Geopolitical tensions in the Middle East have escalated sharply following joint air strikes by Israel and the United States on strategic targets in Iran. While the ultimate trajectory of the conflict remains highly uncertain, the episode highlights the potential for geopolitical shocks to ripple through multiple channels of the global economy—from energy markets and shipping routes to supply chains, inflation dynamics and monetary policy. In this week’s Charts of the Week, we present six charts that illustrate some of the key issues, implications and points to watch, including movements in geopolitical risk (chart 1), shipping activity through the Strait of Hormuz (chart 2), energy prices (chart 3), global supply chain pressures (chart 4), inflation surprises (chart 5) and the evolving structure of global electricity generation (chart 6). Together they provide a framework for thinking about how events in the region could shape the outlook for the world economy in the months ahead.

More Commentaries

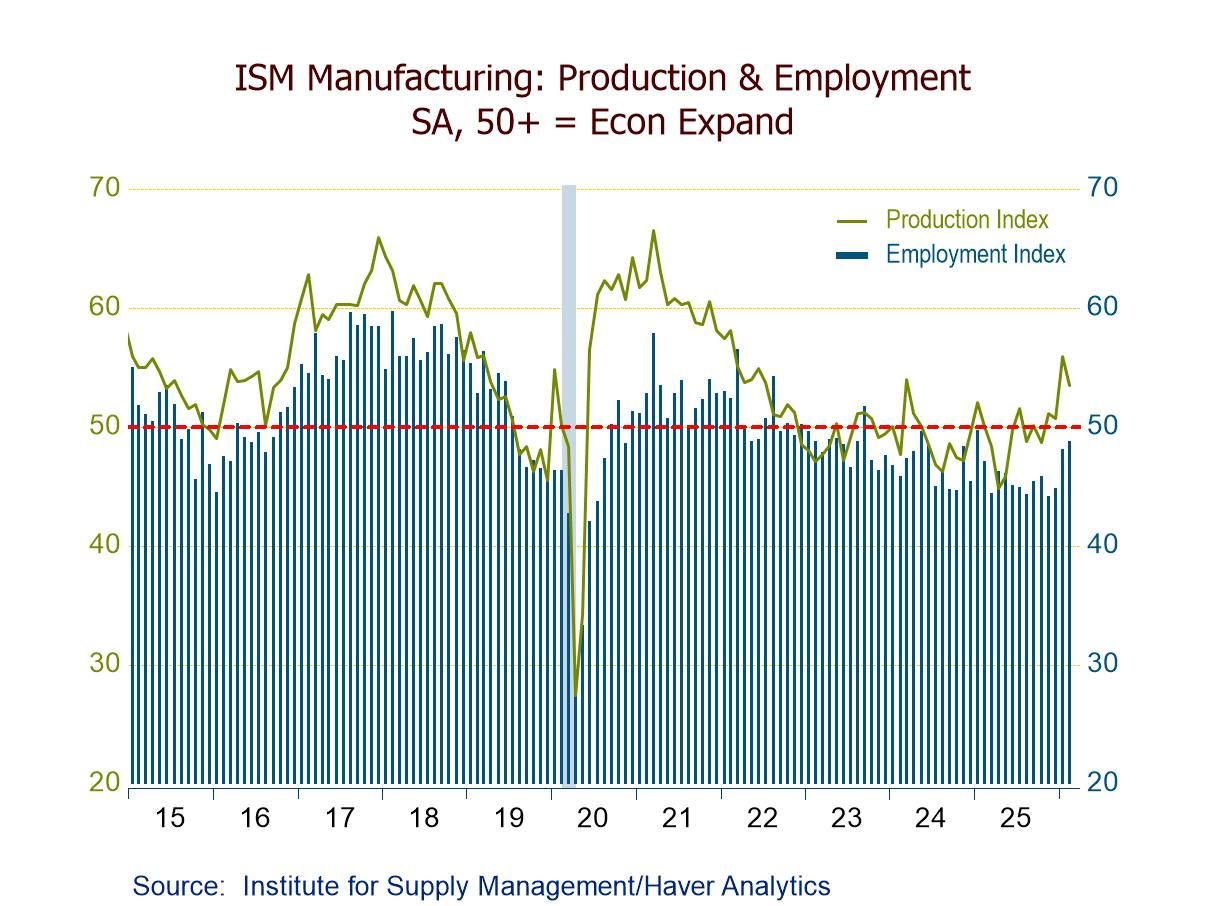

- ISM Mfg. PMI at 52.4 in Feb.; second consecutive month of expansion and only the third in 40 mths.

- Production (53.5) expands for the fourth straight mth.; new orders (55.8) expand for the second successive mth.

- Employment (48.8) contracts for the 29th straight mth. but at the slowest pace since Jan. ’25.

- Prices Index (70.5) hits its highest since June ’22, w/ prices rising for the 17th consecutive mth.

- Exports (50.3) expand for the second straight mth.; imports (54.9) reach the highest level since Feb. ’22.

