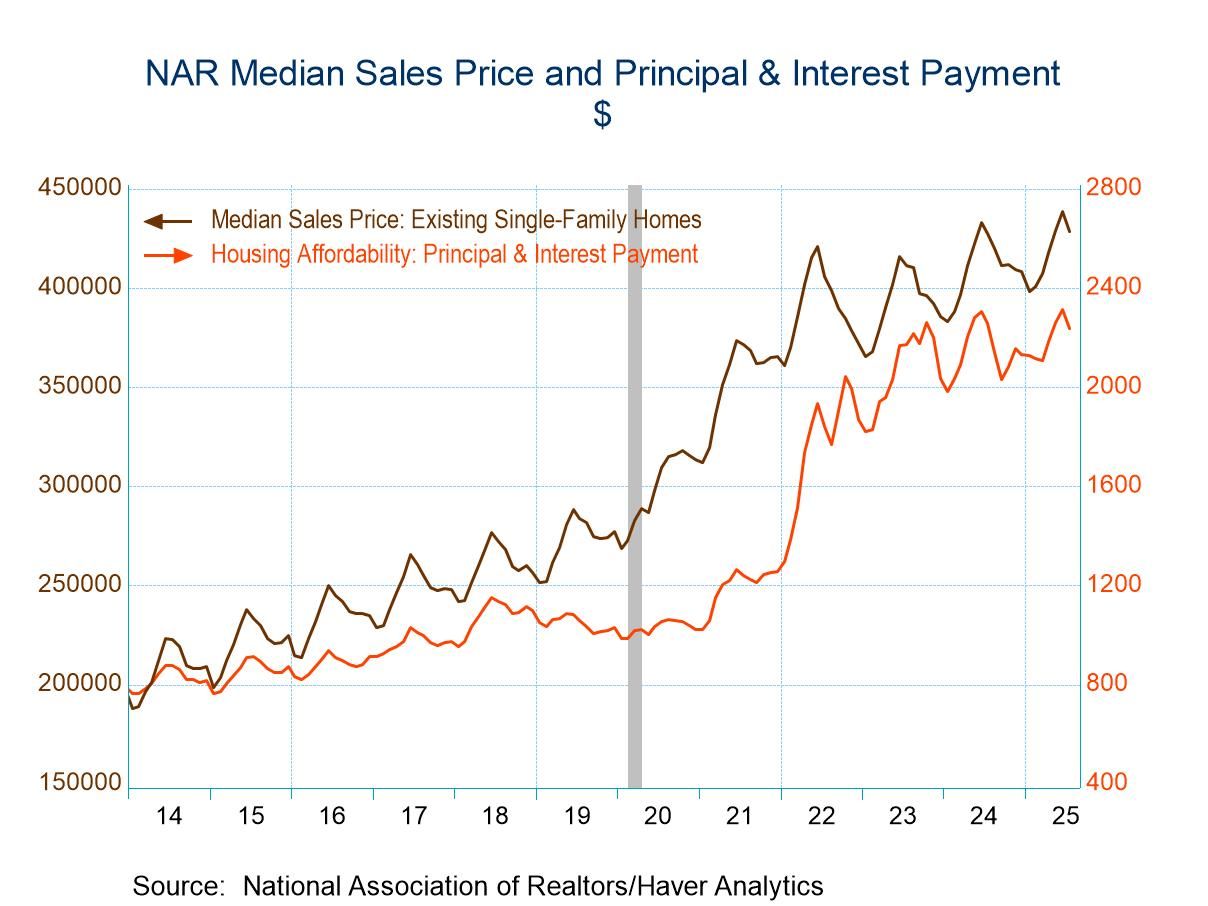

- Home prices & mortgage rates slip.

- Median income edges higher.

- Affordability increases across country.

