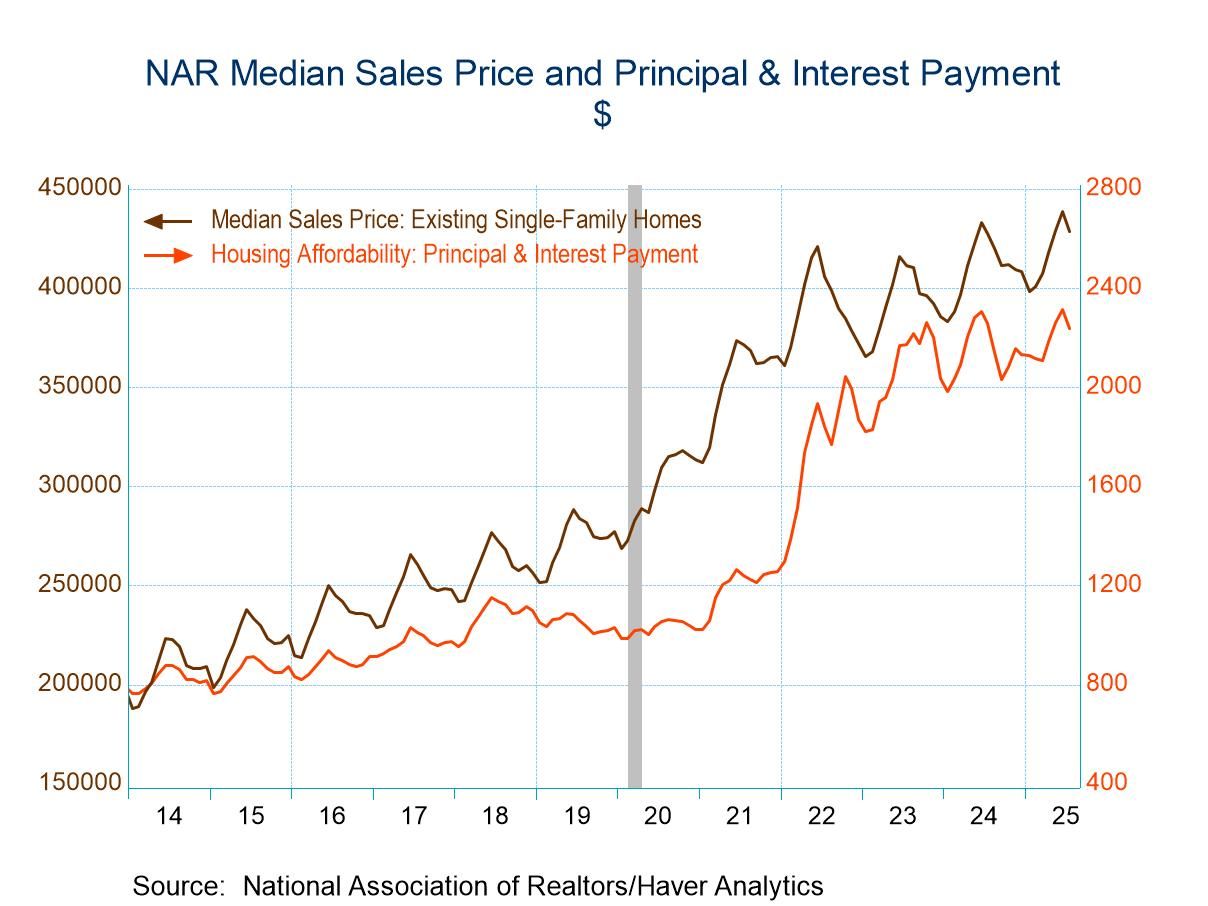

U.S. Housing Affordability Improves in July

- Home prices & mortgage rates slip.

- Median income edges higher.

