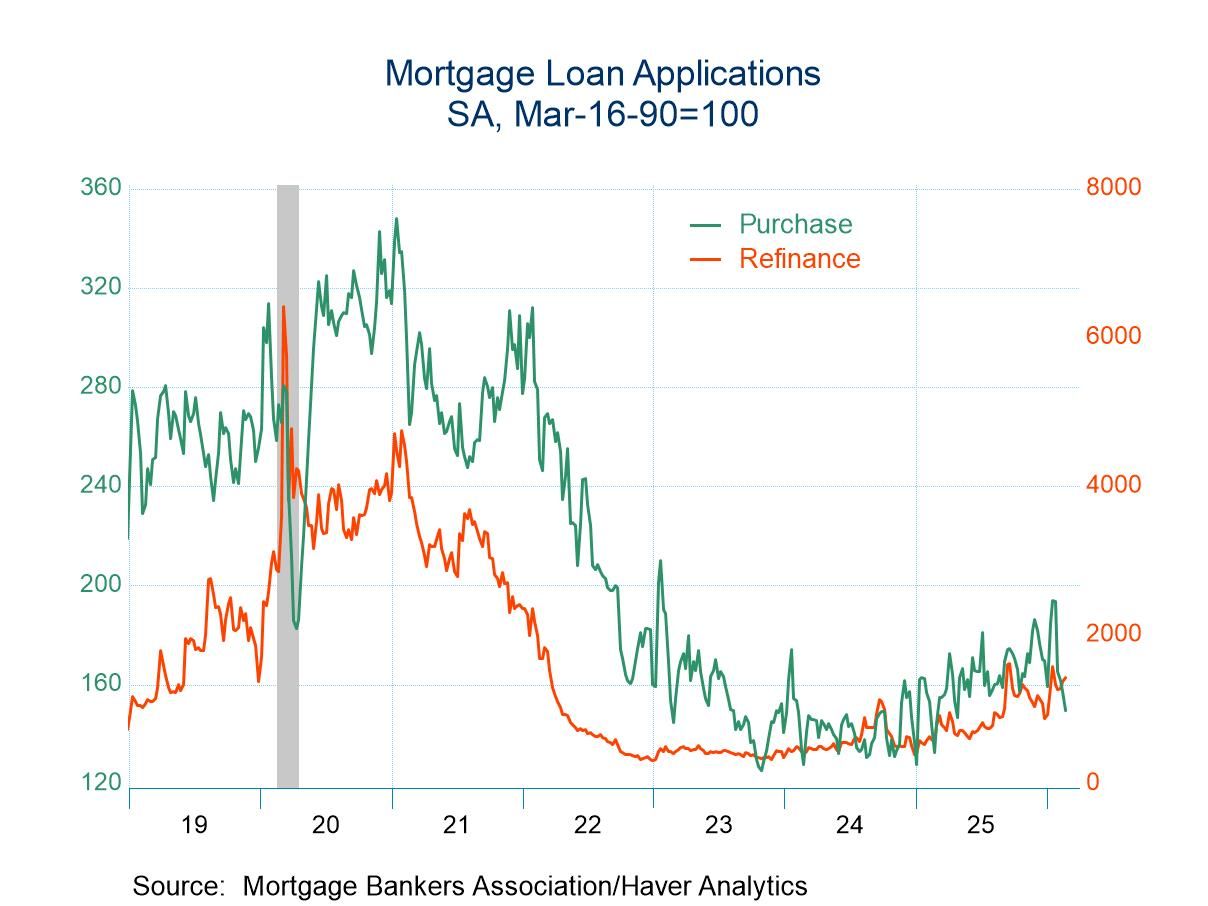

- Applications for loans to purchase declined in the latest week while refinancing loan applications rose.

- Effective interest rate on 30-year fixed loans declined 9bp to 6.24%.

- Average loan size edged up.

