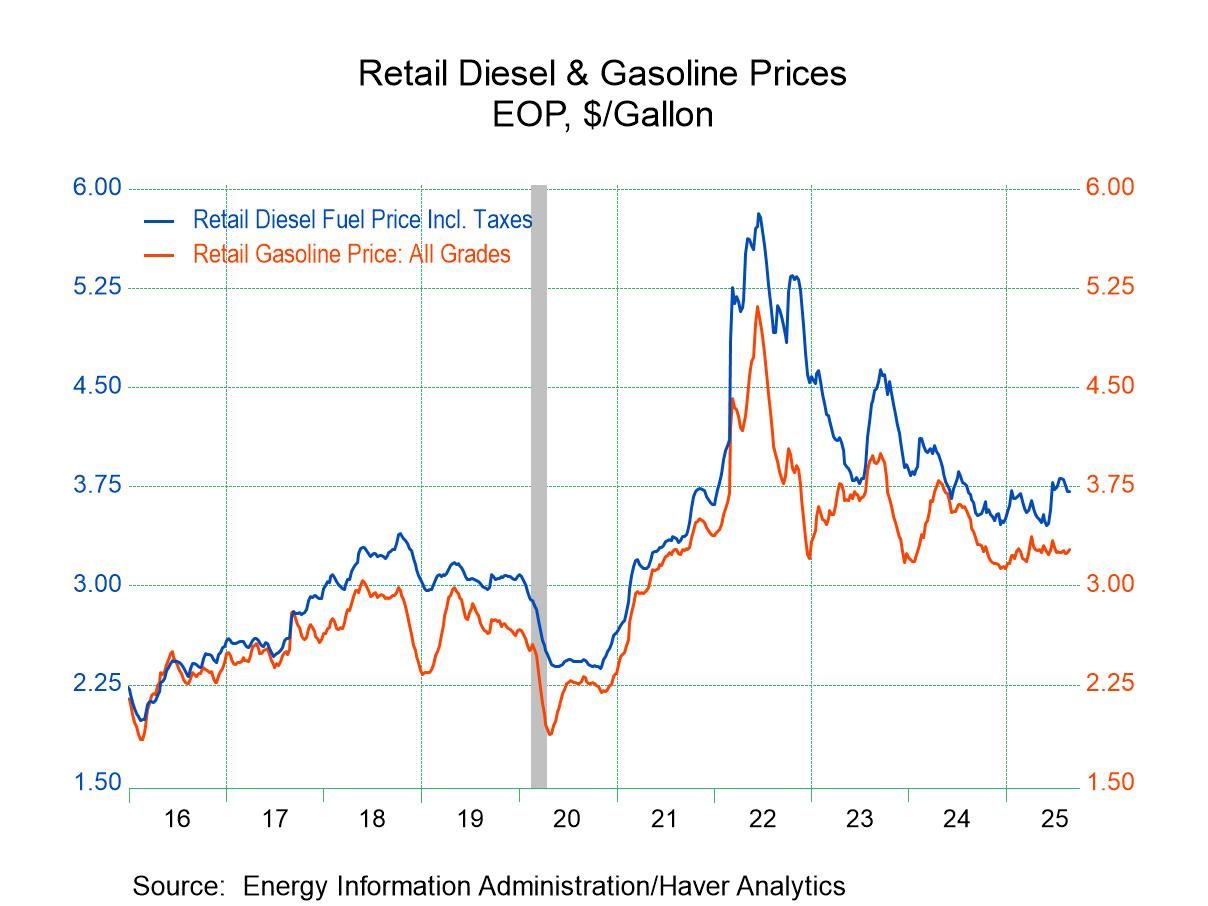

- Gasoline prices rise.

- Crude oil prices ease.

- Natural gas prices decline.