- USA| Sep 12 2025

U.S. Housing Affordability Improves in July

by:Tom Moeller

|in:Economy in Brief

Global| Sep 11 2025

Global| Sep 11 2025Charts of the Week: Labouring the Point

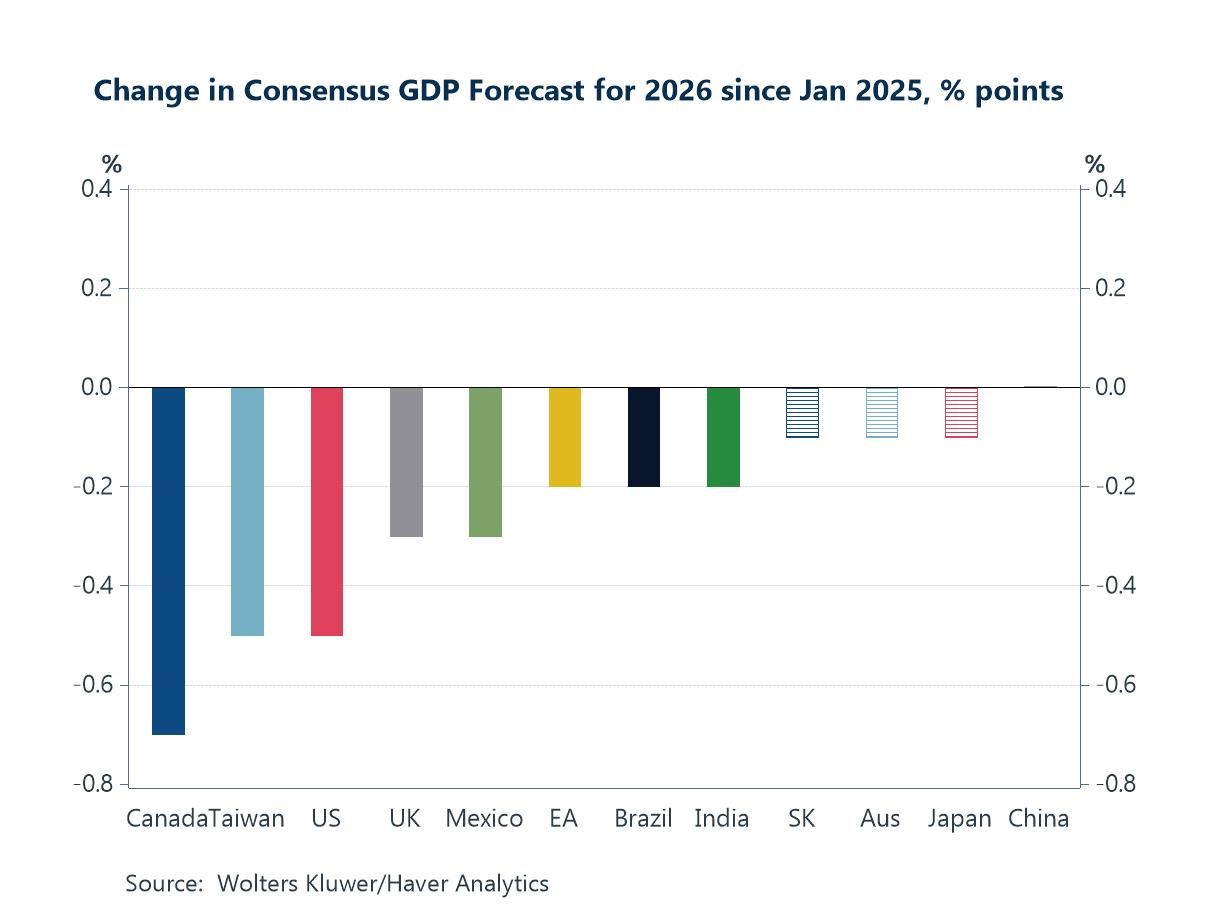

Financial markets have spent the week recalibrating after last Friday’s much weaker-than-expected US payrolls data: government bond yields have declined sharply, while equity markets have remained perky off hopes of a gentler policy path and still-resilient earnings. Even so, the medium-term growth lens has dimmed—since January, consensus GDP forecasts for 2026 have been marked down across most major economies, reflecting a tougher trade regime and geopolitical frictions (chart 1). Turning to the data, the BLS’s preliminary payroll benchmark revision shaved 911k jobs from US employment from April 2024 to March 2025, confirming the idea of a broader cooling in hiring (chart 2). Within that softer backdrop, the composition of job creation has tilted further toward healthcare and social care - not just in the US - supporting headcount but possibly diluting aggregate productivity (chart 3). Elsewhere, China’s latest trade print highlighted a continued rotation of exports away from the US toward other Asian economies (chart 4). On vulnerabilities, France’s private-sector debt leverage—well above peers—underscores that crises more often spring from private balance sheets than sovereign ones (chart 5). And, finally, fears that new US tariffs would reignite supply-chain pressures continue to look overstated, at least for now (chart 6).

