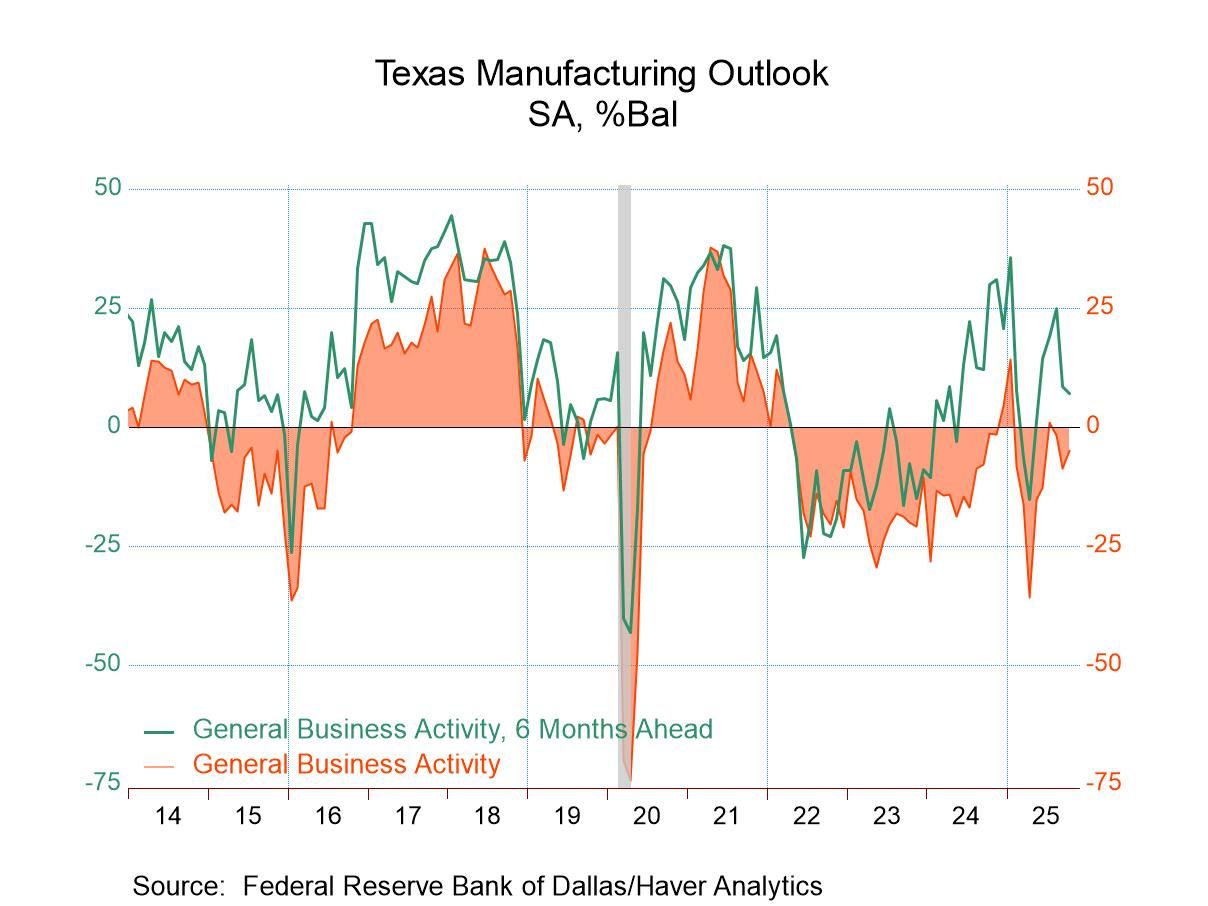

- Current Conditions Survey is negative for eighth month in last nine.

- Production, new orders, shipments & employment stay sluggish.

- Wages & benefits weaken; prices ease.

- USA| Oct 27 2025

Texas Manufacturing Activity Index Remains Negative; Expectations Deteriorate in October

