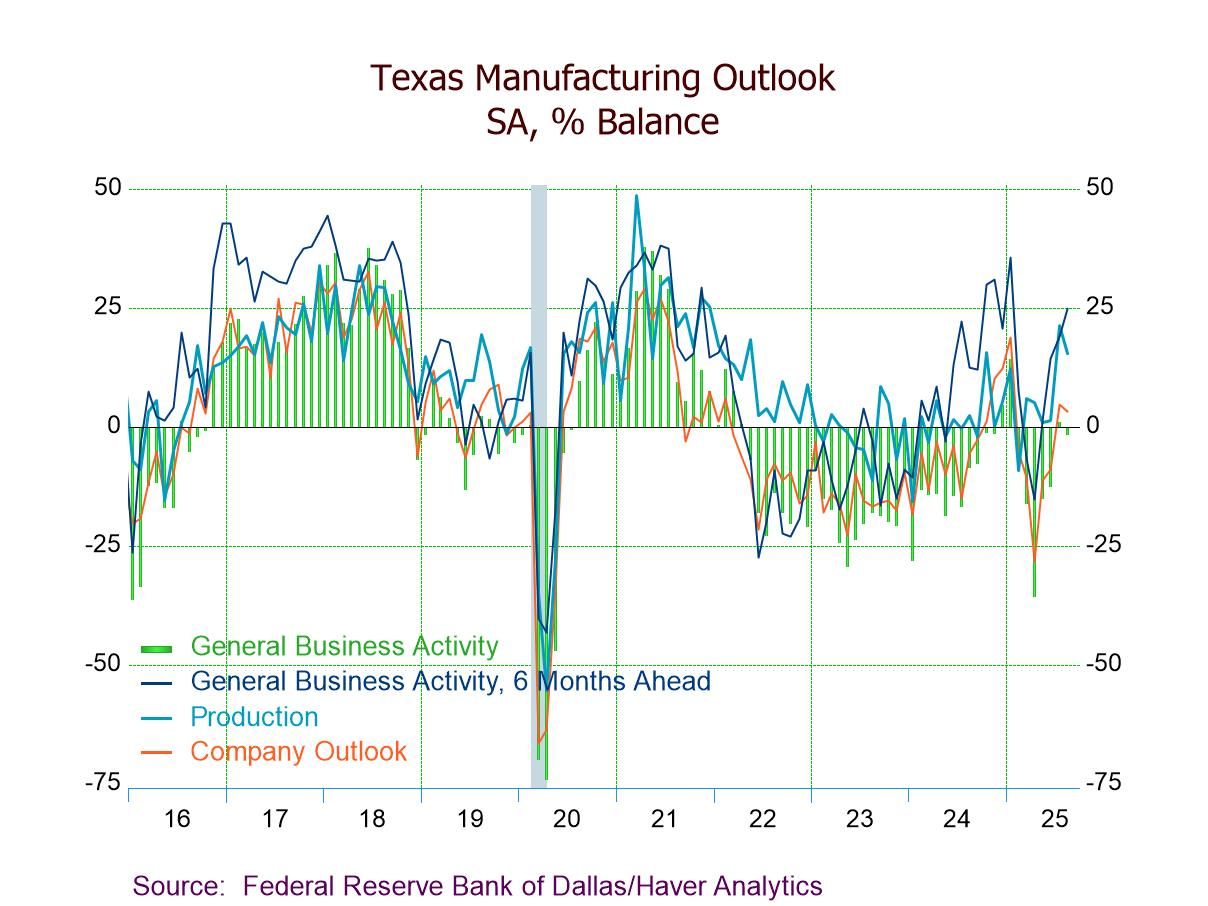

- General business activity -1.8 in Aug. vs. +0.9 in July.

- Company outlook (3.3) positive for the second straight mth.; production (15.3) still above historical avg.

- New orders growth (2.6) and new orders (5.8) up; both positive for the first time since Jan.

- Employment (8.8) rises, the fourth consecutive expansion and the highest since Sept. ’23.

- Prices received index up 4 pts. to 15.1; prices paid index up to a 4-month-high 43.7.

- Future general business activity up to 24.8, the highest since Jan.