- USA| Feb 25 2026

U.S. Mortgage Applications Edged Up in the February 20

- Germany| Feb 25 2026

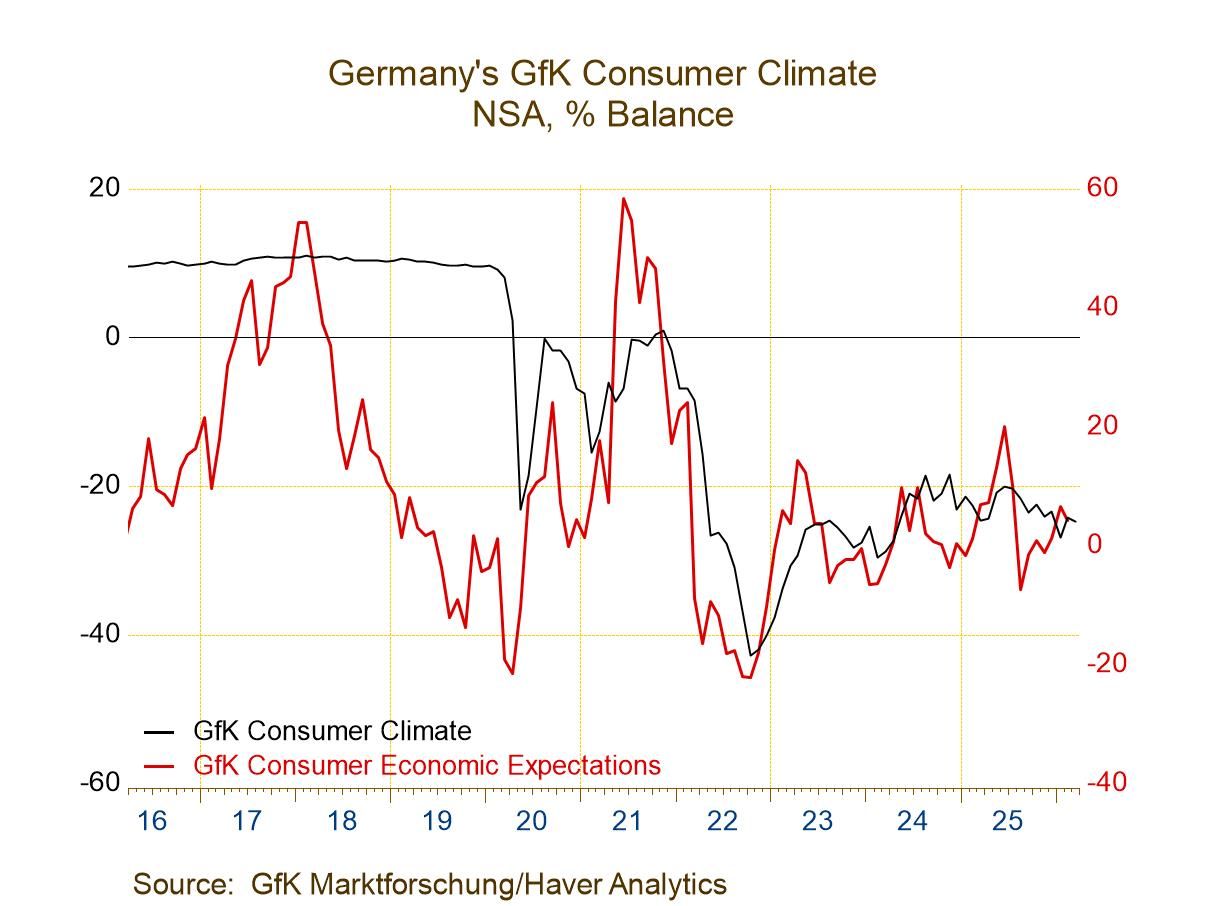

German Confidence: GfK Consumer Climate Erodes

Climate eased in March after improving in February. There still is a net improvement compared to January, but we must turn the calendar back to April 2024 to find a climate reading lower than the current level in March. In sum, there is no sense of ongoing improvement for climate in this report. The economic expectations and income expectations readings, which lag by one month, do show some improvement on a longer timeline. But the propensity-to-buy index is still quite weak.

Climate at -24.7 in March has an 8.2 percentile standing on data back to 2002. The economic expectations, reading, fell back to 4.3 in February from 6.6 in January to set a 49-percentile standing. Income expectations rose to 6.3 in February from 5.1 in January. Income expectations have a 42.4 percentile standing. The propensity to buy weakened sharply to -9.3 in February from -4 in January. Its percentile standing is at a 30.7 percentile level, a bottom one-third standing.

The table also presents consumer confidence readings for three other European economies. Among them, Italy has the strongest ranking at a 74-percentiel standing. The Italian reading is up-to-date through January and has been showing improvement. The United Kingdom and France have similar standings. The U.K. standing is at its 43.7 percentile mark, below its median on this timeline. The U.K. reading is up-to-date through January and has been showing a tendency to improve. France has a rank standing at a 39.7 percentile; it is up-to-date through February. The index has been very slowly improving.

