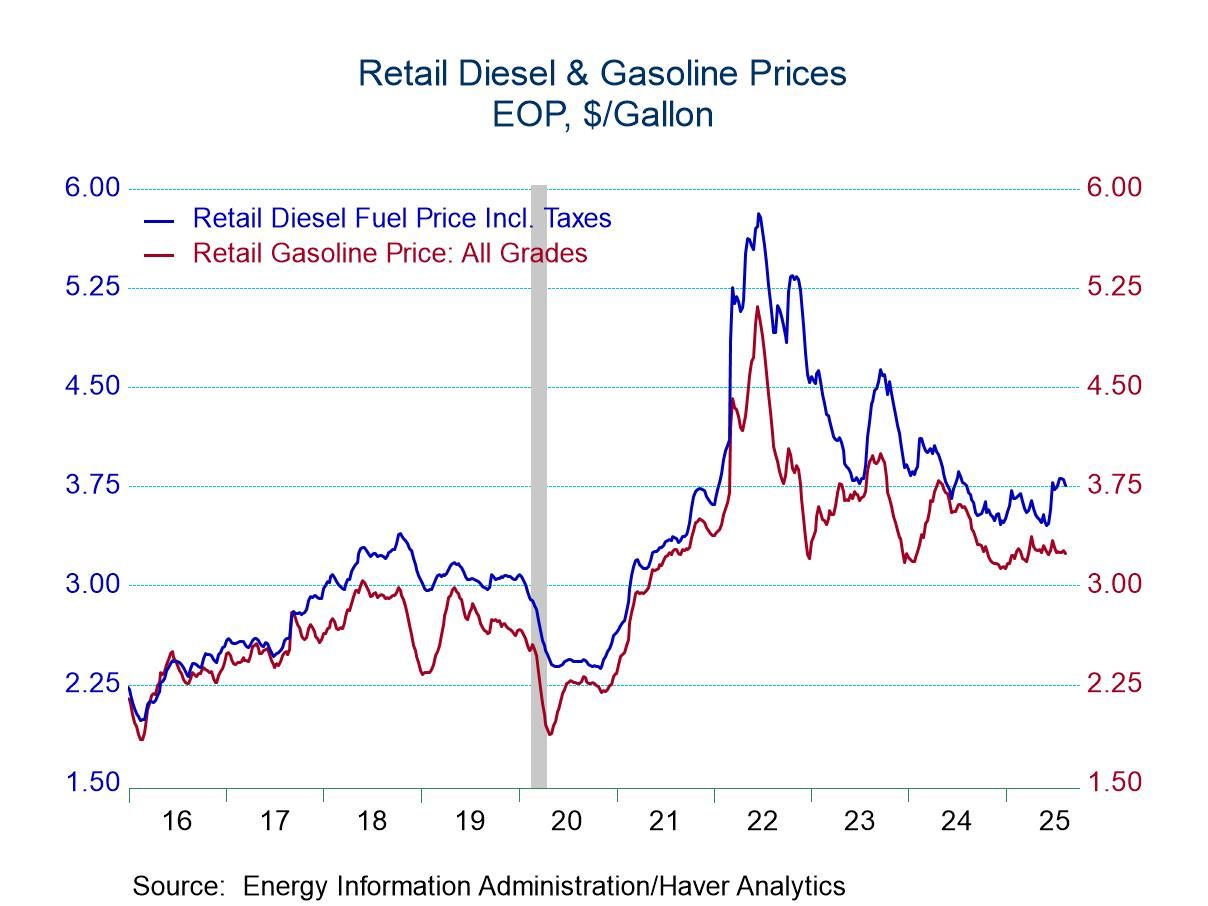

- Gasoline prices weaken.

- Crude oil prices decline sharply.

- Natural gas prices ease.