Global| Mar 02 2026

Global| Mar 02 2026S&P Manufacturing PMIs Show Improvement

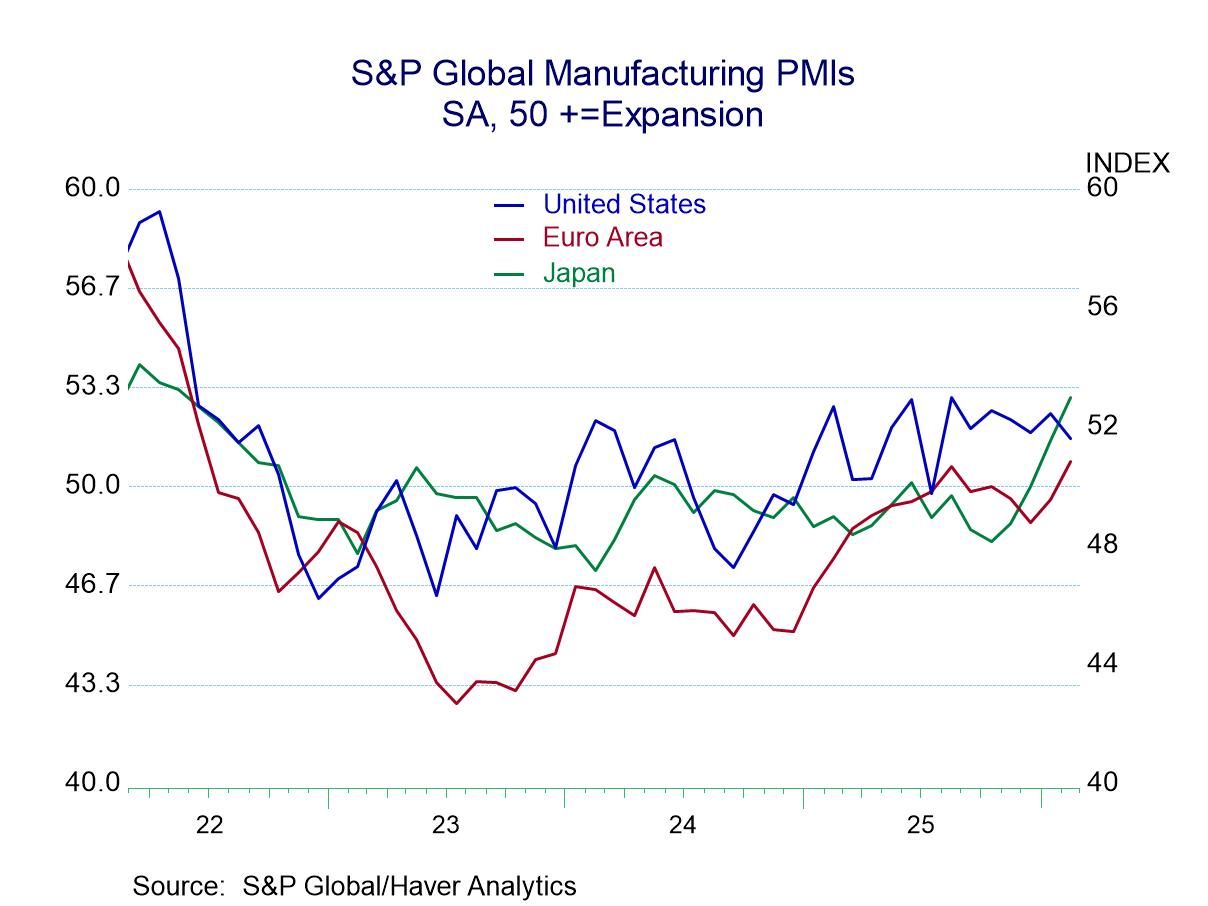

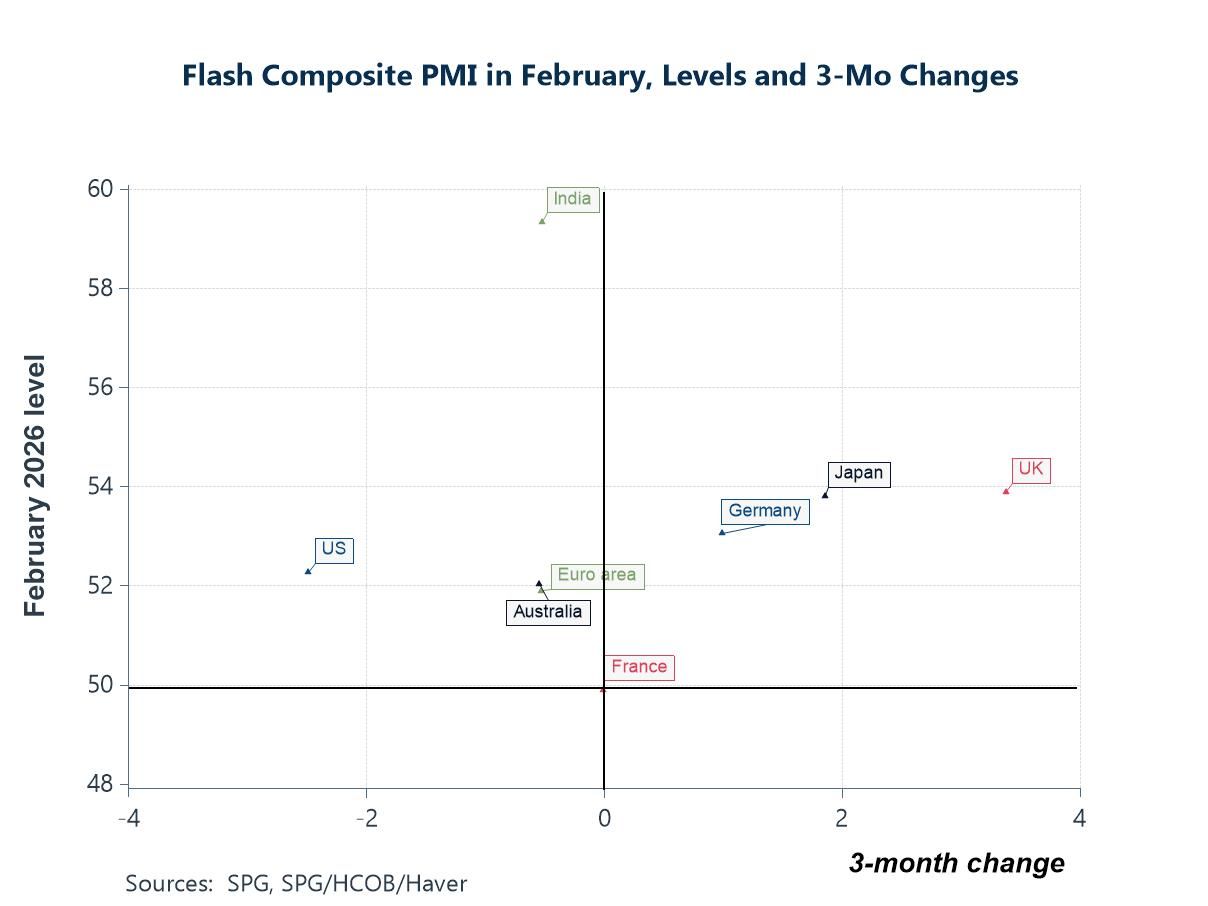

The S&P manufacturing PMI readings for February 2026 continued to show improvement, particularly on a sequential basis.

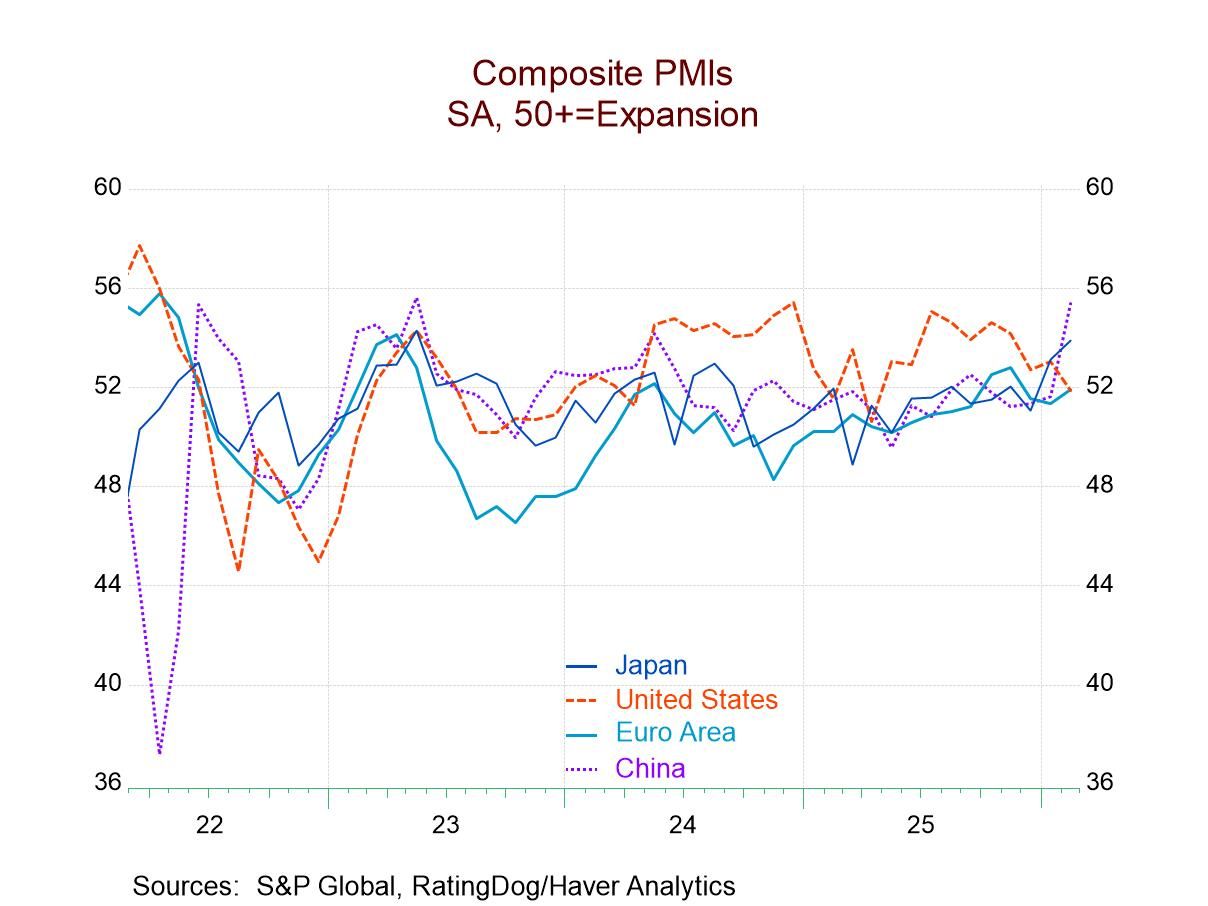

The chart shows a clear upward tendency for the United States, Japan, and the European Monetary Union where the manufacturing PMIs have been on an increasing track for some time. Japan just surpassed the U.S. this month where the manufacturing PMI reading surged above 50. The U.S. has been steady at that level for a number of months; Japan has just moved up while the euro area reading is starting to show some upward trend.

The table takes the underlying diffusion levels reported by these 18 early reporters and shuffles them into six different cohorts to summarize their performance over different periods.

