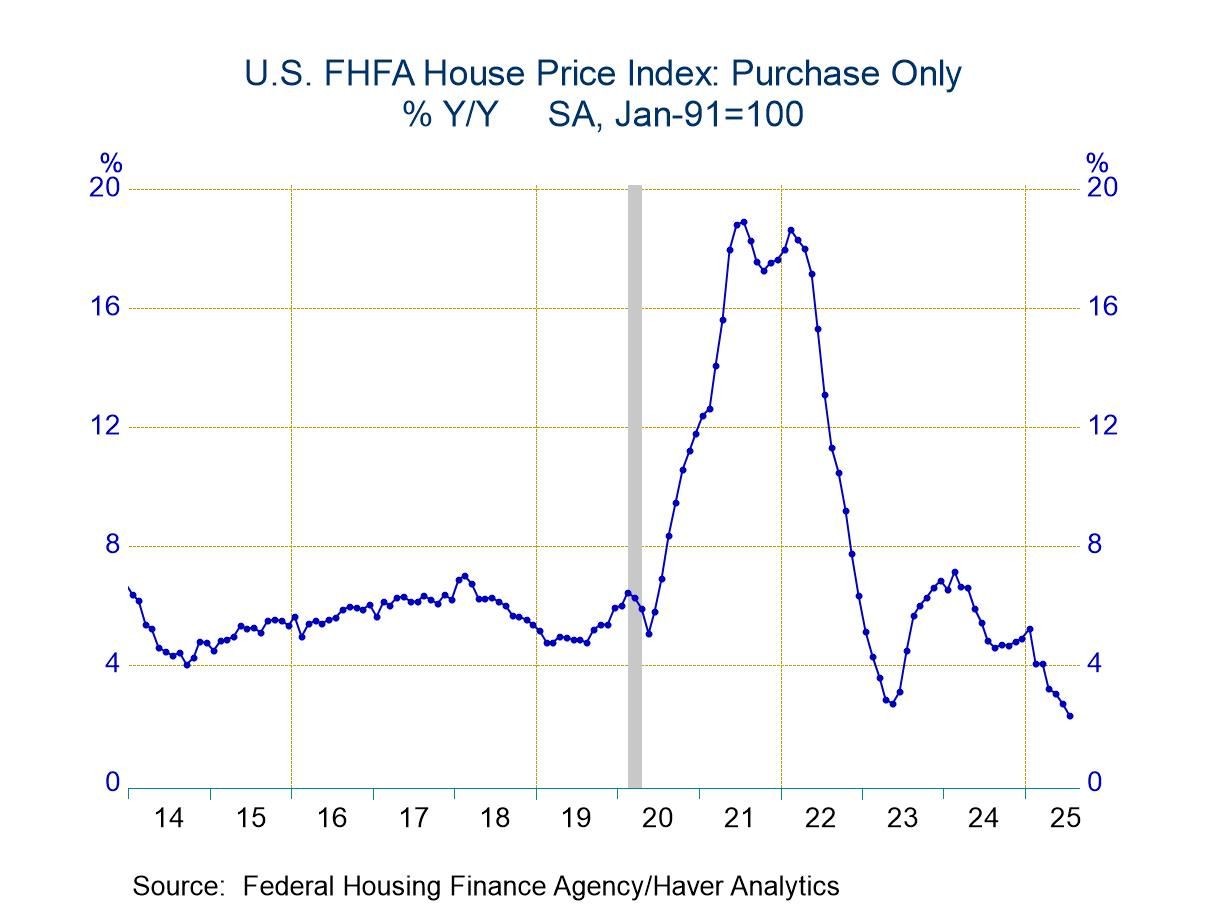

- Prices edge lower for fourth straight month.

- Year-to-year increase is lowest since 2012.

- Monthly price changes are uneven amongst regions.

