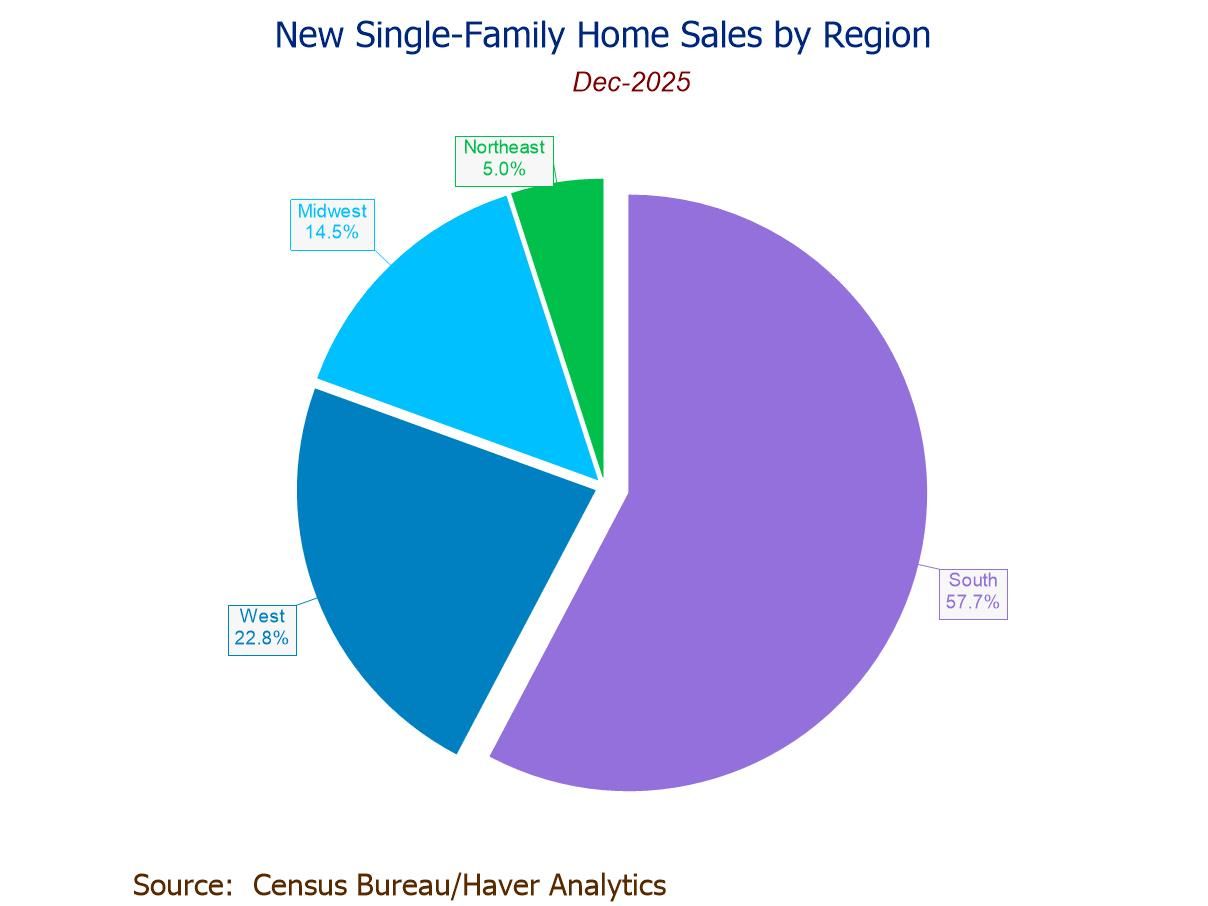

- December sales -1.7% m/m (+3.8% y/y) to 745,000; still 43.5% above the July ’22 low.

- Sales m/m down the Northeast (-37.3%) and South (-6.7%), but up in the Midwest (+31.7%) and West (+9.0%).

- Median sales price up to a three-month-high $414,400; avg. price up to $532,600, highest since July ’22.

- Months' supply eases to 7.6 mths., lowest since July ’23.