In February, we see twice as many reporters in the cohort between 55 and 60 as we saw in January; that proportion moved up to 11.1% from 5.6%. The proportion in the 50 to 55 diffusion category (mild improvement) was unchanged at 55.6%; the proportion showing mild below median performance declined to 33.3% in February from 38.9% in January. The other cohorts showed no membership.

If we look at the data grouped into sequential categories of three-months, six-months, and 12-months, we see the neutral to mildly positive category of 50% to 55% moving from 28.2% of total membership over 12 months to 39.8% of membership over 6 months to 55.6% membership over 3 months. This is a clear improvement in performance over this timeline for the category indicating moderate expansion. The stronger expansion category of 55 to 60 shows a membership of 5.6% for all three-time horizons. The category showing weak declines in the 40 to 50 range for diffusion declined steadily from 66.2% over 12 months to 54.6% over 6 months to only 38.9% over 3 months. Over the last three months, fewer than 40% of the reporters were showing mild declines, 55% of the reporters were showing unchanged-to-moderate increases, while relatively larger increases have been posted by 5.6% of the reporters.

Looking back to the right of the table, we can compare the recent 12-month figures to the previous 12-months and to the 12-months before that to get a sense of the smoothed trend. There what we see is the 50 to 55 category three years ago was at 28.2% of the reporting membership; it moved up to 38% of the membership over just a year ago whereas over the past year that membership had slipped to 28% in an environment where tariffs were imposed. Although, as we see from the sequential data, it has over the shorter periods of six months and three months been seeing an increase in membership in that category.

Over the earlier years, there was also stronger membership in the stronger growth category of 55 to 60 percentile. Three years ago, it registered 8.3%, then fell to 6.4% and now sits at 5.6% over the recent 12 months. Over the recent shorter periods of three months and six months, there has yet to be an improvement in that category. As for the weaker category the cohort from 40 to 50%, we see 62% of the membership in that category three years ago, and two years ago that had fallen back to 55.6%, but then over the past year it had moved up to average 66% of the membership: fully 2/3 of the reporting membership over the last year has been in the 40 to 50 the diffusion category though that membership proportion has been falling over the last six and three months.

The grouped statistics show that there is general progress in place and in line with what we see reported in the chart. In addition, we track the number of reporters That are improving period to period. From 12 months to six months to three months, we see that percentage of reporters showing higher diffusion readings steadily improving from 50% to 61.1% to 77.8%. We also track the number of reporters with diffusion below 50 (that is those that are showing contraction) and that number hasn't changed very much; it's at 13 over 12 months and over 6 months while falling only to 12 over 3 months.

However, if we step away from averaging and we look at the raw scores for the last three months, we see the number of countries reporting output that's contracting at 8 in December, at 7 in January and at 6 in February, a clearer sense of progress. Meanwhile, on the monthly timeline, there's also a sense of improvement - not in a monotonic sense – but there is a hint of better general tendency for the percent of reporters that are showing the tendency for higher diffusion to be reported to rise.

The diffusion statistics are up to date, and they basically describe the proportion of the reporters that are seeing activity improve or decline in the reporting area. Diffusion data don’t tell us how strong that improvement is, just whether it's present. Diffusion data tend to be sensitive. They tend to quickly be able to identify changes in trends and right now we're seeing an uptick, an improvement, in the levels of diffusion being reported in this 18-country sample for manufacturing. The results are not decisive, but they are encouraging.