by:Andrew Cates

|in:Economy in Brief

- USA| Sep 11 2025

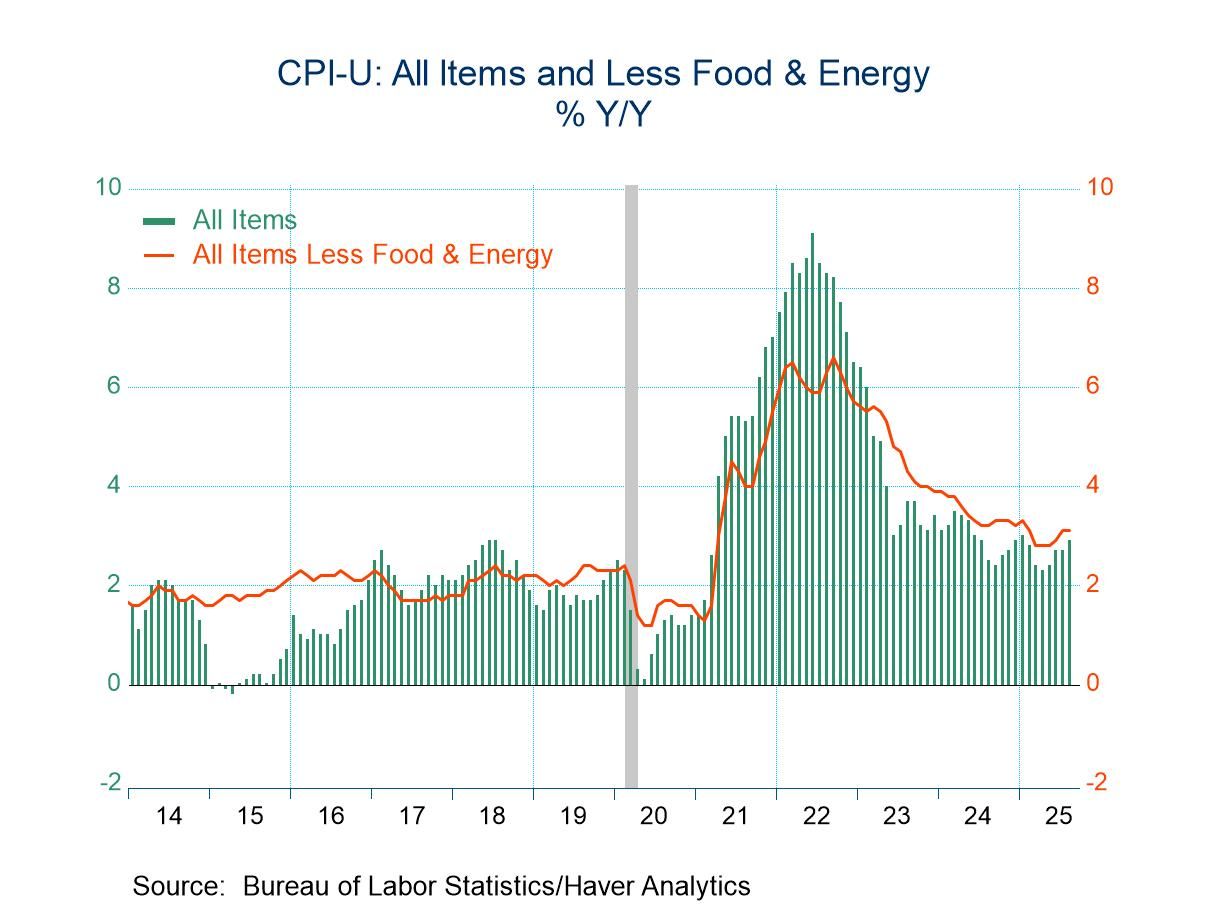

U.S. Consumer Price Inflation Firms in August

- Energy & food prices strengthen.

- Core inflation steadies.