- USA| Feb 20 2026

U.S. New Home Sales Decline in December After November’s Jump

Global| Feb 20 2026

Global| Feb 20 2026S&P PMIs Are Mostly Stronger in February

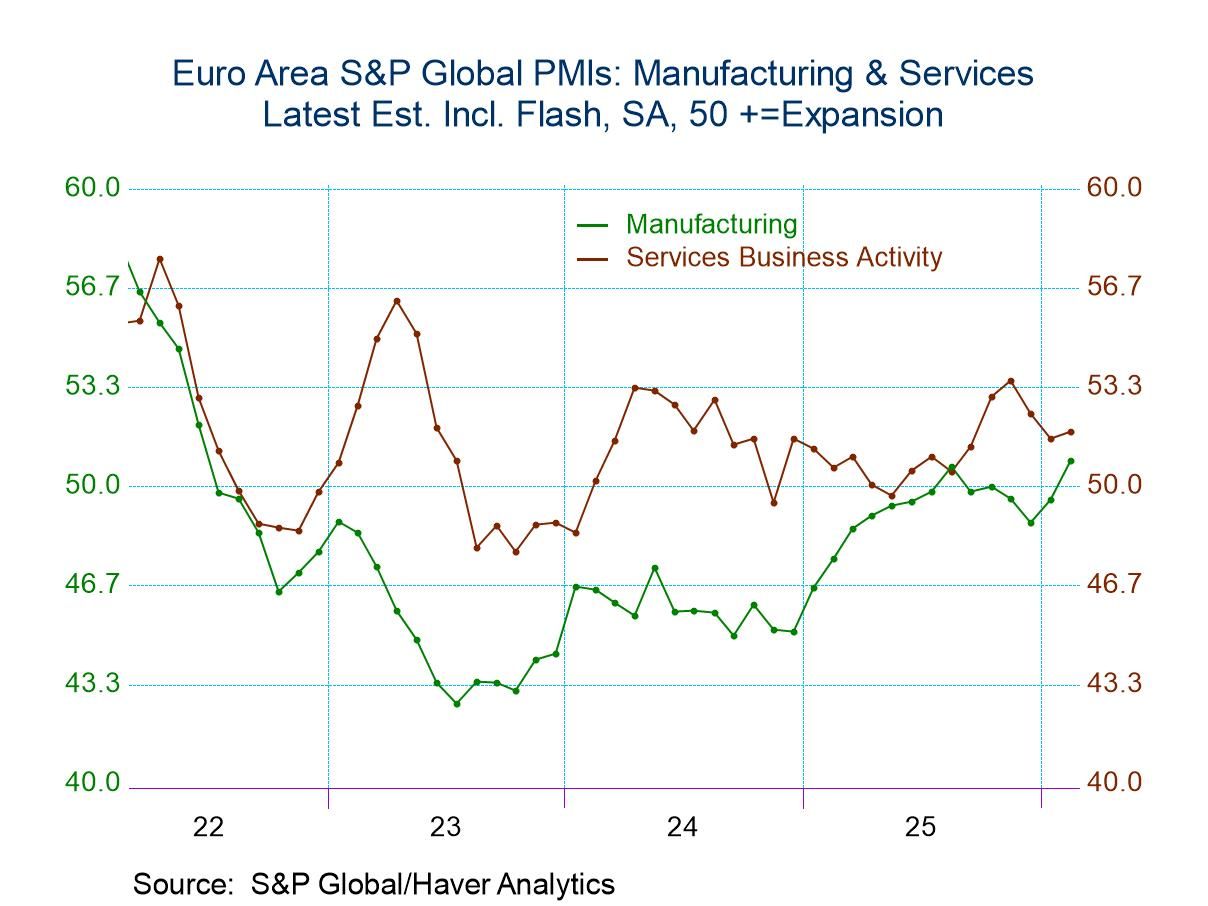

PMI data for February, issued by S&P on a flash basis, show relatively broad improvement PMI performance in February, with the exception of Australia, India, and the United States. The European Monetary Union shows improvement in its composite index as well as for manufacturing and services. This pushed to higher ratings, supported by Germany and France with the exception that French manufacturing took a step back in February. In the United Kingdom, the composite and manufacturing indexes moved ahead but services weakened. In Japan, the composite, manufacturing and services all improved on a month-to-month basis. However, Australia saw a step back in all three sectors after several months of continued strengthening. India also saw a step back in the composite and services after a recent string of improvements being reported. The United States shows uneven conditions, with a weakening across the board month-to-month in February vs. an across-the-board rebound in January, and then across-the-board weakening in December. This leaves the U.S. in a weakening and volatile situation

An unweighted average of the monthly composite, manufacturing, and services indexes shows a one-tick step back for the composite, a small step up for manufacturing, and a small step back in services for February compared to January. January had made across the board improvements relative to December.

Sequential comparisons where data are lagged by one month and the calculations are made only off of hard data (not off of flash or preliminary data) show mixed economic conditions and unclear trends. EMU shows sequential strengthening in the composite as do France and Japan; Japan also shows persistent strengthening in manufacturing, as the yen has been dropping. And while there is a lot of weakening sequentially, there is no persistent weakening reported for 12-months to 6-months to 3-months.

Over three months, there's a split in what is reported with 12 of the 24 sectors weakening compared to six months ago and 12 of them strengthening. Over six months, only six of the sectors are weakening; the remainder strengthening over 12 months; eight of the sectors are weakening over 12 months compared to a year ago, with the remainder strengthening. While it's not a clear path to deterioration, there is a clear tendency to deterioration over three months compared to six months. However, an unweighted comparison of the three sectors shows that composite manufacturing and services still demonstrate a bit of muddy water with the composites weakening over three months only by a tick to 52.9 compared to 53 while manufacturing improves slightly and services weakens slightly compared to six months. Over six months, there's only a slight step back from the statistics reported over 12 months.