- USA| Feb 27 2026

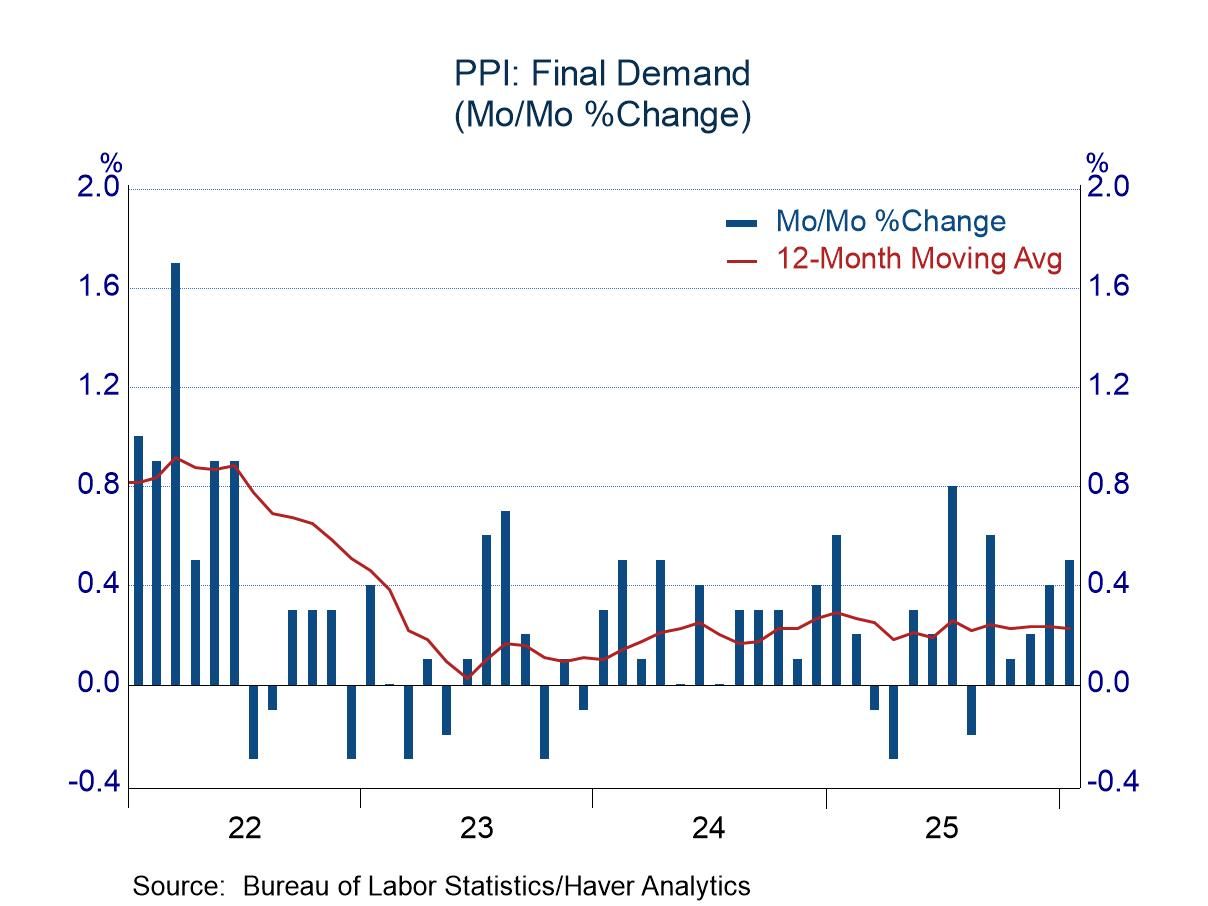

January PPI: Wild Swings in Volatile Areas

- Prices of food and energy fell sharply, while prices of trade services surged.

- Other noisy areas (transportation & warehouse services, construction) posted high-side increases.

- Excluding the (apparently) random shifts, results were tame.

- Headline +0.3% m/m, first m/m rise since August; -0.4% y/y, 11th consecutive y/y fall.

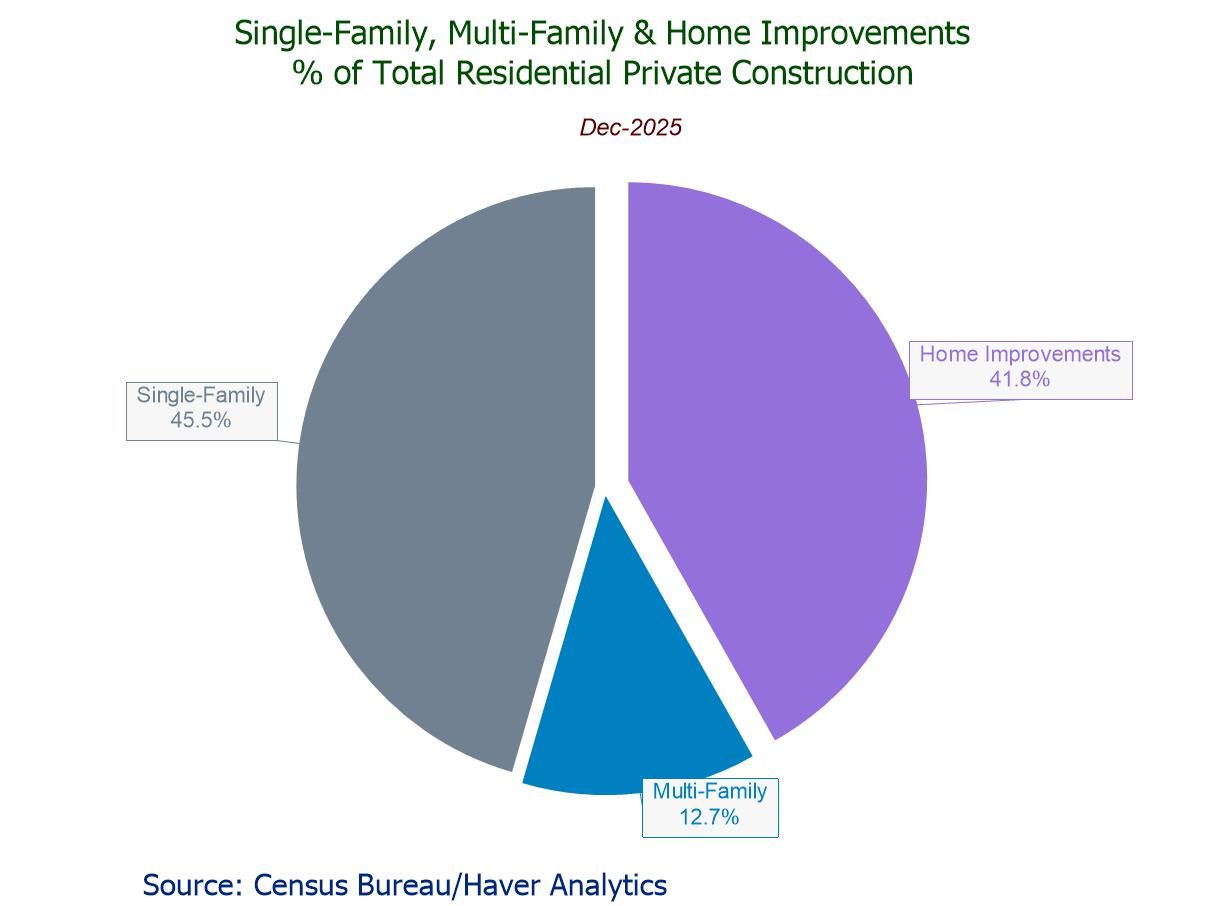

- Residential private construction +1.5% m/m, led by a 1.8% rebound in home improvement building.