- USA| Aug 12 2025

U.S. Energy Prices Fall in Latest Week

by:Tom Moeller

|in:Economy in Brief

Global| Aug 12 2025

Global| Aug 12 2025ZEW Survey Shows Reduced Expectations on Tariff Deal

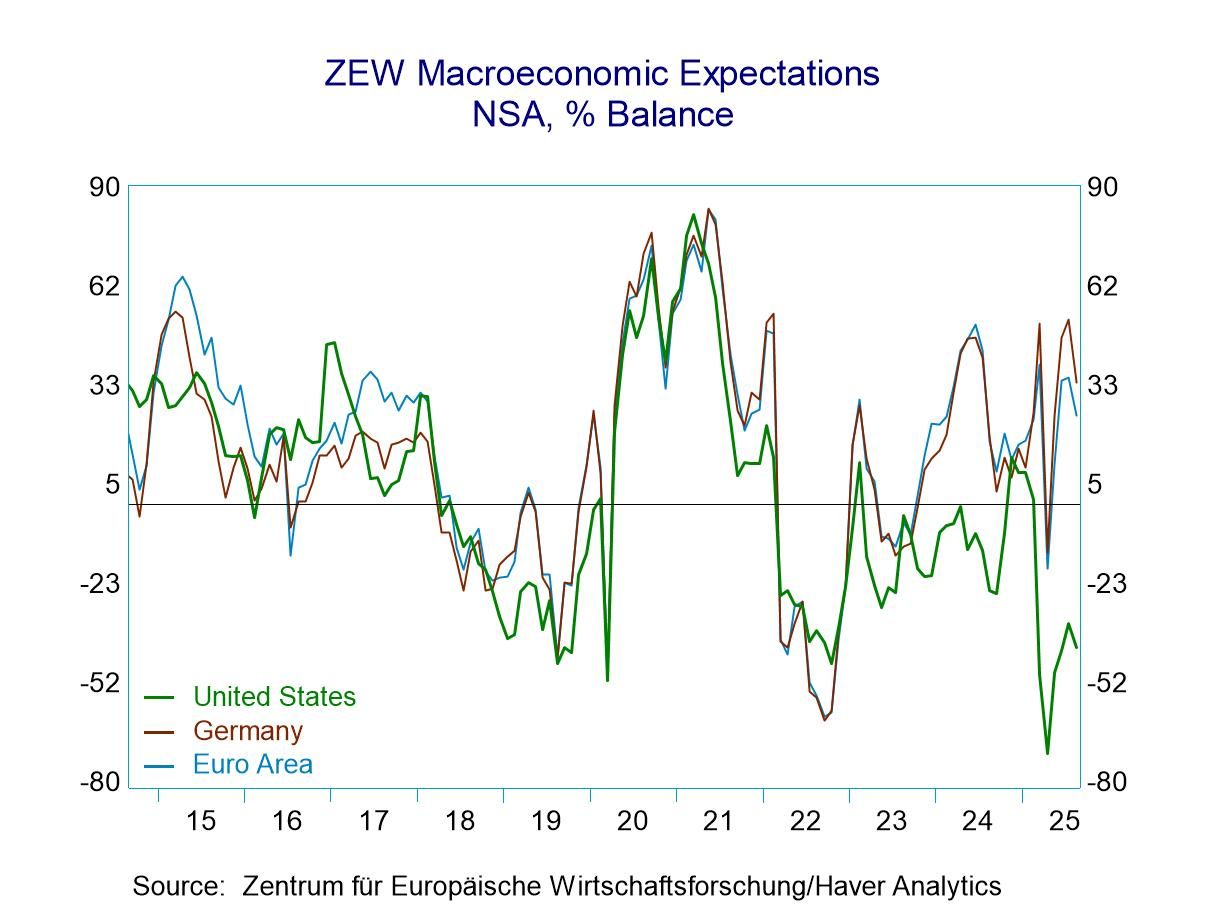

Macro-expectations- The ZEW financial experts registered disappointment this month in the tariff deal that the European Community struck with the United States. Macroeconomic expectations in August for Germany were slashed back to a reading of 34.7 in August from 52.7 in July; for the United States, expectations also were cut to -41.2 from -34.2. These two sets of reductions brought German expectations to a 60.8 percentile standing, leaving them still above their median on data back to the early 1990s. The U.S. reading has a much lower, 9.3 percentile standing on the same timeline. Despite the ZEW experts’ opinion that the tariff deal is bad for Europe, it apparently doesn't boost expectations for the U.S. at all. This, of course, makes me wonder to what extent the forecast has a bit of sour grapes to it.

The economic situation- The economic situation also deteriorates this month with the euro area assessment falling to -31.2 from -24.2 in July. Germany's assessment falls to -68.6 from -59.5 as the tariff deal weighs on Europe and Germany. The current situation for the U.S. improves marginally to +0.1 in August from -5.9 in July. These new readings leave the euro area economic situation reading with a ranking in its 46.9 percentile, Germany ranks in its 22.2 percentile, and the U.S. stands in its 35.1 percentile.

Inflation expectations- Inflation expectations in Europe remain low but increased to some extent in the U.S. where they were already high. The European readings for the euro area fell back to -6.7 in August from -5.8 in July. For Germany, the reading was little changed at -5.1 in August from -5.2 in July. The U,S, rating moved up to +74.5 in August from +64.3 in July. The queue standings for these metrics show the euro area inflation expectations standing in its 27th percentile, the same as for Germany, but for the United States inflation expectations are up to their 95.9 percentile! This is an extremely interesting angle from the ZEW financial experts because we have the Fed in the U.S. poised to cut interest rates. We have the President pushing the Fed to cut interest rates more quickly and more deeply than it wants to do it. And despite the fact that inflation has run over target for four and a quarter years in the U.S., we have the Fed seemingly ready to cut interest rates, perhaps twice by the end of the year, even with the potential for inflation from tariffs knocking at the door. The ZEW experts ‘take’ on the U.S. and its financial situation seems to be quite different from how it's being analyzed in the United States.

Short-term interest rates- Short-term interest rate expectations for the euro area show less of an inclination for rates to fall with the -35.7 reading in August compared to -49.7 in July. For the U.S., the -61.5 reading is lower than July's -43.8, indicating that expectations for rate cuts in the U.S. are growing. The euro area short-term rate expectation has an 18.4 percentile standing whereas in the U.S. the standing is at its 10.4 percentile.

Long-term rate expectations- Long-term interest rates found reductions both in Germany and the U.S. in August. German expectations fell to an index reading of 19.0 from 26.1 in July. In the U.S., the reading fell to 26.4 from 38.7. The queue standings for the German rate are in their 25.5 percentile, below the U.S. where the percentile standing is at its 32nd percentile. In both cases, the expectations for long rates indicate a good deal of moderation. Queue standings well below their respective median readings for both Germany and the U.S. (remembering that the medians for ranked data occur at the 50th percentile mark).