by:Tom Moeller

|in:Economy in Brief

- Finland| Oct 27 2025

Finland’s Consumer Confidence Backs Down for One Month

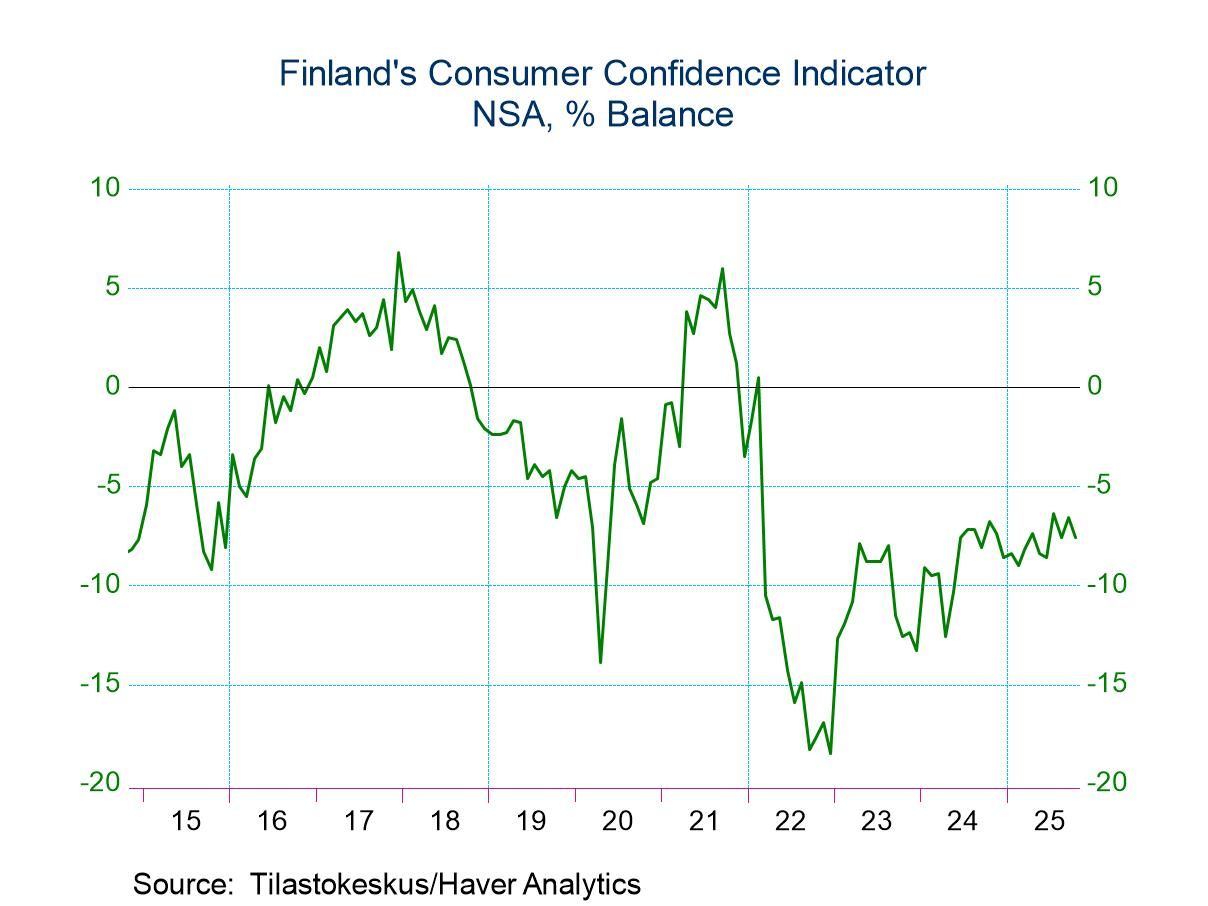

Consumer confidence in Finland slipped in October. The -7.6 reading was a slip from -6.6 in September, bringing it back to its August level of -7.6. The 12-month average for confidence is -7.9; the 12-month low is -9, so there hasn't been a lot of change in consumer confidence over the past year. Confidence currently is relatively firm compared to its recent range in its 12-month average even though it is slightly below that average. The queue ranking for the October level is at its 23.9 percentile, putting it in the lower quarter of its rank of data; one year ago, consumer confidence ranked in its 26th percentile. There's been a modest improvement in confidence over the past year. The rankings are executed over data back to 2002, a ranking over a period of roughly 23 years.

Macro and micro trends The microeconomic indicator for Finnish consumer confidence improved slightly in October, rising to 22.4 from September’s 21.8. At 22.4, it is slightly below its 12-month average, and it has a ranking of only its 11.2 percentile, which is a slippage compared to a 22-percentile standing one year ago. The macro indicator for consumer confidence slipped to -21.7 in October from -20.5 in September; it is slightly above its 12-month low at -23.3 and almost exactly on its 12-month average. The ranking for the macro indicator is in its 22nd percentile, nearly identical to what it was one year ago.

Some details In terms of the rankings, the Finnish consumer confidence survey is dominated by extremely low rankings. Most of them are lower 25th percentile or even lower; however, the index has some redeeming qualities. Among them is the fact that unemployment in Finland, although it deteriorated slightly in October to -30.1 from -27.8 in September, has only a 22.8% standing and it's lower than it was a year ago. People's perception of the personal threat of unemployment fell significantly in October to -17.1 from -12.5. in September; the ranking for that measure is in its 7.7 percentile, a very low ranking and is an improvement from the 17-percentile standing of one-year ago. Despite the weakness in the economy and the difficulties consumers are having in their assessments of confidence, they don't have any kind of fear and certainly not a growing fear of unemployment. That clearly is a silver lining in what we could regard as the dark cloud that dominates this report.

The assessment of the economy now slipped to -40.1 in October from -34 in September. The economy in 12 months is not assessed to be much different than it was a month ago and its ranking in October 2025 is substantially the same as it was one year ago (about a 30-percentiel standing). The assessment of consumer prices showed a slight reduction in inflation in October; however, the ranking of inflation is elevated at a 65.2 percentile standing that's above its historic median, but it's a substantial improvement from the 83-percentile standing of one-year ago.

