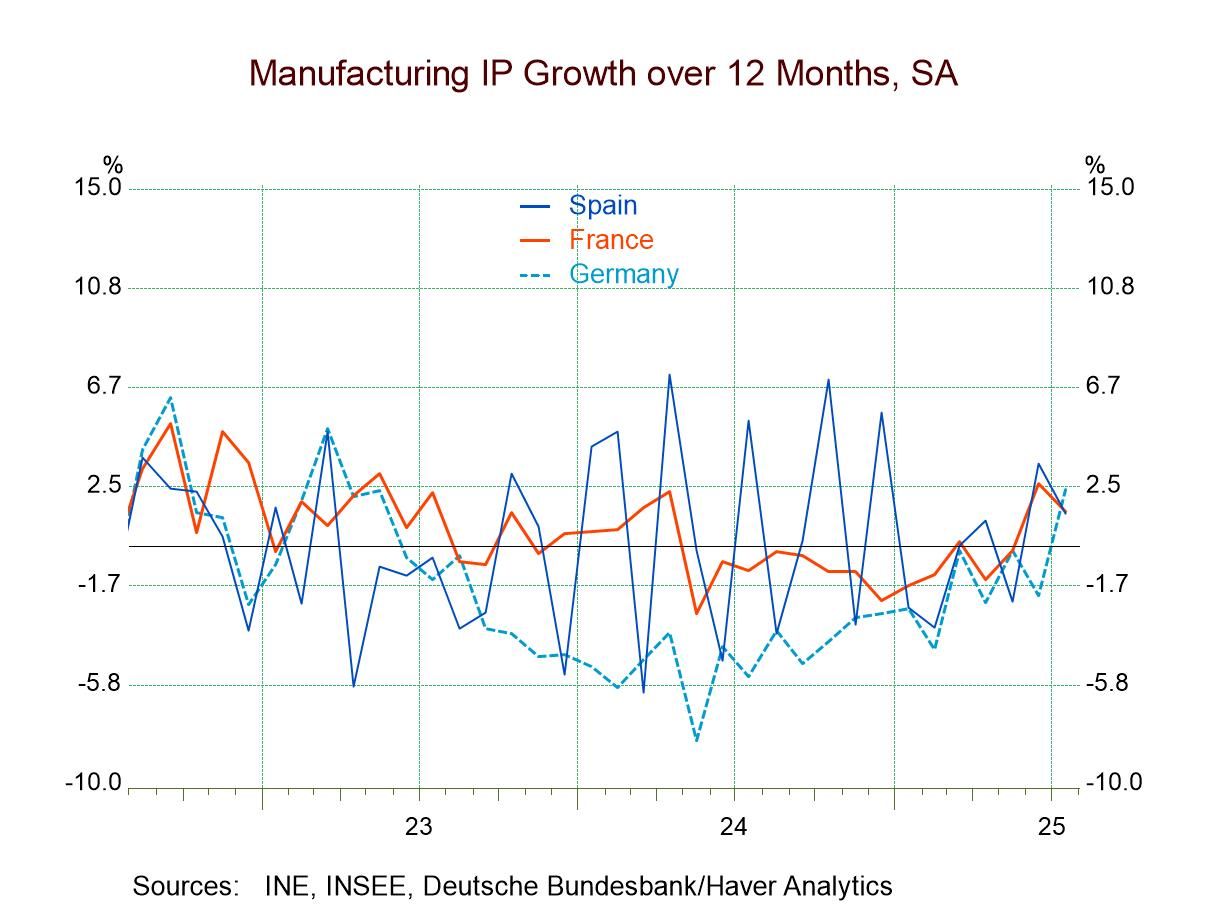

Industrial output in the European Monetary Union predominantly fell in July as 14 early reporting monetary union or economic union members demonstrated that 8 of them logged a decline in industrial production in July. Sticking to only monetary union members there were declines in eight of the 12 reporting countries – a poor month for EMU members.

For the full group of 14, the median change was a decline of 1% in July after logging a median increase of 0.2% in June and a median decline of 0.7% in May. Sequential results show a median increase over 12 months of 1.4% for this full group, a median increase of 4.5% using annual rate data over six months, followed by a 3-month annual rate median decline of 1.4%.

