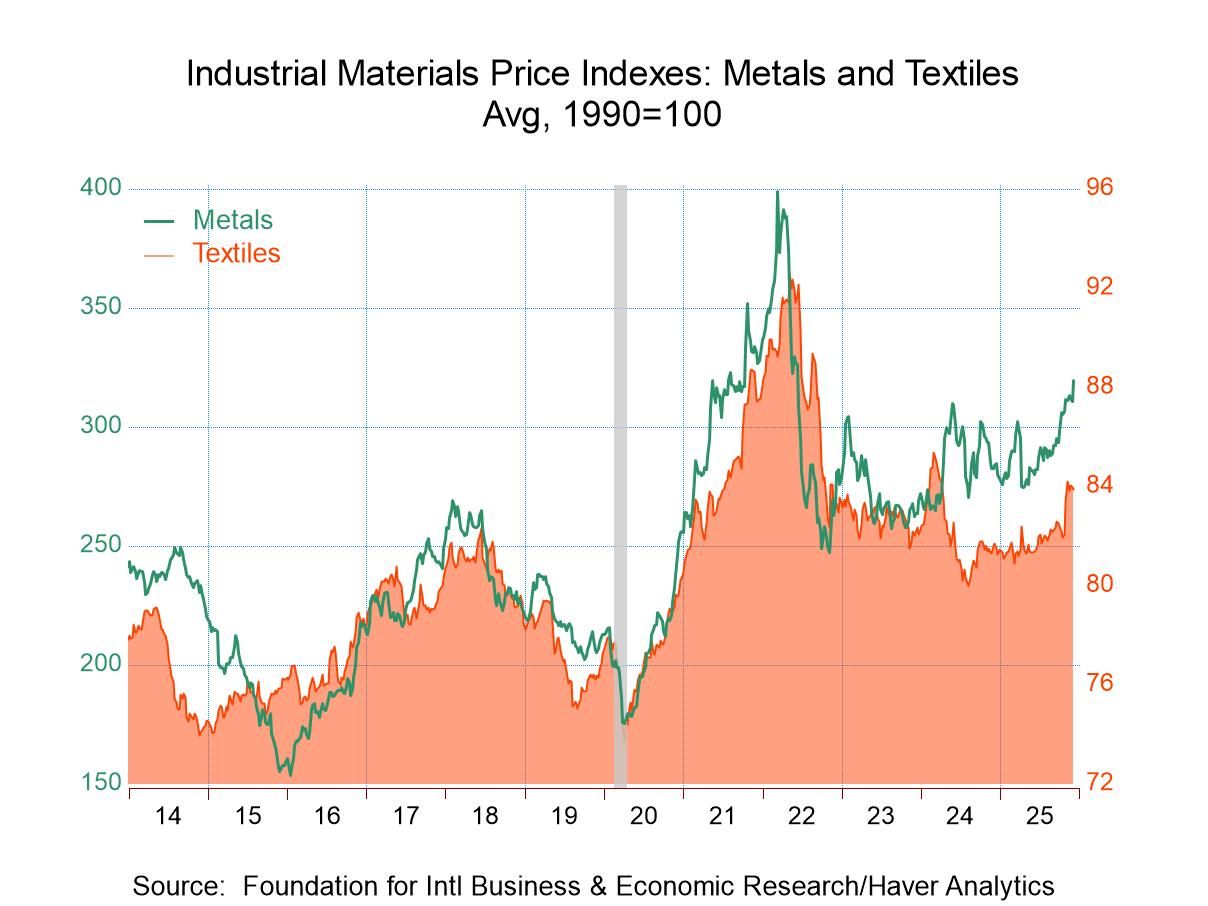

- Higher metals prices lead upturn.

- Crude oil & framing lumber prices also rise.

- Textile prices ease.