The environmental assessments for the month of October showed a deterioration in the favorability the timed the purchase durables at a -16.6 reading in October compared to -12 in September. The favorability of saving was unchanged at -8.3 in September and October. The favorability of a time to raise a loan balance slipped to -29.4 in October from -25.3 in September; the household financial situation slipped slightly to 22.9 from 24; and the possibility to save over the next 12 months rose to 38.2 from 34.5. The rankings on these various metrics remained in the 12th or 13th percentiles for the purchasing, savings, and loan balance assessments. The household financial situation has a higher standing at a 27th percentile - still a nearly a bottom 25% standing. And the possibility to save over the next 12 months, while it improved in the month, has an 8-percentile standing.

Finland did not improve on the month; however, it shows trending toward better times and unemployment fears are low.

Asia| Oct 27 2025

Asia| Oct 27 2025Economic Letter from Asia: To the Summit!

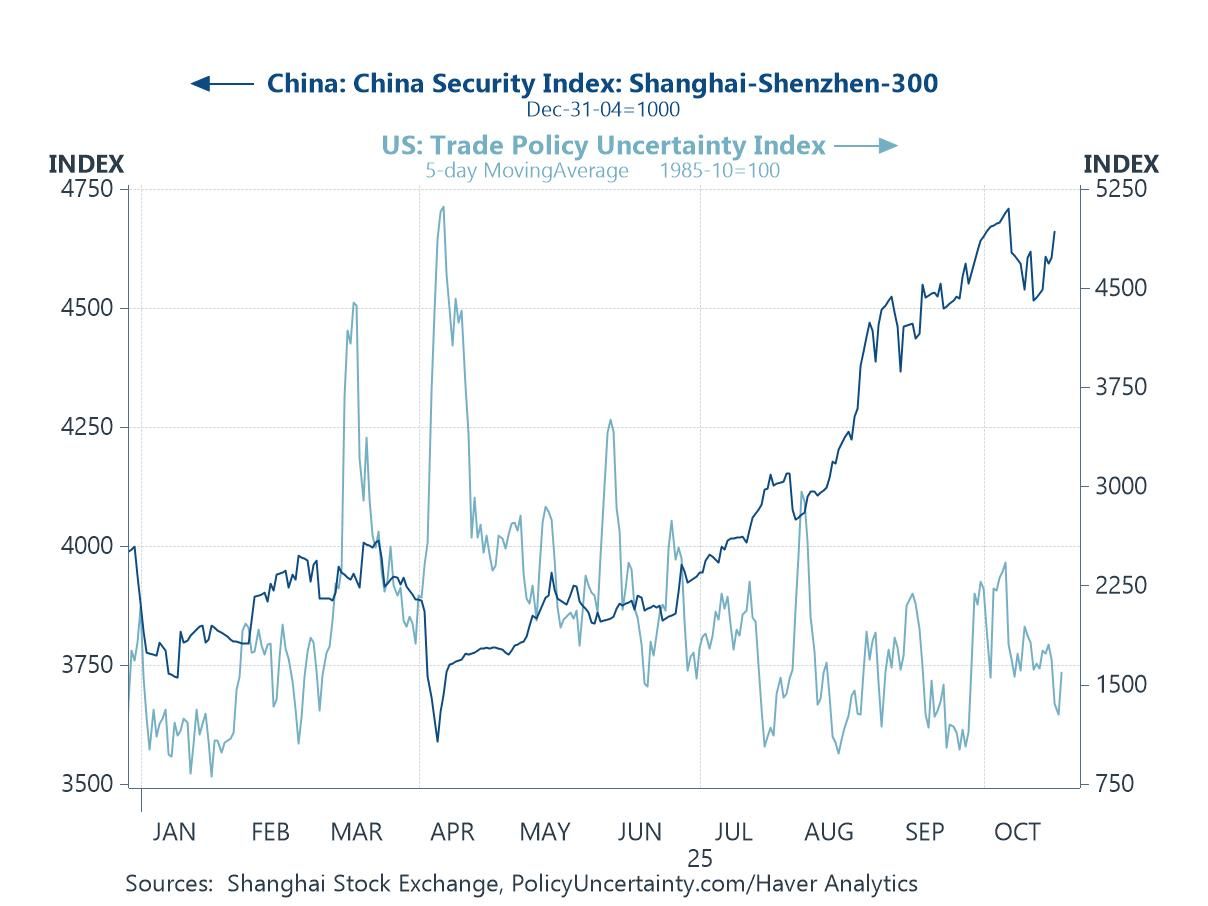

This week, attention remains on developments in Asia as US President Trump continues his regional tour. Over the weekend, his visit to Malaysia for the ASEAN–US summit saw a peace deal secured between Thailand and Cambodia, along with several trade agreements with ASEAN economies. Focus now shifts to Trump’s upcoming interactions with Japan’s new Prime Minister Takaichi and China’s President Xi in Japan and South Korea, respectively. A US–China trade deal is highly anticipated, which, if achieved, could boost market sentiment and reduce uncertainty (chart 1). Leading up to these meetings, encouraging Chinese data has emerged, including a significant improvement in industrial profits, suggesting that efforts to curb race-to-the-bottom price competition are beginning to show results (chart 2).