- USA| Feb 24 2026

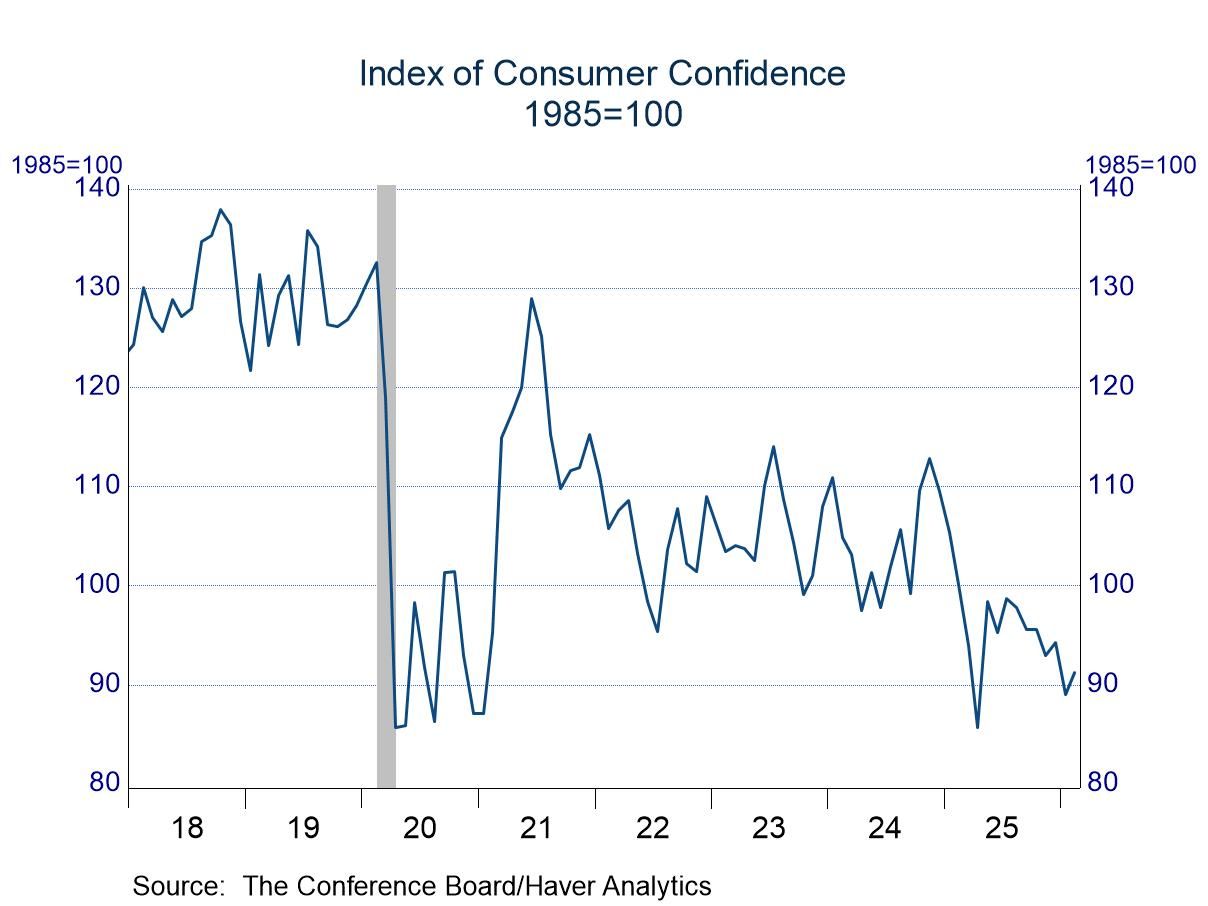

Consumer Confidence: Improvement in February from Upward Revised Levels in January, but Individuals Are Still Unhappy

- Firmer expectations offset dimmer views on the present situation.

- Although views on the present situation dipped, assessments of the labor market picked up.