- USA| Sep 30 2025

U.S. FHFA House Prices Ease in July

by:Tom Moeller

|in:Economy in Brief

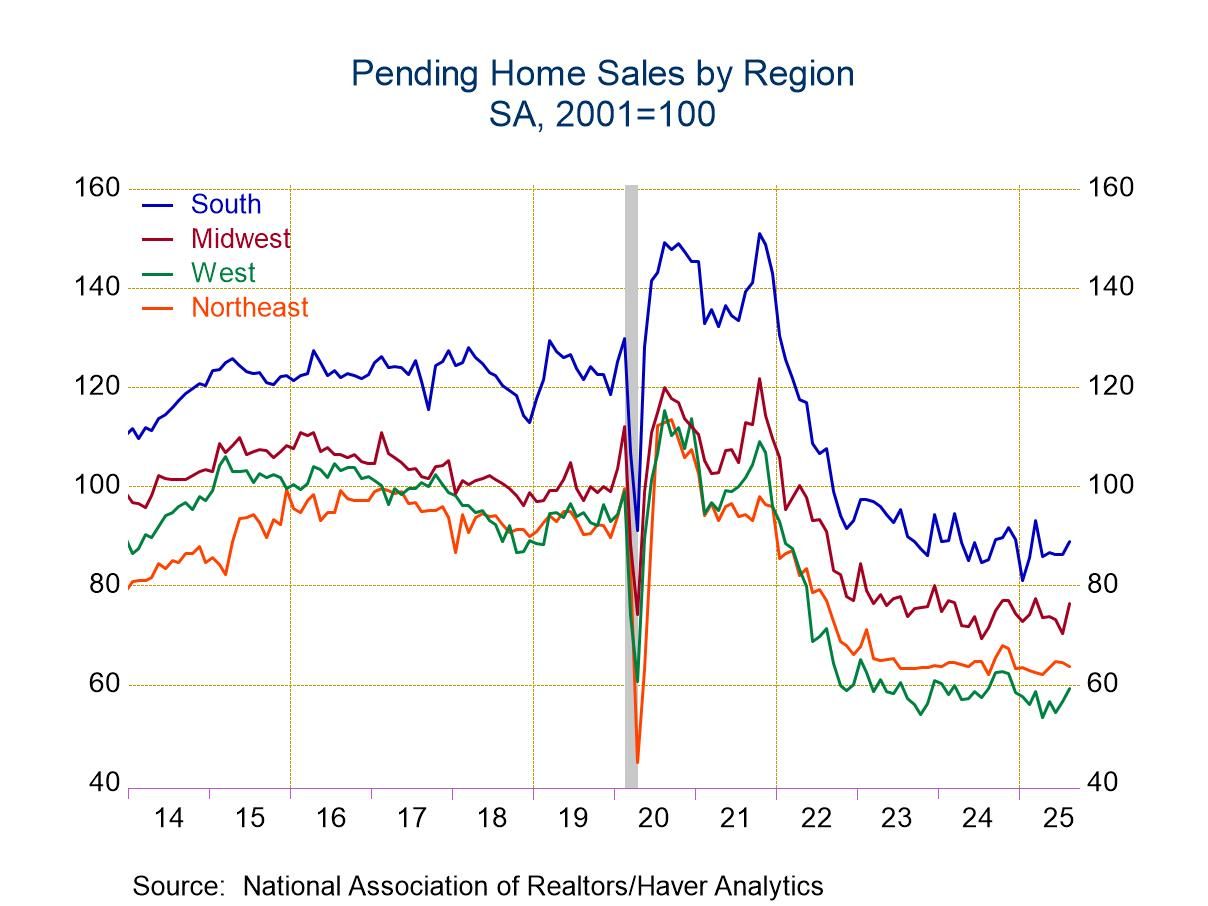

- Sales rise to highest level since March.

- Increase follows declines in three of prior four months.

- Regional changes are mixed.