Introducing

Winnie Tapasanun

in:Our Authors

Winnie Tapasanun has been working for Haver Analytics since 2013. She has 20+ years of working in the financial services industry. As Vice President and Economic Analyst at Globicus International, Inc., a New York-based company specializing in macroeconomics and financial markets, Winnie oversaw the company’s business operations, managed financial and economic data, and wrote daily reports on macroeconomics and financial markets. Prior to working at Globicus, she was Investment Promotion Officer at the New York Office of the Thailand Board of Investment (BOI) where she wrote monthly reports on the U.S. economic outlook, wrote reports on the outlook of key U.S. industries, and assisted investors on doing business and investment in Thailand. Prior to joining the BOI, she was Adjunct Professor teaching International Political Economy/International Relations at the City College of New York. Prior to her teaching experience at the CCNY, Winnie successfully completed internships at the United Nations. Winnie holds an MA Degree from Long Island University, New York. She also did graduate studies at Columbia University in the City of New York and doctoral requirements at the Graduate Center of the City University of New York. Her areas of specialization are international political economy, macroeconomics, financial markets, political economy, international relations, and business development/business strategy. Her regional specialization includes, but not limited to, Southeast Asia and East Asia. Winnie is bilingual in English and Thai with competency in French. She loves to travel (~30 countries) to better understand each country’s unique economy, fascinating culture and people as well as the global economy as a whole.

Publications by Winnie Tapasanun

- USA| Aug 25 2025

Texas General Business Activity Turns Slightly Negative in August, But Expectations Remain Positive

- USA| Aug 19 2025

U.S. Retail E-Commerce Sales Rise in Q2'25

- Sales +1.4%, the 14th q/q rise in 15 qtrs.; +5.3% y/y, the lowest since Q2'22.

- Online share of total retail sales up to 16.3%, the highest since Q2'20.

- Nonstore sales rebound, up for the fourth quarter in five.

- Widespread gain in online sales led by bldg. materials & garden equipt. (+34.7% q/q).