by:Tom Moeller

|in:Economy in Brief

- Germany| Dec 08 2025

German Output Scores Unexpectedly Strong Gains in October

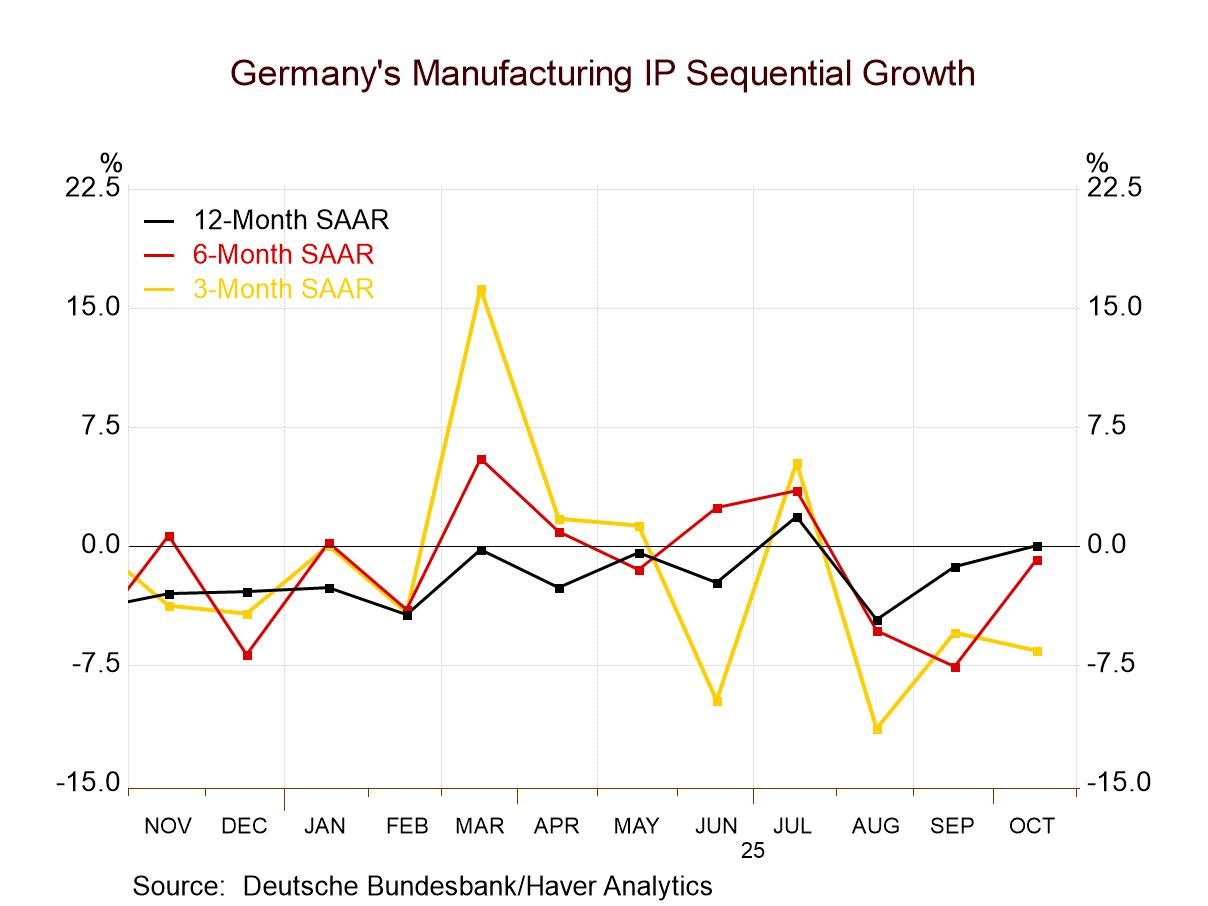

German growth brought a surprise to the upside in October when industrial production rose by 1.8% after rising 1.1% in September and falling by 3.7% in August. German output saw gains of 2.1% in consumer goods output, 2.1% in capital goods output, and 0.6% in intermediate goods output on a month-to-month basis in October. Each of these categories saw output increase in the last two months in a row. However, for most of these sectors’ output declined and fell rather sharply in August.

As a result, of these monthly gyrations, we're staring at somewhat unusual and mixed trends. The monthly trends are encouraging. However, the sequential trends from 12-months, 6-months and 3-months show a steady deceleration in total industrial production growth, a steady deceleration in consumer goods production’s pace, a steady deceleration in the output of the capital goods sector as well, all of those contrasted to a mixed sequential performance with a strong three-month gain for intermediate goods output. The manufacturing sector as a whole, apart from total industrial production, also shows output on a decelerating path from 12-months to 6-months to 3-months. Near-term strength has not been able to override a negative overall trend.

Industrial orders are showing a mixed performance with some strength tagged on at the end over three months. Real manufacturing orders fall by 0.5% over 12 months. They fall by a slightly faster 0.9% annual rate over six months, but then they rise at a 13.3% annual rate over three months. The three-month pickup is reassuring, but it's still not strong enough to drive the year-over-year change into positive territory.

Real sales of manufactured goods are also weak, falling by 1.6% over 12 months, falling to a 6.8% annual rate over six months and then accelerating their drop to a 10.5% annual rate decline over three months. The decline in inflation-adjusted sales growth pace is a disturbing trend, and it mirrors the underlying decline in manufacturing output.

Industrial indicators from the ZEW group, the IFO, and the EU Commission send a somewhat mixed picture monthly. Three of these metrics the IFO manufacturing survey, IFO expectations and the EU Commission index improved in October although the ZEW current index fell relatively sharply in October compared to September. Sequentially the analysis changes with both of the IFO readings for manufacturing and for manufacturing expectations showing progressive improvement from 12-months to six-months to 3-months. However, for the ZEW current index and for the EU Commission survey, the patterns remain mixed although there is improvement in the sense that the 3-month readings are stronger than the 12-month readings.