In Japan, apart from the Trump–Takaichi meeting, markets will closely watch the Bank of Japan’s October monetary policy decision (chart 3). While no change in policy rates is expected, the Bank’s updated forecasts will be scrutinized. Japan’s September trade numbers were encouraging (chart 4), but much depends on the US–Japan trade relationship. Still, Japan’s stronger shipments to other economies, if sustained, could help offset potential US-related headwinds. US–India trade talks also remain in focus, with India reportedly planning to reduce purchases of Russian crude oil—a recurring point of contention (chart 5). At the same time, while India has faced reduced imports from the US due to tariffs, increased shipments to other trading partners, particularly in Asia, highlight a broader trend of trade diversification. Finally, while the ongoing AI boom continues to support exports growth across several Asian economies, the risk of overreliance on semiconductor exports deserves emphasis. Some economies would not have recorded year-to-date export growth without the current AI-driven upcycle (chart 6).

The ASEAN and APEC summits Over the weekend, US President Trump arrived in Kuala Lumpur for the ASEAN–US Summit, where he oversaw the signing of a peace deal between Thailand and Cambodia. He also signed several trade agreements, including commitments by four ASEAN members to remove most—or in some cases all—tariffs on US imports, as well as deals with some members on critical minerals cooperation. While these developments are notable for ASEAN watchers, investor attention now turns to Trump’s next stops in Japan and South Korea. In Japan, focus will be on Prime Minister Takaichi’s first meeting with the US President, while in South Korea, markets will watch whether a long-anticipated US–China trade deal can take shape during the APEC summit. Recent signs of easing tensions—namely the likely suspension of Trump’s 100% tariff threats and China’s possible delay of rare earth export restrictions—could help temper regional uncertainty. This, in turn, may lift market sentiment, marking a welcome reversal from the caution seen in prior weeks (chart 1).