- USA| Aug 15 2025

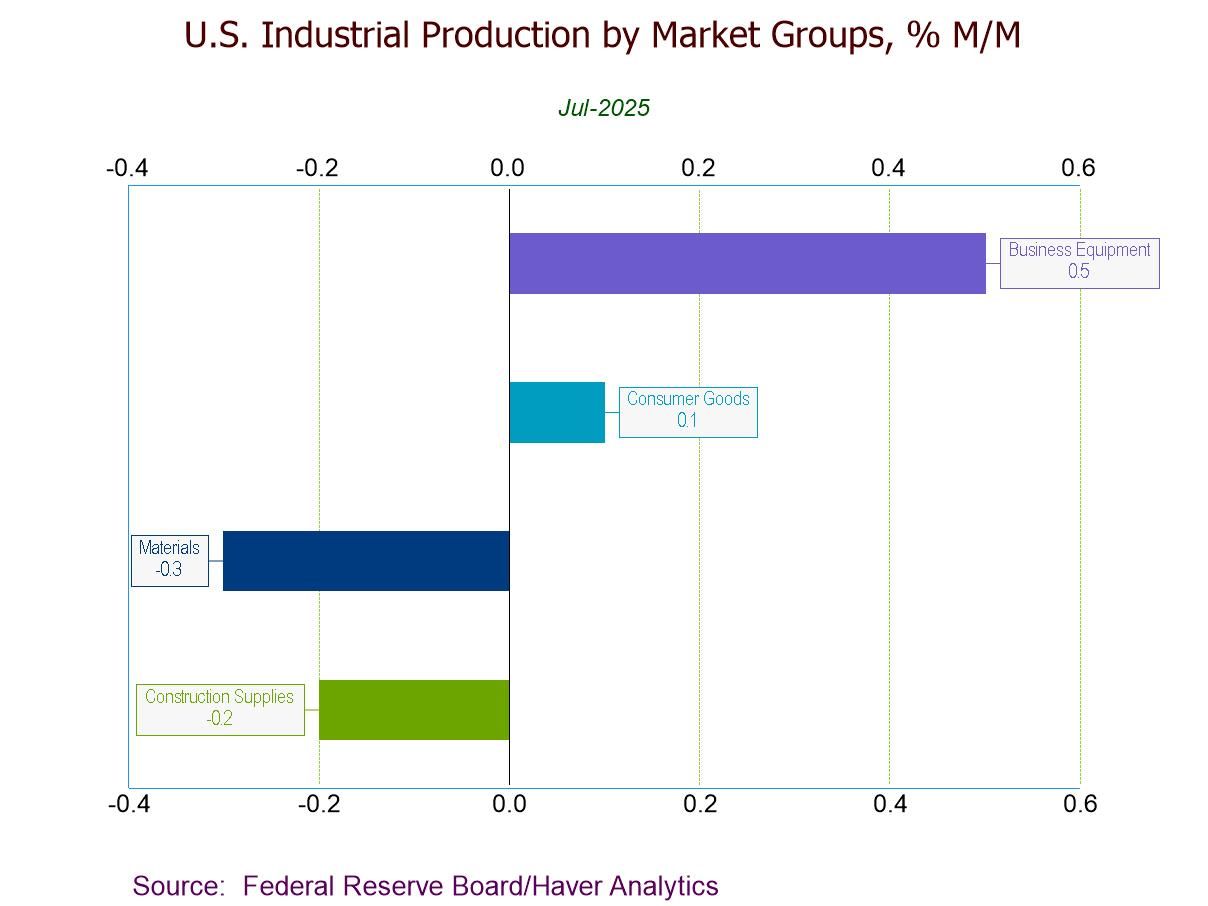

U.S. Industrial Production Eases in July

- July IP -0.1% (+1.4% y/y), led by a 0.4% decline in mining activity.

- Mfg. IP unchanged, w/ durables up 0.3% and nondurables down 0.4%.

- Utilities output -0.2%, the second m/m fall in three months.

- Key categories in market groups post mixed results.

- Capacity utilization down 0.2%pt. to 77.5%; mfg. capacity utilization down 0.1%pt. to 76.8%.

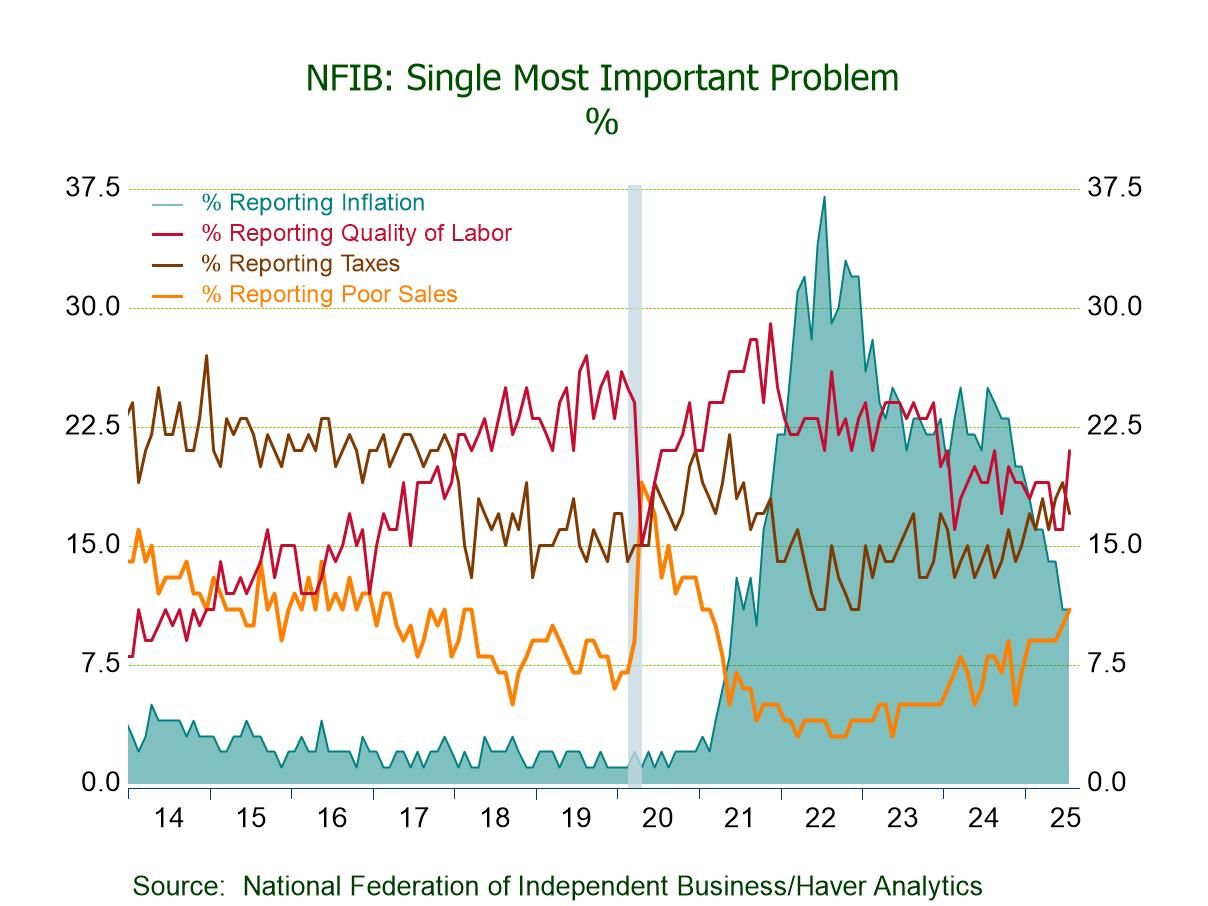

- July NFIB Small Business Optimism Index up 1.7 pts. to 100.3.