Turning back to industrial output data, we have readings from five European economies, three of them are monetary union-even countries. Spain, Portugal, Sweden, and Norway, each show progressive improvement in industrial output as the expansion rate for output improves from 12-months to 6-months and from 6-months to 3-months. In France, output increases over 12 months, even steps up its growth pace over six months but then it logs a decline over three months.

Quarter-to-date all industrial output metrics are showing gains of sone sort for the German sectors and for the European economies. German real orders are rising strongly early in the new quarter while real sales are falling. As for the indicators, the ZEW current index is dropping in Q4 compared to Q3, but the other industrial metrics show gains.

For more perspective, the queue rankings of indicators are generally below their midpoints. However, German sector industrial production and the country-level production in manufacturing are generally showing year-on-year growth rate above their historic medians on data back to 2006. Exceptions are that capital goods output is below its median pace, while German total IP is above its median; the growth rate for Germany manufacturing is not. France, Spain, Sweden, and Norway show year-on-year growth above their historic median pace, but in Portugal the ranking is at its 47th percentile, slightly below its historic median.

The bottom line is that October is an upside-disturbing surprise. It dove-tails with the better performance from the Baltic dry goods index. But the longer-term trends in Germany are still negative, with output in the other European countries in the table is generally on an upswing. Germany is not out of the woods yet.

- USA| Dec 05 2025

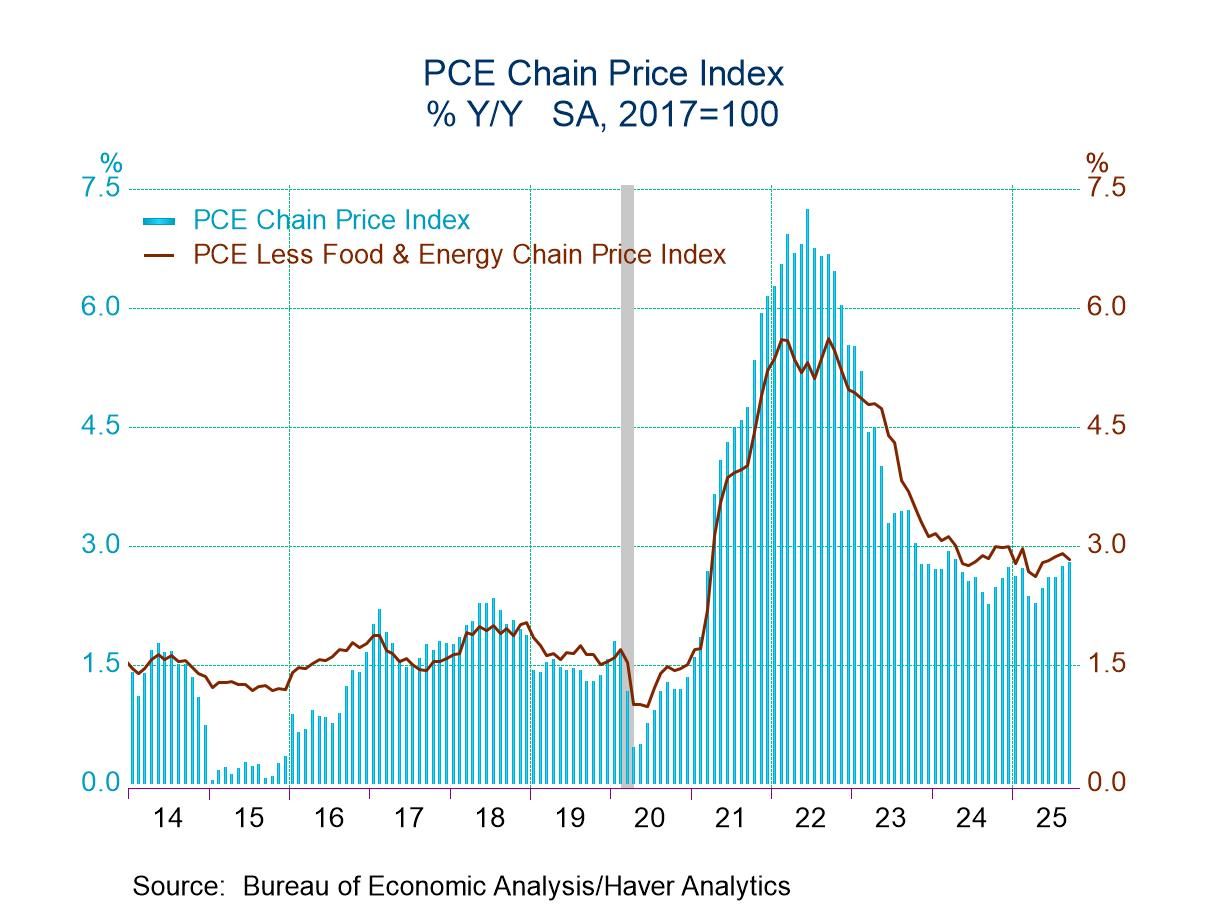

U.S. PCE Core Price Index Gain Eases; Personal Spending Growth Slows & Income Steadies in September

- Total PCE price index drifts up even as core price gain dips.