- Nonresidential private construction -0.7% m/m, fifth m/m decline in six months.

- Public construction -0.5% m/m, reflecting drops in both residential & nonresidential public buildings.

- Europe| Feb 27 2026

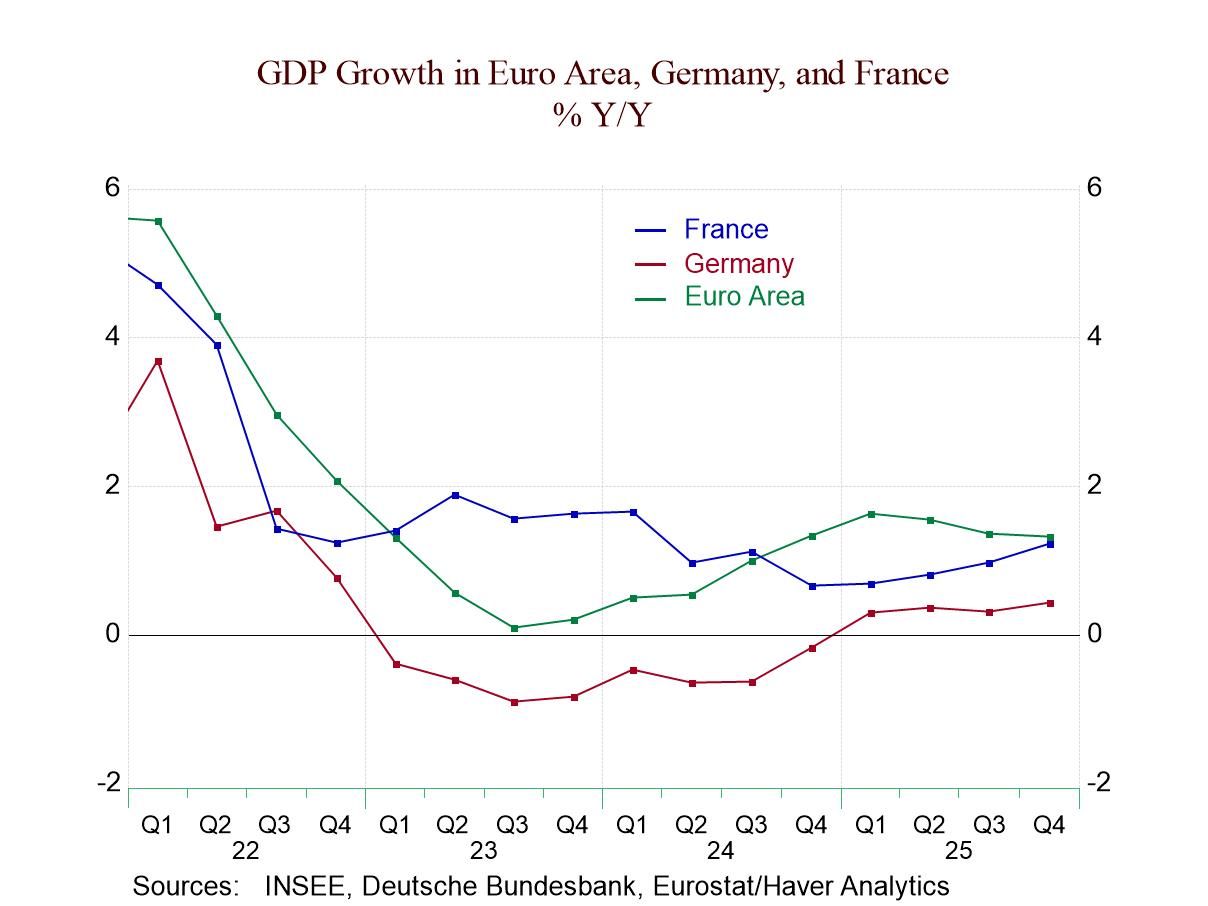

Weak GDP Growth in Europe and Selected Countries Carries On

More countries have reported new results or firmed up their GDP results for 2025Q4. In the EMU, GDP grows by 1.3% year over year in the fourth quarter. The large EMU economies (Big Four) grow by 1% on that horizon, while the rest of the community grows at twice that pace, at 2.1%. U.S. growth on that timeline is 2.2%; Japan’s is 0.2%; and the United Kingdom grows by 0.9%. They are all weak compared to past standards. None of them rank at or above their respective 50th percentile standings on growth rates dating back to 1997.

In Europe, EMU nonmember Denmark’s growth at 3% has an over 50th percentile ranking, at 78.3 percentile mark. Ireland’s growth has a 60.9 percentile standing, while Italy and Portugal have growth rates near their respective 55th percentiles—above their respective medians but not by a lot.