- Affordability increases across country.

by:Tom Moeller

|in:Economy in Brief

- USA| Sep 11 2025

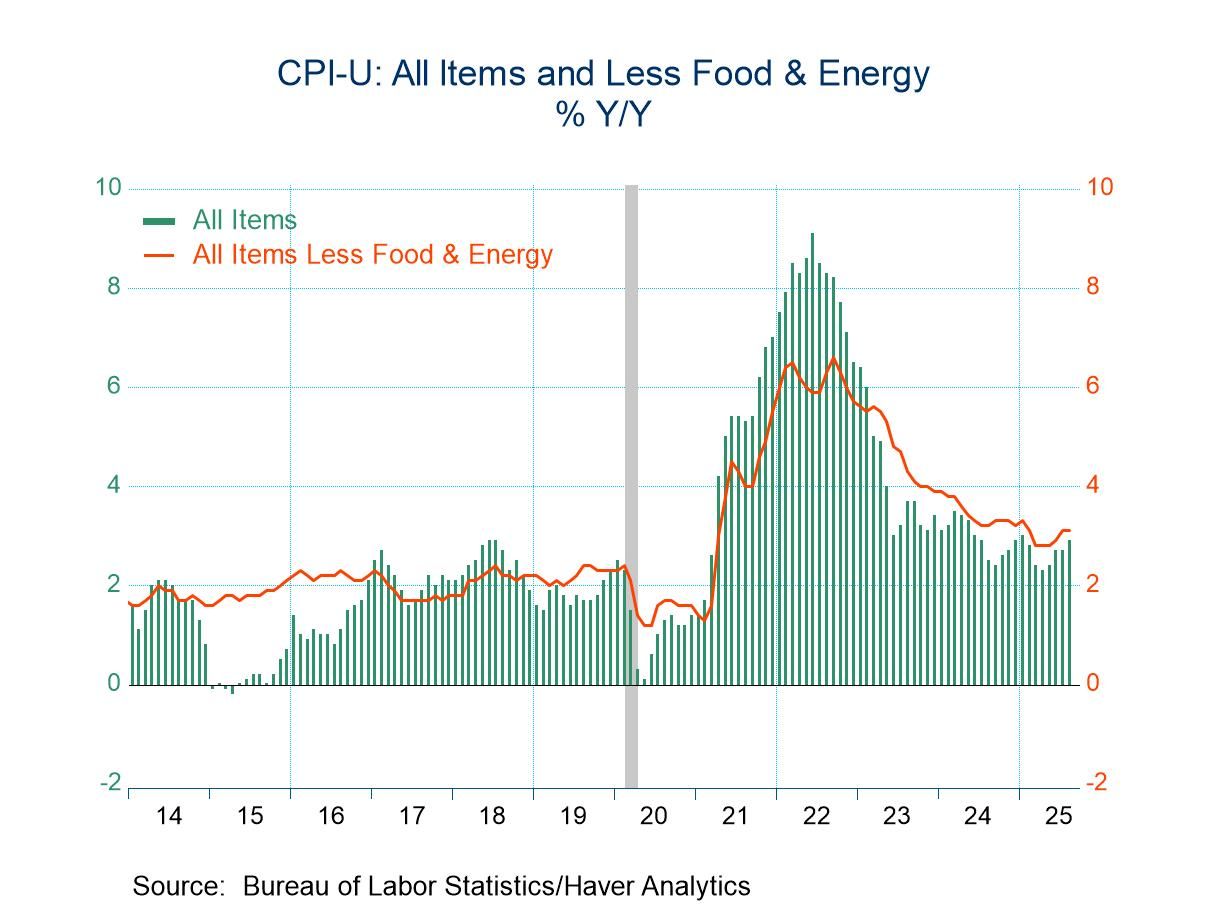

U.S. Consumer Price Inflation Firms in August

- Energy & food prices strengthen.

- Core inflation steadies.

- Core goods gain increases but core services inflation eases.

