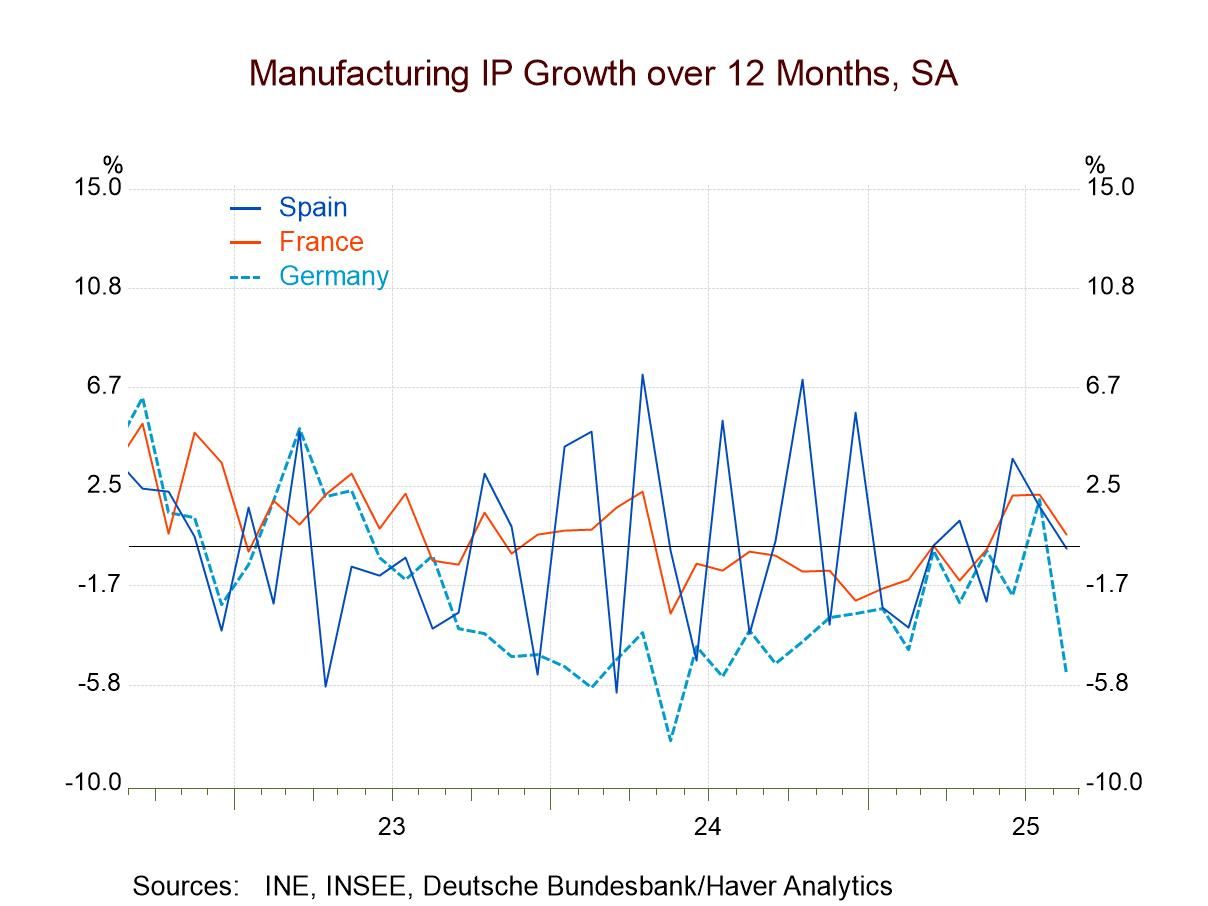

Manufacturing trends in the European Monetary System in August were mixed. Among the 13 countries reporting early industrial production data, six reported output declines.

Looking at the three most recent months of data, June, July, and August, there are four countries that are showing growing weakness month-to-month for each of those three months. Those are Austria, Belgium, France, and Greece. Only two countries are showing steady acceleration over the span; those are Ireland and Portugal.