- Uncertainty Index up 8 pts. to a 5-month-high 97.

- Expectations for economy up 14 pts. to 36%, the highest since Feb.

- Plans to expand business up 5 pts. to 16%, the highest since Jan.

- Expected real sales down 1 pt. to 6%, still positive for the third straight month.

- Percent of firms raising avg. selling prices down 5 pts. to a 6-month-low 24%.

- Quality of labor (21%), taxes (17%), and inflation (11%) are the top three business concerns.

- USA| Aug 05 2025

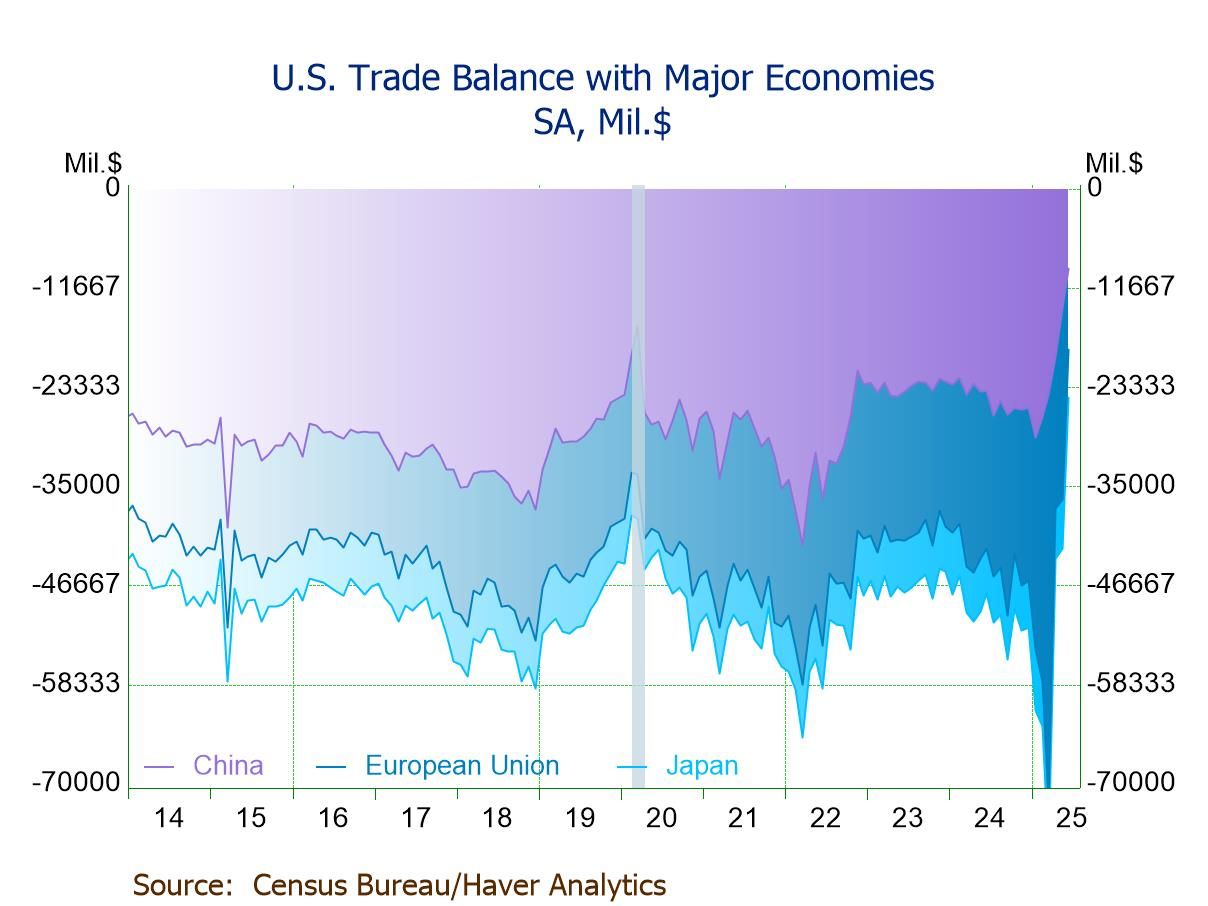

U.S. Trade Deficit Narrows in June; the Smallest Since Sept. ’23

- $60.2 bil. trade deficit, reflecting $85.9 bil. goods deficit & $25.7 bil. services surplus.