Stocks- Stock market expectations were slightly weaker in Europe with the euro area falling to 18.1 in August from 22.4 in July. The German reading fell back to 18.5 from 24.6, while the U.S. reading is little changed at 8.4 compared to 8.6 in July. The standings for all of these readings are around the 15th percentile; there are small differences among the different reporters, but nothing of significance.

- USA| Aug 11 2025

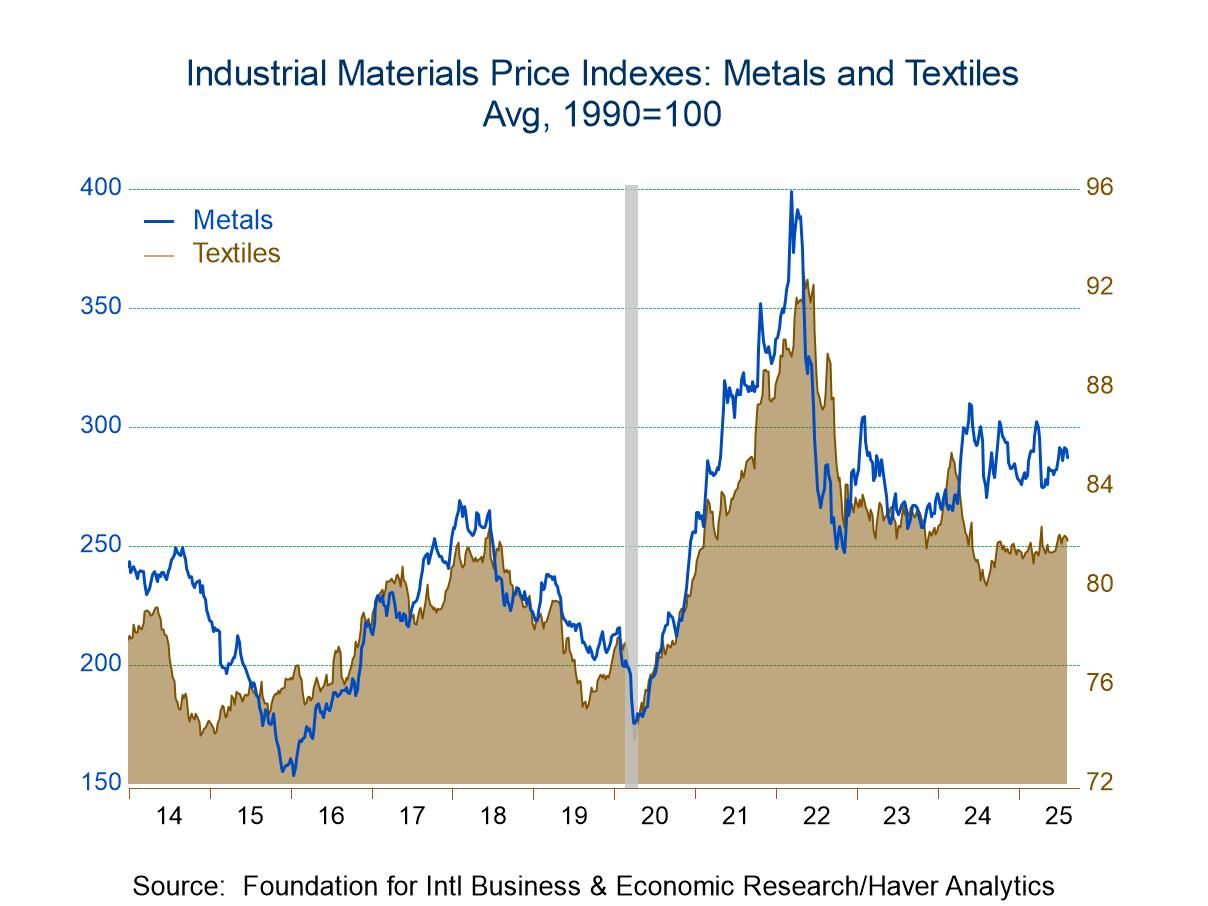

FIBER: Industrial Commodity Prices Retreat in Latest Four Weeks

- Decline is first in three months.

- Crude oil and metals prices move lower.

- Lumber prices improve while textile costs steady.