- Core goods gain increases but core services inflation eases.

by:Tom Moeller

|in:Economy in Brief

- USA| Sep 11 2025

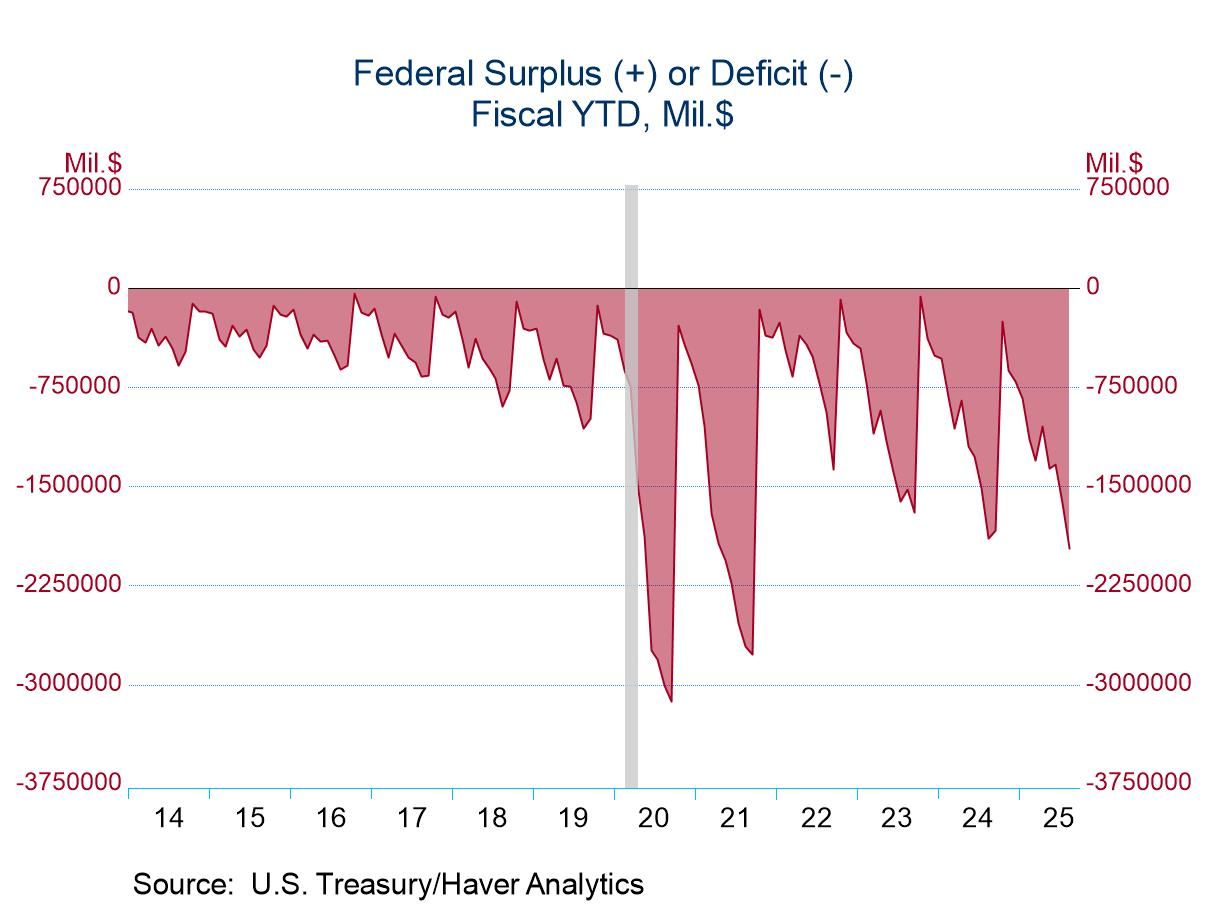

U.S. Federal Budget Deficit Deepens in August

- Monthly deficit is well above expectations.

- Revenues rise moderately while outlays surge.

- Deficit increases in first eleven months of FY’25.

