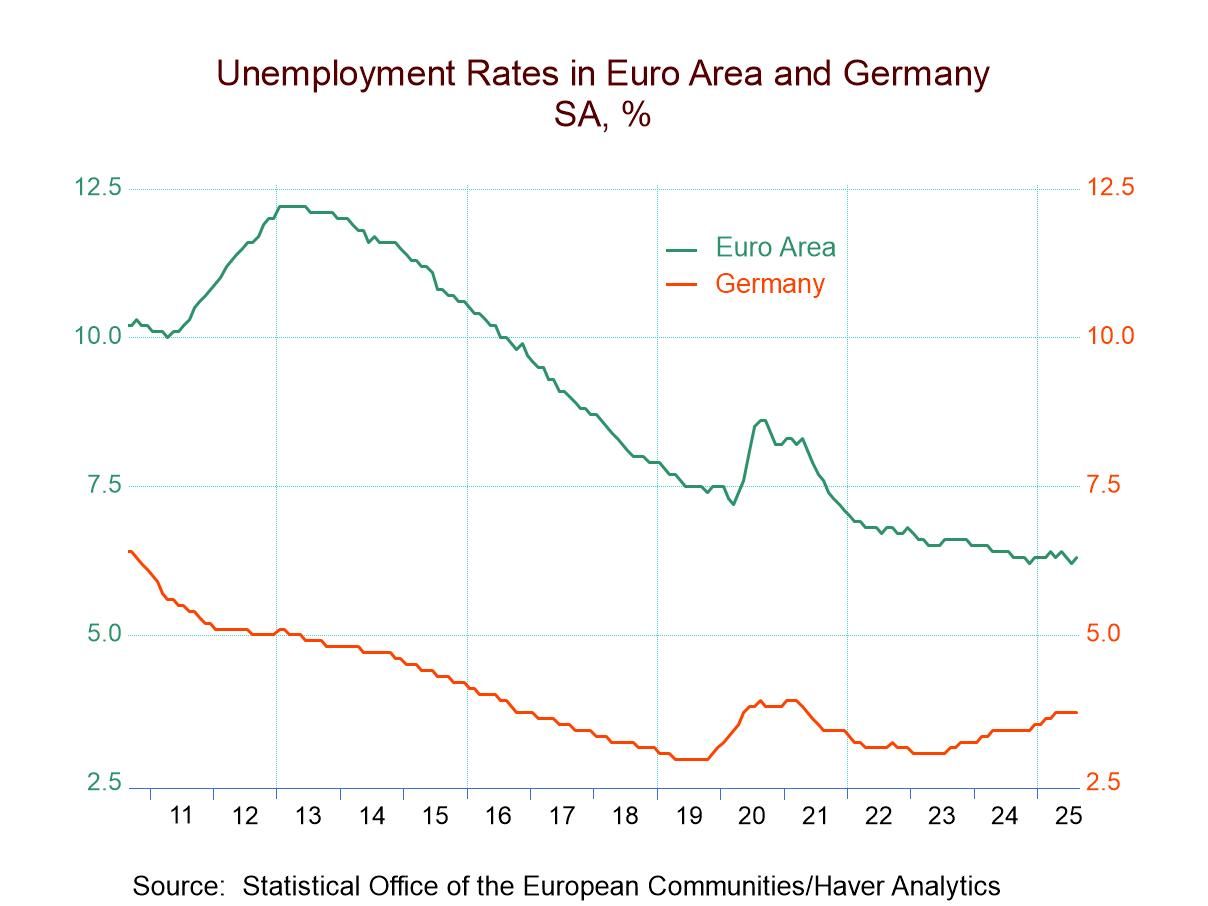

The unemployment rate in the European Monetary Union (EMU) ticked up to 6.3% in August from 6.2% in July, rising one tenth of one percentage point from its all-time low. Even though this is an increase in the unemployment rate, it's a very small increase and it's an unemployment rate that is extremely low for the EMU. The unemployment rate is based on the 20 economies that report unemployment. However, the table reports 12-early reporters and long-standing EMU members that show that the unemployment rate increased in only five countries in August: Austria, Finland, Italy, Portugal, and the Netherlands. All the other countries listed in the table say their unemployment rates were either steady or lower on the month. In July, the unemployment rate rose month-to-month in only one country, which was Ireland where it went up to 4.8% from 4.6%. In June, the unemployment rate rose in only three countries: Austria, Finland, and Greece. Of course, the table is only a sample of countries; there are 20 countries that typically contribute data to the European Monetary Union aggregate. The full slate of data is represented in the EMU total as reported.

Sequential data that look at changes in unemployment rates over three months, six months and 12 months, show that among these 12 member countries over 3 months only four had unemployment rates increasing; over 6 months five countries had unemployment rates increasing; over 12 months seven countries have their unemployment rates higher.

When we take the reported unemployment rates as of August and put them in a queue of data back to the year 2000, there are only three countries in the monetary union that have unemployment rates that are above their median for that period. And those are Austria, Luxembourg, and Finland. All the rest of the countries have unemployment rates that rank below their 50th percentile which places them below their respective medians for that period.

In fact, apart from the three countries that have their unemployment rates above their respective medians, the rest (the remaining nine) rank in their bottom 25th percentiles. All of the highest-ranking unemployment rates among those nine are Ireland at the 23rd percentile, and Germany and Portugal at the 22nd percentile. Italy, for example, still has an unemployment rate that ranks at its 0.7 percentile. Greece's unemployment rate, even though it's 8.1%, has been lower only 3.3% of the time. The unemployment rate for the entire monetary union has been lower only 3.2% of the time. If we look at the broader unemployment rate for the European Union, it has been lower only 2.6% of the time.

Global

Global