by:Tom Moeller

|in:Economy in Brief

- Europe| Aug 11 2025

Inflation: Better-Contained in EMU - Part of Along Road of Progress

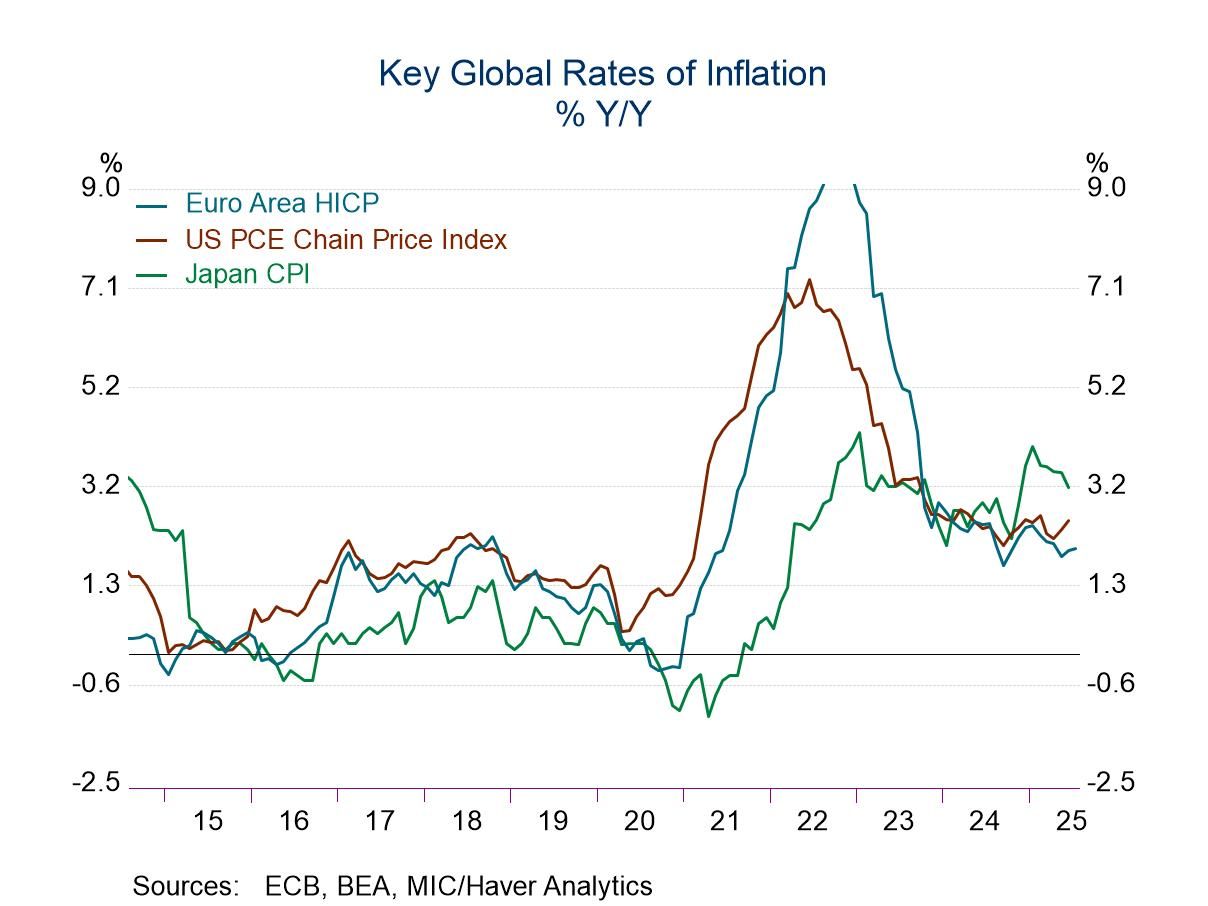

As more updated inflation data continue to post, we can look back at EMU historic inflation performance and try to gain some perspective. Since the euro area went to single currency status and set a program in motion for replacing domestic currencies (whose exchange rates were by then locked) with the euro-currency unit, there has been a lot of shifting of inflation and in relative prices among members. In the early days, there was a lot of concern about that and about entry level inflation commitments in the community.

On a to-date basis, despite the recent loss of control over inflation (in the wake of COVID and the Russian invasion of Ukraine) which the ECB has now mostly – but not fully- contained, core inflation in the EMU still runs hot and does so somewhat broadly. Still, headline inflation in the euro area has run at a compounded annual rate of 2.1% since January 1999, very close to its original 2% commitment.

Current headline inflation rates among early reporting and early EMU members (11-countries) show year-on-year inflation at 2.4% or higher in six of them- highest at 3.5% in Austria.

Since currencies were bound together and blended into the euro in January 1999, price levels among these members have risen in differing magnitudes, ranging from 92% in Luxembourg to 63% in France. That leaves a lot of potential for competitiveness gaps between those countries depending on the industries that most responsible for the price-level rise differences.

Price levels have risen more slowly than for the EMU overall in France, Finland, Ireland, Germany, and Italy. When the EMU was first being implemented, there were massive and chronic inflation differences between hard money countries like Germany, the Netherlands, Finland and a few others. The Mediterranean countries including France, Spain, Portugal, Italy, and Greece had typically run much higher rates of inflation. However, after over a quarter century in the cauldron of monetary singularity, we find that Spain and Portugal have averaged inflation rates of 2.4% and 2.2% while the EMU has averaged a pace of 2.1% during the period. Italy has averaged 2.1%. These are tightly clustered results.

The Monetary Union has had its difficulties, its tensions, its debt crises, and has withstood an influx of migrate that created tensions in the area (an influx that cost former EU member the U.K. its membership). But in the end, current inflation rates are mostly in alignment and so do not seem to display much more variation that the sorts of inflation rate difference you see among various states within the United States. The worst start-to-date inflation performance is in Luxembourg at 2.5% -and that probably matters the least since it is a financial center and does not compete much in manufacturing.

The far-right hand column in the table ‘memorializes’ history by showing the largest divergence between German inflation and each member over this history back to 1999. The current largest one-year inflation rate gap with Germany is Austria at 1.5% but after that it is Spain at 0.6% and then Portugal, Luxembourg, and Belgium -all at 0.5%. These gaps bear no relationship to the historic annual discrepancies as large as 28%. Four countries have their largest discrepancy with Germany annual inflation at over 20%; the others are greater than 15% but less than 20%.