by:Tom Moeller

|in:Economy in Brief

- USA| Sep 11 2025

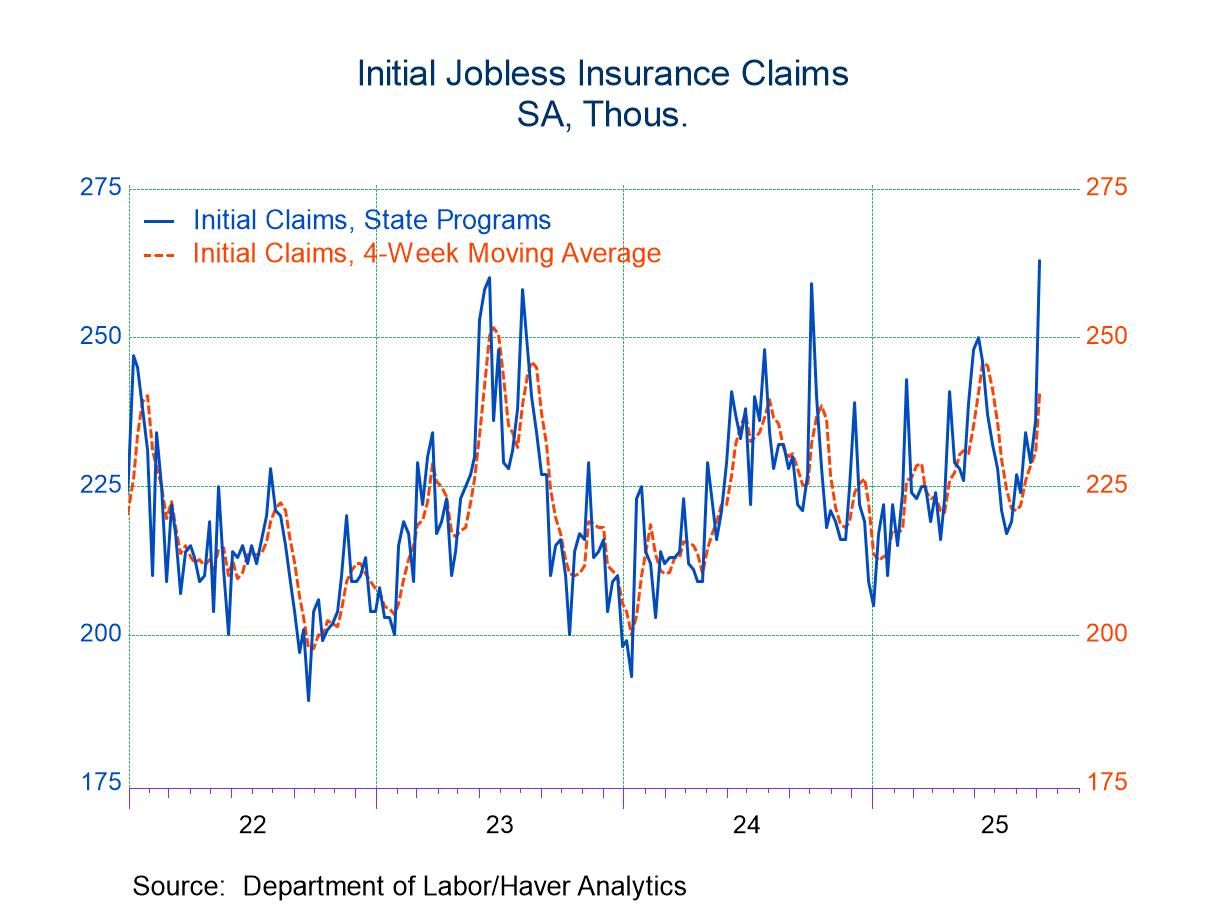

U.S. Initial Unemployment Insurance Claims Jumped in Latest Week

- Initial claims jumped 27,000 in latest week containing the Labor Day Weekend.

- Continuing claims were unchanged.

- Insured unemployment rate holds steady.