Not a lot of shifting, but some good news and bad news The bottom line is there's not a whole lot of change going on according to the PMI data. On a breadth basis, there has been some improvement, but the magnitudes involved seem to wash out some of that improvement, neutralizing when expressing as average comparisons. However, one place where there does appear to be evidence of more solid performance is in the queue percentile standings. Among these 8 reporters involving 24 sectors, only four sectors report current standings below their median on data back to January 2022. One of those countries is India, with a weaker composite and services sector; the other is the United States, with a weaker composite and services sector. The U.S. composite has a queue percentile standing at its 42nd percentile, below its neutral position of 50%. The U.S. services sector is even weaker with a 36-percentile standing, close to the lower third of all the U.S. PMI values that have shown for services since 2022 on a monthly basis.

U.S. economy has been cranking out some reasonably strong economic numbers across the board including consumer spending and GDP figures, allowing for a disappointing fourth quarter that is being attributed to the government shutdown. However, what's been lacking on the U.S. side has been strong job market performance and, of course, because of mortgage rates being high, there has been a weak construction sector in the U.S. economy. Still, the queue standing across the board for other countries should be reassuring. The average composite ranking for this group of countries is in the 70th percentile, with manufacturing in the 75th percentile and services in their 61st percentile. These are relatively firm readings and should be reassuring. At the same time, central banks have made progress on inflation and tightening cycles have not been engaged or easing cycles are being extended for all central banks except for the Bank of Japan, which has been experiencing growth and inflation in different measures from the rest of the G7 countries. On balance, however, global growth appears to be moving forward and now we'll have to see what happens with the U.S. Supreme Court having overthrown the imposition of tariffs that the Trump administration put in place without Congressional backing. We could see some considerable shifting in the months ahead.

Global| Feb 19 2026

Global| Feb 19 2026Charts of the Week: AI, Policy Easing and a Shifting Risk Premium