For reference, I include the United States and the United Kingdom at the bottom of the table. They are two peas-in-a-pod with aggregate price levels rising over 90% each over this period. We can see the impact of that on the dollar’s value as well as on the value of the pound sterling over this period. If exchange rates are locked (as in the EMU), domestic prices are forced to rationalize themselves in the domestic economy. If exchange rates are left to fluctuate, the pressure on the domestic price level to adjust is alleviated because the exchange rate can adjust instead. Forcing adjustments in prices through a domestic chain of events is usually more painful than undergoing exchange rate change and, the later, simply change all prices in unison at least those for tradeable goods.

Asia| Aug 11 2025

Asia| Aug 11 2025Economic Letter from Asia: Trade-Offs

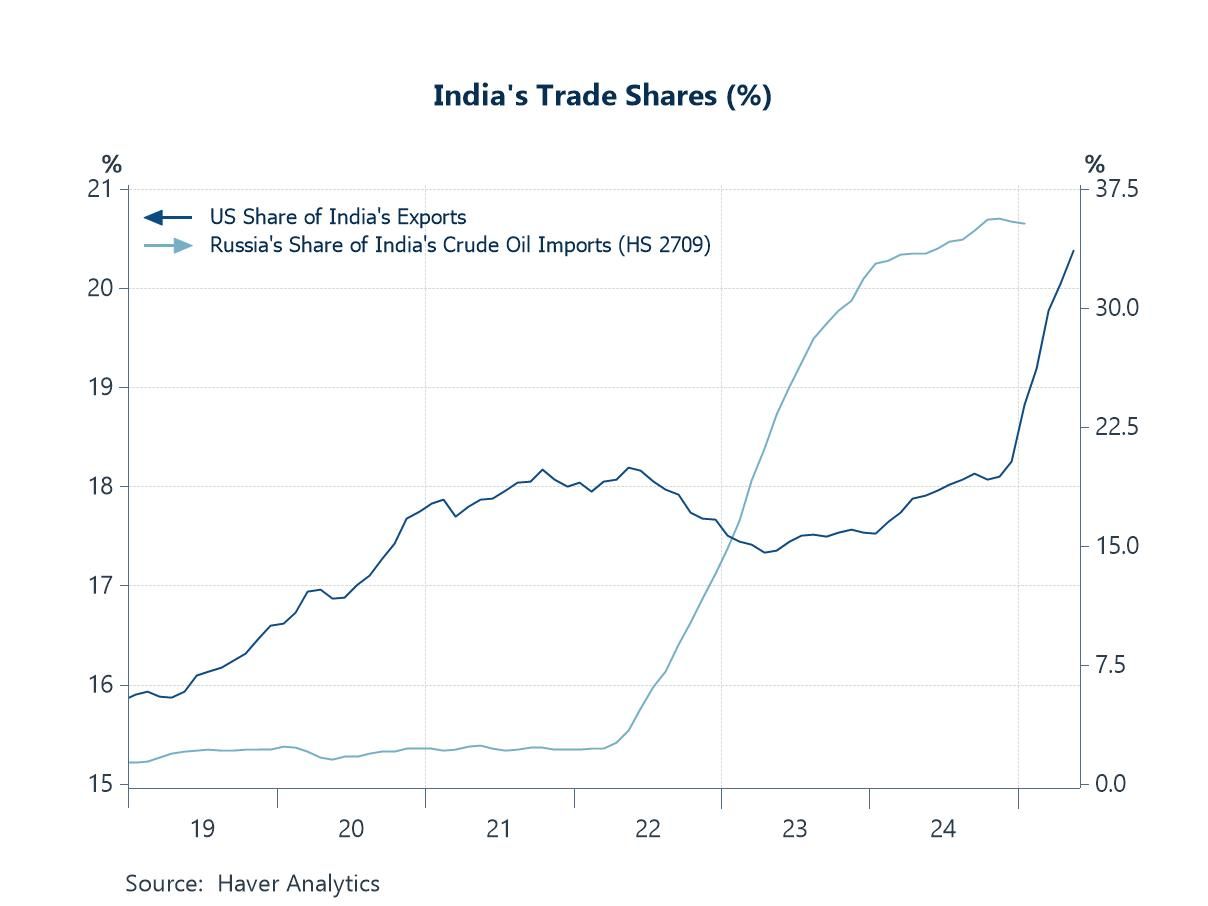

This week, we look at key economic and trade developments across Asia amid persistent geopolitical tensions and shifting policies. US-India trade talks, once expected to produce a quick deal, have stalled. India now faces up to 50% additional US tariffs—half from revised reciprocal rates and half linked to its continued imports of Russian oil, which make up about 35% of its crude supply (chart 1). Around 20% of India’s exports go to the US, leaving its economy exposed to the impact of these measures. In China, a flurry of economic data releases for July will provide a comprehensive update. Despite resilient numbers of late, doubts persist about the sustainability of growth. Recent retail sales gains have been partly fuelled by a government subsidy program, which is likely a one-off, while the property market continues its multi-year decline. Export growth has endured (chart 2), but largely supported by importers’ front-loading ahead of tariffs,an effect that’s likely to be temporary. The US-China tariff pause may be extended, though talks remain ongoing, and risks of renewed tensions persist. Meanwhile, China’s trade surplus continues to expand as exports shift toward Africa, Southeast Asia, and Europe (chart 3).