- USA| Aug 26 2025

U.S. Energy Prices Are Mixed in Latest Week

by:Tom Moeller

|in:Economy in Brief

- France| Aug 26 2025

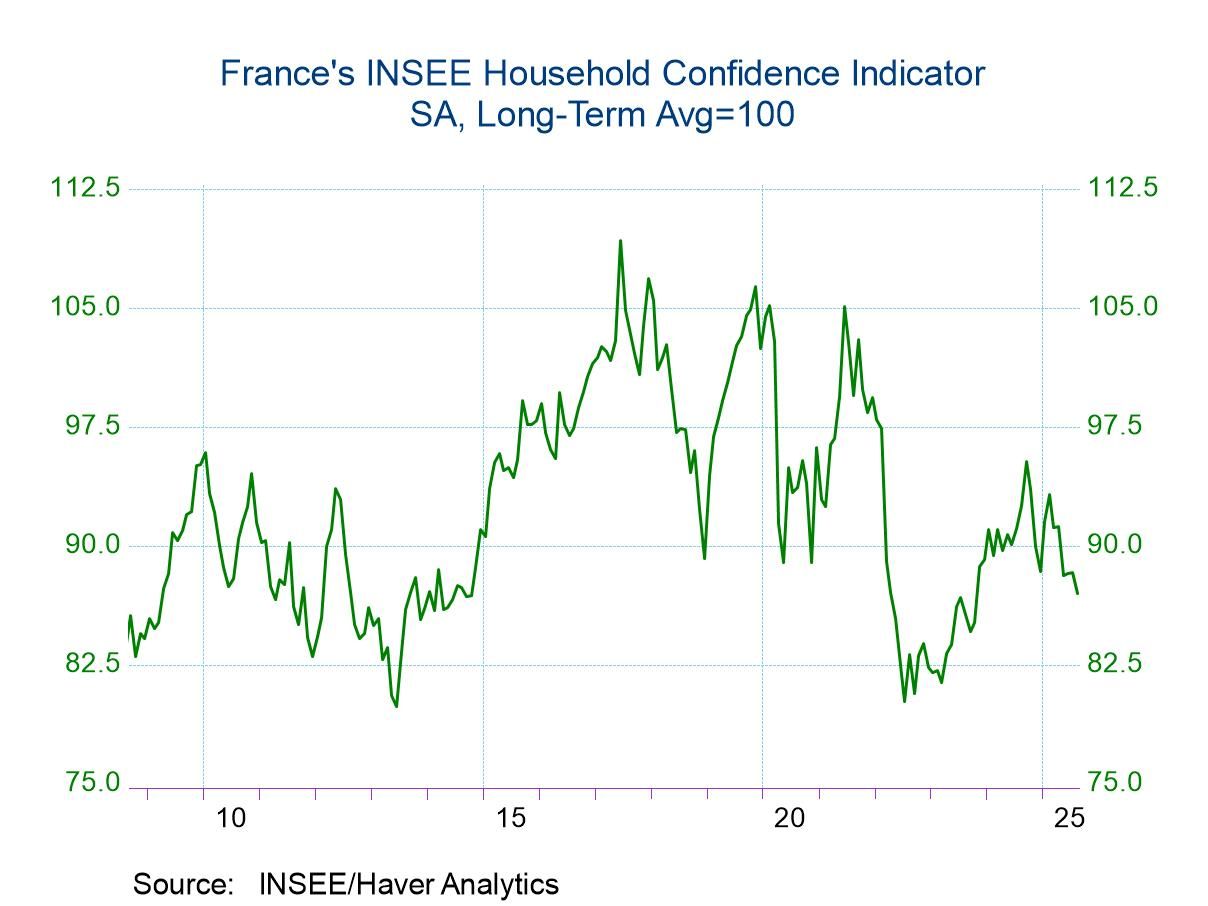

French Consumer Confidence Weakens

Low confidence French consumer confidence as reported by INSEE fell to 86.98 in August from 88.31 in July; the standing leaves that reading in its 21.7 percentile of data back to August 2004. This reading, which hovers between the lower 20th percentile and the 25th percentile, clearly indicates weak conditions and assessments on the part of French consumers.

Living standards past and future are poor The assessment of living standards over the last 12 months weakened in August to -74.2 from an assessment of -70.8 in July. Past living standards have a percentile standing in their 17.8 percentile placing them in the lower 20th percent of their historic queue of data.

Living standards for the next 12 months, a more pertinent reading, slipped to -63.9 in August from -61.5 in July. While the negative reading isn't as deep as for the past 12 months, the ranking of that rating is even worse in its lower 4-percentile! The expected living standards over the next 12 months have been weaker only 4% of the time back to August 2004. That is certainly a worrisome development.

Unemployment is more feared Unemployment expectations for the next 12 months moved up to an index value 55.6 in August from 54.2 in July and have a 73.5 percentile standing- a top 30% standing among historic data back to August 2004.

Inflation pressures exist and are tepid The assessment of prices for the last 12 months weakened to -8.5 in August from -6.1 in July; the past 12 months’ assessment of prices has 43.9 percentile standing, slightly below its median for this backward-looking horizon. However, assessments of prices for the next 12 months have a -26 rating, a higher reading than -30 in July and -40 in June; that bears a standing in its 52.4 percentile, above its historic median indicating that some further inflation pressure is expected- a bit more than normal.