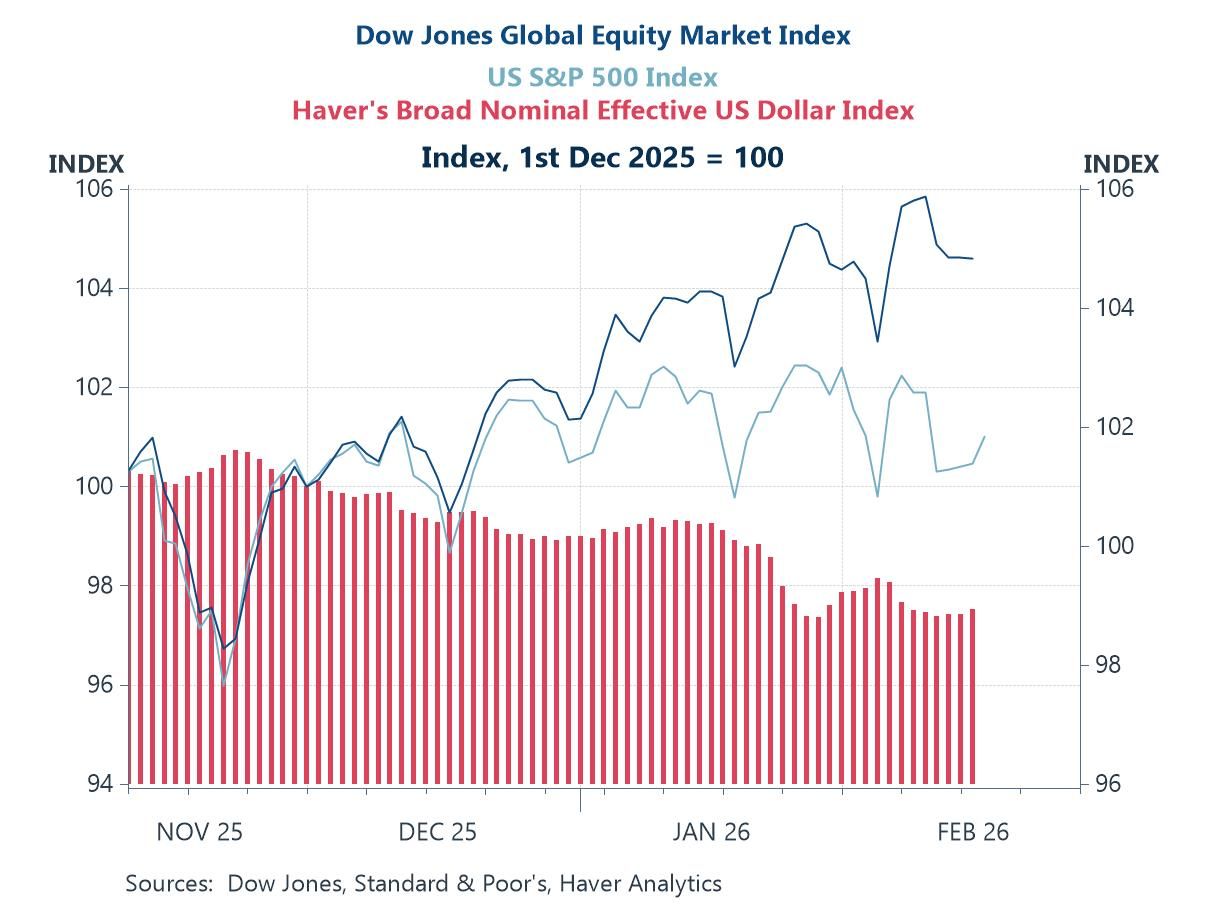

Recent weeks have seen renewed market swings — a softer US dollar, rotation within equities and shifting rate expectations — as investors reassess valuations, policy risks and the durability of US exceptionalism. Yet a consistent macro thread runs through our charts this week. Global equities continued to outperform the US, hinting at a modest rise in the US risk premium alongside AI-valuation concerns (chart 1). At the same time, firmer bank lending growth across major economies reflects looser monetary policy and arguably helps explain why risk assets remain broadly supported despite volatility (chart 2). On productivity, a US pickup is evident but likely reflects capital deepening from AI infrastructure rather than a decisive surge in total factor productivity (chart 3). Industrial production in advanced Asia reinforces where that build-out is concentrated — at the heart of the semiconductor supply chain (chart 4) — while strong US orders for computers and electronic products underline the intensity of domestic demand for high-tech and AI-related equipment (chart 5). Finally, renewed equity inflows into Emerging Asia show investors positioning around this AI-centric growth dynamic (chart 6). In short, easier policy and AI-driven investment are sustaining momentum — but the breadth and durability of the productivity dividend remain a key open question.

