Global| Jun 19 2014

Global| Jun 19 2014Activity Tapers off in Japan

Summary

There are not too many different ways to look at the ongoing weakness in Japan. All sectors are weakening and in all cases the drop off has been relatively severe. The headline index stands only in the 33rd percentile of its historic [...]

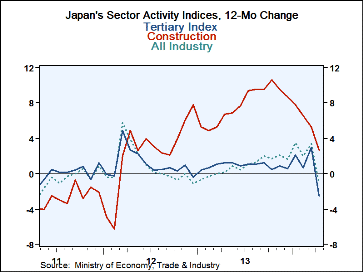

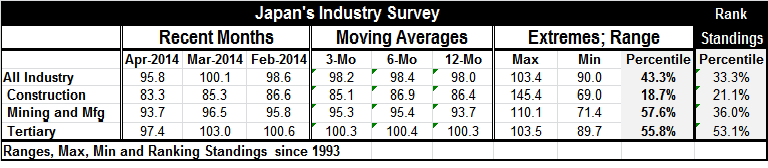

There are not too many different ways to look at the ongoing weakness in Japan. All sectors are weakening and in all cases the drop off has been relatively severe. The headline index stands only in the 33rd percentile of its historic queue of data, a very weak position. The construction sector stands in the 21st percentile of its queue. Mining and manufacturing stand in the 36th percentile. Only the tertiary sector, services, stands above the 50th percentile mark. That tells you something, since services are usually a pay as you go proposition. You cannot stockpile services. The weakness in Japan's economy now is mostly about hoarding.

There are not too many different ways to look at the ongoing weakness in Japan. All sectors are weakening and in all cases the drop off has been relatively severe. The headline index stands only in the 33rd percentile of its historic queue of data, a very weak position. The construction sector stands in the 21st percentile of its queue. Mining and manufacturing stand in the 36th percentile. Only the tertiary sector, services, stands above the 50th percentile mark. That tells you something, since services are usually a pay as you go proposition. You cannot stockpile services. The weakness in Japan's economy now is mostly about hoarding.

Japan's economy is in a peculiar short-term boom-bust cycle; this is the bust phase. The economy boomed ahead of the imposition of the sales tax as everyone bought ahead everything that they could to avoid the tax. Now, in the aftermath of the tax, activity is much weaker as people live off of their pre-purchases. The leading index released today also was weak as it sees the same forces in play.

But weak is not glum. The monthly Tankan survey, run by Reuters, showed that business confidence is still solid. Japanese businesses have seen these tax-related boom-bust cycles before. They know that as bad as it seems, it is temporary and that activity will come back.

Business confidence is not misplaced; it just has perspective. So these irregularities in activity do not tell the real story of what is happening in Japan. The very strong GDP growth in Q1 was not real and neither will be the weakness of Q2. Japanese businesses are expecting to get through to the period when pre-sales can no longer carry the consumer and see activity pick up again. Businesses remain patient and optimistic in Japan.

Robert Brusca

AuthorMore in Author Profile »Robert A. Brusca is Chief Economist of Fact and Opinion Economics, a consulting firm he founded in Manhattan. He has been an economist on Wall Street for over 25 years. He has visited central banking and large institutional clients in over 30 countries in his career as an economist. Mr. Brusca was a Divisional Research Chief at the Federal Reserve Bank of NY (Chief of the International Financial markets Division), a Fed Watcher at Irving Trust and Chief Economist at Nikko Securities International. He is widely quoted and appears in various media. Mr. Brusca holds an MA and Ph.D. in economics from Michigan State University and a BA in Economics from the University of Michigan. His research pursues his strong interests in non aligned policy economics as well as international economics. FAO Economics’ research targets investors to assist them in making better investment decisions in stocks, bonds and in a variety of international assets. The company does not manage money and has no conflicts in giving economic advice.