- Japan| Sep 11 2025

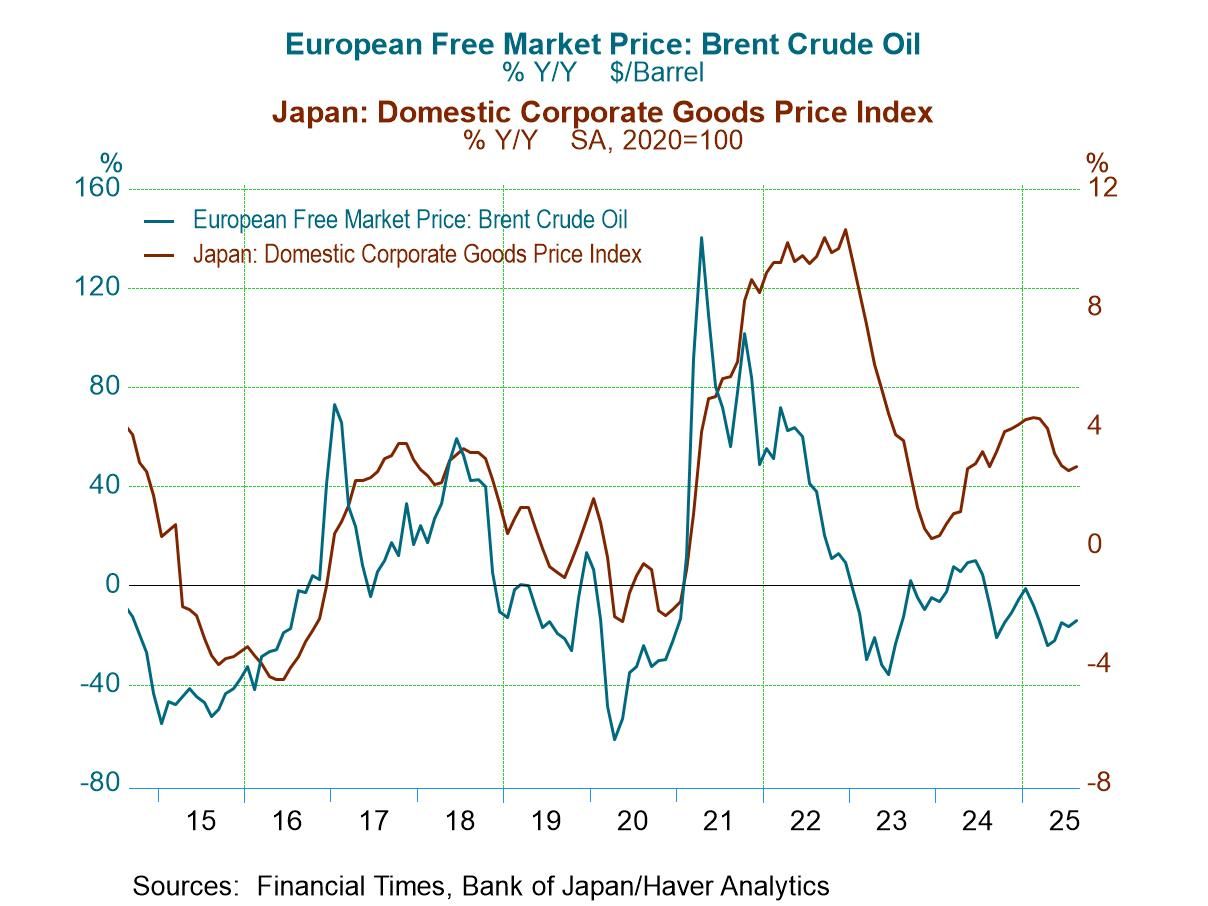

Japan’s PPI Plods Ahead

Japan’s PPI data reveal that not all the inflation measures are flashing danger or warning signals. Japan's preferred CPI gauge that excludes energy & fresh food, for example, is one of the hottest gauges of inflation. It happens to be the gauge that the Bank of Japan emphasizes the most and so it has put policy somewhat on edge worried about inflation.

However, the other Japanese metrics are not showing the same degree of inflation that that one is showing. The PPI from Japan was up by 0.2% for the second month in a row in August after falling by 0.2% in June – a very restrained performance. The 12-month inflation rate is 2.7% that falls to 1.1% over six months, then to 0.6% over three months – all at annual rates. For all of manufacturing, the PPI is up by 1.6% over 12 months, flat over six months and then back up to 1.3% over three months; none of these are particularly troubling inflation gauges although I recognize that the PPI is not the CPI and this is not the target of monetary policy.

Still, for Japan, it's reassuring to see that inflation is not simply running wild. In fact, when viewed in several different ways, it's actually rather controlled.