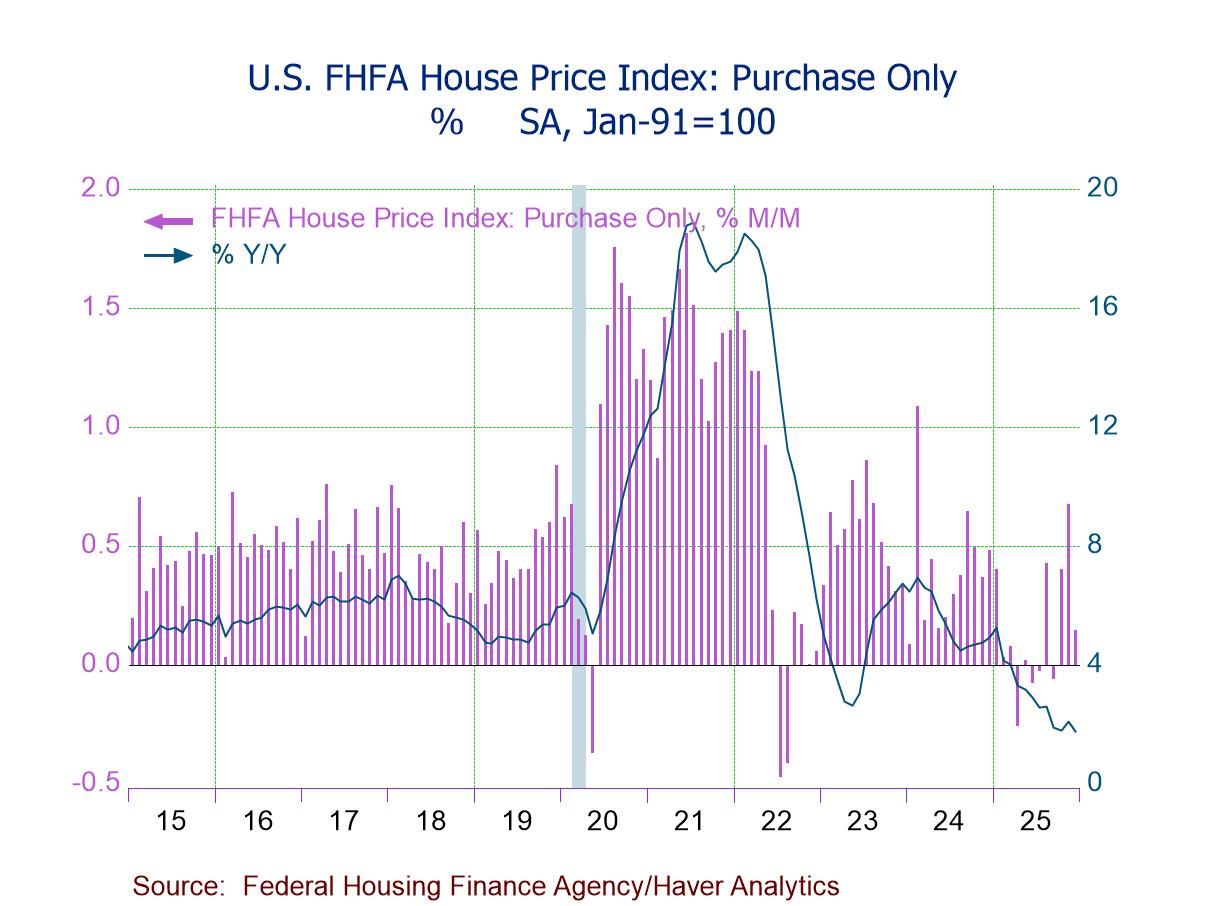

- FHFA HPI +0.1% (+1.8% y/y) in Dec., the smallest of three straight m/m gains.

- House prices up m/m in six of nine census divisions, led by Middle Atlantic (+1.1%), but down in West South Central (-1.0%) and East South Central (-0.1%); prices flat m/m in Pacific.

- House prices up y/y in six of nine regions, led by East North Central (+5.2%), but down in Mountain (-0.6%), Pacific (-0.4%), and South Atlantic (-0.1%).

- House price growth accelerates to 0.8% q/q (+1.8% y/y) in Q4'25 from 0.3% q/q (+2.4% y/y) in Q3.