On the region’s growth backdrop, Japan’s preliminary Q2 GDP reading and final Q2 figures from Taiwan, Hong Kong, and Malaysia are due. Taiwan’s preliminary Q2 GDP shined, boosted by AI-driven exports (chart 4), while Hong Kong and Malaysia have been treading water. Japan has faced export headwinds from US tariffs, particularly in autos, though recent US-Japan and US-Korea deals reducing auto tariffs may support future growth (chart 5). Monetary policy watchers will focus on the Reserve Bank of Australia, expected to cut rates but signal an end to easing, and the Bank of Thailand, likely to cut rates amid deflation risks (chart 6).

The US-India furore The trajectory of US-India trade talks has not unfolded as initially expected. At one point, these negotiations were considered among the most likely to yield an early deal. However, that has not materialized. In fact, India now appears to be in a potentially worse position than it was around its Liberation Day period, as it faces the prospect of up to 50% in additional US tariffs. Of that, 25% stems from the revised reciprocal tariff rate from the US, while the remaining 25% is linked to India’s continued purchases of Russian oil. India has thus found itself in a bind: on the one hand, it is under pressure to reduce imports of Russian oil—which have grown about 35% of its total crude oil imports, as shown in chart 1—while on the other, its exports to the US, which now make up roughly 20% of its total exports, could be seriously harmed by US tariff measures.

- USA| Aug 08 2025

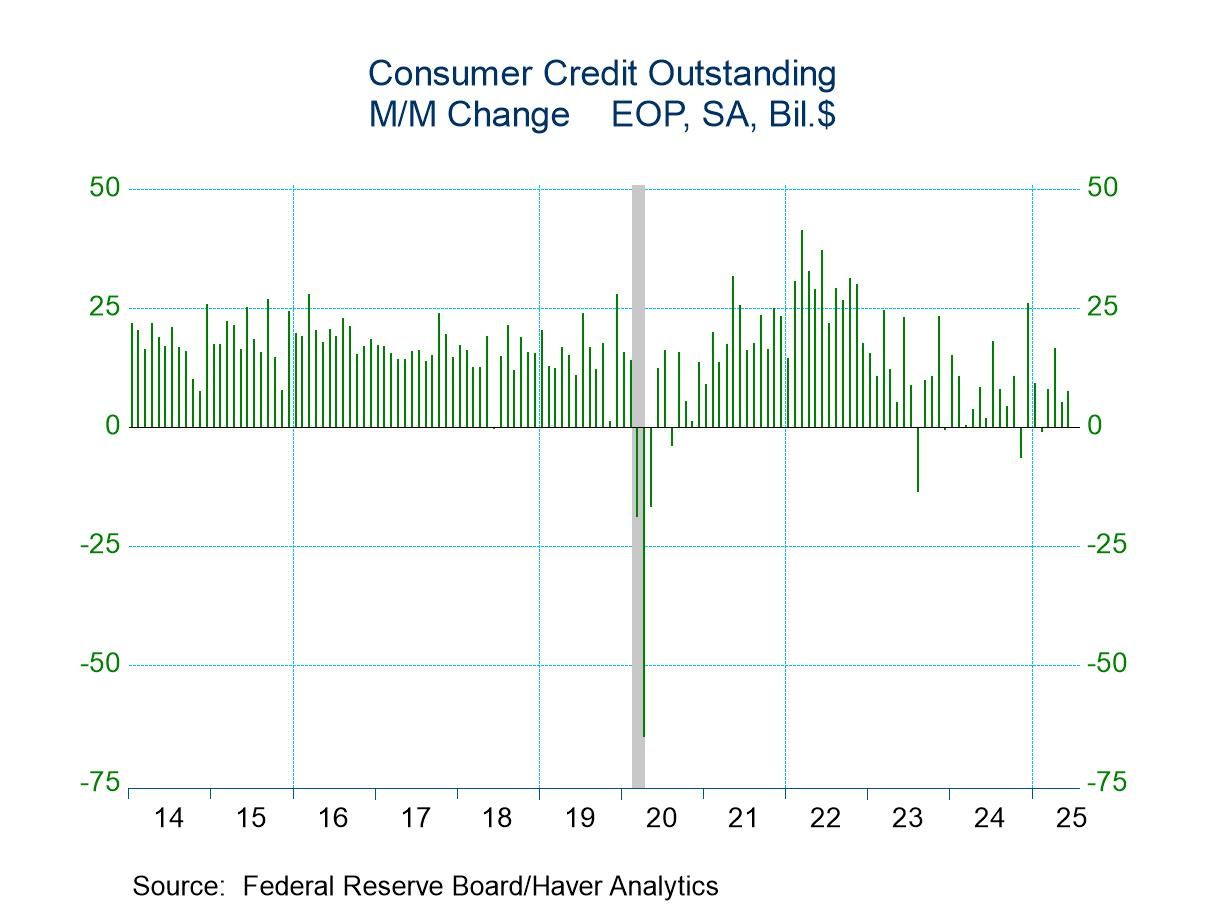

U.S. Consumer Credit Picks Up in June

- Moderate increases in last two months follow strong April gain.