by:Tom Moeller

|in:Economy in Brief

- USA| Sep 11 2025

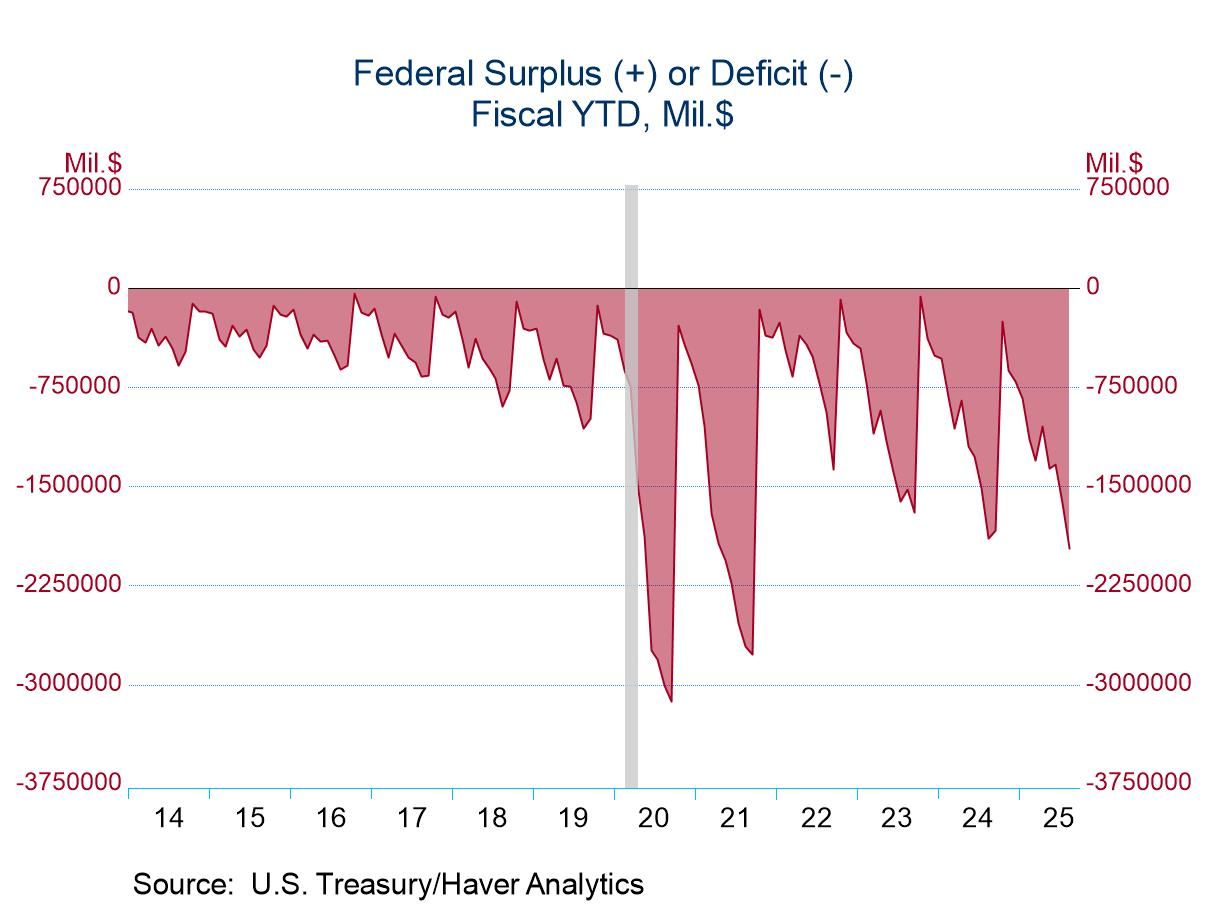

U.S. Federal Budget Deficit Deepens in August

- Monthly deficit is well above expectations.

- Revenues rise moderately while outlays surge.

- Deficit increases in first eleven months of FY’25.