- France| Feb 24 2026

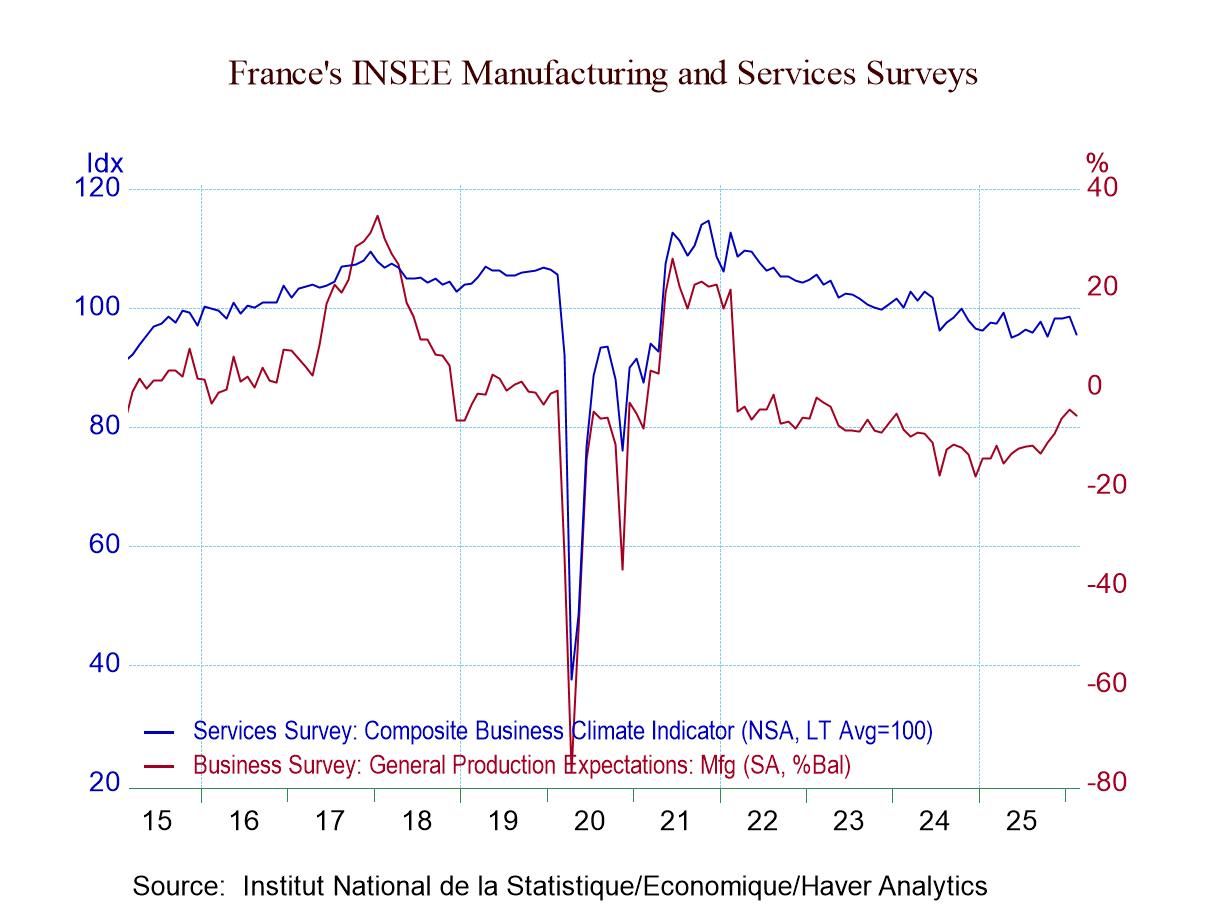

French Manufacturing and Services Surveys: Two Sectors, Two Different Trends, and Lingering Weakness

Neither the service sector nor the manufacturing survey value is particularly strong. The services climate headline has a 25-percentile standing; it has been higher about 75% of the time. That is not a good result. For manufacturing and industry, the standing is just short of the 50% mark which leaves it quite close to its historic median. That is not strong, but it is not weak either; it’s a modest middle ground. But February’s reading gave up ground, falling to 102.1 from 105.4 in January, back essentially to its December 2025 level. Even so, the February value has not been exceeded persistently until we go back to August 2022—three and one-half years ago.

The rebound in manufacturing is nascent; we can question its sustainability. And it is also only a modest step up after February’s erosion. Orders and demand flared higher in January and backed down in February. Orders and demand have a 50-percentile standing, with foreign orders much stronger at a 75-percentile standing. While production has a sub-median, 42-percentile standing, responses, when aggregated, show an ‘own-personal’ response standing at 62.2%. Maybe there is more granular, industry-level confidence that is being restrained by macroeconomic pessimism. This two-tier response is recreated compatibly for prices where firms see high own price trends stronger than their whole-economy trend. The own-price trends are elevated with a ranking over their 60th percentile while the macro price expectation is at a 48-percentiel standing. Production expectations are a classical representation of this month’s survey, falling back this month after some improvement last month and sporting a 49.1 percentile standing – a near median result. The manufacturing survey does not suggest any trouble; it exhibits near normal behavior, with orders at a midstream level/ranking.