- Real PCE gain slips as goods outlays fall.

- Personal income gain steadies.

by:Tom Moeller

|in:Economy in Brief

- Europe| Dec 05 2025

GDP in EMU Is Firmer Quarter-to-Quarter, But Slowing

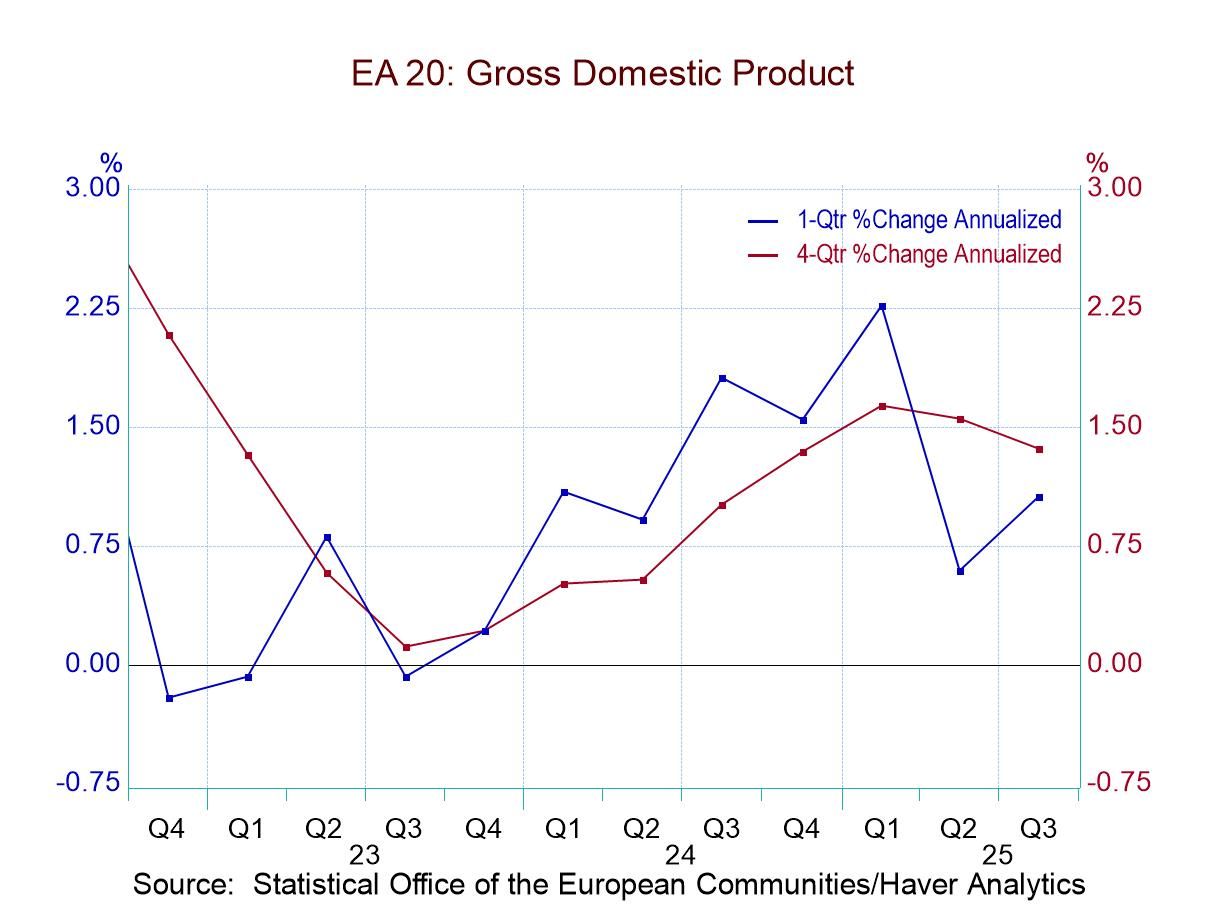

Growth in the euro area came in a little bit stronger in the third quarter as growth is up 1.1% compared to 0.6% in the second quarter and 2.3% in the first quarter. These are annualized quarter-to-quarter results. Ranked on growth rate data back to 1997, the EMU 1.4% GDP growth rate has a 41.3 percentile standing which puts it below its median growth rate for this period.

Among the countries in the table that includes 16 European countries, Japan, as well as the European Monetary Union aggregate, only 6 countries have growth rates above their medians in 2025-Q3. One of them, Denmark, is not a monetary union member; it has a standing in its 90.2 percentile. Ireland has a rank standing in its 83.7 percentile. Portugal has a growth standing in its 66.3 percentile. Greece's growth rate is in its 60.9 percentile. Cyprus’ standing is in its 57.6 percentile. The median growth rate among reporting members has year-over-year growth at 2.0% and that's a 41.3 percentile standing.