- USA| Oct 24 2025

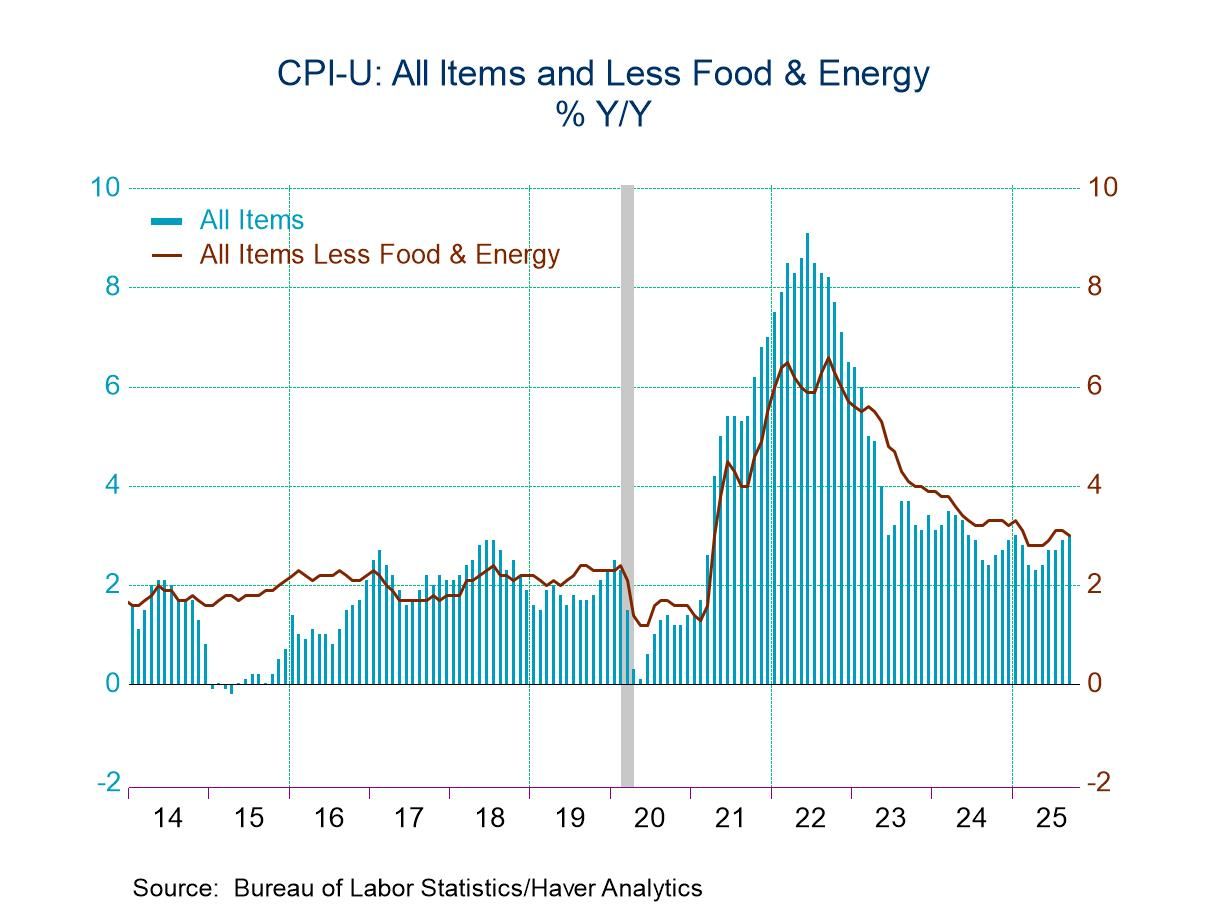

U.S. Consumer Price Inflation Moderates in September

- Monthly gains in total & core price indexes ease.

- Year-to-year comparisons edge higher.

- Core goods prices remain firm, but core services inflation eases.

