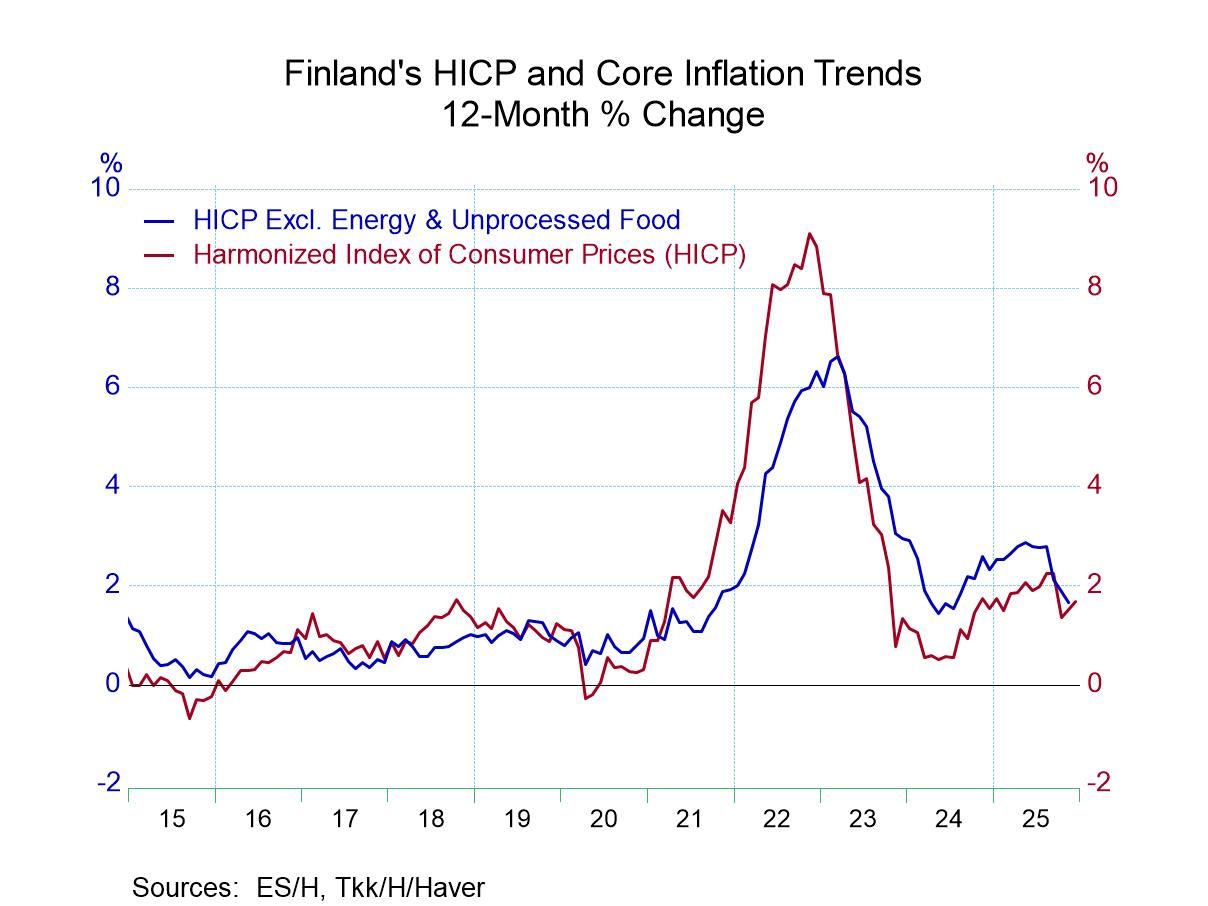

When inflation fell in the post COVID. Finish inflation slipped easily below the 2% mark and then accelerated rather strongly but continued to remain below 2% most of the time until recently. In September of last year, Finish inflation once again made a strong move below 2%. The harmonized inflation rate over 12 months for Finland is 1.3% in October, 1.5% in November, and 1.7% in December. These are all 12-month, year-over-year gains. From October through November, Finland’s core measure of the HICP also has been below 2%.

In December, Finland's HICP measure kicked up its heels to log a 0.3% gain after rising 0.2% month-to-month in November and falling by 0.5% in October. Among the 9 categories that make up the detailed national CPI that's released at the same time as the HICP, four of the components showed gains less than 0.2% with three components showing gains of 0.6% or more on a monthly basis. This followed a November report in which seven of the nine categories and the national index itself showed month-to-month declines and where 55% of the categories decelerated from October. By comparison, in December 85% of the categories accelerated relative to November, but then given the weak nature of the November report, that's not particularly surprising. October had been another month of extremely disciplined prices with the headline HICP falling by 0.5% month-to-month and with six declines in monthly prices, against accelerations in only 35% of the categories. Clearly Finland has been in a period when inflation has been extremely tempered.

Sequential trends showed that the HICP headline measure is up by only 1.7% over 12 months although it's up at a 5.9% annual rate over six months and then up by only a 0.1% annual rate over three months. Inflation accelerates for 40% of the categories over 12 months compared to 12-months ago, it accelerates over 6 months compared to 12-months for 60% of the categories, and it accelerates over 3 months compared to 6-months only 30% of the categories. The year-over-year and three-month performances shows a great deal of inflation discipline in Finland.

The rankings, or queue standings, of the inflation rates show the headline, which is up 1.7% over 12 months at a 56.1 percentile ranking over that period back to 2001. That places the measure on slightly above its median on data back to 2001. The national index, however, is up by only 0.2% over that span. And it has a 14.3 percentile weight extremely weak among the components in the domestic price index: five of them have rankings above the 50-percentile mark overall on 12-month changes back to 2001. The greatest increases are in health & medical care with a 90.4 percentile standing, recreation & culture prices have an 81.7 percentile standing, communication has 83-percentile standing, education has a 55.2 percentile standing, and food & nonalcoholic beverages are close to the median at a 50.4 percentile standing. The weakest prices on the standing basis are housing, fuel & light at an 8.7 percentile standing and as well as other goods & services at a 5.7 percentile standing.

Asia

Asia