Quarterly growth in the third quarter decelerates in four of the reporting monetary union countries. This is down from 9 decelerations in the second quarter. Growth also decelerates in the third quarter in six countries when measured on a year-over-year basis. Monetary union growth decelerates year-over-year as well.

There's not a particular pattern to the median growth rate, which was at 2.2% on the fourth quarter of 2024, slipped to 1.7% in 2025-Q1 and then to 1.6% in in 2025-Q2, and it has picked up to a 2% pace in the third quarter of 2025. The monetary union overall growth rate which is weighted for the size of the underlying economies, shows 1.3% growth in the fourth quarter of 2024, stepping up to 1.6% in the first quarter, remaining at 1.6% in the second quarter, and then slipping slightly to 1.4% in the third quarter of 2025.

Growth is favored in the smaller economies in the European Monetary Union as the four largest economies have a year-on-year growth rate that is below the growth rate for the rest of the European Monetary Union in each of the last four quarters. The year-over-year growth rate for the third quarter shows the largest four EMU economies are growing at a 0.9% year-over-year pace compared with 2.7% pace for the rest of the monetary union. This strength is also reflected in the growth standings with the four largest economies having a growth rate standing at their 37th percentile, compared to a 57.6 percentile for the rest of the monetary union.

We have no comparison for the United States right now because U.S. GDP has been delayed by the U.S. shutdown dynamics. But both Japan and Switzerland are logging relatively weak growth rates in the third quarter of 2025, with Japan at 1.1% year-over-year and Switzerland at 0.5%. Japan's growth rate is still a 50th percentile ranking while Switzerland's growth rate is a 13.6 percentile ranking against its historic results.

The growth rate for the monetary union is revised lightly higher than it was; still, it shows growth slowing quarter-to-quarter on an annualized basis. Only three of the monetary union reporting countries in the third quarter show quarterly growth actually falling; German growth is dead flat at zero. The overall monetary union growth rate is still quite moderate on a quarterly as well as annual basis. However, growth is still in train; inflation remains moderate. Growth in the monetary union is generally supported more by the smaller countries than by the large countries.