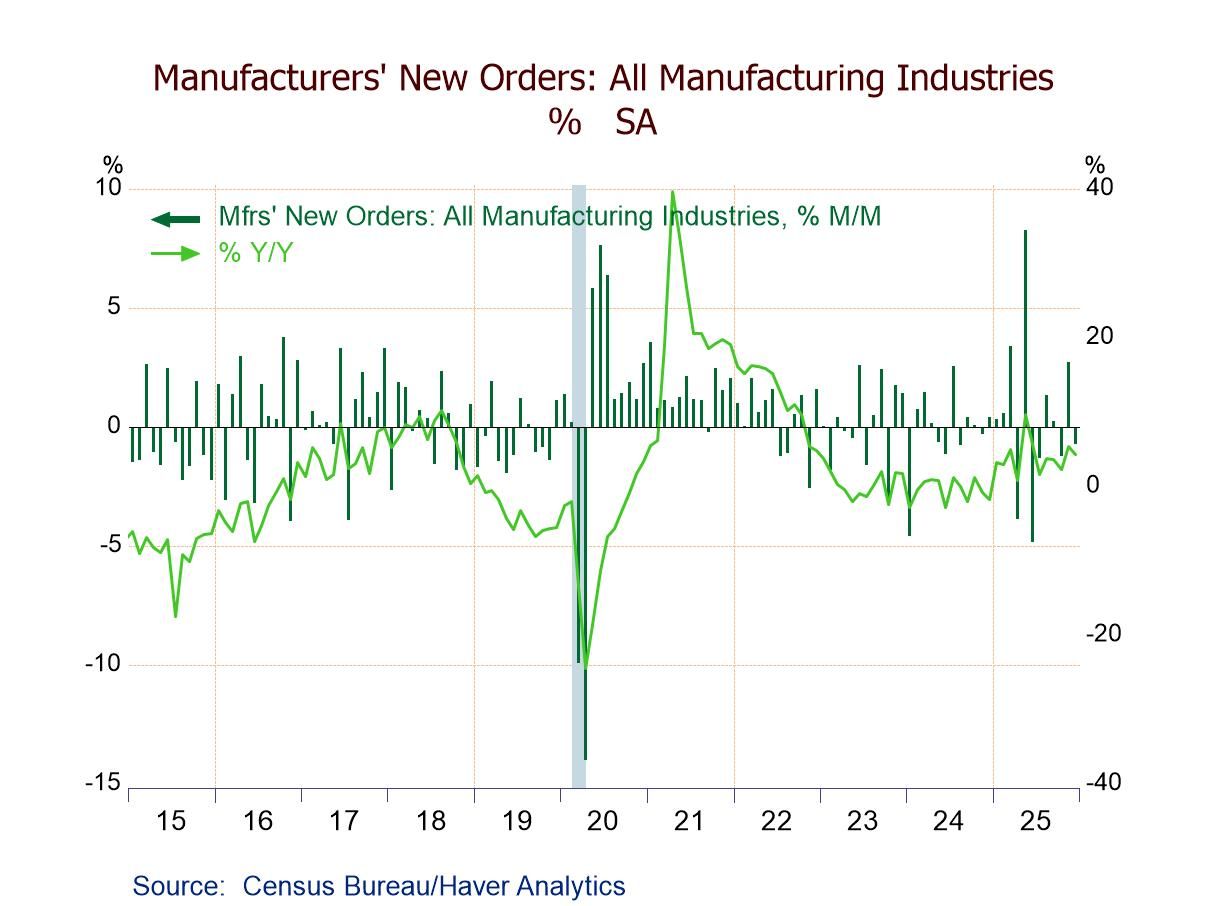

- December factory orders -0.7% m/m (+4.3% y/y); still 7.2% above the Jan. ’24 low.

- Durable goods -1.4% m/m; nondurable goods orders flat; shipments +0.5% m/m.

- Transportation orders -5.4% m/m, led by a 24.8% plunge in nondefense aircraft orders.

- Unfilled orders +0.9%, the fifth straight m/m rise.

- Inventories +0.1%, the second consecutive m/m increase.