by:Andrew Cates

|in:Economy in Brief

- USA| Feb 19 2026

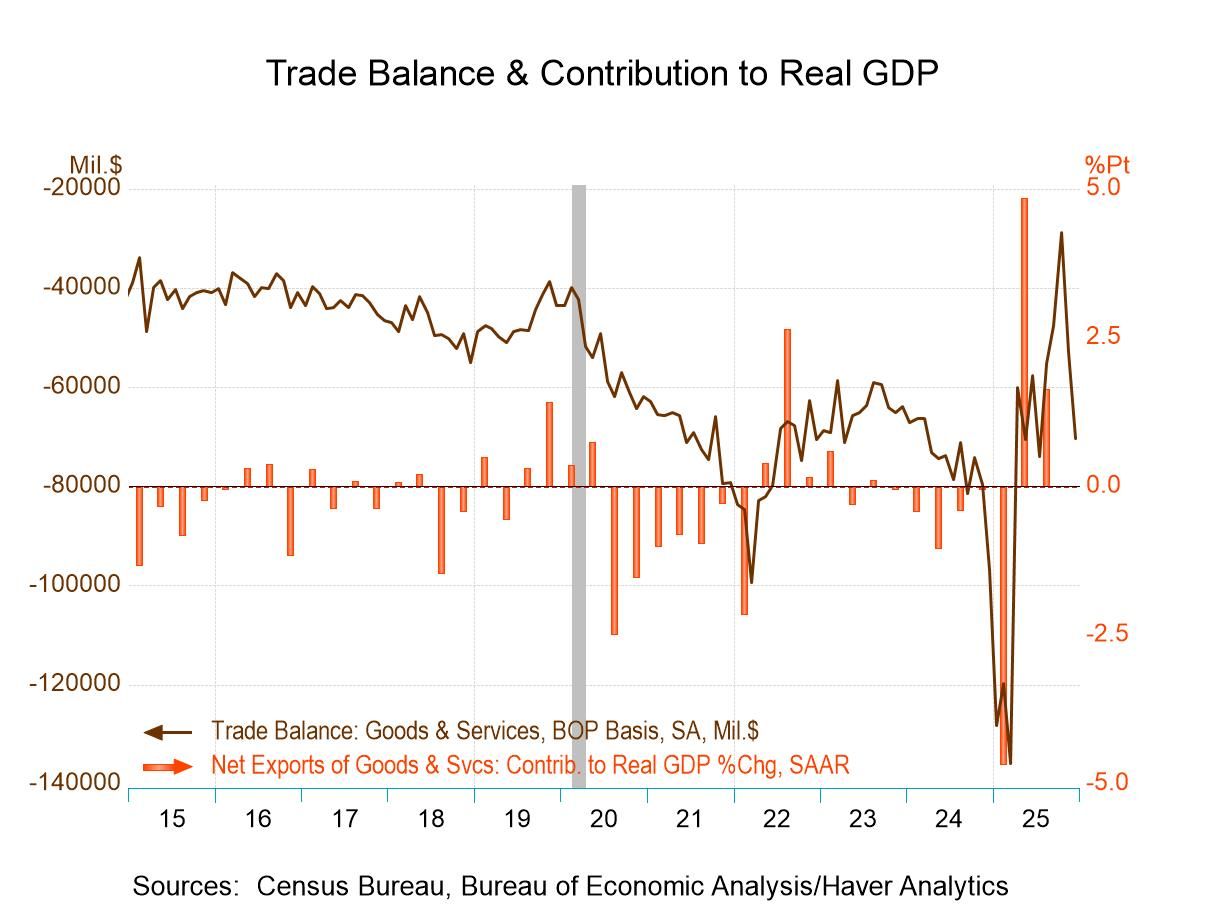

U.S. Trade Deficit Widened Much More Than Expected in December

- The overall deficit widened to $70.3 billion in December from $53.0 billion in November.

- The goods deficit widened markedly to $99.3 billion from $83.6 billion in November.

- The services surplus narrowed slightly to $29.0 billion from $30.6 billion in November.

- Exports fell 1.7% m/m on top of a 3.4% monthly decline in November while imports rose 3.6% m/m following a 4.2% gain in November.

- For all of Q4, the real goods trade balance narrowed, suggesting that trade contributed to overall GDP growth.

by:Sandy Batten

|in:Economy in Brief

- USA| Feb 19 2026

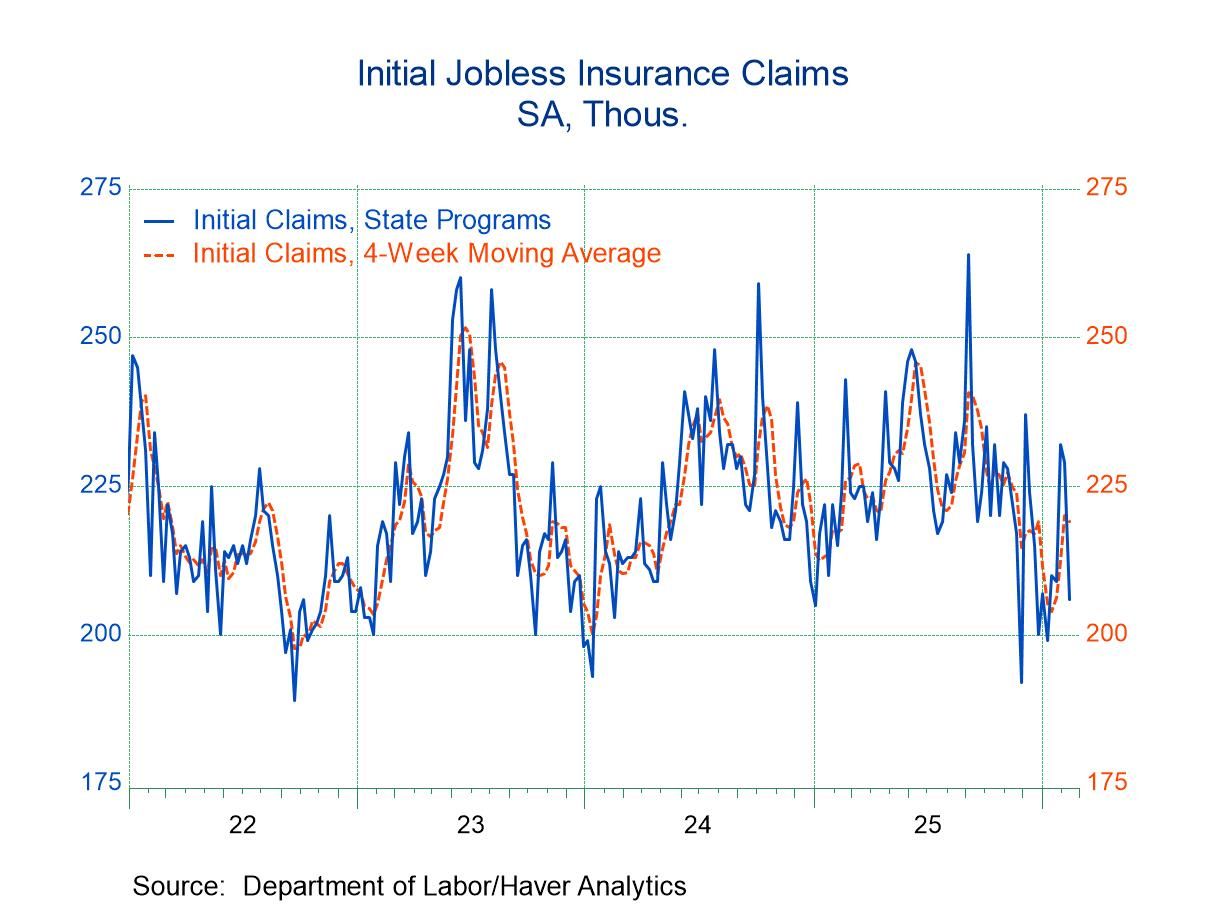

U.S. Initial Unemployment Claims Declined in Latest Week

- New claims dropped by 23,000 to 206,000.