Favorability to save The favorability to save and the ability to save over the next 12 months had dipped slightly in August, but they have very high standings as the favorability to save has an 88.5 percentile standing and the ability to save over the next 12 months has a 96.8 percentile standing.

Spending environment is still solid The environment for spending is somewhat mixed although generally quite solid and positive. The exception is the favorability to buy a car which slipped slightly in August and has a 39.7 percentile standing for that response which means that it's only less favorable to buy a car about 40% of the time. However, the favorability for home purchases and housing renovation, while both of them increased slightly in August, have standings in their 78.6 percentile and 88.5 percentile, respectively. The favorability to buy consumer durables improved in July and stayed at that reading of -4 in August; the reading corresponds to a 76.2 percentile standing which is roughly a top 25 percentile response.

Asia| Aug 26 2025

Asia| Aug 26 2025Economic Letter from Asia: A New Normal

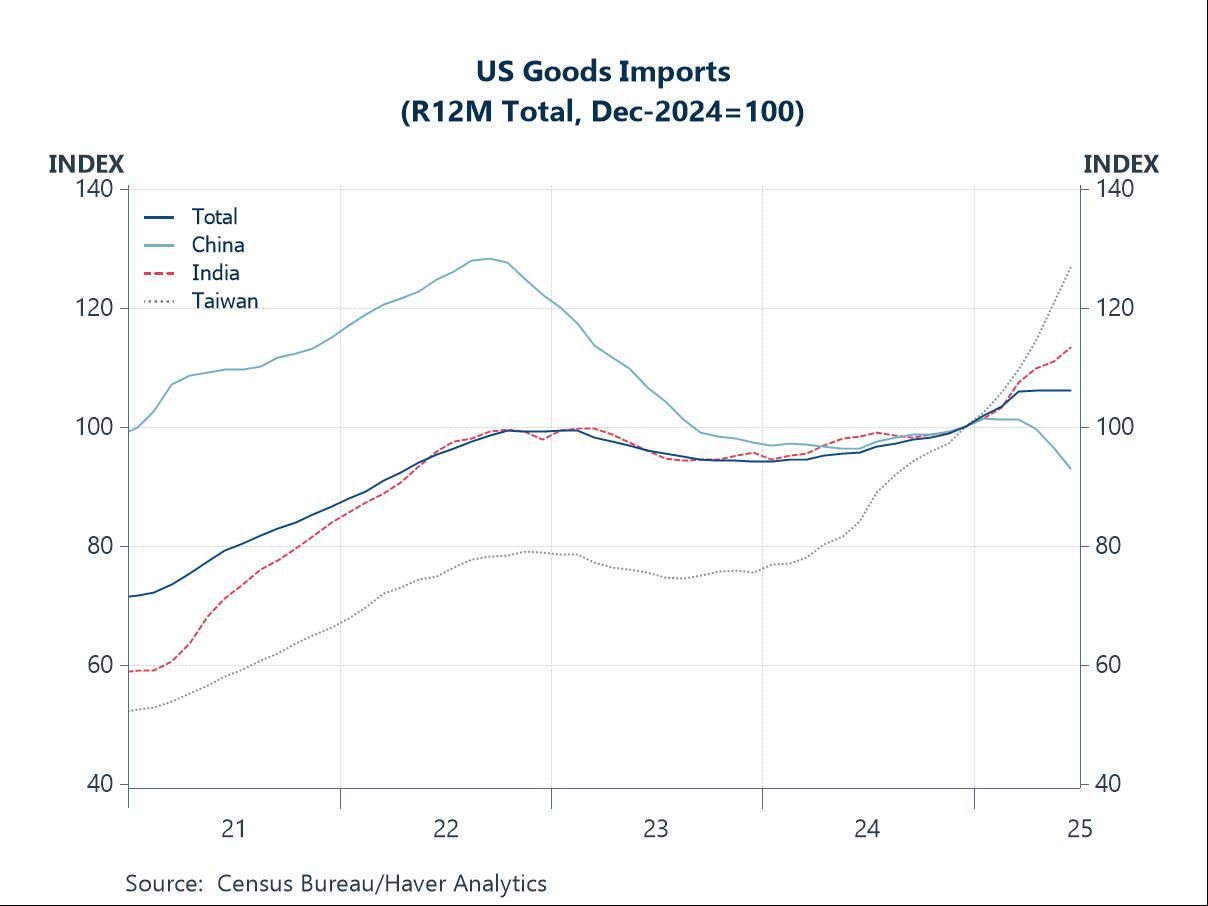

This week, we explore how the new round of US reciprocal tariffs is reshaping global trade patterns. The US import profile is already being reshaped: imports from China have fallen as intended, while higher shipments from other economies, such as India and Taiwan, have broadly offset the decline, keeping overall import levels largely unchanged (chart 1). Coupled with steadily growing exports, this has improved the US trade balance. China, meanwhile, has absorbed the hit from reduced US export revenues by redirecting shipments elsewhere, particularly to its Asian trading partners. Substantial growth has been seen in transportation goods, including EVs, while exports of mineral products have declined (chart 2).