by:Tom Moeller

|in:Economy in Brief

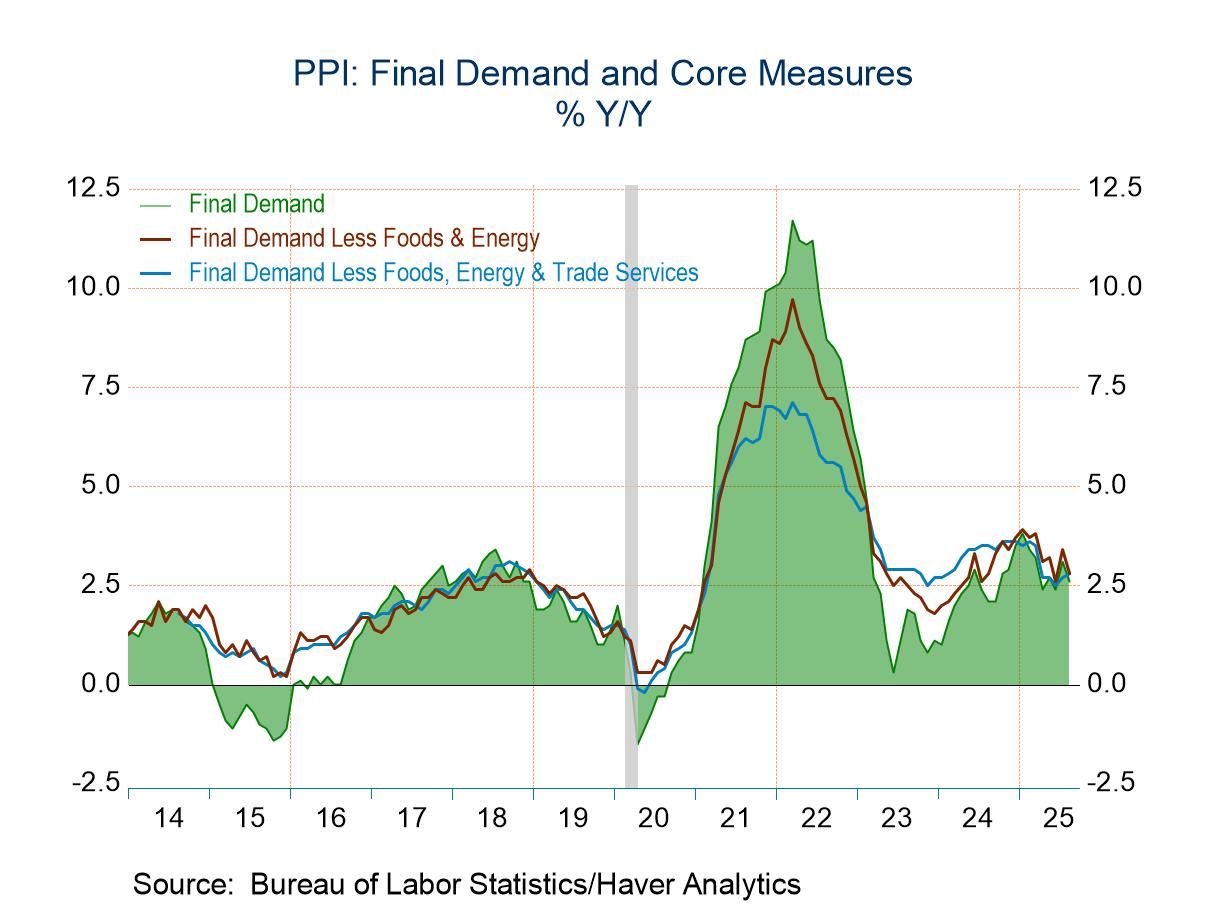

- Energy prices fall while food prices edge higher.

- Trade service prices decline after sharp increase.

- Core goods price inflation eases.