by:Tom Moeller

|in:Economy in Brief

- USA| Sep 29 2025

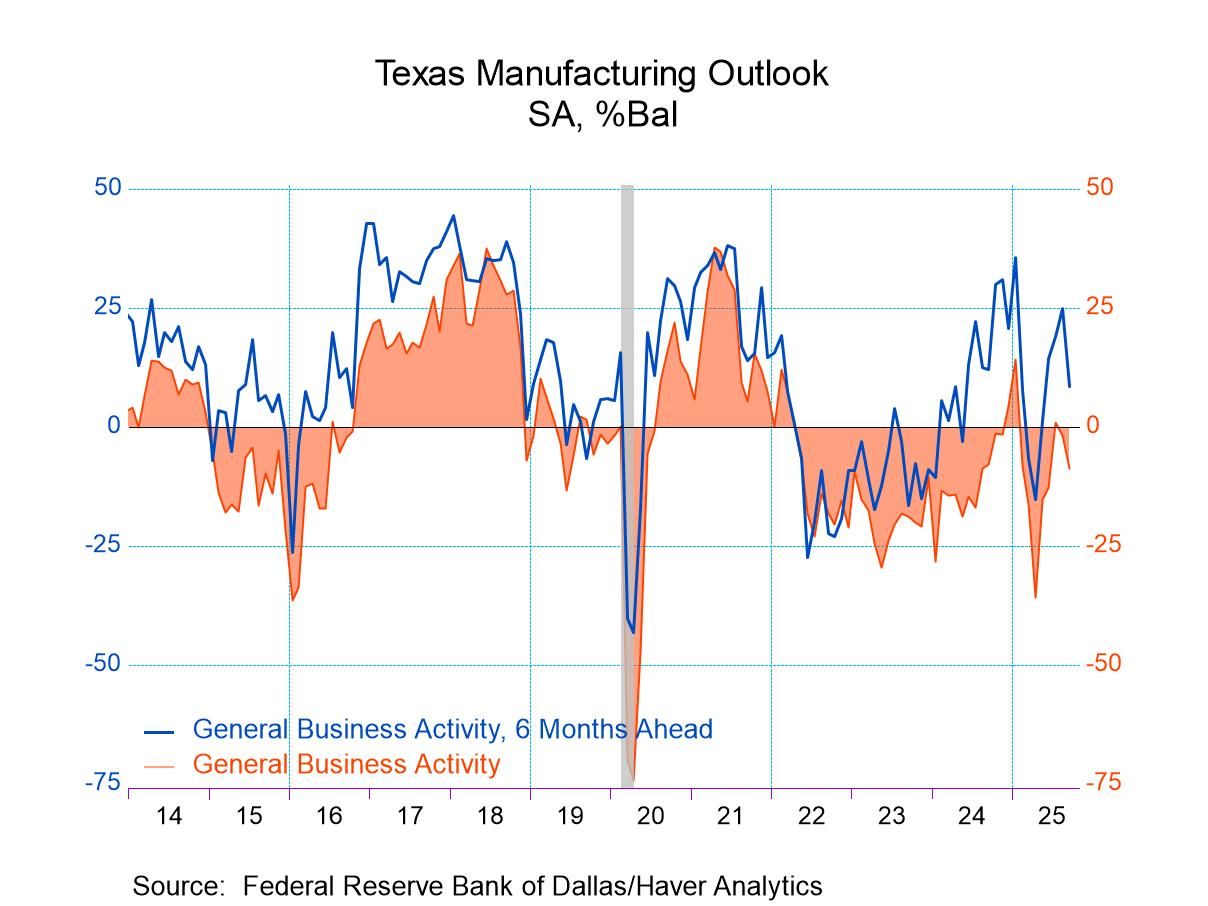

Texas Manufacturing Activity Index Turns Negative & Expectations Weaken in September

- Current Conditions Survey is negative for seventh month in last eight.

- Production, new orders, shipments & employment weaken.

- Prices ease but wages & benefits improve.