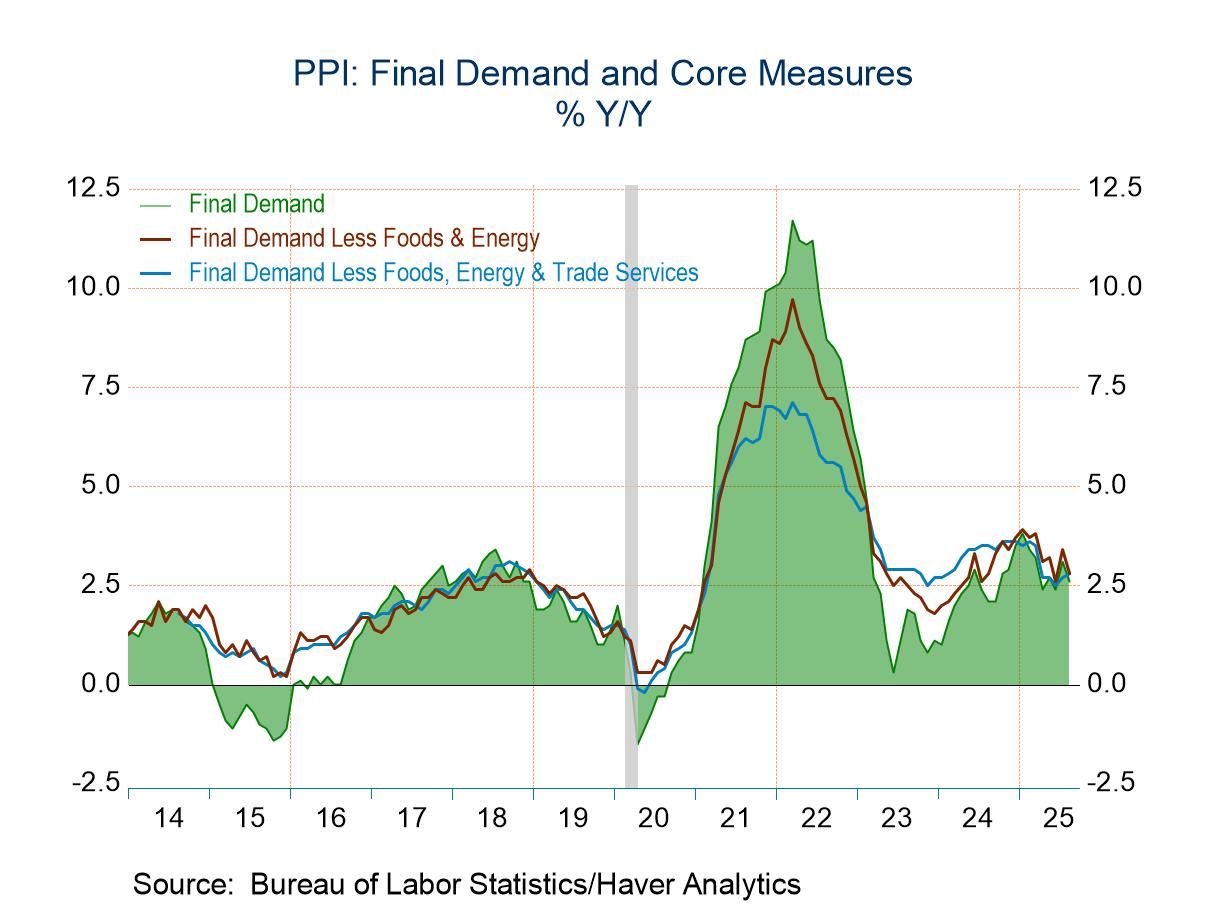

Viewing inflation in Japan and the context of trends in the United States and then the European monetary Union, we find that the broad pressure inflation is concentrated in the U.S. although it may not be tariff-related. In Europe, inflation is broadly controlled. The U.S. is showing the most pressure and of course it has the strongest economy, and it also has an ongoing problem with tariffs that are putting some extra measure of pressure on prices. The U.S. PPI generates a very strong inflation rate over three months - and even an elevated 12-month reading of 3.5%. However, we don't see anything like that coming out of the European Monetary Union where year-over-year inflation is barely positive even though over the most recent three months inflation has accelerated to a 2.2% annualized rate. That's still a relatively subdued rate.

In Japan, the ordinary CPI and the core show relatively subdued inflation over the last year. The headline CPI is 3.1% over 12 months, but it dives under 2% over six months and to a 2.2% pace over three months. Japan's core is only 1.6% over 12 months and its annual rates are under 2% for six months as well as for three months. The inflation situation in Japan, particularly for producer prices, seems to be in pretty good shape with the quarter-to-date inflation rate for the PPI at 0.6% and for all of manufacturing at 0.8%. With oil prices remaining moderate, the outlook for inflation to remain in this more moderate range is still good, and Japan continues to have weak growth; demand should not be putting pressure on inflation. The Bank of Japan should be relatively happy with Japan's producer price number, the domestic corporate goods price index for August.

