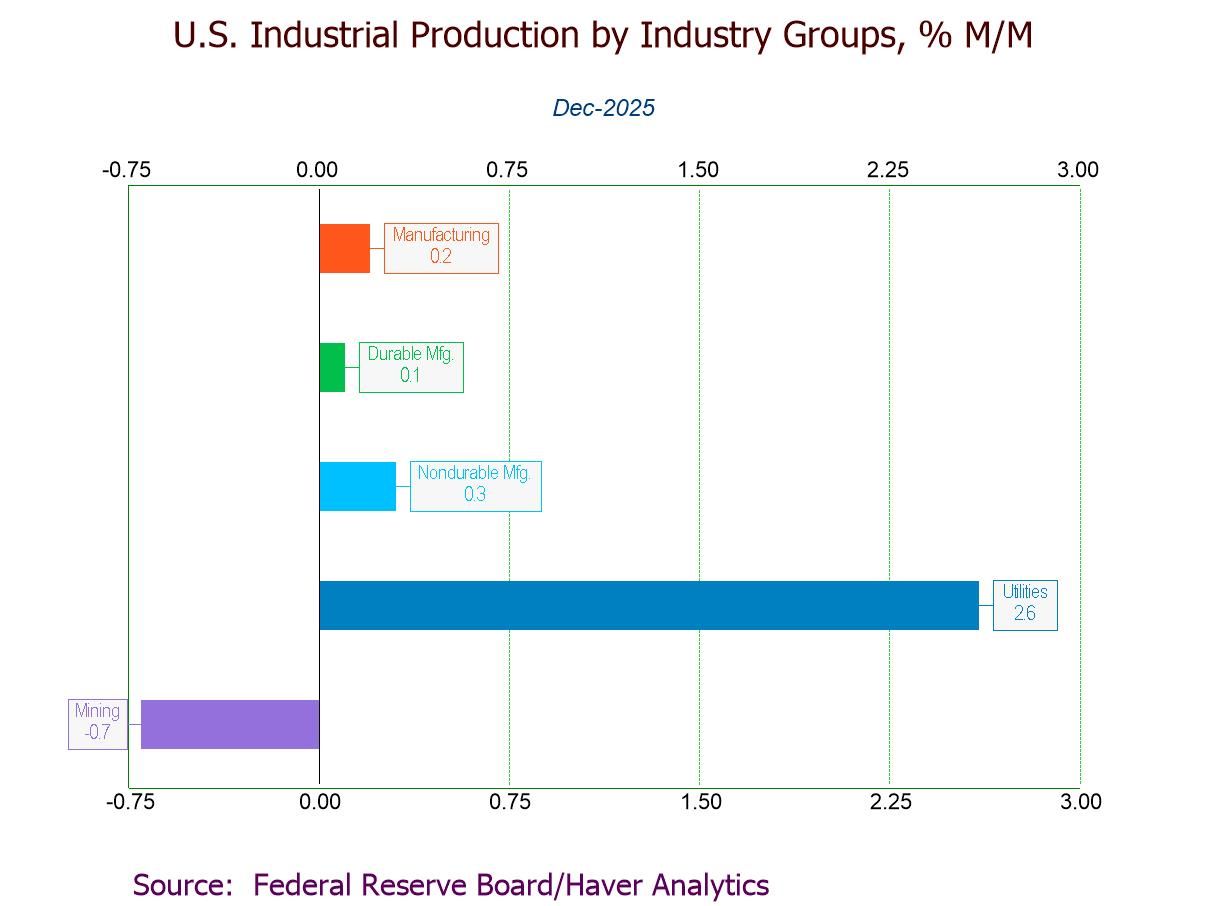

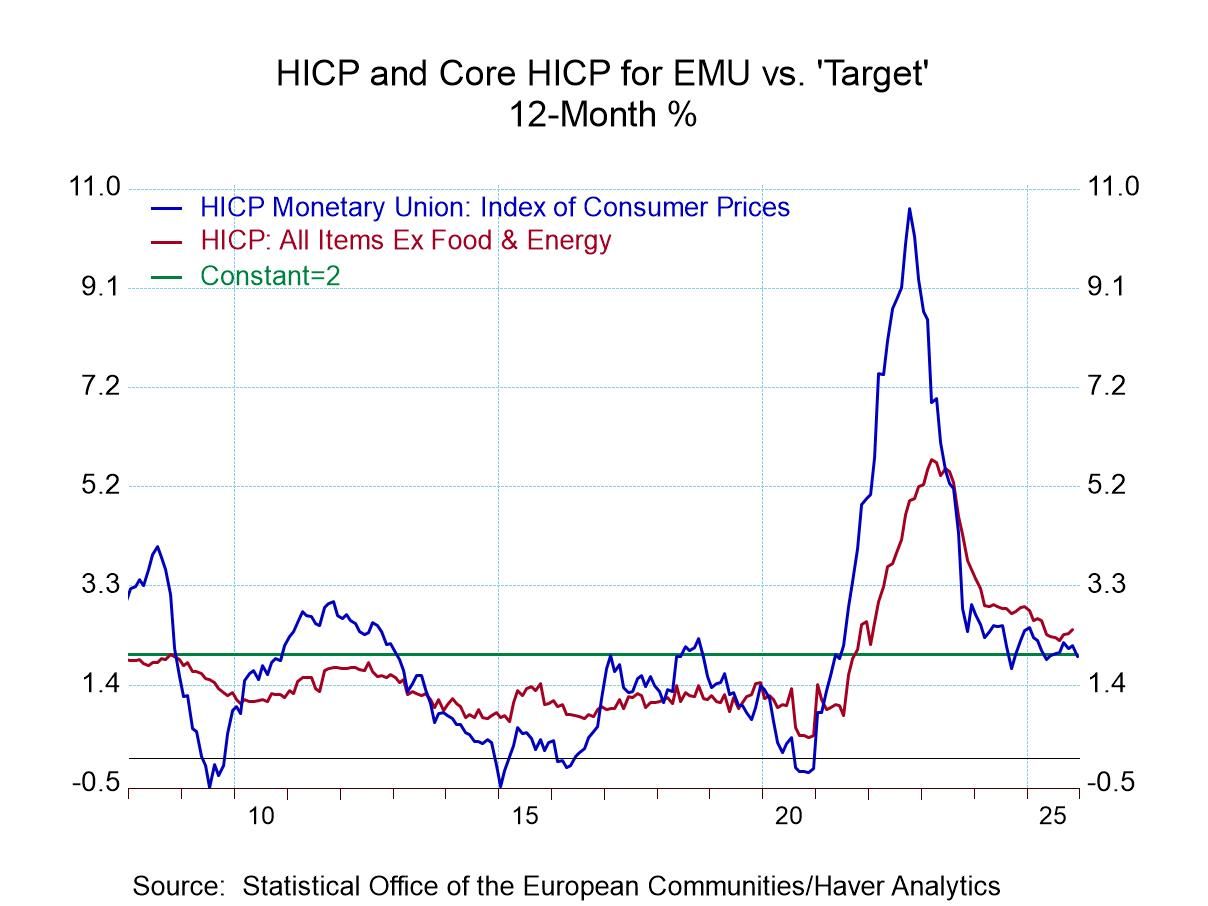

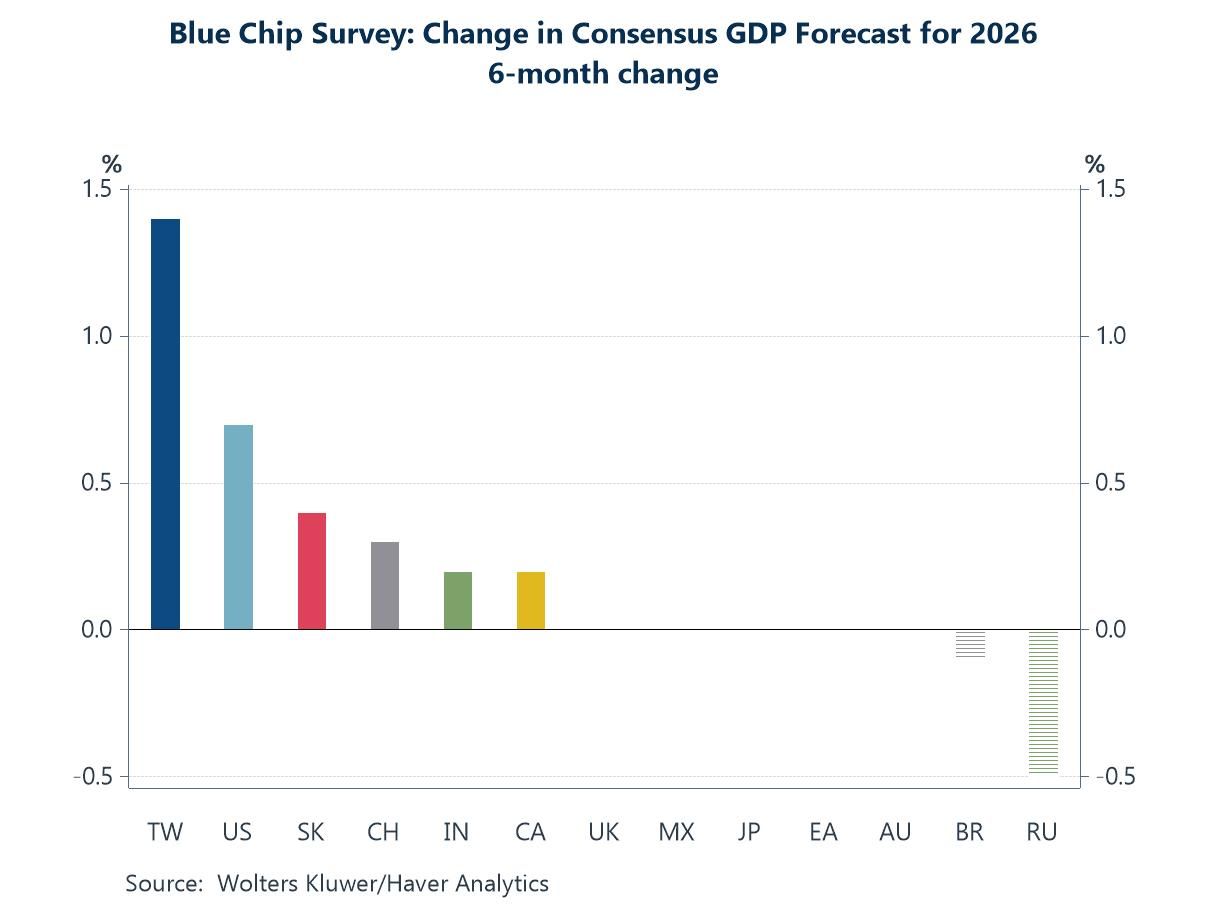

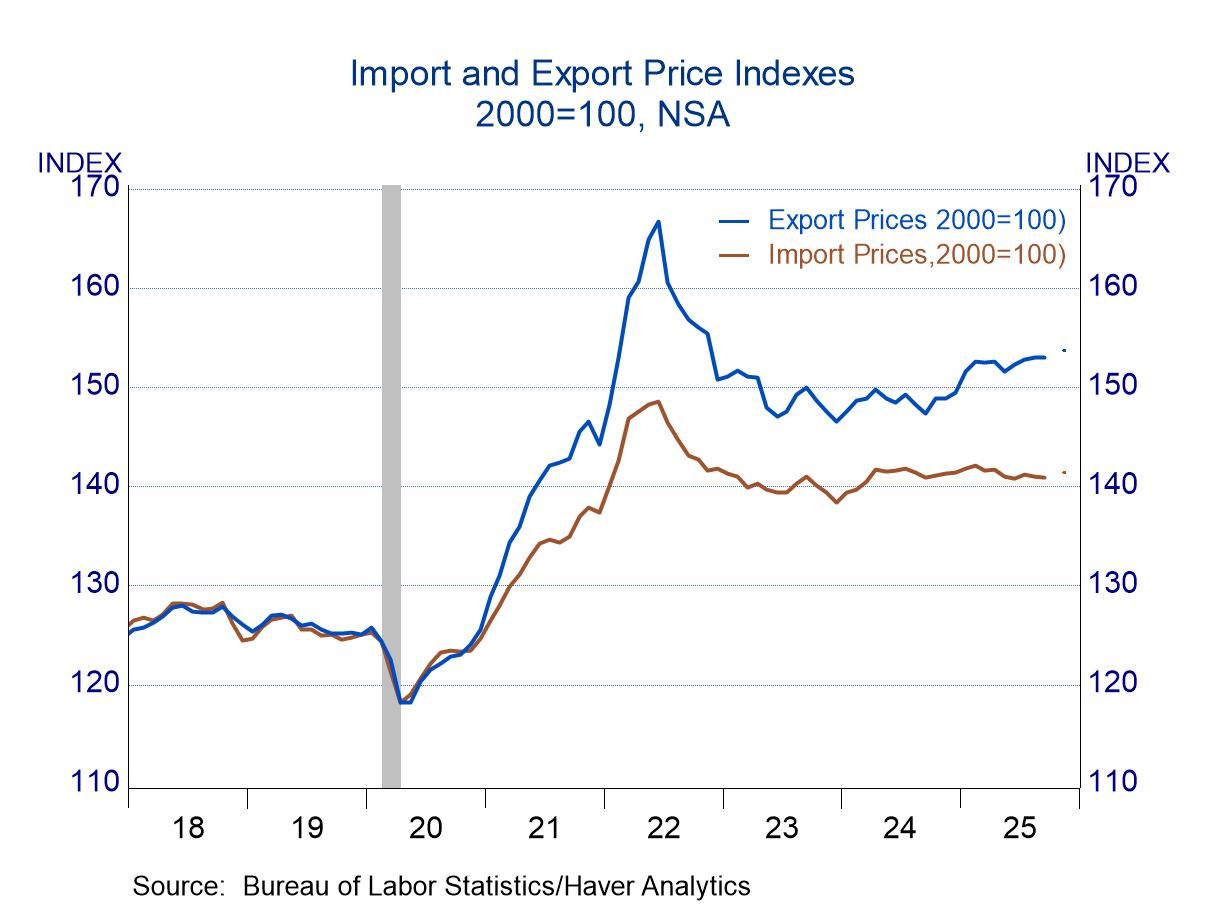

This week, we dive into several key developments across Asia. China’s Q4 GDP marked a further extension of its recent growth slowdown, yet full-year growth still came in exactly at the government’s 5% target for 2025 (chart 1). That said, the road ahead remains challenging, as December’s data delivered a mixed set of outcomes. Encouragingly, new external inroads, starting with Canada’s opening up of EV trade with China, could pave the way for additional opportunities (chart 2). In