- Exports -0.5% m/m, down for the second consecutive month.

- Imports -3.7% m/m, down for the third straight month.

- Real goods trade deficit narrows to $84.6 bil. after May’s widening.

- Goods trade deficits w/ China at a record low, w/ EU at a June ’13 low, and w/ Japan at a 4-month low.

- USA| Aug 01 2025

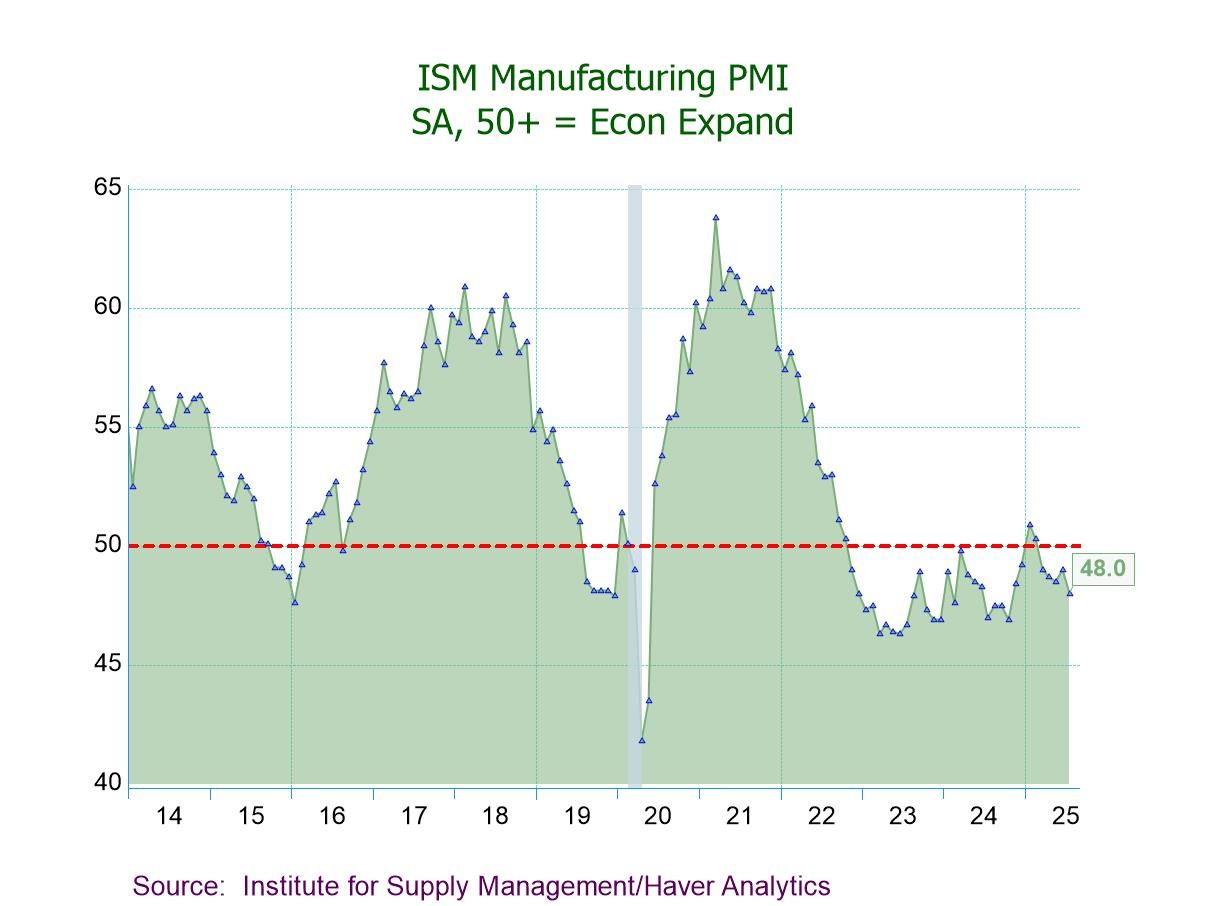

U.S. ISM Manufacturing PMI Contracts in July to a Nine-Month Low

- 48.0 in July vs. 49.0 in June; the fifth consecutive month of contraction.

- Production (51.4) expands to a six-month high.

- New orders (47.1) contract for the sixth successive month.