by:Tom Moeller

|in:Economy in Brief

- Europe| Sep 29 2025

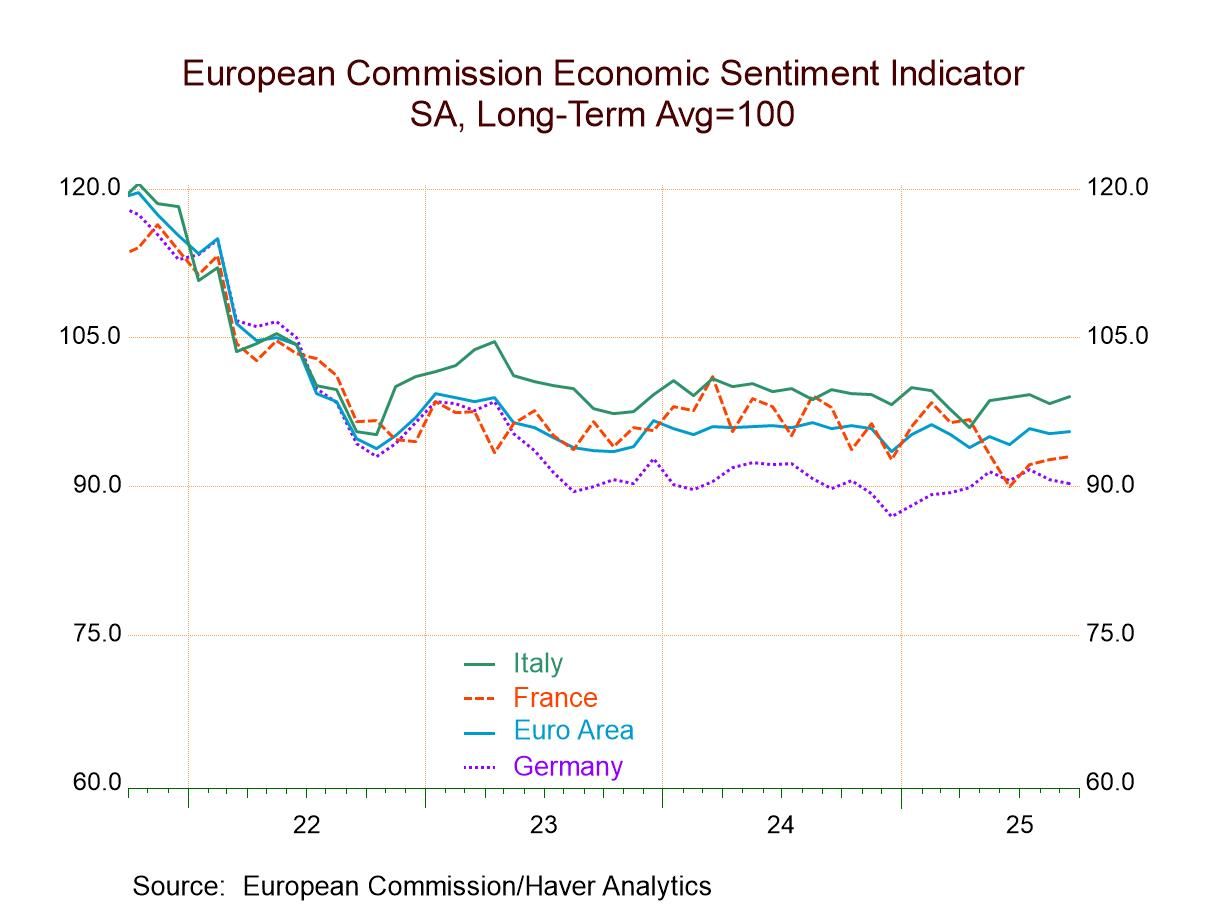

EU Indexes Firm Slightly on the Month for EMU

The European Monetary Union indexes for September showed slight uptick to 95.5 from 95.3 in August. However, at 95.5 the September reading was still below the July reading of 95.8, but it was above the June reading of 94.2. EU sentiment indexes have been moving sideways since the end of 2022 without much trend.

All the components except for construction rank and roughly their respective 20th to 30th percentiles of their historic queues of data. The exception is construction, where the sector has a 74.6 percentile standing and retailing with a nearly 46-percentile standing, leaving it marginally below its median. However, the industrial sector ranking is at its 26-percentile, services rank at their 27th percentile and consumer confidence is at its 20th percentile. On the whole that’s a collection of quite weak readings: one firm, one marginal and three weak.

Compared to January 2020 before COVID struck, all the sectors and the aggregate index are lower by about 8 to 10 points over the five-and-one-half-year period. The exception is the industrial sector, which is lower by only five points.

National sentiment monthly showed eight declines in September, compared to seven declines in August and only five month-to-month declines in July.

The sector rankings for large country industrial sentiment shows they're all ranking below 50% except for Spain. Spain also has the only above 50-percentiel standing for consumer confidence at a strong 96.5 percentile. Retailing has two of the large economies ranking above 50%: Italy and Spain. No service sector readings for the large economies are even close to neutral. Construction, however, ranks above the 50% mark in three of four large economics and in France, where it falls short and has a ranking that is still at its 45th percentile. Weakness is broadly shared across EMU sectors for the large and small alike.

The services sector weakness in the EMU is quite important because it's a job producing sector. It’s no coincidence that consumer confidence and services in the EMU have the lowest standings. The outlook for the monetary union is going to depend a lot on how the forces of inflation develop as well as how the war in Ukraine develops. In the meantime, U.S. budget politics could rile markets, and we are told that China is trying to dazzle the Trump Administration with a trade deal if it backs off support of Taiwan independence. Both of these are potentially global market moving events that are in flux.