by:Tom Moeller

|in:Economy in Brief

Global| Oct 23 2025

Global| Oct 23 2025Charts of the Week: Risks and Relief

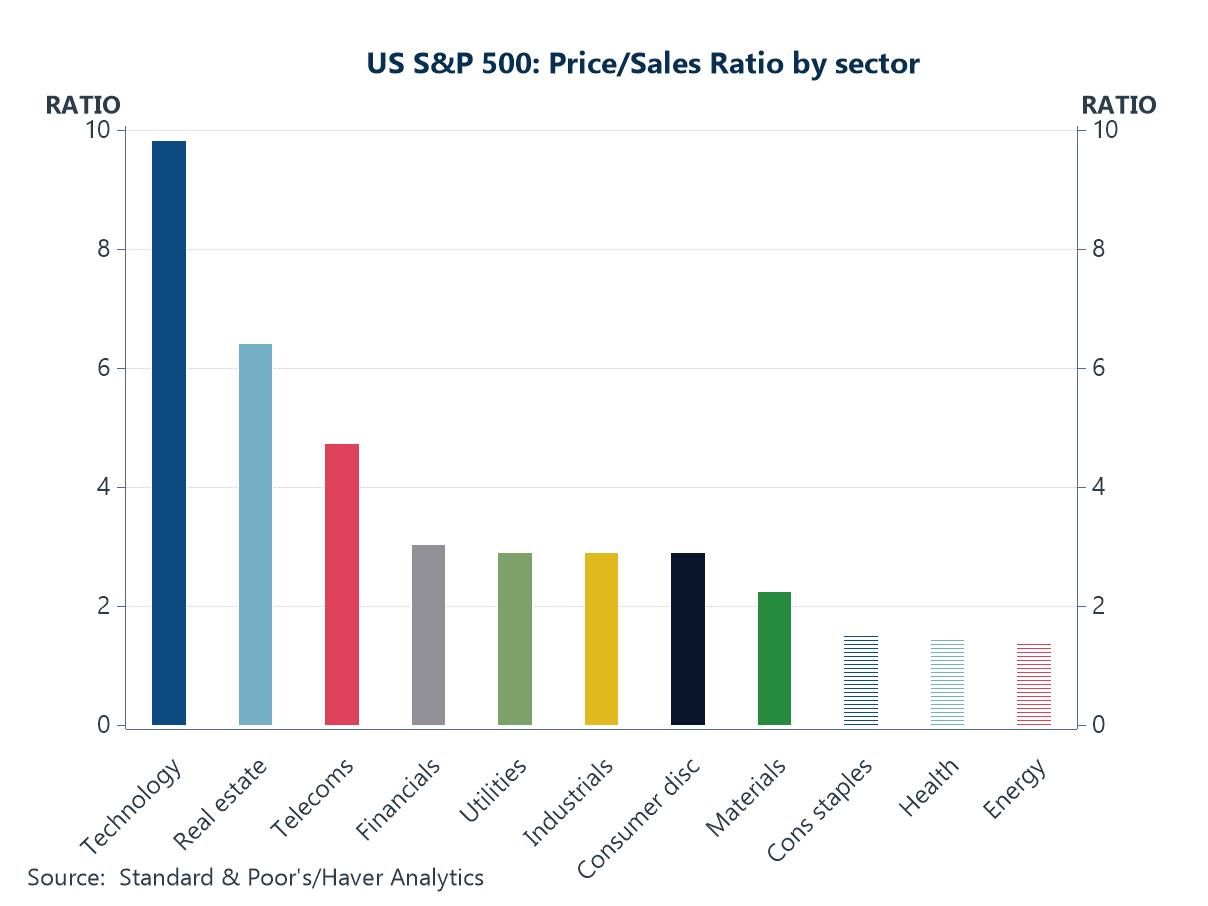

Financial markets have been caught between conflicting crosscurrents in recent days. On the one hand, risk sentiment has been weighed down by mounting concerns over US lenders and broader credit conditions, renewed tariff worries, the ongoing government shutdown, and growing unease about a potential AI-driven valuation bubble (chart 1). On the other, expectations have strengthened that major central banks will continue to ease policy in the face of softer growth and moderating inflation, fueling hopes of a soft landing (chart 2). Supporting that view, oil prices have declined off easing geopolitical tensions in the Middle East (chart 3), and China’s credit impulse—together with stronger-than-expected GDP—has provided a quiet but important lift to global growth momentum (chart 4), even if property market weakness persists. US wage growth also continues to cool according to some private sector surveys (chart 5), helping to ease inflation concerns, while in the UK, softer headline inflation has been welcomed, though sticky services CPI and rising producer prices have tempered the good news (chart 6). Taken together, the macro narrative is one of lingering risks offset by moderating inflation pressures and easing hopes—an uneasy equilibrium that has left financial markets more volatile but still resilient.

by:Andrew Cates

|in:Economy in Brief

- USA| Oct 23 2025

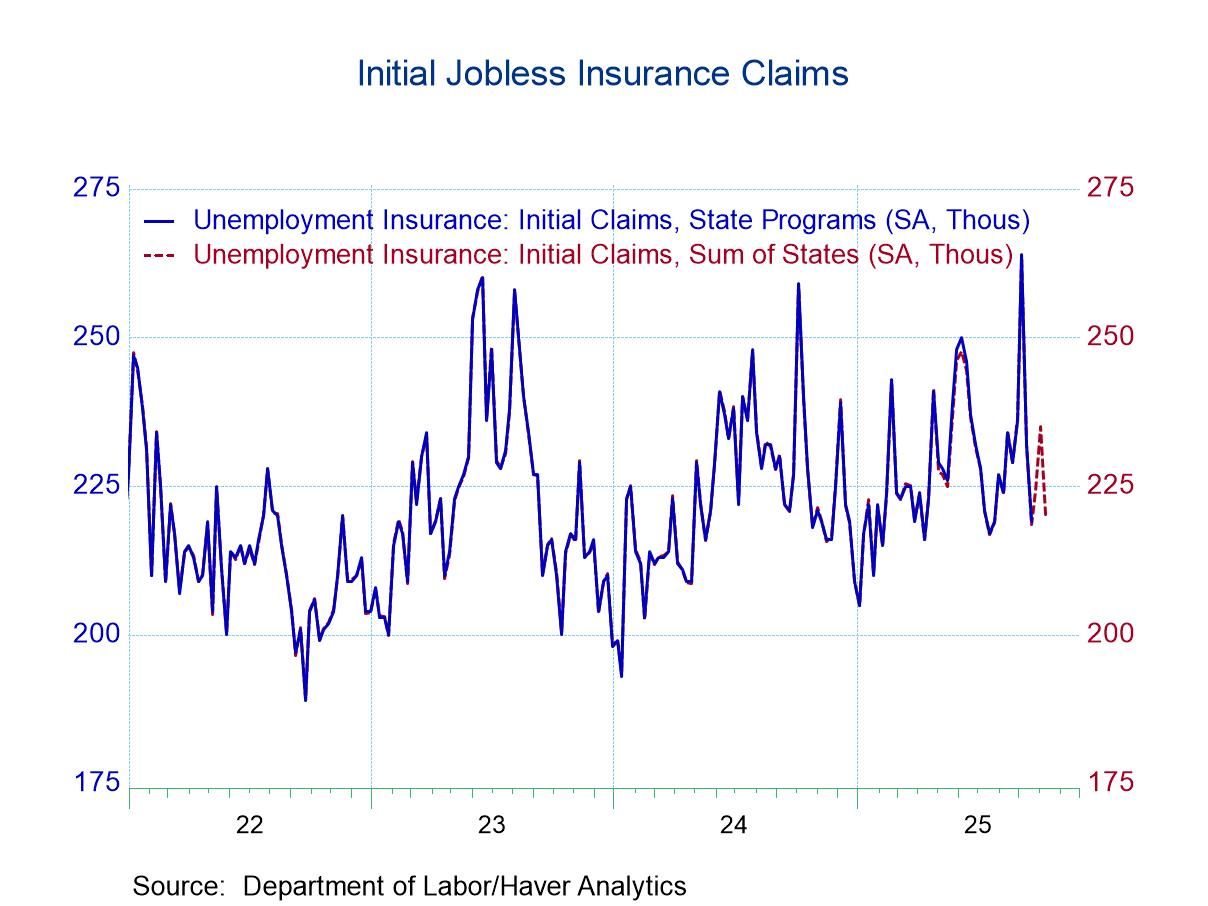

U.S. Unemployment Insurance Claims Ease in Latest Week

- Initial claims decline, reversing earlier increase.

- Continuing claims move lower.