Looking more broadly, the current tumultuous global trade landscape—while having supported Asian growth (chart 3) through front-loading by US importers—now poses significant downside risks for the region, particularly with higher US reciprocal tariffs in effect. At the same time, the combination of these growth risks and cooling inflation has paved the way for further central bank easing across much of Asia. Many central banks have opted to follow the path of least resistance, implementing additional easing so far this year (chart 4), with further moves expected in the coming weeks.

In sector-specific developments with potential global impact, President Trump’s threat to impose up to 300% tariffs on semiconductors could reverberate through Asia, home to most of the world’s semiconductor manufacturing and the primary source of US imports (chart 5). This would also affect American consumers, given how pervasive semiconductors are in everyday products. Another potential flashpoint is rare earths: Trump has threatened a 200% tariff on China if it does not supply sufficient magnets, underscoring China’s dominant position in the sector (chart 6).

The new normal We have entered a new normal, marked by US President Trump’s updated reciprocal tariff rates that took effect earlier this month. Beyond the usual considerations—such as comparative production advantages, shipping costs, and geographic proximity—producers now must also account for varying US tariff rates in their decisions. They must decide whether to onshore production to the US, reshore from abroad, or shift operations to economies facing lower US tariffs. Given how fluid the tariff landscape remains, it is unsurprising that many businesses are cautious about committing to major, long-term investments. Moreover, with Washington increasingly hawkish on alleged “transshipments” designed to circumvent tariffs—particularly from economies like China—producers face added deterrents against simply re-routing trade flows. As shown in Chart 1, this new tariff regime has already reshaped US trade patterns. Imports from China have cooled sharply as the rivalry intensified and mutual tariffs escalated earlier. In contrast, despite persistent uncertainty over future trade actions, US imports from some other Asian economies—such as Taiwan and India—have surged, led by computer and electronic products. Overall, rolling 12-month US import values have stalled this year, while exports have continued to expand, resulting in an improved US trade balance.