Asia| Sep 29 2025

Asia| Sep 29 2025Economic Letter from Asia: Tariff Medicine

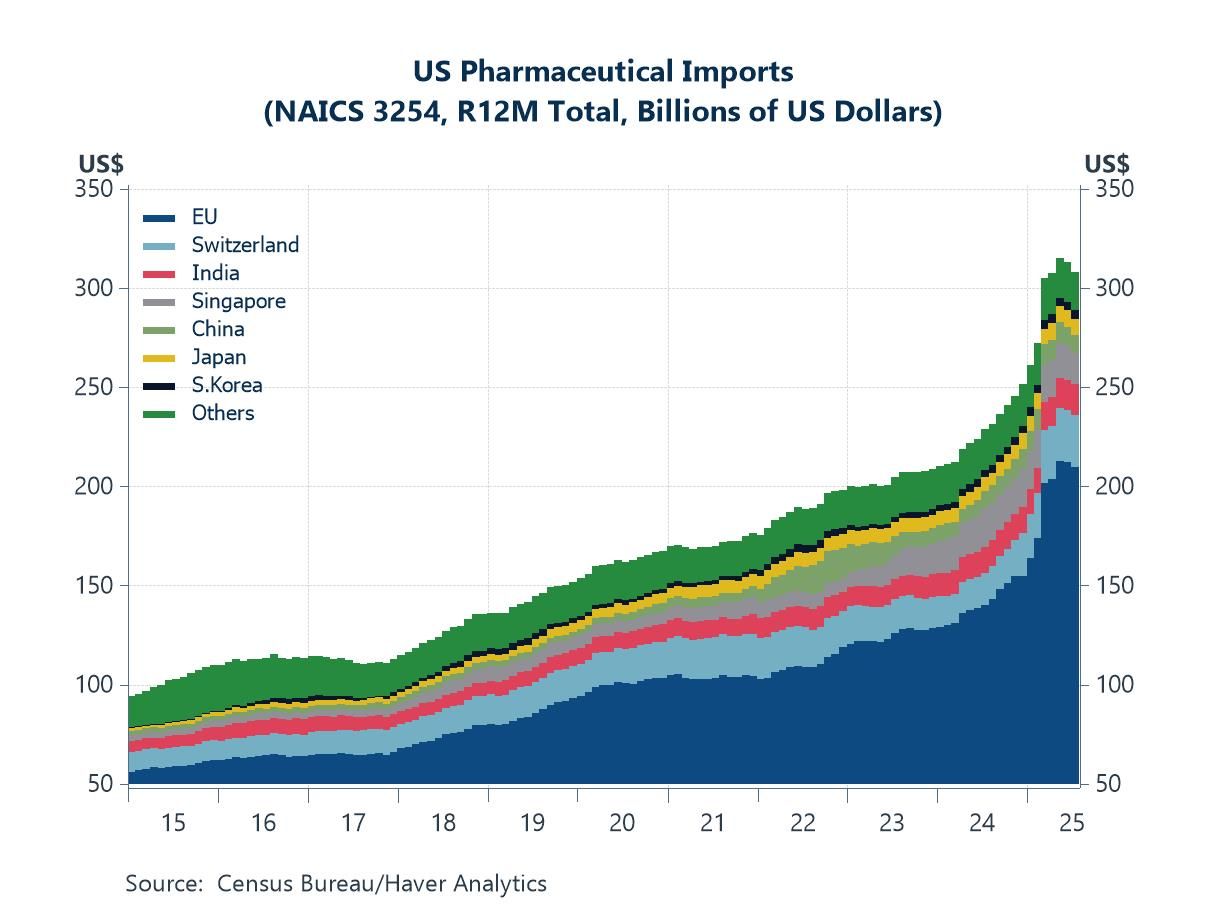

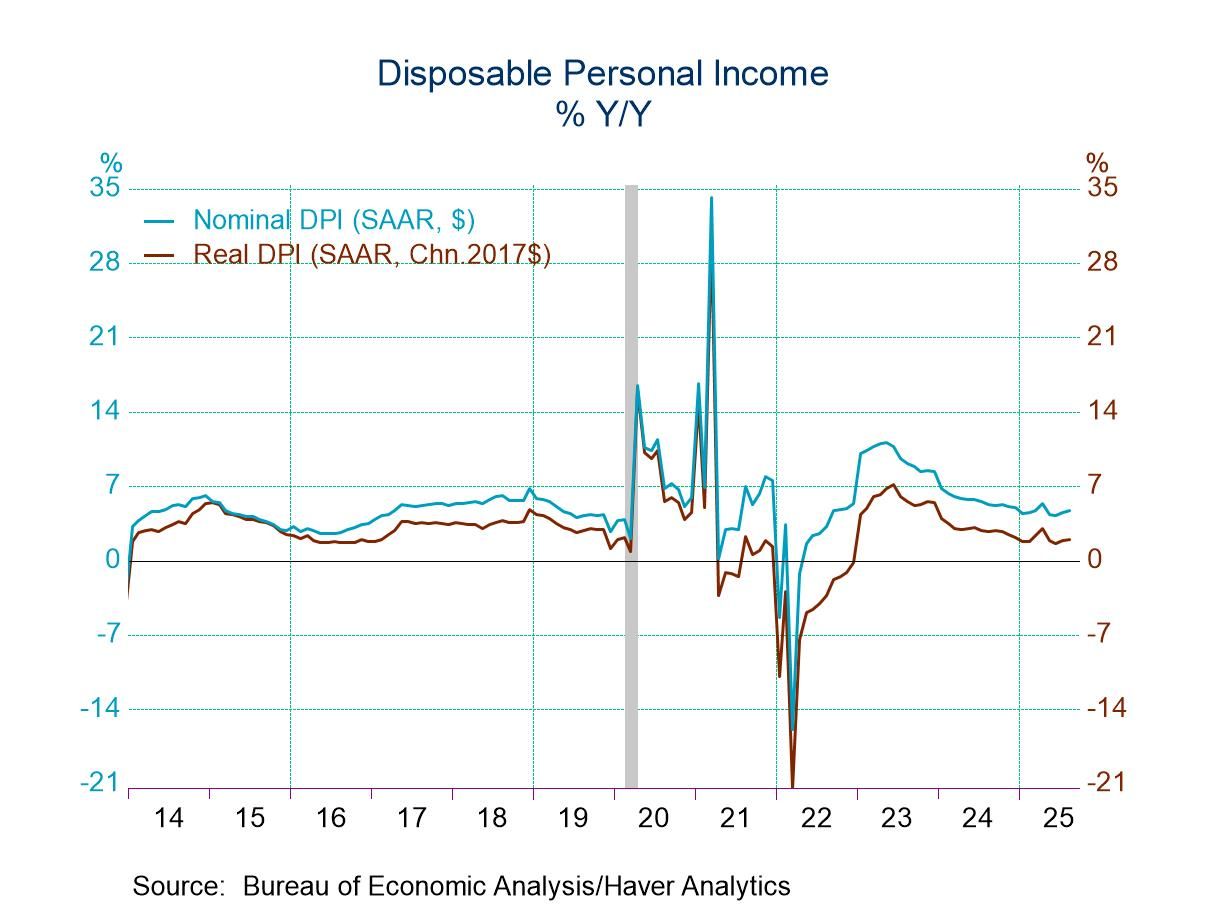

This week, we examine the recent flurry of global trade developments and their potential impact on Asia. The previous multi-week tariff calm proved short-lived after US President Trump announced 100% tariffs on branded and patented pharmaceutical products last week. A point of relief lies in the exemption of economies such as the EU and Japan, owing to prior agreements on lower sectoral rates. On the flip side, other major exporters to the US, including India and Singapore, now face increased uncertainty (chart 1). Adding to the pressure, Trump also introduced a $100,000 fee on new H-1B visa applications, disproportionately affecting Indian nationals and workers in IT-related sectors, though visa issuance had already been declining in recent months, partly due to seasonality (chart 2).

In India, the central bank meets this week and is likely to pause again on rate cuts, as concerns over rupee weakness (chart 3) take precedence despite lingering growth risks from US tariffs and other headwinds. In China, the government announced it will no longer seek Special and Differential Treatment (SDT) in future WTO negotiations—a significant policy shift. The move comes amid slowing trade growth (chart 4) and ongoing efforts to pivot toward a consumption-led economy. Japan has experienced moderate currency weakness (chart 5) as investors reassess central bank policy ahead of the ruling party’s leadership vote on October 4th. Australia also faces a monetary policy decision this week, with markets expecting a rate hold amid rising price pressures (chart 6) and signs of economic stabilization.

US pharmaceutical tariffs Last week, US President Trump announced new sectoral tariffs, imposing 100% duties on imports of brand-name or patented pharmaceuticals, effective October 1. This marks the first major tariff action in weeks, ending a brief lull in trade tensions. A key point of relief is that prior agreements with certain US trading partners, including the EU and Japan, provide exemptions, meaning the new steep tariff rate will not apply to them. In contrast, countries without such provisions will face the full 100% duty, which is likely to weigh on their growth through reduced export revenues. This includes major exporters to the US such as Switzerland and, in Asia, India and Singapore, among others (see chart 1). It should be noted, however, that the data shown below do not distinguish between generic and branded or patented pharmaceutical products. Additional points of possible relief include the fact that most of India’s pharmaceutical exports are generics, and that many exporters from Singapore already have plans to expand manufacturing capacity in the US.

- Personal income increased 0.4% m/m but compensation slowed.

- Real PCE increased 0.3% m/m in August on top of a 0.4% m/m increase in July.

- July/August real PCE up 2.8% annualized from Q2 average, providing a solid base for Q3 GDP growth.

- Headline PCE inflation edged up further to the fastest y/y pace since February.