Global| Feb 26 2026

Global| Feb 26 2026Charts of the Week: The AI Undercurrent

Over the past few days, financial markets have been navigating a fresh wave of policy and geopolitical cross-currents, with the US Supreme Court ruling on executive tariff authority adding a new layer of uncertainty to the trade outlook. At the same time, the AI investment boom continues to provide an important cyclical tailwind, even as investors remain alert to valuation risks, while renewed tensions involving Iran have reintroduced an energy risk premium. Against that backdrop, this week’s charts paint a picture of a global economy that is still expanding but becoming more differentiated. Latest flash PMI surveys confirm that global activity remains in growth territory despite some cooling in the US (chart 1). Strong semiconductor exports from Korea (chart 2) and surging US data-centre investment (chart 3) both underscore the continued force of the AI capex cycle, while a strong pickup in German capital goods orders (chart 4) hints at a more traditional, policy-linked investment impulse emerging in Europe. Meanwhile, the tight co-movement between oil prices and US front-end yields highlights (chart 5) the ongoing macro sensitivity to energy markets, and the recent downward drift in Japanese government bond yields — alongside softer data surprises — suggests that global bond markets may be receiving at least a modest anchoring impulse from Japan (chart 6).

by:Andrew Cates

|in:Economy in Brief

- USA| Feb 26 2026

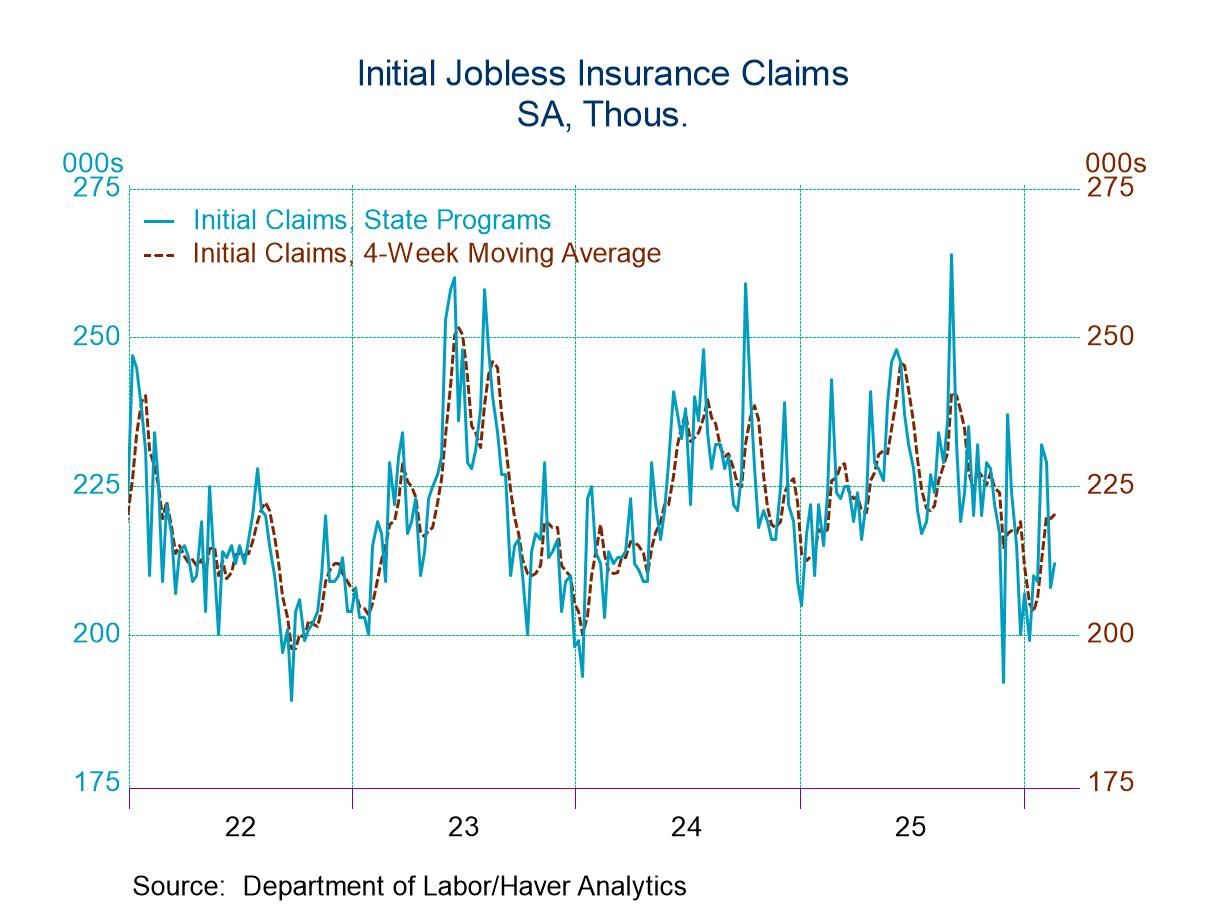

U.S. Initial Unemployment Claims Rose in Latest Week

- New claims rose by 4,000 to 212,000.

- Continuing claims declined by 31,000 to 1.833 million.

- The insured unemployment rate remained at 1.2% for the 12th consecutive week.