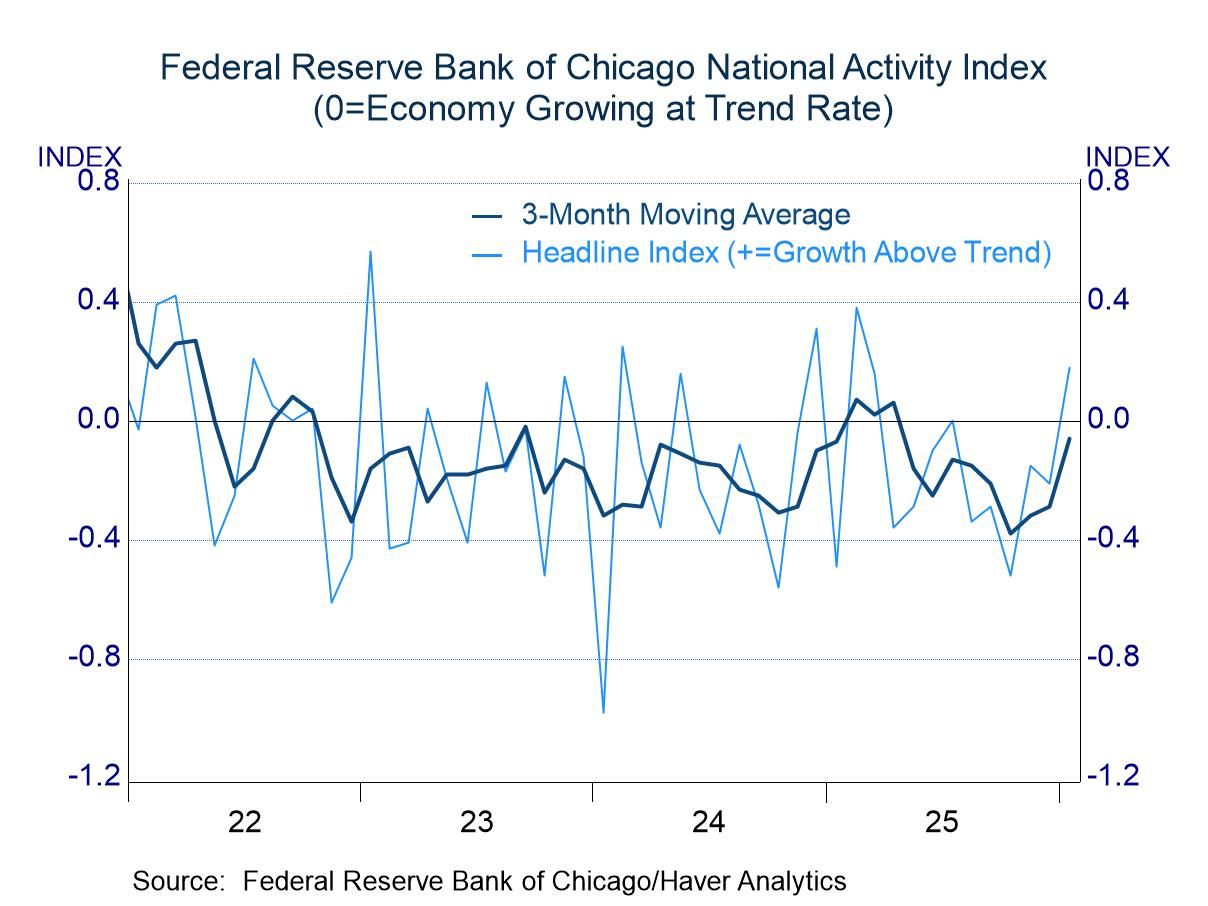

- January results showed noticeable improvement from prior months.

- All four components contribute positively.