- USA| Aug 25 2025

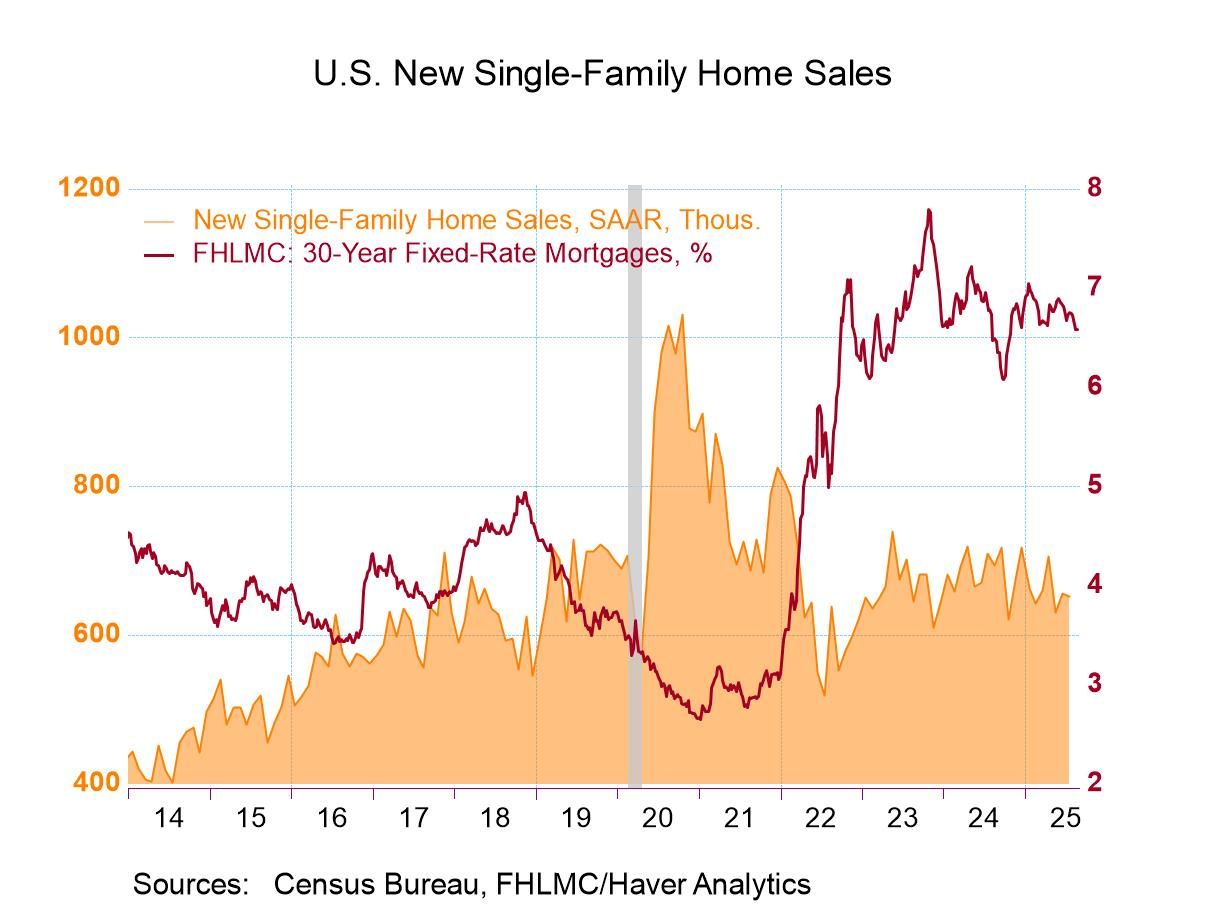

U.S. New Home Sales & Prices Ease in July

- Small decline in sales follows sharp increase.

- Sales are mixed throughout the country.

- Median sales price declines for second straight month.