- Europe| Feb 26 2026

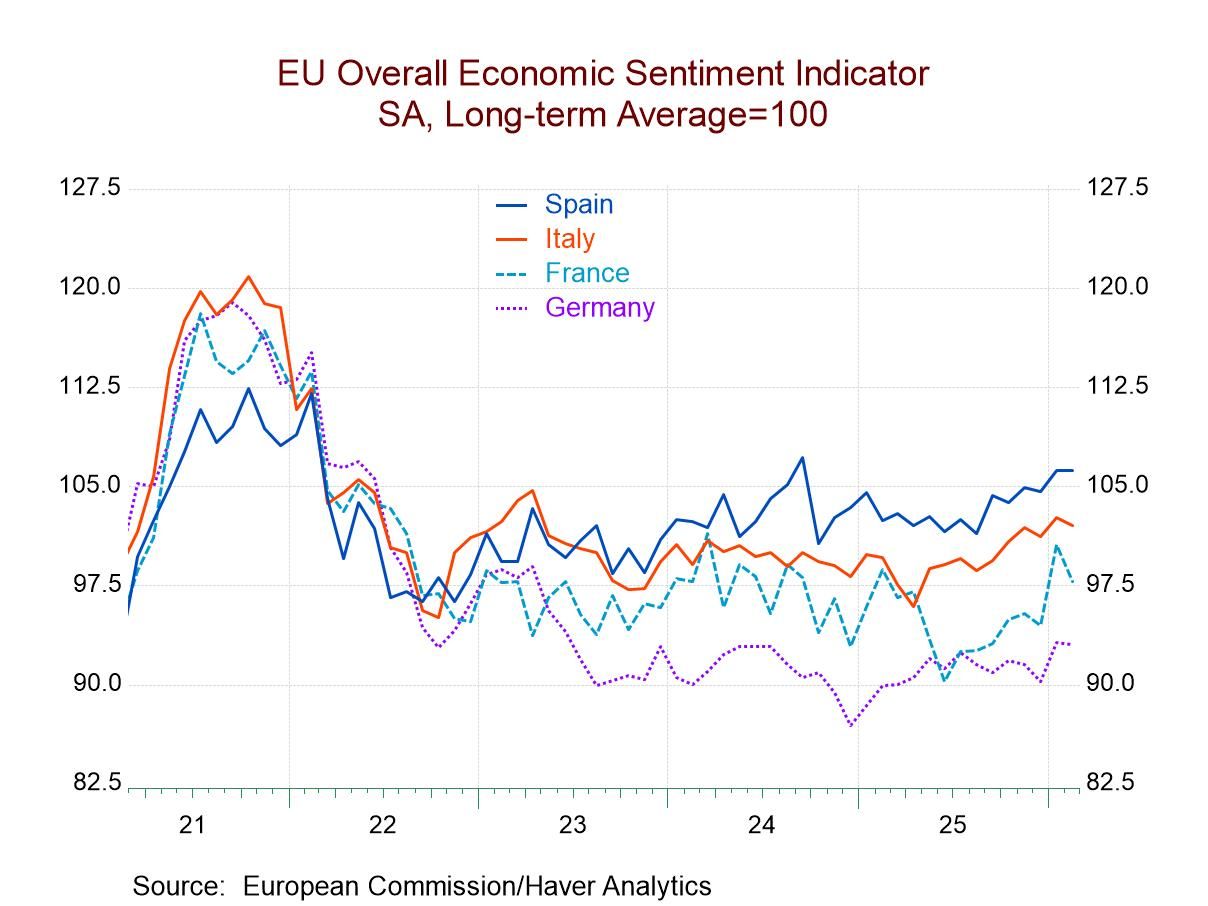

EMU Indexes Back Off But Hold Uptrend

EU Commission indexes that assess economic performance for the countries in Europe and in the European Monetary Union slipped in February to 98.3 from 99.3 in January; however, the February reading is still relatively strong by recent standards and leaves the index largely in an uptrend.

The February readings saw the industrial sector unchanged, a small upward move in consumer confidence, and a one-point backtracking in construction, as retailing improved by a point. The services sector index stepped back by two points, putting it back at its December level.

Ranking standings for economic groups The key ranking of the sectors in February show only two of the sectors with readings above their medians (i.e., above a ranking of 50%). Those sectors are retailing with a queue standing in its 60.4 percentile and construction with its queue standing in its 79.3 percentile. Consumer confidence continues to be the weakest with a 27.8 percentile ranking, services check in with a 33.4 percentile ranking, and the industrial sector has moved up to a 43.6 percentile ranking. However, the overall monetary union ranking is only in its 41st percentile, substantially below its historic median which resides at a standing at the 50-percentile mark.

Country level performance Beyond the sectors, there are 18 of the 20 monetary union countries that provide early readings to this survey. Eleven countries showed weakened performance in February compared to January. In January, seven countries had weakened relative to December. In December, seven countries had weakened relative to November. However, in December, four of the countries that weakened were the four largest economies in the monetary union. In January, none of the largest four economies weakened month-to-month. Now, in February, we have three of the four largest economies weakening month-to-month, with the other one, Spain, posting an unchanged reading. The large countries in the monetary union have begun to have a little more difficulty over these last three months.

Standings by country Percentile-standing data showed that, of the 18 countries in the table, only 8 have readings that place them above their historic medians on data back to the mid-1980s. The large countries have split performance, with Italy reporting a 59.8 percentile standing and Spain reporting a 72.4 percentile spending, while the two largest monetary union economies, Germany and France, post readings in the 23rd percentile for Germany and the 44th percentile for France. The ranking for the monetary union as a whole is at its 41st percentile. That compares to an unweighted average ranking in the 44th percentile for all the countries when their individual rankings pooled and averaged. The two ratings are close together.

Apart from the Big Four Among the rest of the monetary union members, countries with readings above the 50th percentile are Malta, Greece, Lithuania, Latvia, the Netherlands, and Cyprus. Four countries vie for having the weakest reading in the table, with readings in their 20th percentile region. That list includes Big Four member Germany with the 23.5 percentile standing, Slovakia with a 23.8 percentile standing, Belgium with a 23.1 percentile standing, and Austria with a 22.1 percentile standing. There is considerable heterogeneity among the rankings of the monetary union member countries across all size classes. In addition, as we saw above, looking at the sectors, the sector rankings varied from a low of 27th percentile standing for consumer confidence to a high of 79th percentile standing for construction.

- of2699Go to 1 page