by:Tom Moeller

|in:Economy in Brief

- USA| Sep 10 2025

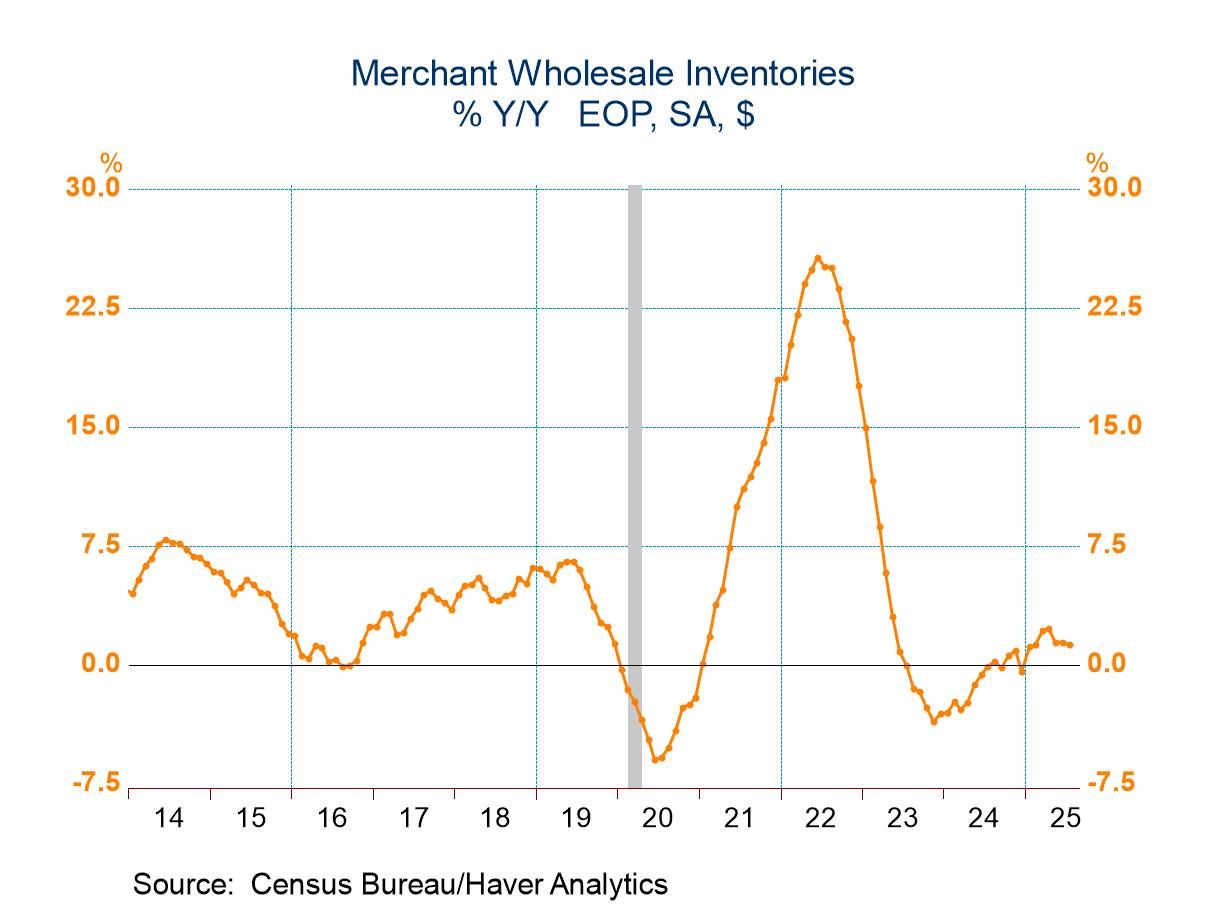

U.S. Wholesale Inventories Edge Higher in July; Sales Surge

- Durable goods inventories fall as nondurables rise.

- Sales strengthen broadly.

- I/S ratio eases to another three-year low.