- Nonrevolving credit usage strengthens as revolving credit eases.

by:Tom Moeller

|in:Economy in Brief

- Japan| Aug 08 2025

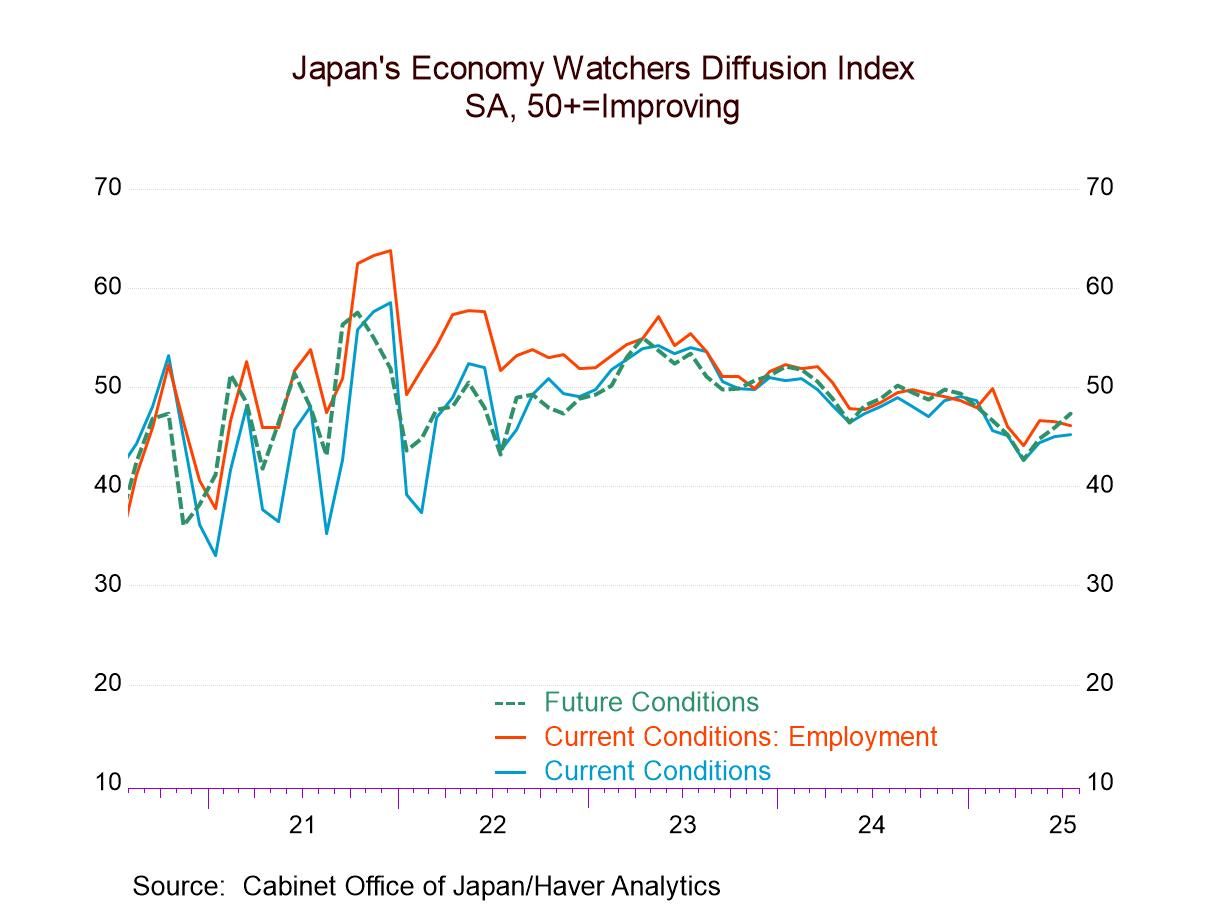

Japan’s Economy Watchers Index Rebounds

Japan's economy watchers index is showing some rebound after a period of weakness. The economy is not breaking out into sharply improved readings; however, the monthly readings have now increased and improved for three months in a row for both the current and the future indexes. The increase for the current index over three months is 2.6 diffusion points; for the future index it's 4.6 diffusion points. Over 12 months, both readings are still lower on balance.

Percentile standings-rankings Both headline readings are still below their historic medians, but the current index has a 34.8 percentile standing and the future index has a 39.5 percentile standing. The headline queue standings in both cases are below 50%- a reading below 50% indicates a reading below its historic median.

Diffusion readings Current index components all have diffusion readings below their respective 50 marks, which tells us that they're all showing contraction. The surveys show a headline reading of 45.2 for the current index in July, compared to 47.3 for the future index in July. For the current index, all of the component rankings are below 50 for July, June and May. For the future index, there are three readings above 50 in July and none for June or May.

July’s Future Index improvement The improvement in July for the future index is concentrated in eating and drinking places, services, and employment – all are households or individual-linked readings. That may reflect some sense of relief that Japan’s tariff negotiations with the United States were progressing and finally a deal was struck. The future index, in addition to having several diffusion readings above 50 in July, shows three readings that have queue standings, above the 50th percentile, putting them above their historic medians. Those are readings for eating and drinking places, services, and for housing. The reading for housing takes on a 59.3 percentile queue standing even though its diffusion index remains below 50 at 47. In July it moved up to 47, making a relatively sharp gain from a reading of 42.7 in June.

There is, therefore, relatively more evidence of improvement going on in the future index compared to the current index where monthly gains were generally smaller.