Over three months among the 14 reporting countries, 8 show increases; however, 6 show declines and the declines that are logged are all large, starting with the decline of 21% at an annual rate in Luxembourg, 13.4% in Finland, a decline of 10.8% in Portugal, a decline of 8.3% in Malta, a decline of 4.9% in the Netherlands, and a decline of 4.3% in Ireland. The countries with declines over three months are experiencing very significant and sharp declines.

Looking at the full slate of countries over three months, only 33.3% are showing output accelerations. That compares to 6-months when only 30.8% show output accelerations; however, over 12 months compared to 12-months ago, two-thirds show output acceleration. Acceleration is fairly broad-based when compared to a year ago, but over shorter horizons there's clearly more of a slowing in progress and less uniformity.

This is early in the third quarter; industrial production data show six countries already indicating quarter-to-date output declines in Q3.

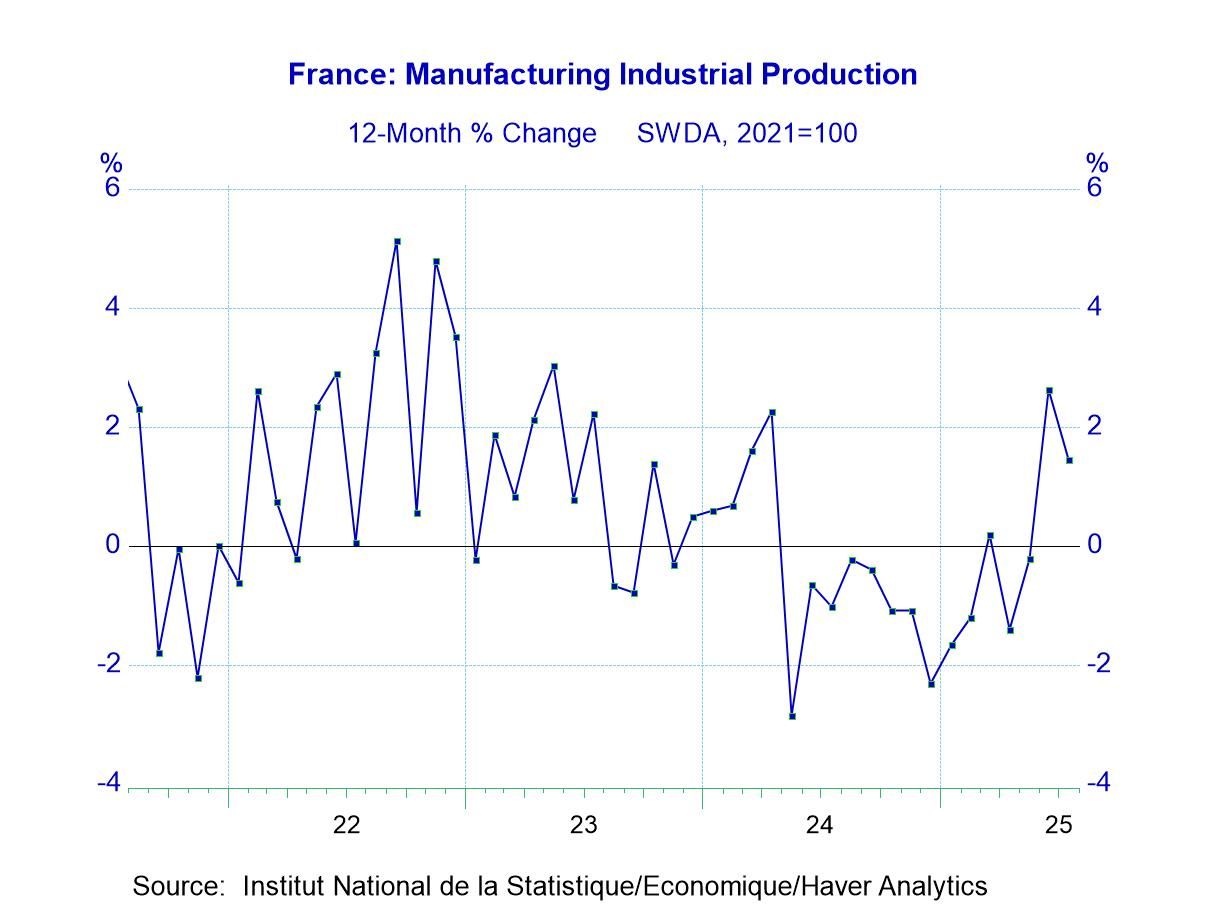

Interestingly, the queue rankings data executed on year-over-year growth rates have become much firmer and stronger. There are only 4 reporting countries in the table with year-over-year growth rates ranked below the 50th percentile: Finland, the Netherlands, Greece, and Luxembourg. The average of the median ranks is at the 64th percentile mark, a nearly top one-third standing. Germany, France and Italy have standings well into their respective 60th percentiles– for Germany, in the 70th percentile. IP growth in manufacturing is scoring out at a more resilient performance level despite the drift into recently weaker growth rates. This will be a trend worth watching.