by:Tom Moeller

|in:Economy in Brief

- USA| Aug 25 2025

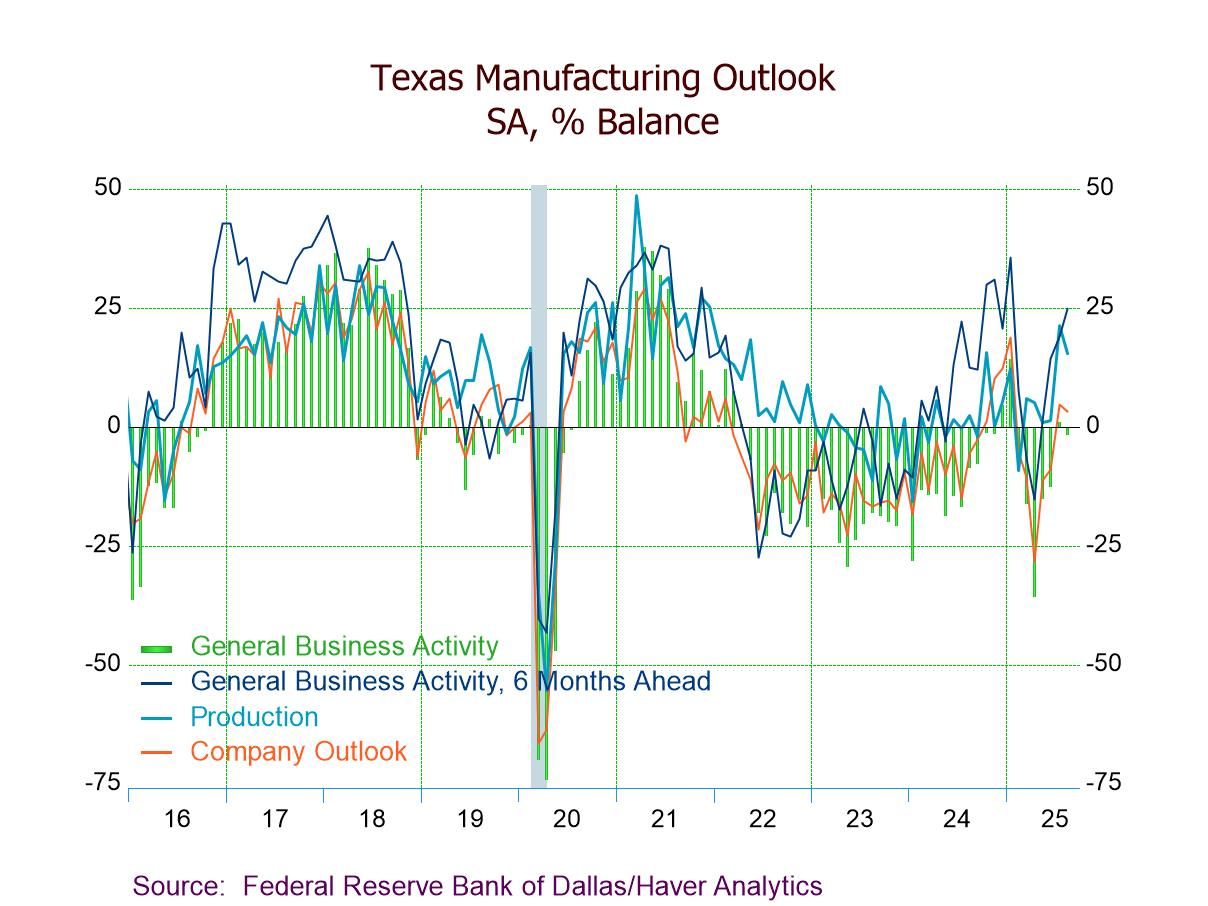

Texas General Business Activity Turns Slightly Negative in August, But Expectations Remain Positive

- General business activity -1.8 in Aug. vs. +0.9 in July.

- Company outlook (3.3) positive for the second straight mth.; production (15.3) still above historical avg.

- New orders growth (2.6) and new orders (5.8) up; both positive for the first time since Jan.

- Employment (8.8) rises, the fourth consecutive expansion and the highest since Sept. ’23.

- Prices received index up 4 pts. to 15.1; prices paid index up to a 4-month-high 43.7.

- Future general business activity up to 24.8, the highest since Jan.

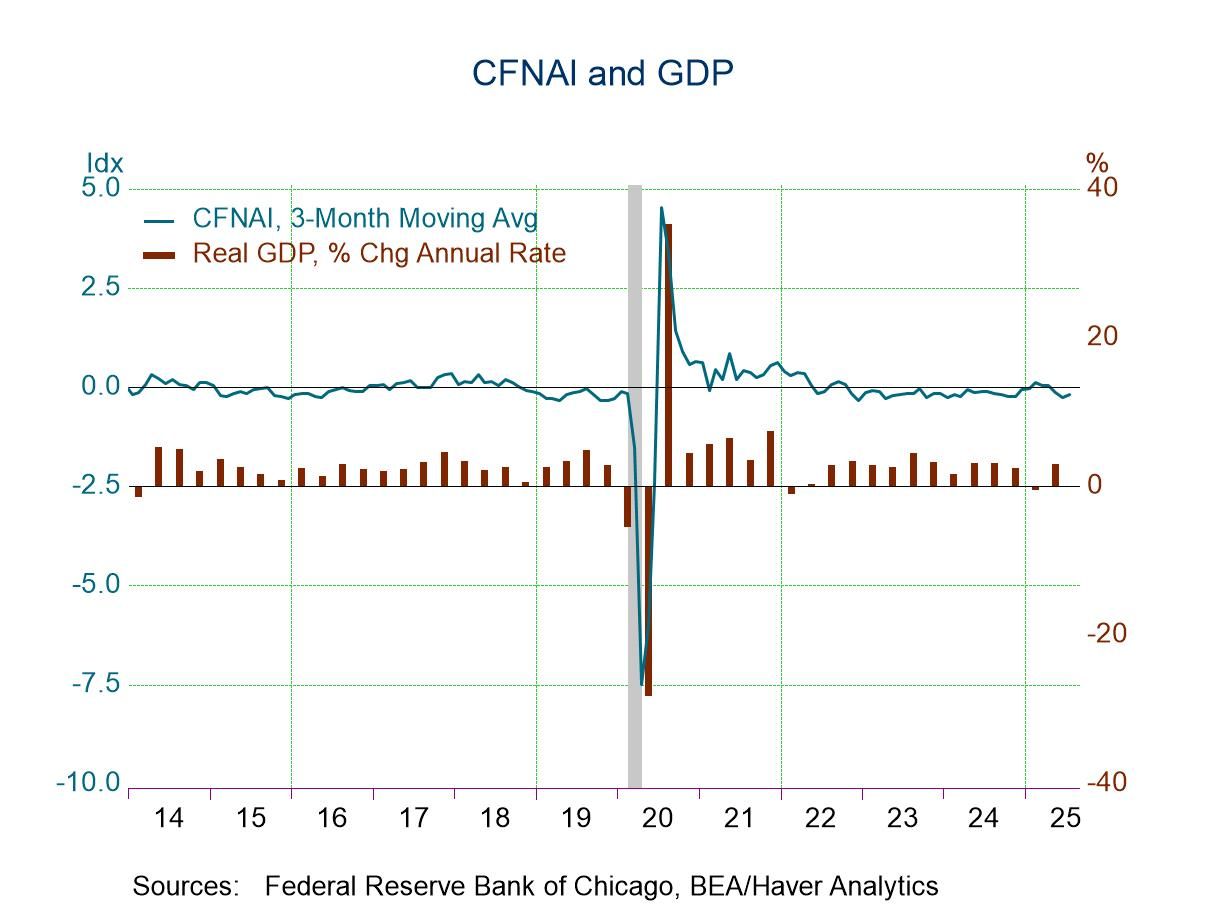

- Three of four components make negative contributions.