- Continuing claims rose by 17,000 to 1.869 million.

- The insured unemployment rate remained at 1.2% for the 11th consecutive week.

- Belgium| Feb 19 2026

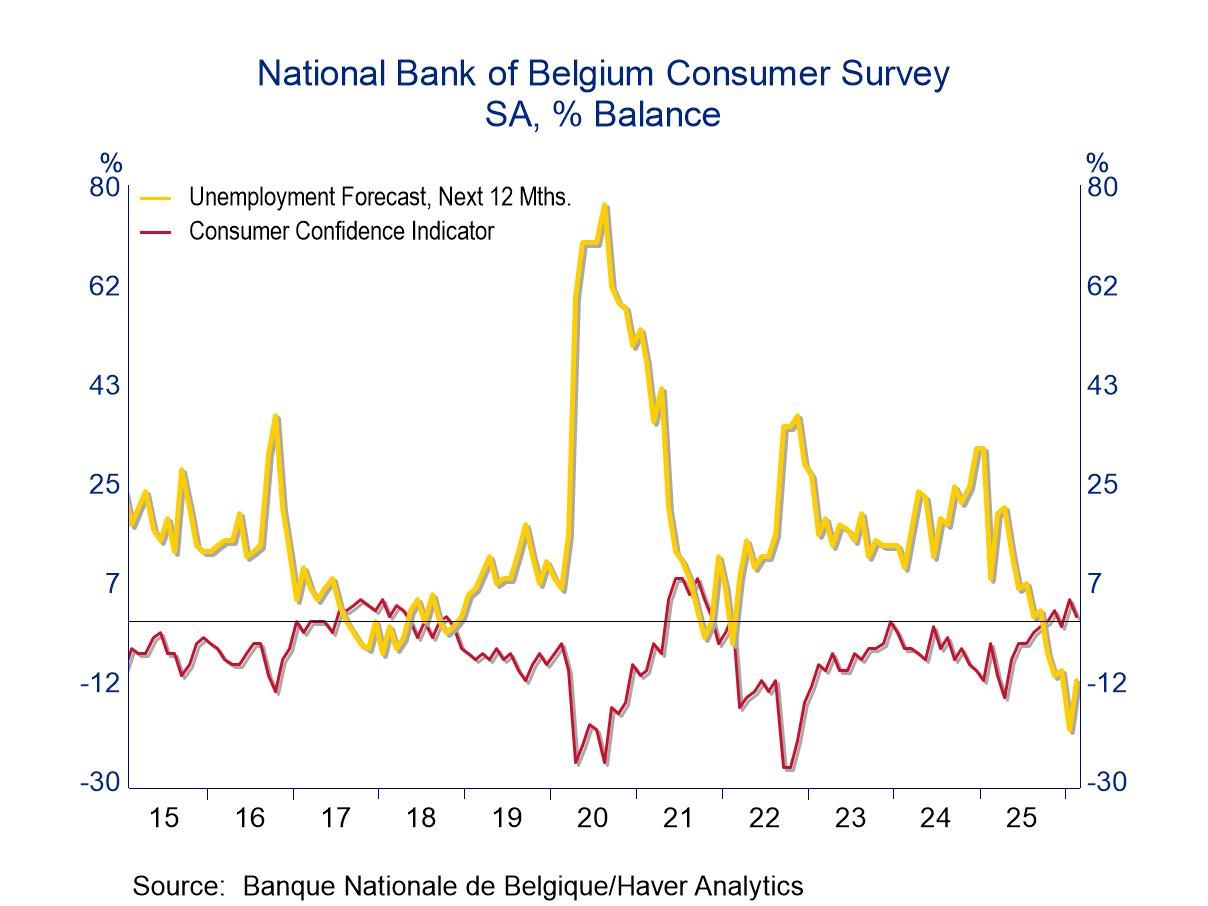

Belgian Consumer Confidence Clings to a Positive Reading

Belgian consumer confidence slipped in February. But it has made a long climb back to positive territory and that reading is holding on at +1 in February, down from +4 in January.

Belgian consumer confidence has been slowing progressing from a reading of -4 twelve-months ago to -2 six-months ago and to +2 just three-months ago. This progression shows a trend of improvement under way for the Belgian consumer.

Also, importantly, the queue reading of the consumer index in February is at a standing of 85.3, a top 15-percentile reading on data since 1991.

The economic situation is not as robust. It has improved for the next 12 months to -25 from a reading of -29 in January. There is a slight weakening in readings from 12-months to 6-months to 3-months, and the current February reading of -25 diffusion has a 15-percentile standing on data back to 1991. This concept carries a larger negative value over the next 12 months than under the last 12 months. However, that reading nonetheless has a stronger standing at its 24.9 percentile than the outlook for the 12 months ahead. The economic situation is clearly suppressed compared to the confidence reading.