- State unemployment rates vary.

by:Tom Moeller

|in:Economy in Brief

- USA| Oct 23 2025

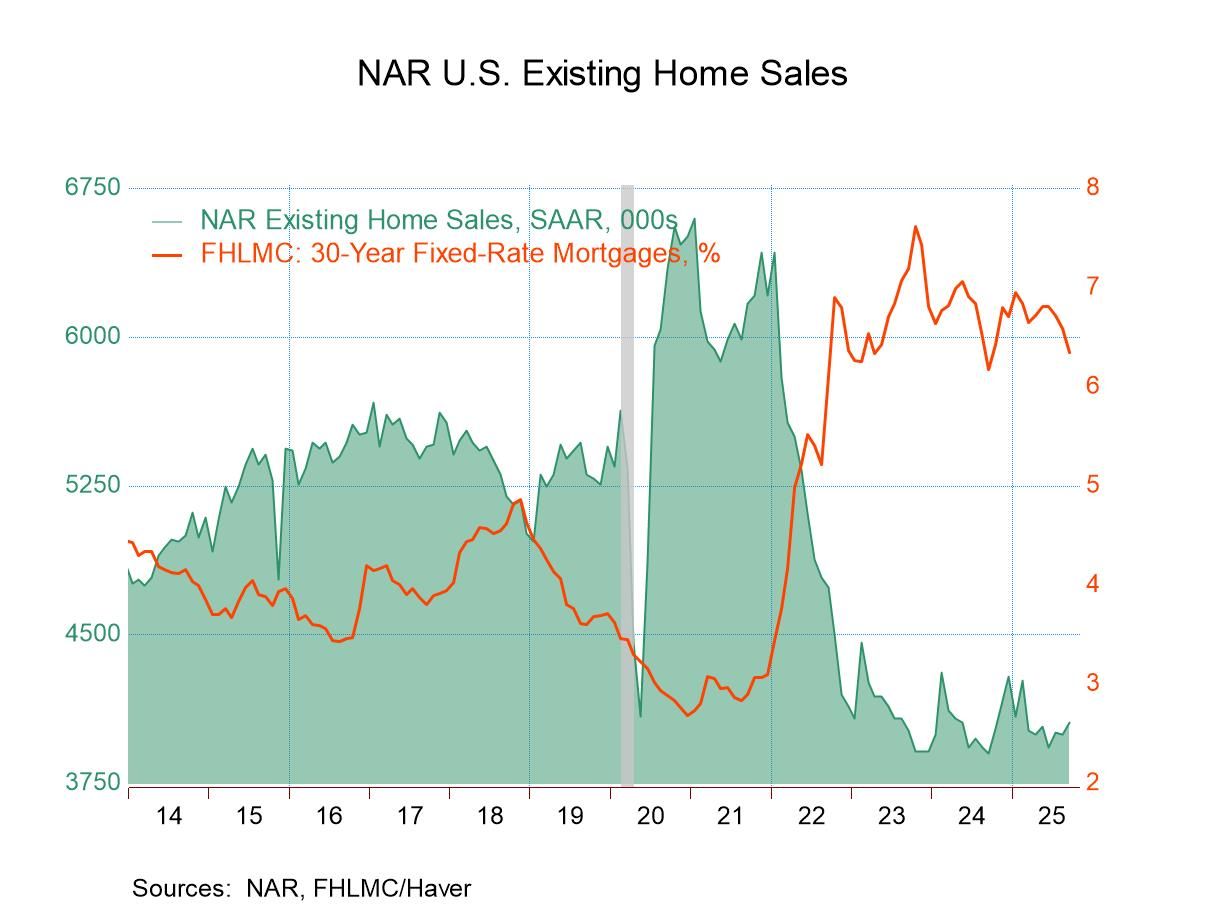

U.S. Existing Home Sales Rise in September; Prices Decline

- Home sales reach their highest level in seven months.

- Sales are slightly higher m/m in most of country.

- Median sales price falls in most of country.