- Germany| Feb 23 2026

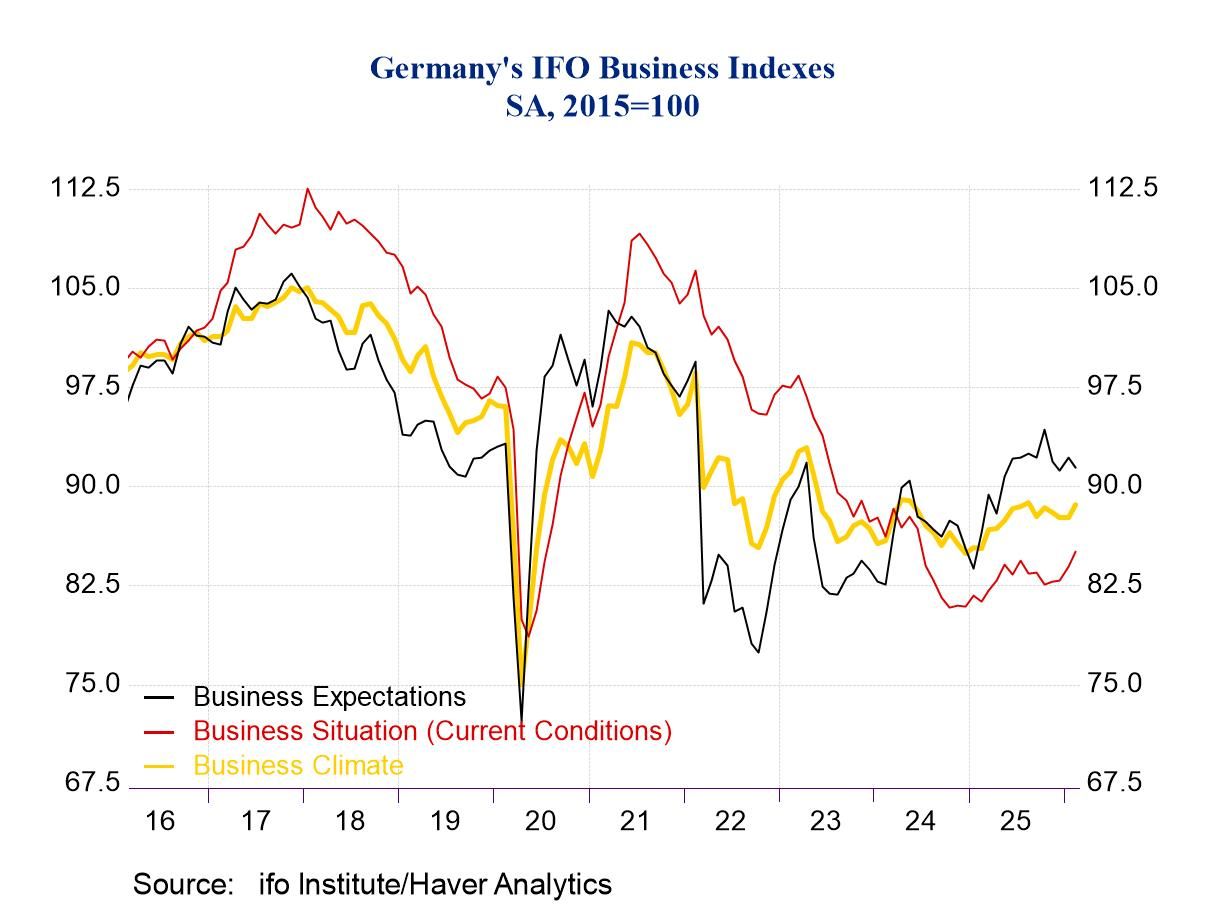

German IFO: Business Confidence Claws Its Way Out of a Hole

Germany's IFO index shows improvement in February compared to January. The climate index improves, the current conditions index improves, and expectations improve. All three all-sector headlines improve in February compared to January. However, all three metrics continue to register net negative readings, indicating that the sectors are showing more contraction than expansion, but less contraction than it had been the case previously. We ranked these headlines on data back to 1993; the climate index has a 22.5 percentile standing, expectations have a 22.4 standing, and current conditions have a 16.9 percentile standing. All three of the headline metrics have standings in the lower quartile of their queue of values back to the early 1990s. This is clearly not a stellar report but a report from an economy that is struggling. Even though it's widely reported that the climate index is currently on a six-month high; it may be on a six-month high, but it's not really much different than it was six months ago and only up by 1.1% from its lowest mark in the intervening five months—so not impressive. This is a grueling, crawling, dig-out from difficult circumstances. The COVID pandemic was a sucker punch to the global economy, and it was followed by the Russian invasion of Ukraine that hit Europe especially hard because of the proximity.

Since then, other geopolitical tensions have risen. Europe's relationship with the United States has deteriorated, in part because Europe—Germany in particular—was reluctant to detach itself from its mercantile relationships with Russia and was also reluctant to increase its financial participation in NATO. The U.S. was carrying the burden of the protective umbrella for Europe at a time when Europe didn't really think it needed a protective umbrella and so it was unwilling to pay for anything more substantial. When the rainy day came and when the Russian invasion of Ukraine occurred, Europe was completely unprepared and the U.S. was its protector. While Germany and other European countries quickly made it clear that they were fully on board with NATO defense, the U.S. was much less enthusiastic about carrying the burden after Europe had put its financial probity ahead of its defense spending obligations. Now Europe does not see the U.S. and its perceived greater needs for security because of improved navigation from the Arctic Circle to the North Atlantic.

These troubles continue to dog the relationship between the United States and Europe, and the European Community. And Europe’s own economic struggles continue. In the climate readings, all four of five sectors improve from January to February. Current conditions improve in three of the five sectors, with retailing and wholesaling slipping month-to-month. Expectations do improve overall, but three of five sectors take a step back in February, with expectations improving sharply for services, and substantively for wholesaling. Still manufacturing, construction, and retailing expectations stepped back.

Across the three broad areas of assessment across five sectors in each, there are only two (two of fifteen) sector metrics that rank above their 50th percentile (above their respective medians) when ranked against readings back to 1993. Both of those elevated rankings are for construction, one for Climate, and the other for current conditions, but construction expectations, at a 44.5 percentile standing, are not far below their median.

Still, the lowest environmental standings are for services, except under expectations where the services reading is second-weakest to retailing. The graphic shows some tendency for an upturn in climate and current conditions, but they are countered by an expectations path that has topped out and has been gradually leaning lower—and doing that with a current ranking in only its 22.5 percentile. So, while there is some life in the IFO survey this month, we are still looking at a patient in intensive care, not one ready to join Olympic competition—at least not yet.

- of2699Go to 2 page