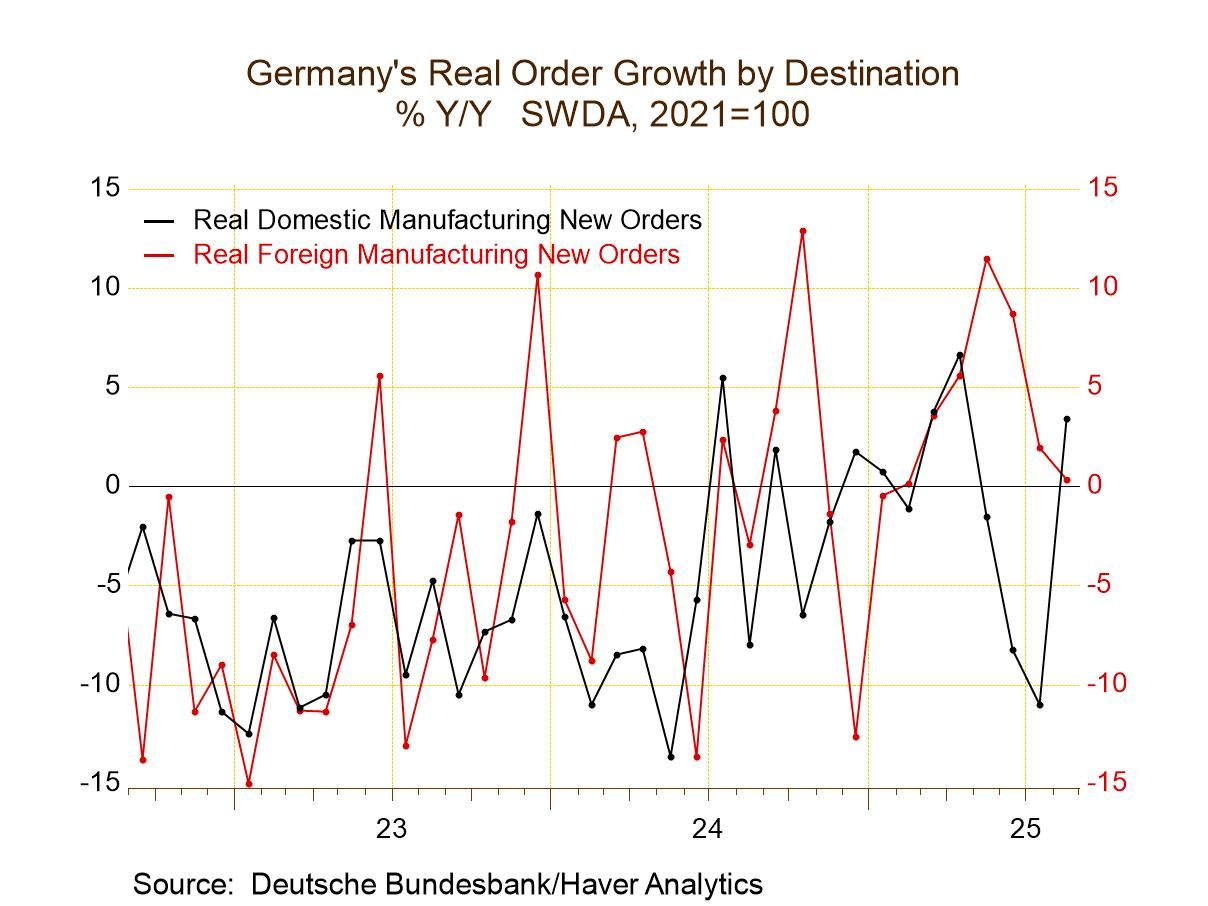

Looking at sequential data, growth over 12 months, six months and three months, progressive weakening is seen in four countries Germany, Spain, Ireland, and Portugal that compares to acceleration in Belgium, France, and the Netherlands. In terms of Monetary Union nonmember countries, Sweden is showing persistent acceleration while Norway is showing persistent but very moderate deceleration.

These data are rife with contradictions as no accelerating/decelerating trend sequentially persists over the next three months in the same direction. The European Monetary Union is clearly in a period of transition in terms of growth and conditions have been weak and are not yet breaking out to the upside. What this tells us is that a period of acceleration has not yet stepped up and weakness, even deceleration has lingered. Quarter-to-date data show us that there are output declines in most of these economies with only five EMU Members showing output growing in the quarter-to-date period.

This continues to be part of an extended period in which industrial output has been extremely weak: we can support that with the numbers. Looking at these 13 members, we assess the ratio of industrial production today compared to where it was in January of 2020 before COVID struck and before the Russian invasion of Ukraine. This comparison goes back 5 1/2 years; Germany, France, Italy, Spain, Luxembourg, and Portugal all have levels of output today in terms of manufacturing output that are lower than they were in January 2020. This is a very long period to go without having output recover to its level in January 2020.

Separately the table ranks countries on growth rates, This ranking is a ranking of output growth on 12-months rates over data since 2007. On that basis, seven of the countries in the table have year-over-year growth rates below the median growth that they had during this period back to 2007. That's slightly over half of the monetary union countries in the table that are reporting growth rates below their median for this extended period of 20 years, much of it delivering very weak growth.

Hope springs eternal, for a manufacturing rebound. Central banks right now are trying to run relatively accommodative policies and are tolerating some inflation overshooting to do that; however, it doesn't appear to have been enough to excite any acceleration in manufacturing output. Europe continues to be challenged in terms of manufacturing growth. There is really nothing in these data that make us optimistic that conditions are getting better.

Global

Global