Prices show a slight weakening for the next 12 months compared to the January reading. However, the 12-month to 6-month to 3-month readings show a move up to stronger price levels. The ranking of the February price reading is a top 16-percentile reading; inflation in Belgium is still on the hot side.

However, prospects for unemployment have shifted sharply to show a much lower expectation of unemployment; unemployment expectations increased from -20 in January to a diffusion reading of -11 in February, with a ranking in its lower two percentile.

The environment for making a major household purchase over the next 12 months has eroded over the past few months, although it shows a trend toward improvement from 12-months to 6-months to 3-months. Still, the February reading has a 29.7 percentile standing, well below its historical median (represented by a 50 percentile standing).

The ‘favorable to spend at present’ index weakened quite sharply in February and has been slipping from 12-months to 6-months to 3-months. It registered in February a standing in only its 10th percentile, extremely weak. The consumer is not leading Belgium into recovery on the back of spending.

The financial situation expected over the next 12 months has been relatively static month-to-month as well as across the last 12 months. The ranking for expected conditions is weak at a 34th percentile reading. But the current financial situation, while stepping back on the month, has an 82.7 percentile standing. The financial situation reading appears to be in some flux, but the actual current readings have been firm in relatively strong territory for some time.

Household savings for the next 12 months backed down in February but had been strengthening over the past year. The February reading is quite high, a top 9-percentile reading. The favorability to save has not changed much over the past year but has eroded slightly in February. The February current assessment for savings is at a 62.2 percentile reading, much weaker than its 12-month outlook reading.

The Belgian consumer is experiencing some crosscurrents. Consumer readings are underpinned by low expectations for unemployment and by a solid current situation appraisal. However, the economic situation remains weak and is not trending higher and inflation readings are still uncomfortably high.

- USA| Feb 18 2026

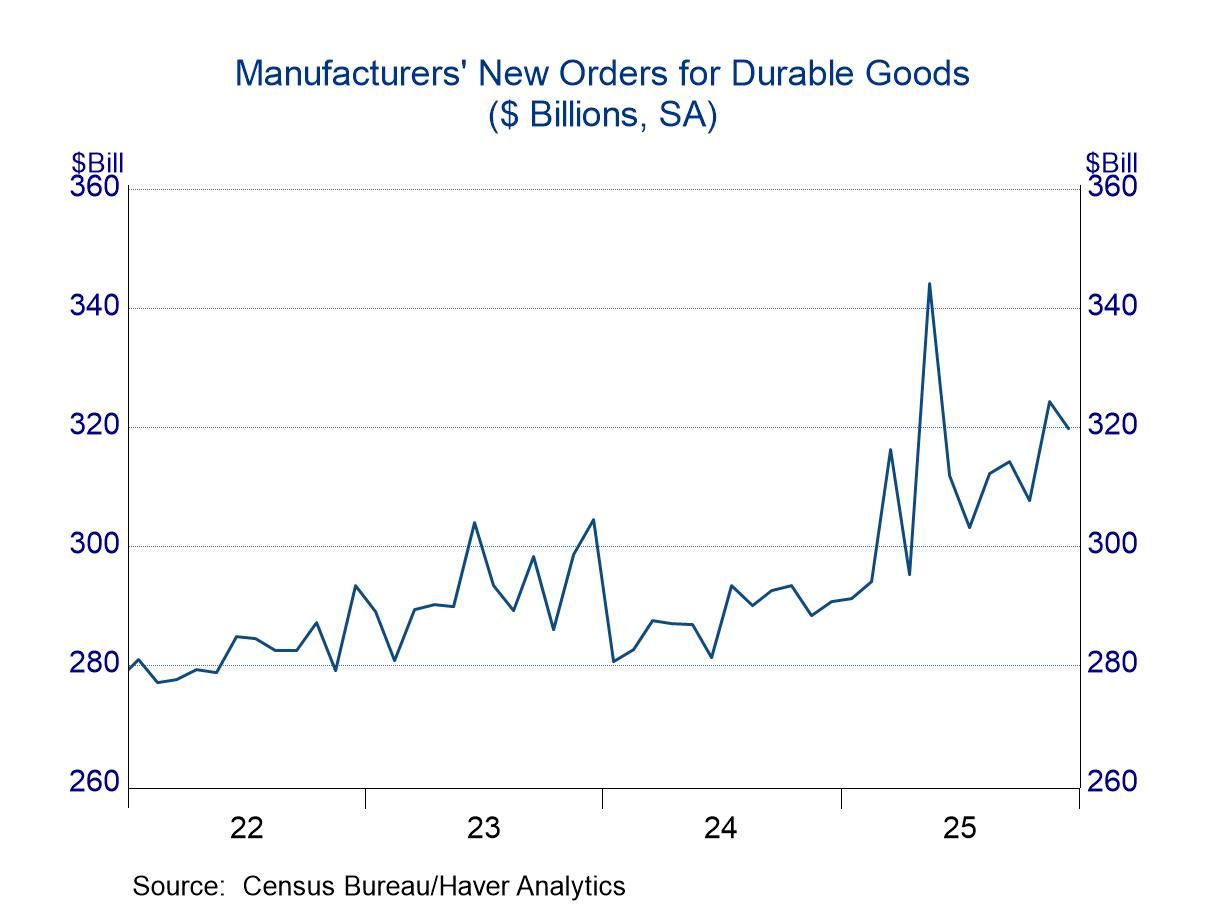

Durable Goods Orders: Irregular Upward Trend Continues

- A broad-based advance in December offset a drop in aircraft bookings.