- Production & employment lead downturn.

- Three-month trend improves.

by:Tom Moeller

|in:Economy in Brief

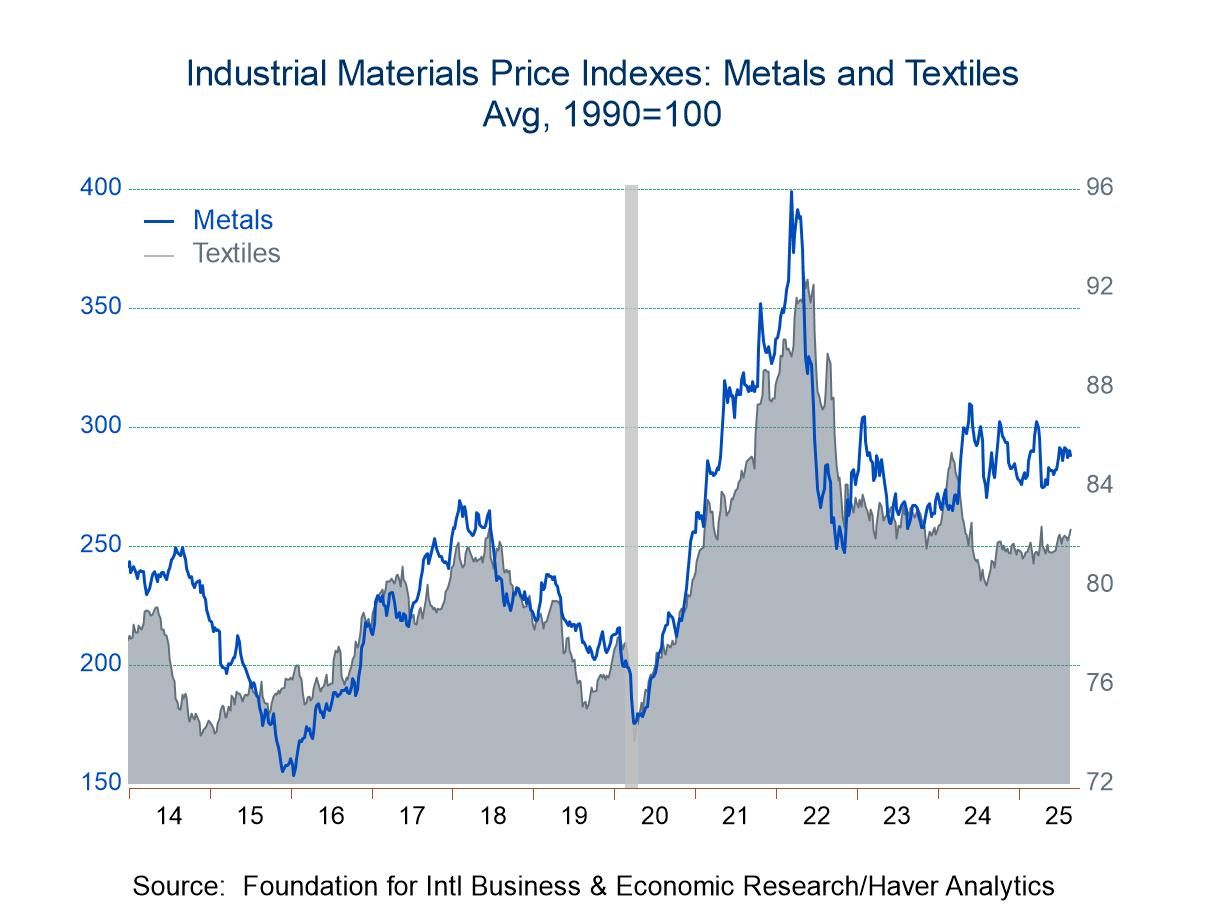

- Decline reverses earlier strength.

- Crude oil costs lead the weakening.