Global| Dec 04 2025

Global| Dec 04 2025Charts of the Week: Diverging Paths, Converging Risks

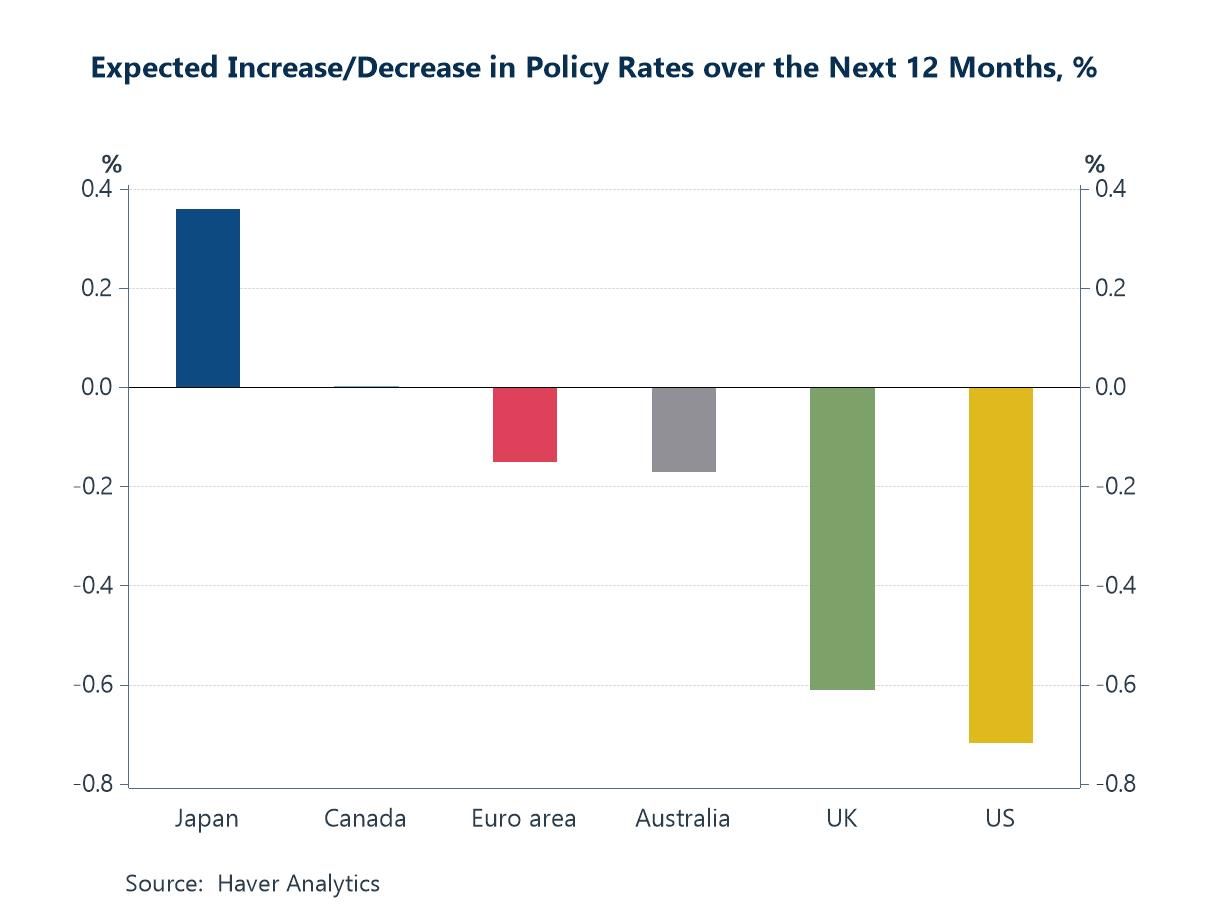

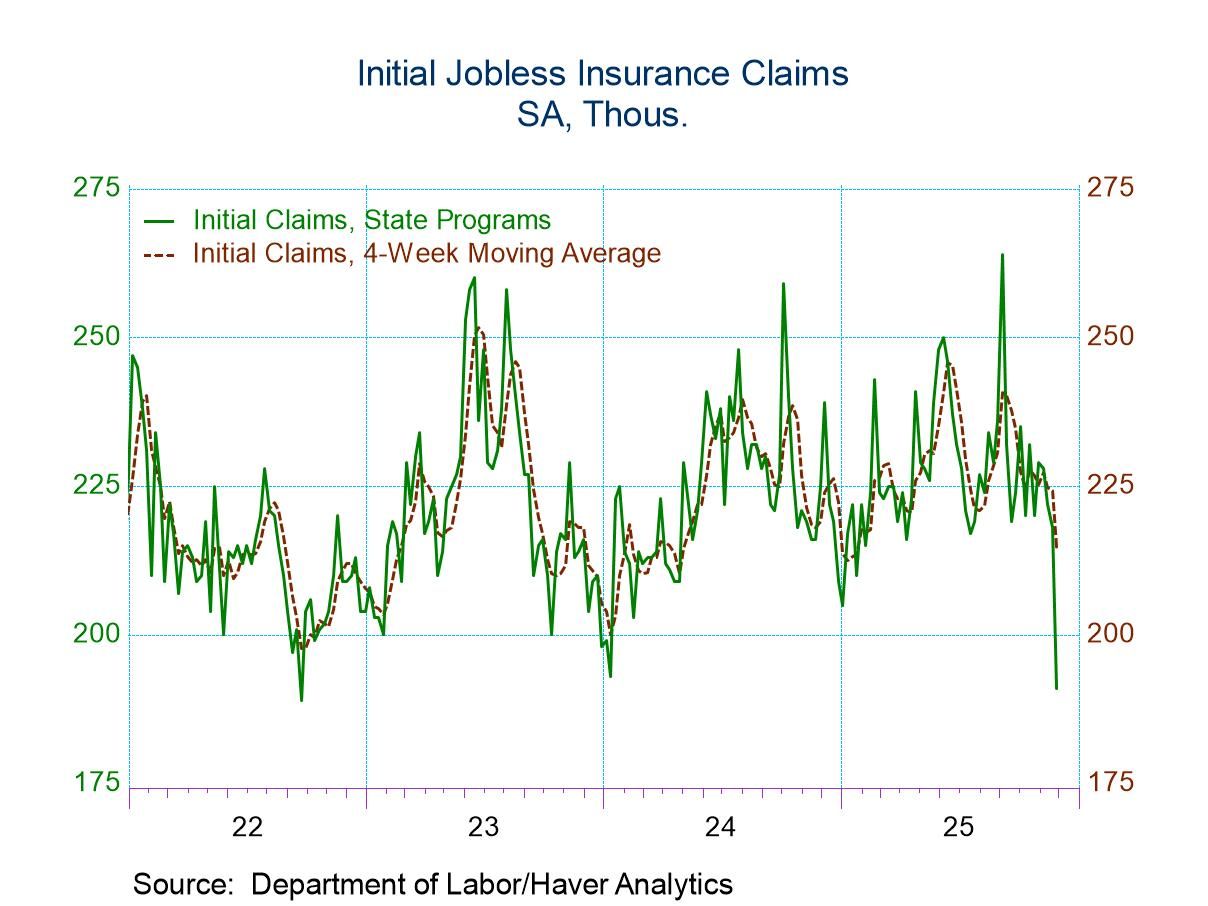

Global financial markets have been navigating a more unsettled backdrop in recent weeks, with choppier risk sentiment and shifting rate expectations reshaping the macro narrative. US assets have been particularly sensitive to signs of cooling labour-market momentum and the temporary loss of official payroll data during the government shutdown, while rising real yields in Japan and renewed fiscal tightening in the UK have added further cross-currents. Against this backdrop, Blue Chip forecasts point to a world edging gradually toward easier monetary policy, but with a striking divergence between a more dovish Fed and a still-normalising Bank of Japan (chart 1). The softening in US private payroll growth, captured by the ADP data, reinforces the case for Fed easing at a time when official data are unavailable (chart 2). In the euro area, sticky underlying inflation could leave the ECB wary of further meaningful cuts (Chart 3). Japan’s climb in real JGB yields, underpinned by stronger capex and supportive policy signals, continues to reverberate through global rate markets (chart 4). In the UK, the gilt–Treasury spread has widened over the year but narrowed slightly post-Budget as investors priced the growth-dampening effects of fiscal tightening (chart 5). And in the global goods sector, while the manufacturing PMI still points to only mediocre growth, the revival in South Korean semiconductor exports underscores the extent to which AI-related demand remains one of the few clear bright spots in an otherwise subdued industrial landscape (chart 6).

by:Andrew Cates

|in:Economy in Brief

- USA| Dec 04 2025

U.S. Factory Orders Unexpectedly Increase in September

- Shipments are steady.

- Order backlogs post firm increase.

- Both durable & nondurable goods inventories slip.

by:Tom Moeller

|in:Economy in Brief

- Decline in initial claims at lowest level since January.

- Continuing claims edge lower; jobless rate steadies.

- State unemployment rates vary.