- Employment (43.4) contracts to the lowest level since June ’20.

- Prices Index (64.8) indicates prices rise for the 10th straight month; exports & imports contracting.

- USA| Jul 30 2025

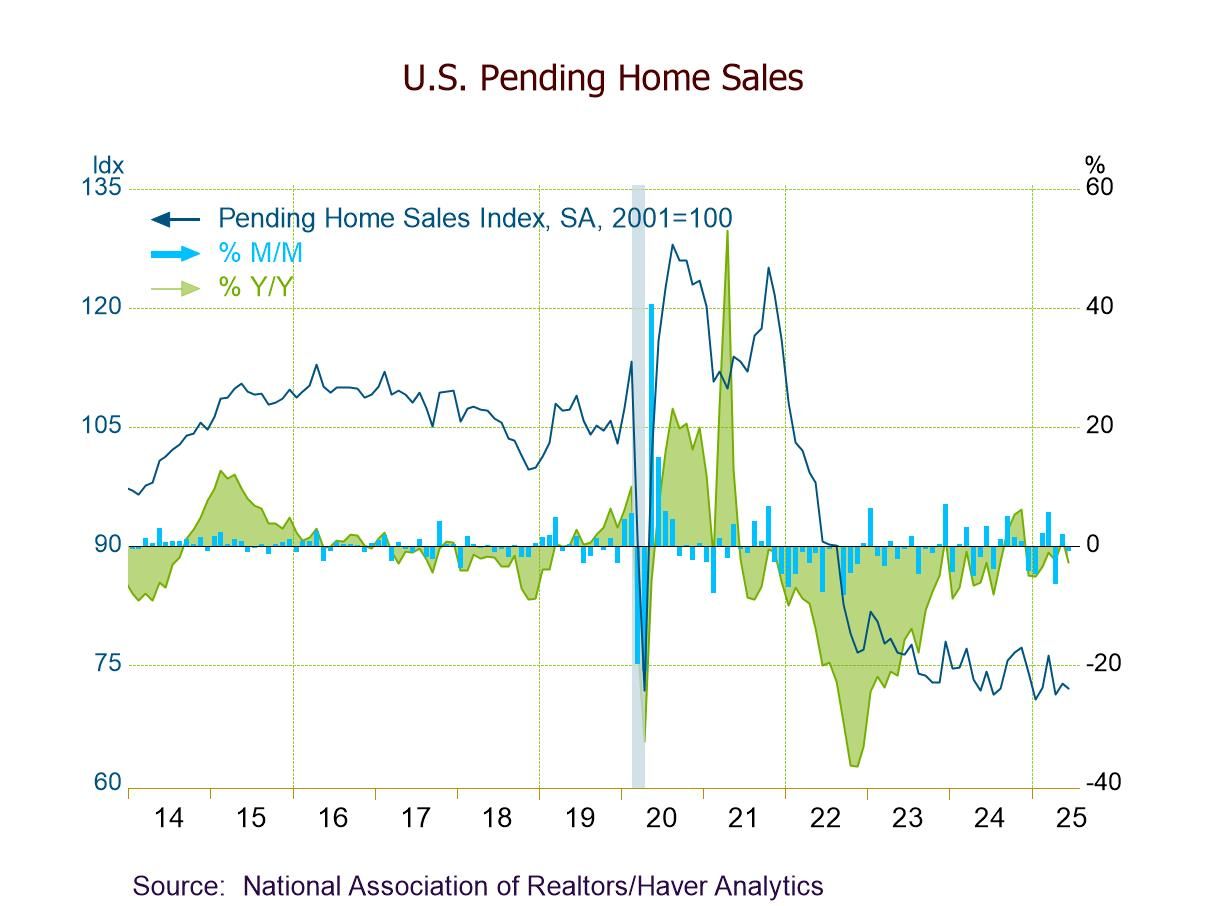

U.S. Pending Home Sales Decline in June

- PHSI -0.8% (-2.8% y/y) in June vs. +1.8% (+1.1% y/y) in May.

- Home sales down m/m in three of four major regions but up m/m in the Northeast (+2.1%).

- Home sales down y/y in the Midwest, South, and West; flat y/y in the Northeast.

- USA| Jul 29 2025

U.S. Goods Trade Deficit Unexpectedly Narrows in June

- Deficit: $85.99 bil. in June, smaller than $96.42 in May.

- Exports -0.6%, down for the second straight month, led by an 8.1% decline in exports of industrial supplies & materials.

- Imports -4.2%, down for the fourth month in five, led by a 12.4% drop in nonauto consumer goods imports.