by:Sandy Batten

|in:Economy in Brief

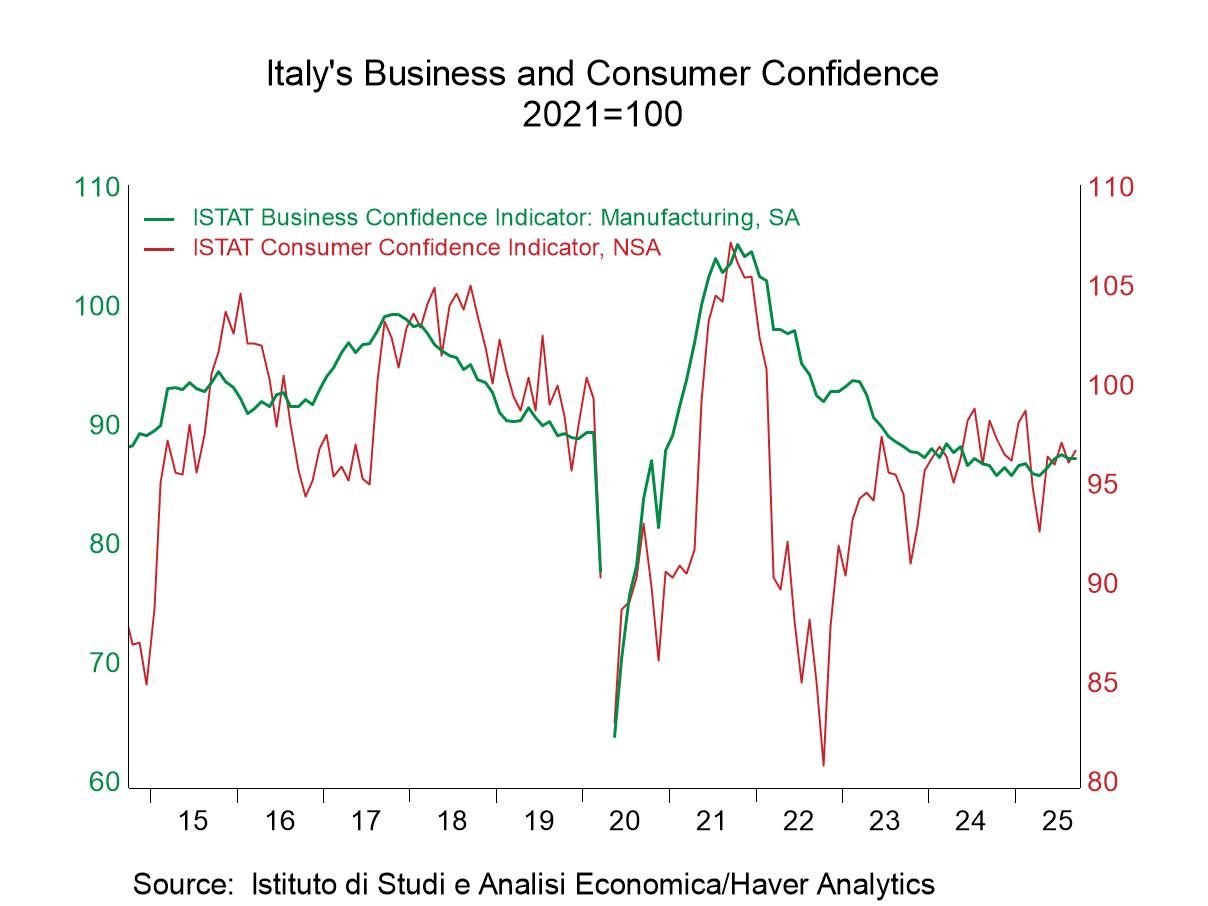

- Italy| Sep 26 2025

Italy’s Confidence Creeps Higher

The chart shows that within the big picture Italian confidence both business and consumer confidence has been relatively steady in recent months for about a year. The consumer reading has had some volatility but no trend. Technically in the current month business confidence is unchanged, and consumer confidence has moved up a couple of tenths of a point on the index of consumer confidence. The index is higher by 0.7% over three months and lower by 1.5% over 12 months. When ranked on data back to late-1997, the current index ranks in a 68.7 percentile of its queue of data, placing it in the top one-third of confidence values over that period. It’s a reasonably firm reading and a high reading by most standards among European countries at this time.

Assessments of the overall situation over the last 12 months improved to net survey reading of -62 in September from -67 in August. That reading has a 63.6 percentile standing.

Assessing the overall situation for the next 12 months ahead, there's another improvement to -20 in September from -24 in August; however, this is a much weaker reading, residing in a 10.7 percentile of its historic queue of data. So, while the overall situation has been relatively firm and the overall confidence reading is firm, the outlook for the next 12 months has some ominous undercurrents to it. Unemployment expectations have increased slightly to a -3 reading from -4. That index in September has a 27.5 percentile standing, a relatively low standing overall but still a little high to be really comfortable from a consumer confidence standpoint. Household budget assessments improved slightly to +24 from +23, which has a very strong standing in its 88th percentile.

The household financial situation, looking ahead, improves slightly; over the last 12 months it deteriorated slightly. The backward-looking measure has a 67.8 percentile standard while the forward-looking measure has a 12.2 percentile standard, once again, raising those concerns about what the future is going to hold.

The current assessment for household savings slipped slightly to a reading of 49 in September from 52 in August; the future reading is steady at -6 in September. The current reading has a 34.9 percentile standing; the future reading has the 97-percentile standing. This higher reading for the future is not necessarily good news as responses to savings are typically correlated negatively with responses about intentions to spend and are often associated with concerns about the future. However, the direct question about the environment for making major purchases showed a slight improvement to -29 in September from -30 in August and produced a standing in a 66.9 percentile, a top one third reading. For now, the consumer in Italy is still undaunted and holds relatively firm view of the environment for spending. The business environment assessment was unchanged month-to-month but overall has a much weaker standing.

The businesses assessment is only in the 24.5 percentile of its historic queue of data marking the responses as a bottom 25 percentile response which is not reassuring.