semiconductors, the latest US tariff measures proved far more limited in scope than initially feared, helping to explain the muted market reaction to the announcement (chart 3). Relatedly, commitments by major Taiwanese chipmakers to expand investment in the US have brought Washington and its largest chip supplier closer together, culminating in a US–Taiwan trade deal (chart 4).

In Japan, attention has turned to the possibility of a snap Lower House election in February. The interim political uncertainty, alongside expectations around future policy, has weighed on the yen and pushed Japanese yields higher (chart 5), with some observers increasingly concerned about the narrowing window to pass the FY2026 budget by April, given the likely dissolution of the Lower House. In South Korea, President Lee’s recent visits to China and Japan point to improving bilateral ties, although he continues to navigate a delicate balancing act amid still-elevated China–Japan tensions. Domestically, elevated house prices and high household debt continue to limit the scope for further monetary policy easing (chart 6).

China Alongside its regular slate of monthly economic releases, China unveiled its Q4 GDP figures earlier today, with the economy expanding by 4.5% y/y during the quarter. While Q4 growth continues the recent trend of deceleration seen over the past few quarters, the outcome brings China’s full-year growth for 2025 right in line with the government’s 5% target (chart 1). This defied expectations among some investors that the economy would fall short. This outcome aligns with earlier discussions that China remained within reach of its growth target despite slowing momentum. That said, the outlook ahead remains challenging. December’s monthly data painted a mixed picture, with declines in fixed asset investment accelerating and retail sales growth cooling further, even as industrial production growth remained relatively resilient.

Asia

Asia