by:Tom Moeller

|in:Economy in Brief

- USA| Sep 09 2025

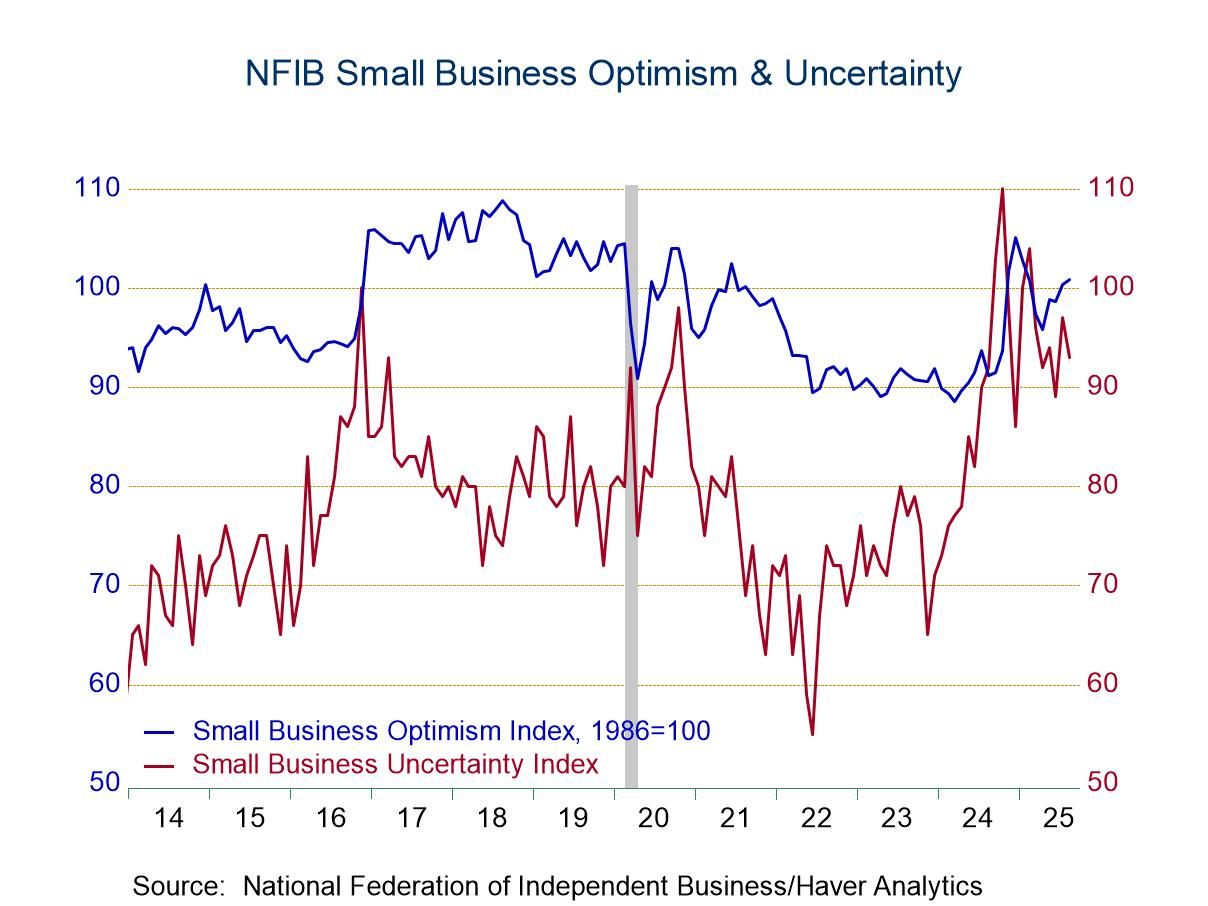

U.S. NFIB Small Business Optimism Index Improves in August

- Sales & employment expectations improve.

- Economic & business expansion plans ease.

- Percent raising prices and price expectations decline.