- Lumber & metals prices follow, but textile costs rise.

by:Tom Moeller

|in:Economy in Brief

Global| Aug 21 2025

Global| Aug 21 2025Charts of the Week: Cracks Beneath The Shine

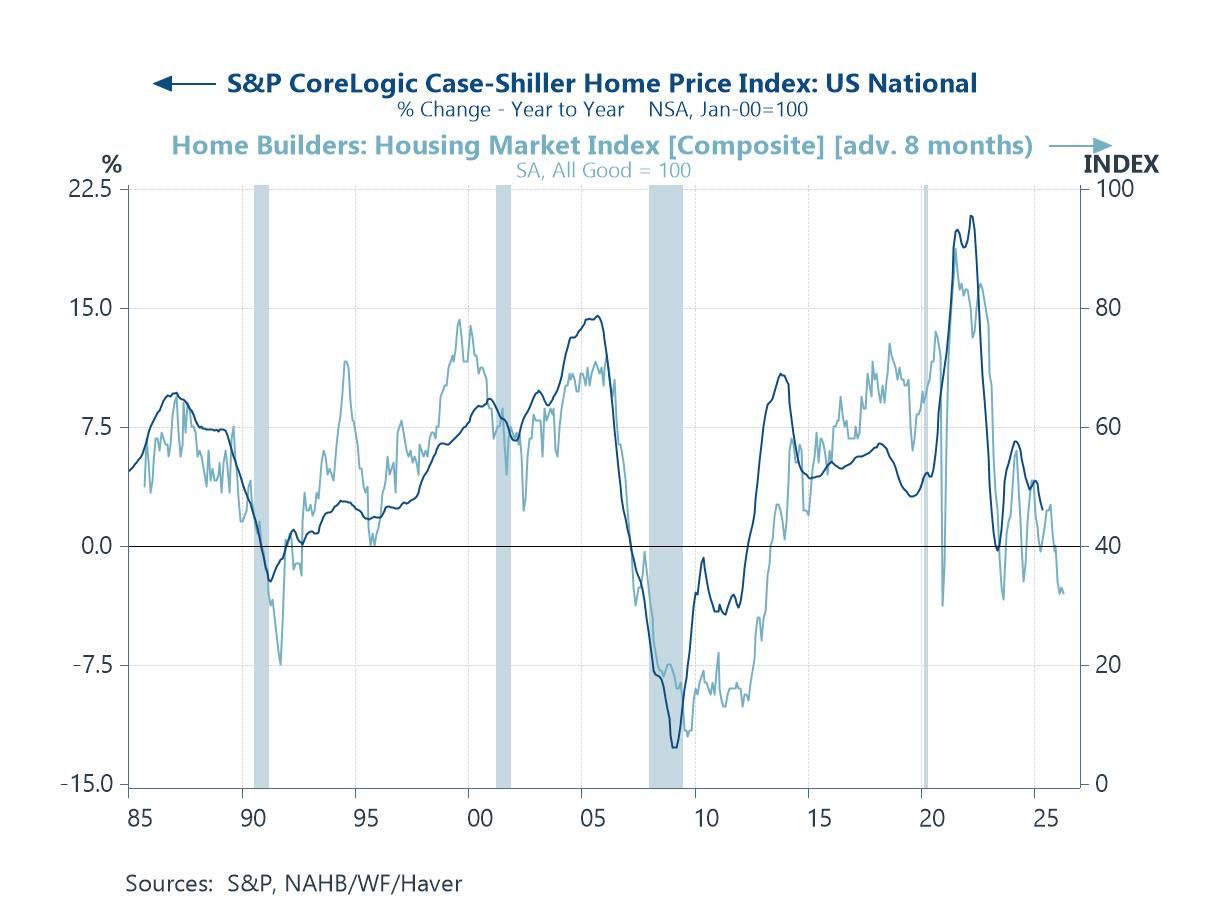

Recent financial market gains have been underpinned by resilient global data, AI-fuelled optimism, and hopes that most central banks will continue to loosen monetary policy. Yet beneath the surface, a more complicated picture may be emerging. In the US, housing indicators are flashing warnings about household balance sheets and credit channels (chart 1), while China’s latest data—covering retail sales, industrial output, and property—underscore persistent weakness (chart 2). In the UK, this week’s data showing sticky services inflation is complicating the Bank of England’s easing path (chat 3), while back in the US, medium-term inflation expectations have been rising despite softer oil prices (chart 4), hinting at a more disruptive role for trade policy. Against this cyclical backdrop sit deeper structural challenges: global energy consumption remains overwhelmingly dependent on fossil fuels, the clean energy sector has lost momentum amid high costs and policy uncertainty, and equity markets have punished renewables even as climate imperatives intensify (charts 5 and 6). Together, these dynamics suggest that while markets continue to trade on optimism, the mix of weak housing signals, patchy Chinese demand, sticky inflation, and an uneven energy transition potentially leaves the global outlook more fragile than headline performance implies.

by:Andrew Cates

|in:Economy in Brief

- of2693Go to 41 page