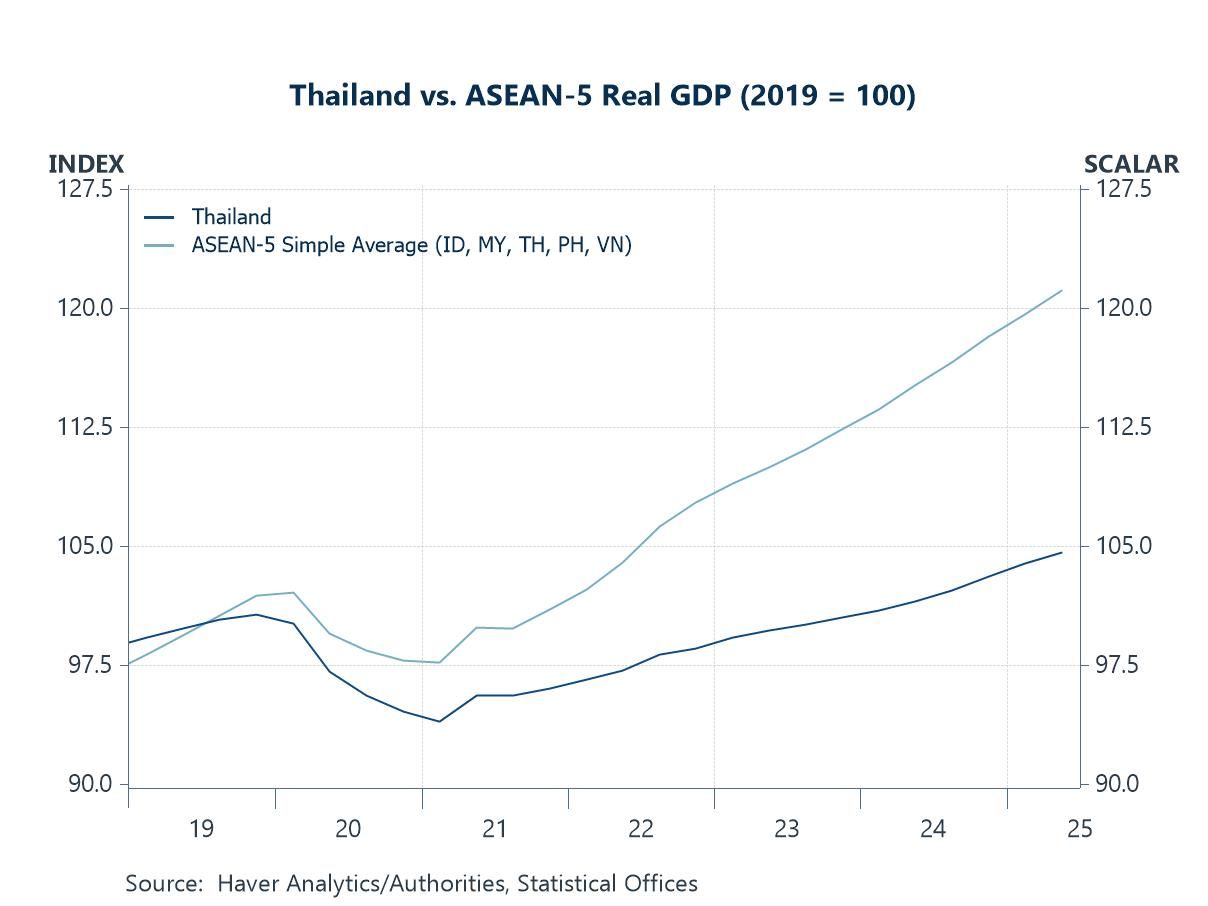

Asia

Asia