- Unfilled orders are beginning to build.

- Orders for nondefense capital goods ex-aircraft remain on a solid path.

- USA| Feb 18 2026

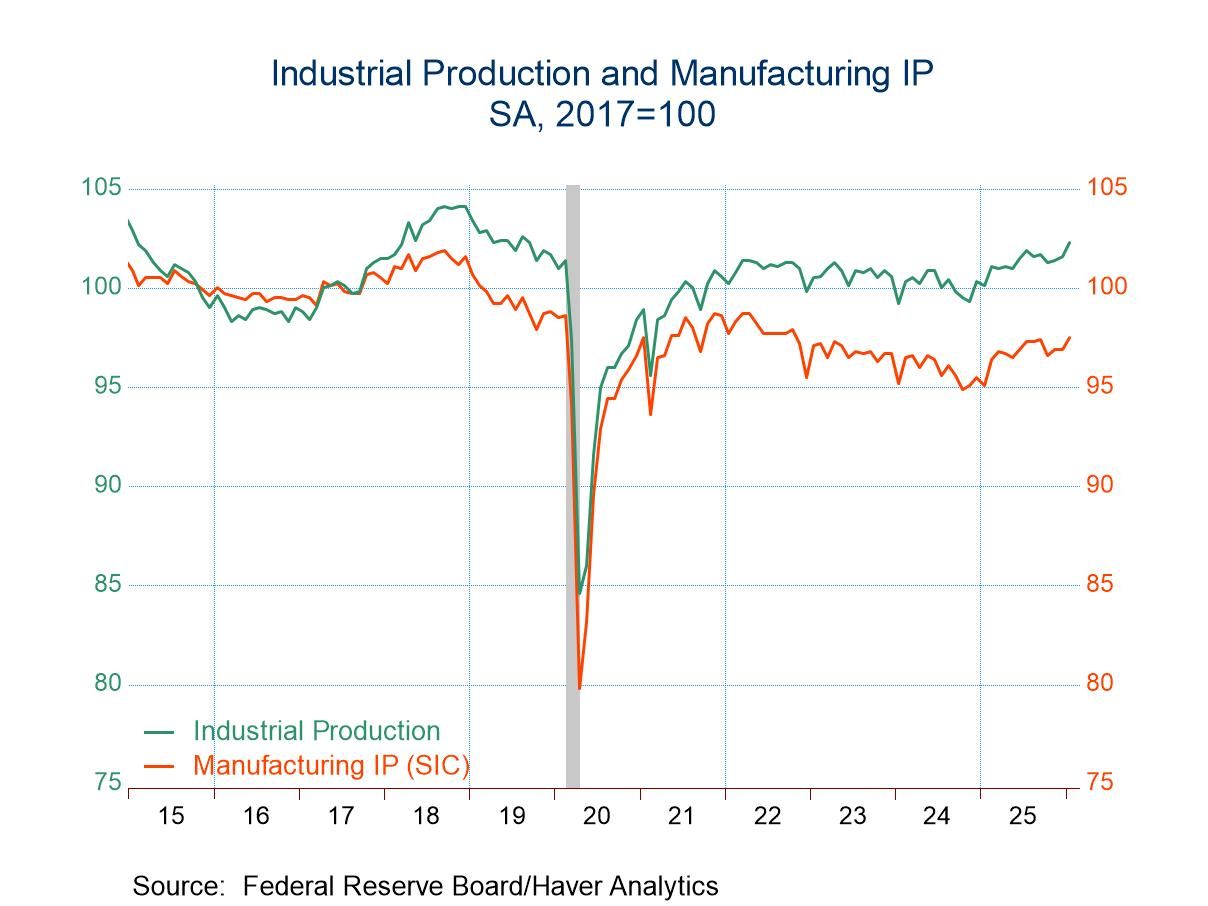

U.S. Industrial Production Jumped in January

- Total industrial output increased a larger-than-expected 0.7% m/m in January.

- However, there were meaningful downward revisions to the previous two months.

- Manufacturing output increased 0.6% m/m, mining declined 0.2% m/m, and utilities production jumped 2.1% m/m.

- Rates of capacity utilization edged up in January but remained well below their long-term averages.

by:Sandy Batten

|in:Economy in Brief

- of2700Go to 4 page