The breadth of improvement Month-to-month the current index improved in 60% of the categories in July compared to 70% in May and June. The future index components improved across the board in July, 80% of them improved in June, and gains were across the board again in May. Looking at the changes over three months, six months, and 12 months according to average data, over three months 60% of the current categories improved compared to none over six months and 80% over 12 months. For average future data, 100% improve over three months, none improve over six months and 60% improve over 12 months.

Global| Aug 07 2025

Global| Aug 07 2025Charts of the Week: Downside Risks

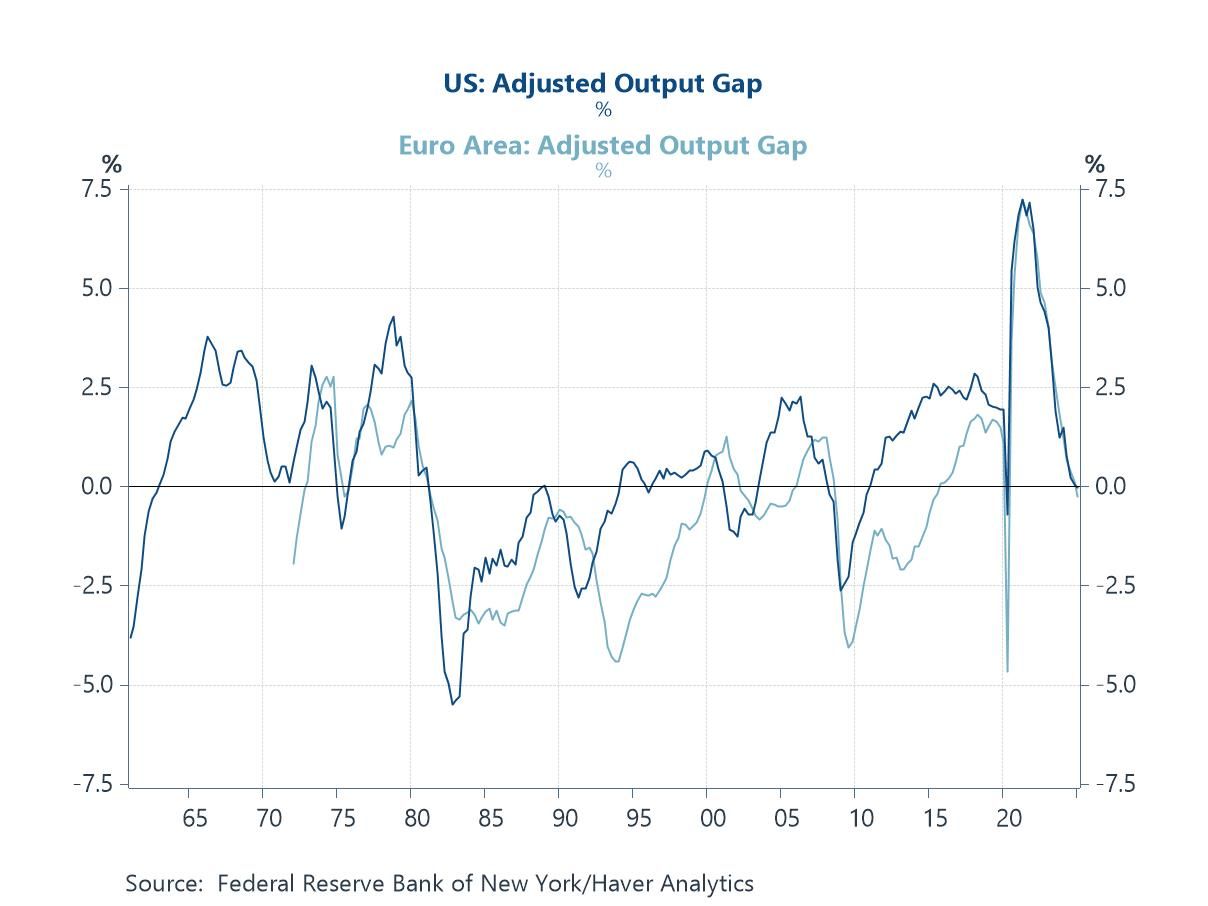

Last week’s weaker-than-expected US labour market report—marked by sluggish payroll growth, rising unemployment, and downward revisions to prior months—sparked a notable shift in financial markets. Bond yields fell sharply as investors repriced the outlook for Fed easing, with rate cut expectations brought forward. This recalibration arguably reflects growing awareness of mounting downside risks across the US and broader global economy. Several indicators reinforce this view. Output gaps in many major economies are narrowing or turning negative, signalling that demand is falling short of potential (chart 1). The US housing market looks fragile, amidst weak builder sentiment and falling prices (chart 2). US bank lending standards are still restrictive, with implications for credit availability, household and business investment, and overall economic momentum (chart 3). Some (though not all) global sentiment surveys have softened, and positive growth surprises are now fading. Meanwhile, and despite earlier fears, US tariffs have not triggered renewed supply chain stress or inflationary pressures (chart 5). Add to that the ongoing deflation in China’s producer prices, and the macro narrative could be tilting more decisively toward slower growth and diminishing inflation risks—leaving policymakers with more space to continue easing monetary policy (chart 6).

by:Andrew Cates

|in:Economy in Brief

- of2700Go to 52 page