- USA| Jul 24 2025

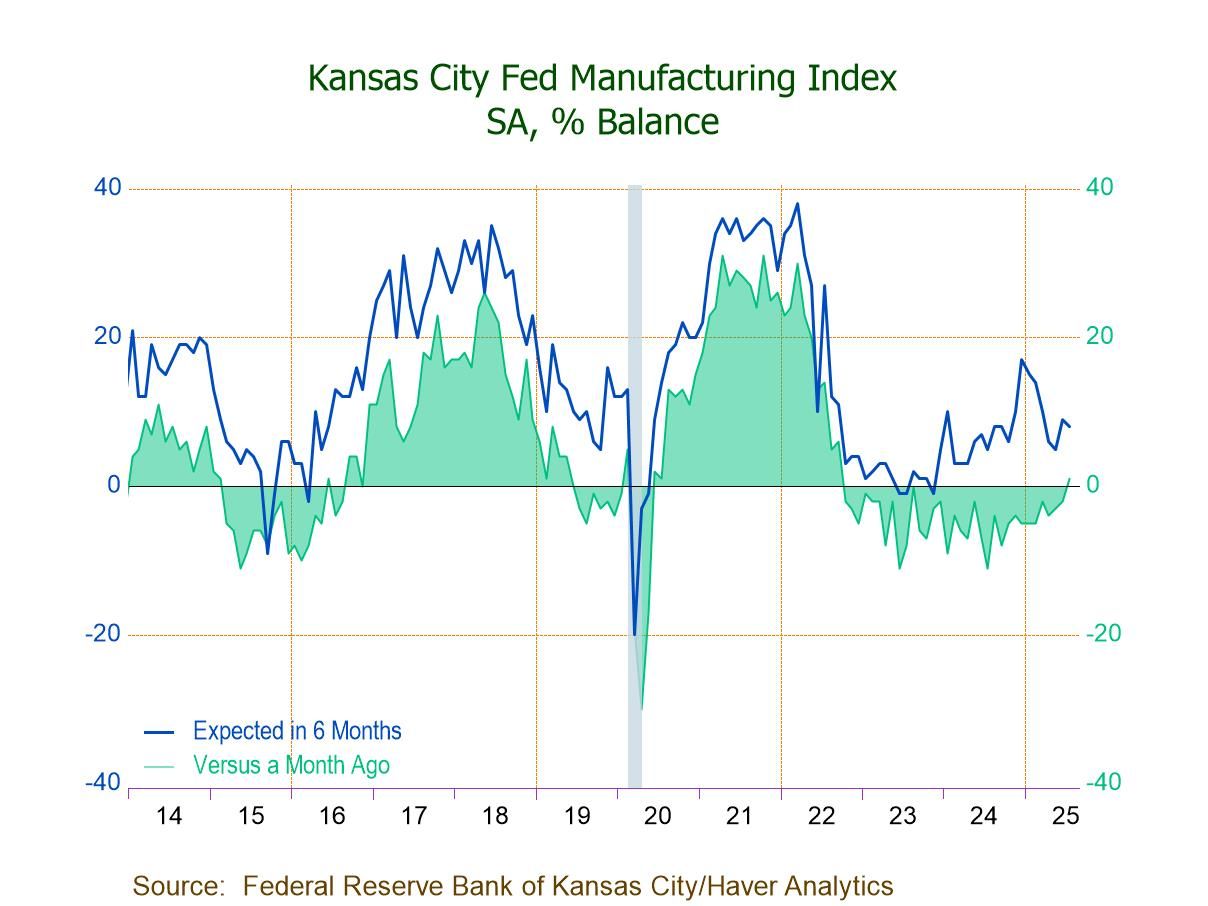

Kansas City Fed Manufacturing Index Rises in July; First Positive Reading Since Sept. ’22

- July Composite Index at 1 reflects positive numbers in materials inventories (8) and new orders (2), while employment (-11) and production (-3) post negative readings.

- Price growth cools somewhat, w/ prices paid down 4 pts. to 47 and prices received down 3 pts. to 18.

- Expectations for future activity, while edging down to 8, remain in positive territory.