- Energy prices fall while food prices edge higher.

- Trade service prices decline after sharp increase.

- Core goods price inflation eases.

by:Tom Moeller

|in:Economy in Brief

- USA| Sep 10 2025

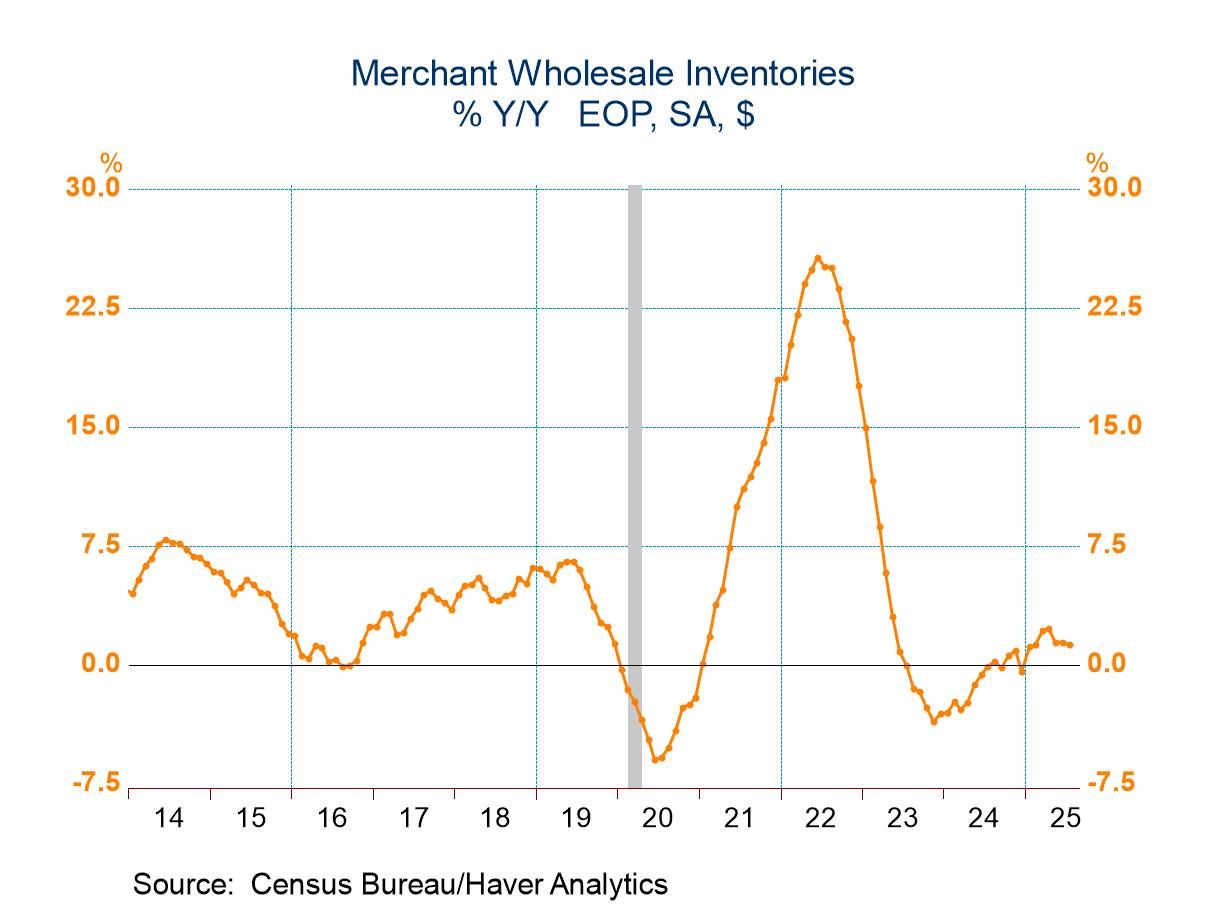

U.S. Wholesale Inventories Edge Higher in July; Sales Surge

- Durable goods inventories fall as nondurables rise.

- Sales strengthen broadly.

- I/S ratio eases to another three-year low.

by:Tom Moeller

|in:Economy in Brief

- of2700Go to 42 page