by:Tom Moeller

|in:Economy in Brief

- Europe| Dec 04 2025

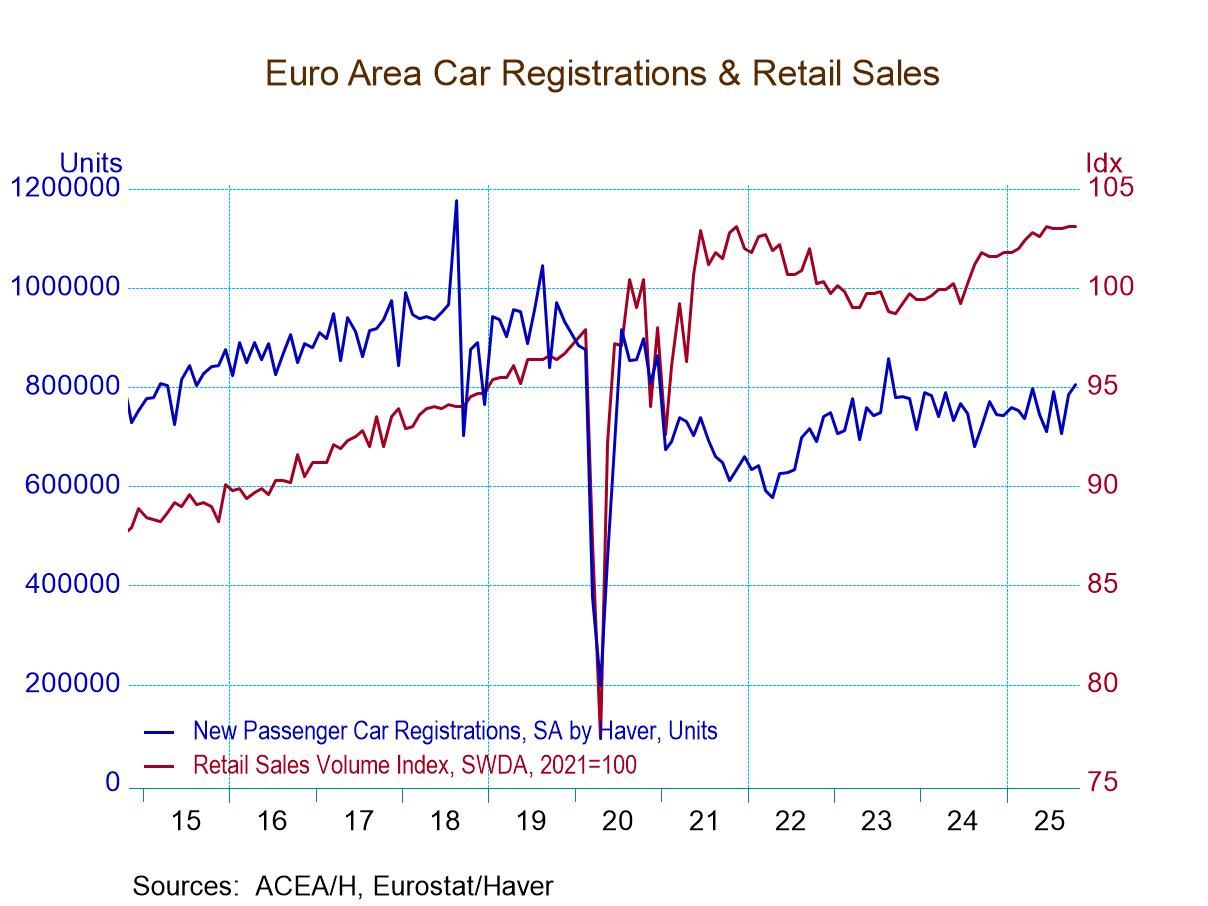

EMU Retail Sales Are Flat in October

European Monetary Union (EMU) retail sales in October were flat. Food & beverage sales rose by 0.3%. The profile on sales continues to be weak although from 12-months to six-months to three-months sales are still growing. However, the growth rates are decelerating sequentially. Total sales volumes grow by 1.5% over 12 months, advance at a 0.6% annual rate over six months, and gain at an even slower 0.4% annual rate over three months. Food & beverage volume spending rises by 1% over 12 months and at a 2.1% annual rate over three months after declining 0.4% over six months.

Quarter-to-date total euro area sales volumes are rising at a 0.4% rate while food volume is rising at a 1.9% annual rate. None of this is impressive.

Motor vehicles show healthier trends Motor vehicle sales have shown some life the last two months after falling 10.8% in August; they snapped back, rising by 11.3% in September and now, in October, there's a further 2.5% increase month-to-month. Over 12 months vehicle sales rise by 4.5%, over six months sales slow to a 1.8% annual rate, but then, over three months, they pick back up to grow strongly at a 7.4% annual rate. As a result of these gyrations, motor vehicle sales volumes are up at a 40.8% annual rate in the quarter-to-date, that's one-month into the fourth quarter.

Country level retail performance On a country-by-country basis, we have a smattering of results from Monetary Union members and other European reporters. In October, among the seven individual countries reporting, there are sales declines in three of them; in Germany sales fell by 0.3%, in Sweden they fell by 0.3%, and in the United Kingdom volumes fell by 1.1%. In addition, sales were flat in Spain in October and flat in Norway as well. Only Denmark and the Netherlands logged sales increases. Dutch sales rose 2.6% month-to-month while Danish sales rose by 0.9% month-to-month.

Sequential country sales patterns Sequentially, looking at annualized growth rates over 12 months, six months and three months, there are steady decelerations in two countries in the table: Germany and Norway. For Germany sales grow 0.9% over 12 months but move on to contract at a 1.7% annual rate over three months. For Norway sales rise by 3.4% over 12 months, then contract at a 1.2% annual rate over three months. There's a slight acceleration in sales in Denmark as sales grow 3.8% over 12 months, rise at 3.9% annual rate over six months, and then advance at a 5.4% annual rate over three months. However, the rest of the countries in the table produce unclear trends.

On a quarter-to-date basis, motor vehicles are surging, rising at a 40.8% annual rate, and providing the clearest notion of all being well. Country level retail sales excluding autos are growing most strongly in the Netherlands, at an 11.1% annual rate, followed by Denmark with a 6.7% annual rate and Spain at a 2.6% annual rate. Swedish QTD sales grow at a 1.5% annual rate, as sales volumes in Germany, the United Kingdom, and Norway show declines. U.K. sales fall at a 2.7% annual rate, German volumes fall at 1.5% annual rate, and Norwegian volumes fall at a 1.4% annual rate.

Results since January 2020 The COVID and post COVID period results to date have been marked by significant weakness. Retail sales since January of 2020 show total Euro-Area sales volumes are up by 5.7%, that's barely 1% per year. Food and beverage volumes are up by only 1% on a net basis. By country, the UK shows sales falling on balance by 3.7% on this five- and three-quarter-year horizon. Sales rise 1.7% in Sweden, 3.6% in Germany, and 4.1% in Norway. There are slightly more substantial sales in Denmark with a gain of 5.5%. The Netherlands show a net sales gain of 6.9%, and Spain logs a net rise of 9%. So, the Spanish numbers are quite solid. The Dutch and Danish numbers are moderate, and apart from that the other sales numbers are quite weak. These sales results span a period of 5 ¾ years and over such a period we would expect more substantial gains than what these countries are reporting now. Compounded a 1% per-year gain would results in a 5.9% increase in sales on this period. However, over this span vehicle sales are lower by 8.9%. That’s a substantial setback over such a period. Only two countries surpass that marker, and one other one comes close. The overall euro area number comes close (5.7%).

Summing up Retail sales numbers do not signal recession; however, they continue to point to very weak retail sales. Vehicle sales have picked up recently and have showed increases in all three horizons and that's certainly a bright spot and welcome after a long span of underperforming. Across the European Monetary Union, consumer confidence continues to lag and that weakness is reflected in the ongoing sluggishness in retail sales.

- of2693Go to 14 page