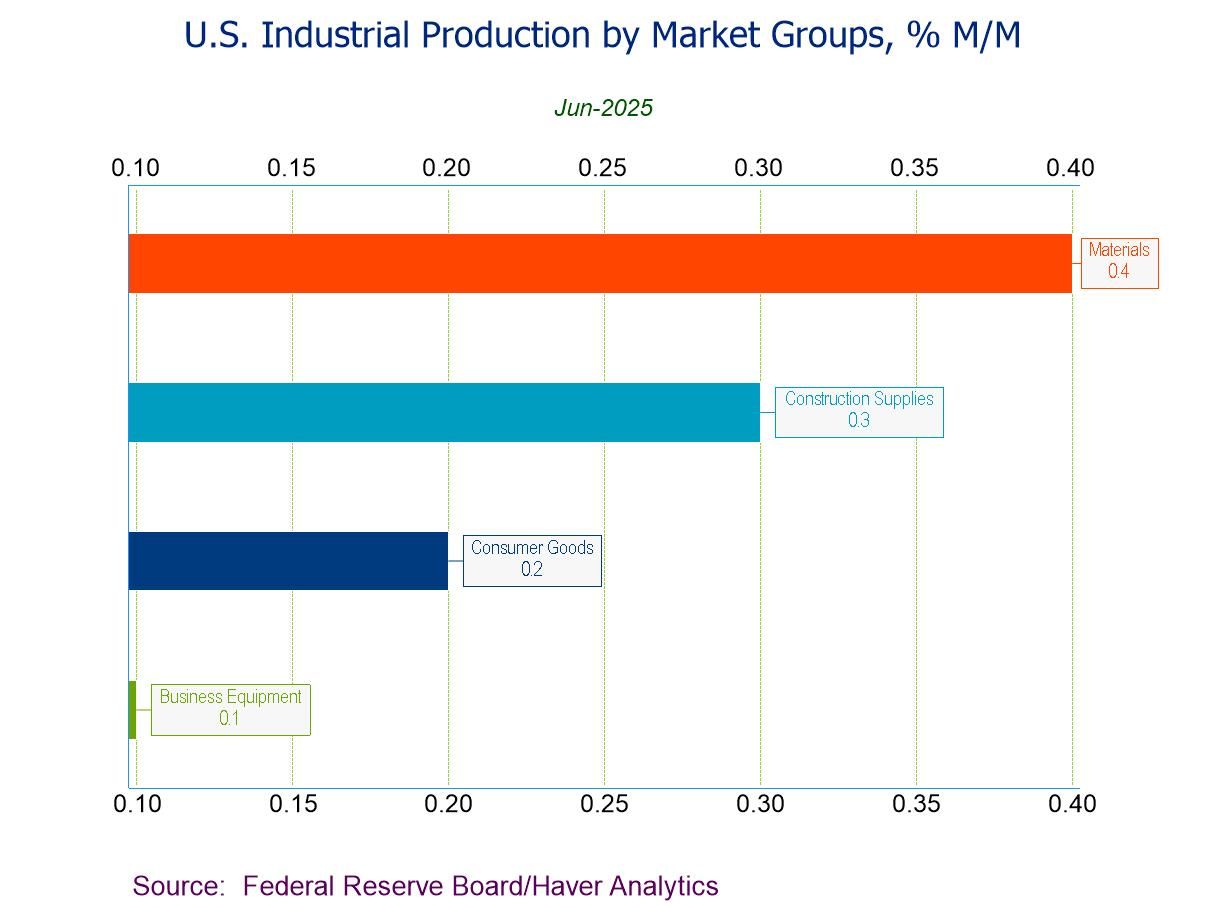

- June IP +0.3% (+0.7% y/y), led by a 2.8% rebound in utilities output.

- June IP Index at the highest level since Dec. ’18.

- Mfg. IP +0.1%, w/ durables unchanged and nondurables up 0.3%.

- Mining activity -0.3%, the second m/m fall in three months.

- Key categories in market groups all increase.

- Capacity utilization up 0.1%pt. to 77.6%; mfg. capacity utilization up 0.1%pt. to a 3-month-high 76.9%.

- USA| Jul 09 2025

U.S. Mortgage Applications Advance 9.4% in the July 4 Week, the Third Straight W/W Rise

- Purchase applications +9.4% w/w; refinancing loan applications +9.2% w/w.

- Effective interest rate on 30-year fixed-rate loans falls to 6.95%, the lowest since the Apr. 4 week.

- Average loan size declines for the third time in four weeks.

- USA| Jul 02 2025

U.S. Mortgage Applications Rise 2.7% in the June 27 Week

- Purchase applications edge up 0.1% w/w; refinancing loan applications jump 6.5% w/w.

- Effective interest rate on 30-year fixed-rate loans drops to 6.97%, the lowest since the Apr. 4 week.

- Average loan size rebounds to the highest level since the May 9 week.

- of28Go to 4 page