by:Tom Moeller

|in:Economy in Brief

- USA| Sep 09 2025

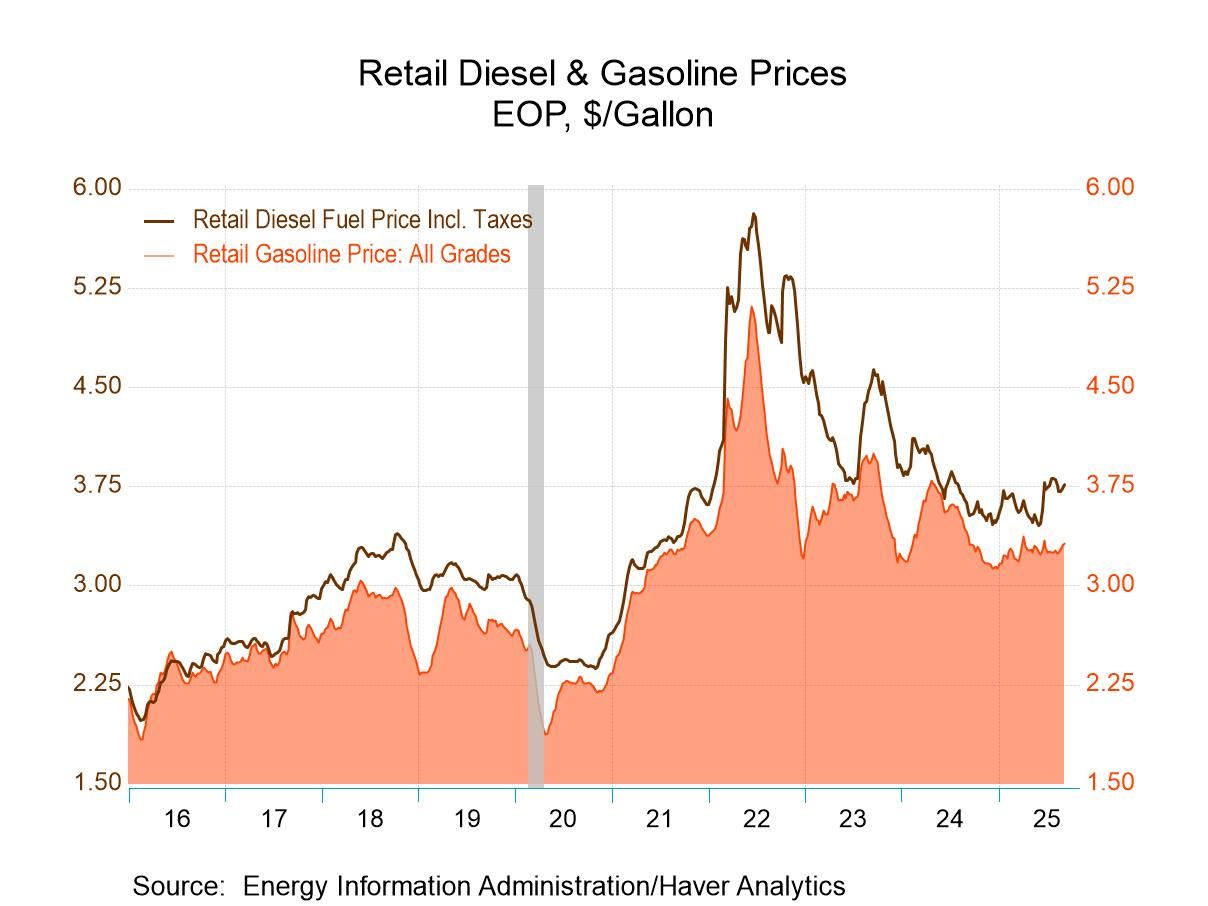

U.S. Energy Prices Are Mixed Last Week

- Gasoline prices increase to late-June high.

- Crude oil prices ease after prior week’s increase.

- Natural gas prices rise to four-week high.

by:Tom Moeller

|in:Economy in Brief

- USA| Sep 08 2025

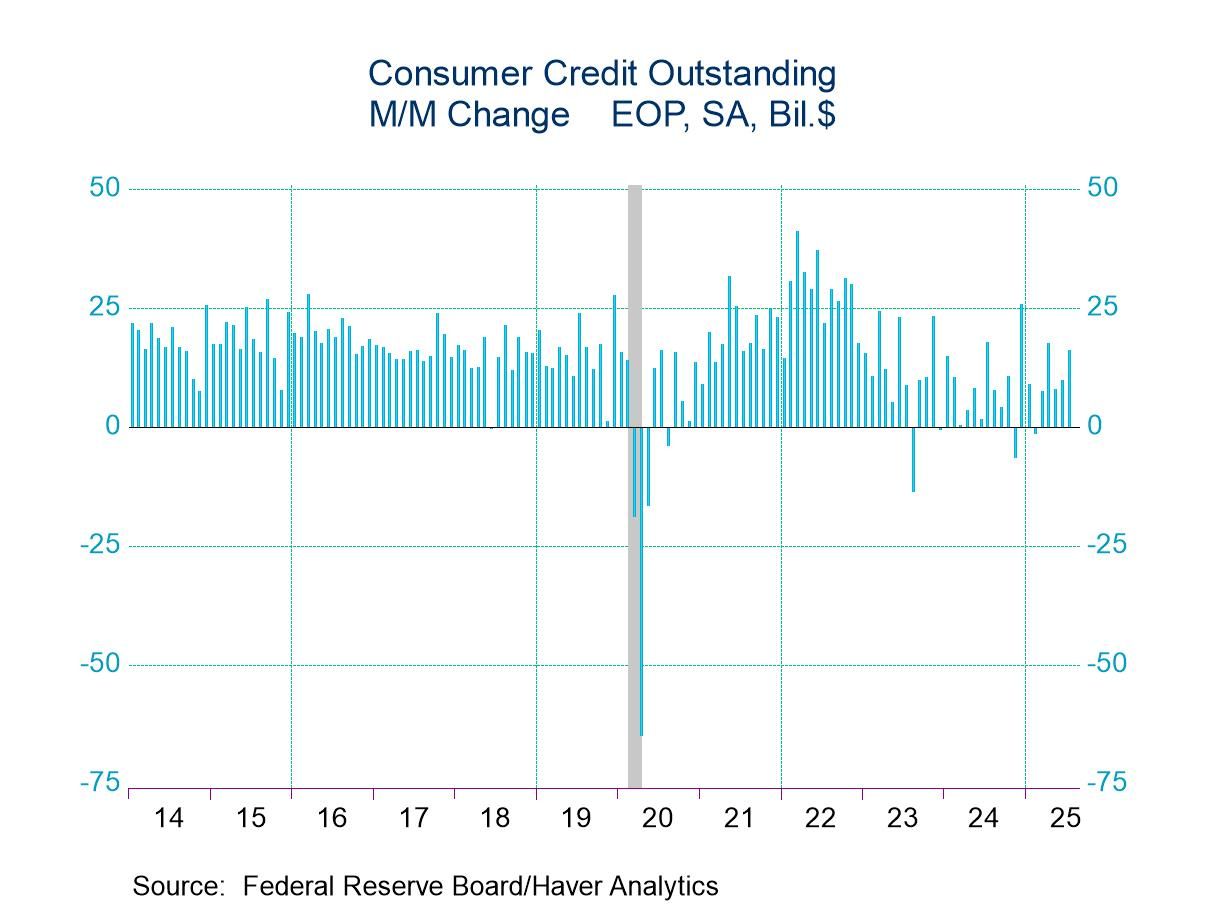

U.S. Consumer Credit Surges in July

- Notable gain in credit usage follows two months of moderate growth.