Global| Sep 25 2025

Global| Sep 25 2025Charts of the Week: Resilient Activity, Noisy Policy

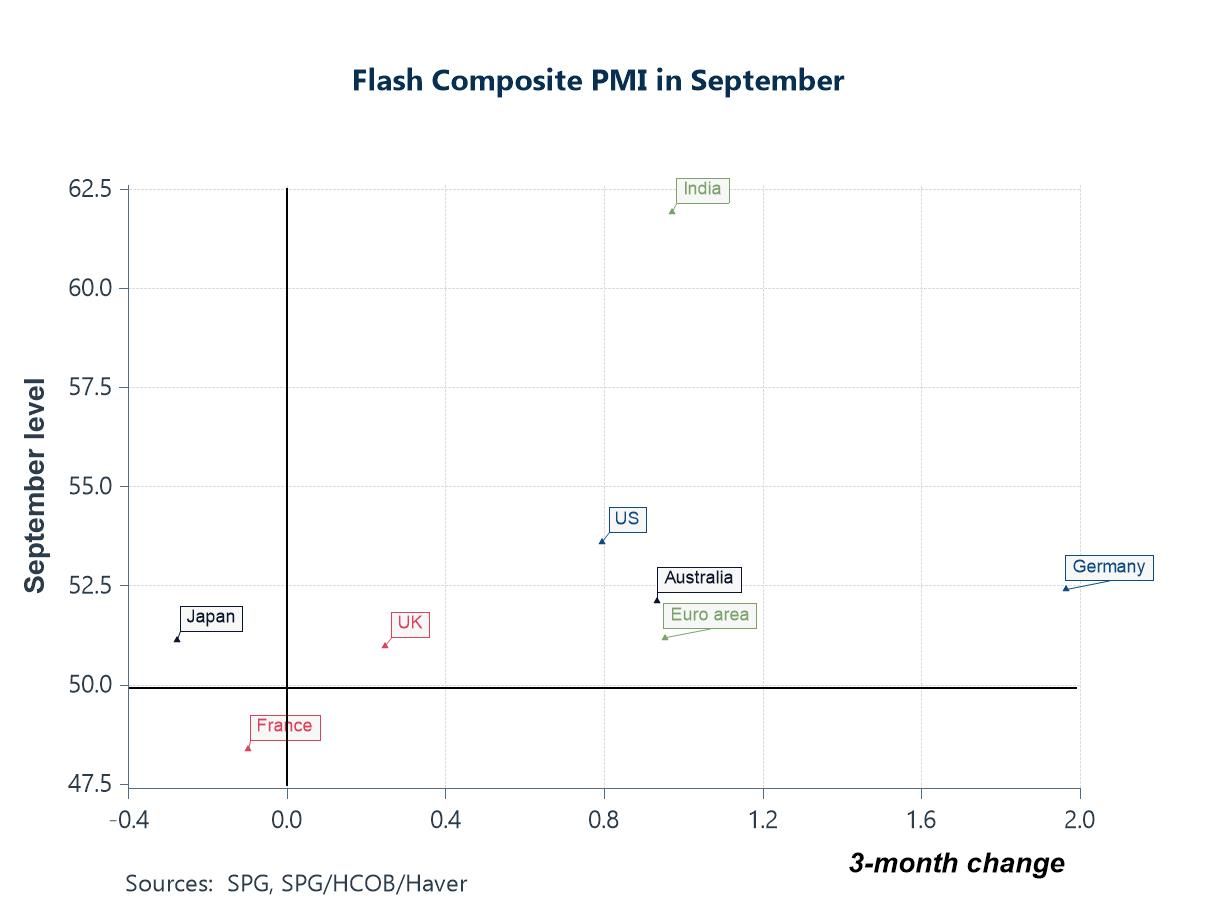

Global financial markets have remained steady over the past few days: equity volatility remains low, credit spreads remain contained and core yields have drifted rather than lurched, even as policy noise—especially around US trade—remains high. Against that backdrop, this week’s flash PMIs describe a resilient but uneven expansion: Germany has inched back into growth, while France has slipped further into contraction, a divergence echoed in bonds where the OAT–Bund spread has widened amid political and fiscal uncertainty (charts 1 and 2). Latest trade data from South Korea reinforce the idea of a tech-led floor under global activity, with semiconductor exports still advancing even as broader shipments remain choppy (chart 3). Labour demand indicators tell a similar story of moderation without fracture: high frequency data for job-postings have flattened in the US and UK and have turned up in Germany (chart 4). Stepping back, the latest US flow-of-funds report show a financing mix still anchored by heavy public borrowing absorbed by foreign investors but offset by a sizeable private-sector surplus—one reason perhaps for why the world economy has remained resilient despite persistent policy uncertainty (charts 5 and 6).

by:Andrew Cates

|in:Economy in Brief

- of2700Go to 37 page