by:Tom Moeller

|in:Economy in Brief

- United Kingdom| Oct 23 2025

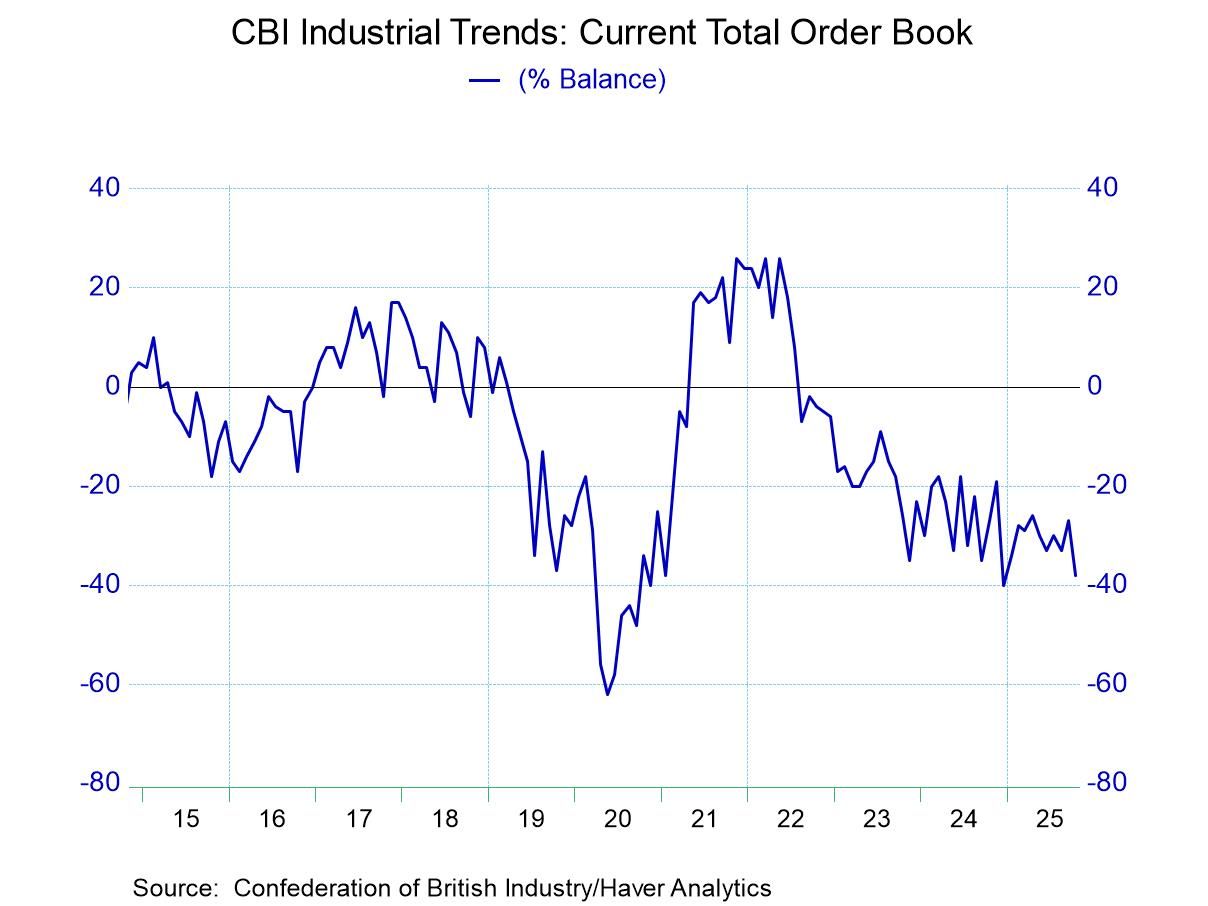

UK CBI Industrial Orders Drop as Prospects Fade

Industrial orders in the United Kingdom fell to a reading of -38 in October from -27 in September this compares also to a level of -33 and August. The 12-months to 6-months to 3-month average progression shows steady deterioration for orders with the 12-month average at a -31 reading, compared to the October reading of -38. Dated back to 1991 the current orders reading ranks in the lower 8% of its historic queue of data, among the observations on that timeline marking this as an exceptionally weak reading on the month and, underpinning the notion, that growth in the UK is weakening and perhaps providing for the Bank of England a way to avoid raising rates in the face of what continues to be excessive inflation.

Export orders also slipped in the month to -46 compared to a reading of -32 in September and -33 in August. Export orders also have deteriorated steadily as the 12-month, the six-month, and the three-month averages are becoming sequentially weaker. Comparisons show the 612-month average at -33 to this month's -46 reading. The percentile standing for export orders is similarly weak to overall orders at a 7-percentile standing.

Looking ahead, the output volume for the next three months finds the index at -19, down from -14 in September and -13 in August. The sequential reading on this metric weakens as well from readings of -9 over 12-months to -12 over 6-months to -15 over 3 months. All that compares to the current October reading of -19. The deterioration there is clearly in place; the queue percentile standing of the October level is at 6%, marking it, once again, as exceptionally weak.

Looking at the prices over the next three months brings an unfortunate increase to 16 from 4 in September and 9 in August. However, the expected inflation results are not on the same deteriorating path as orders trend and expected output. Despite the monthly jump in October, the 12-month average of ‘expected inflation’ is 18, that's reduced to 16 over 6-months and further reduced to 10 over 3 months. The jump in October is a jump that is away from trend, and I suppose we will have to wait to see where it settles in. The trending results for inflation are somewhat more encouraging. The jump in October is quite discouraging although it does come against the background of weakening economic data which simply puts the central bank in a more difficult position to make a policy decision. Price expectations for 3-months ahead have a ranking in their 73rd percentile meaning that they have been stronger a little more than 25% of the time on data back to 1991.

The PMI industrial indicator is up to date through September; here we have a comparison of the manufacturing PMI to the CBI survey. The manufacturing PMI eased to 46.2 from 47 in September. The manufacturing PMI on averages over 12-months, 6-months and 3-months is without a clear trend and has been fluctuating. The manufacturing PMI on data back to 2021 has a 12-percentile standing. The clear message is that conditions in manufacturing in the UK are very weak as the CBI and PMI percentile standings agree. Combined with the CBI inflation outlook, it leaves the BOE in a difficult place.

- of2693Go to 24 page