- Revolving credit picks up as nonrevolving credit eases.

by:Tom Moeller

|in:Economy in Brief

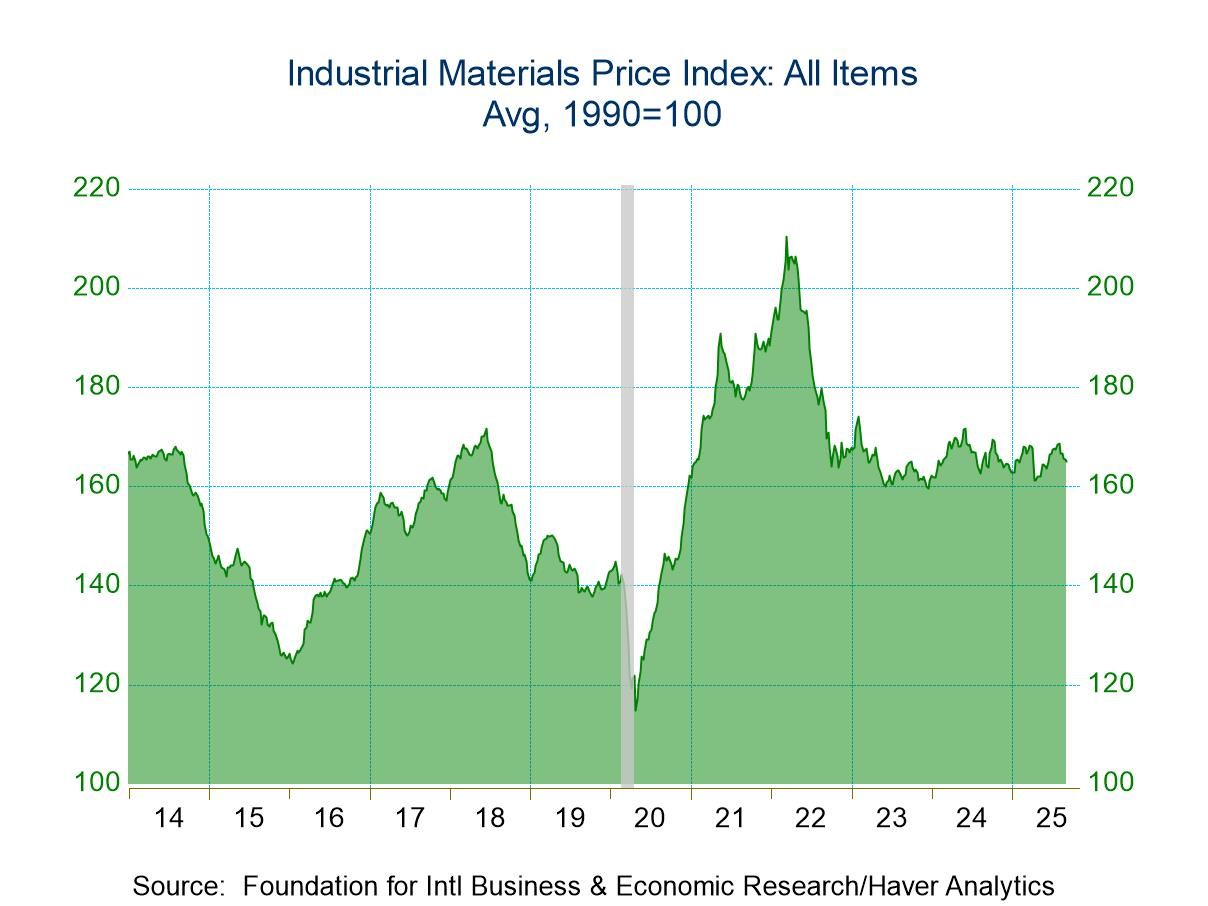

- Decline extends last month’s weakness.

- Crude oil costs & lumber costs decline.

- Metals prices improve.

by:Tom Moeller

|in:Economy in Brief

- of1081Go to 7 page