Inflation in the United Kingdom is still running hot in June. The CPIH rose by 0.4% in the month with its core rate that excludes energy, food, alcoholic beverages & tobacco also rising 0.4% month-to-month. In both cases, these increases compare to a rise of 0.1% in May. On that perspective, the two-month trend is somewhat muted. However, in April the CPIH headline rose by 0.6% and the core rose by 0.4%, so the U.K. finds itself in another period of excess inflation.

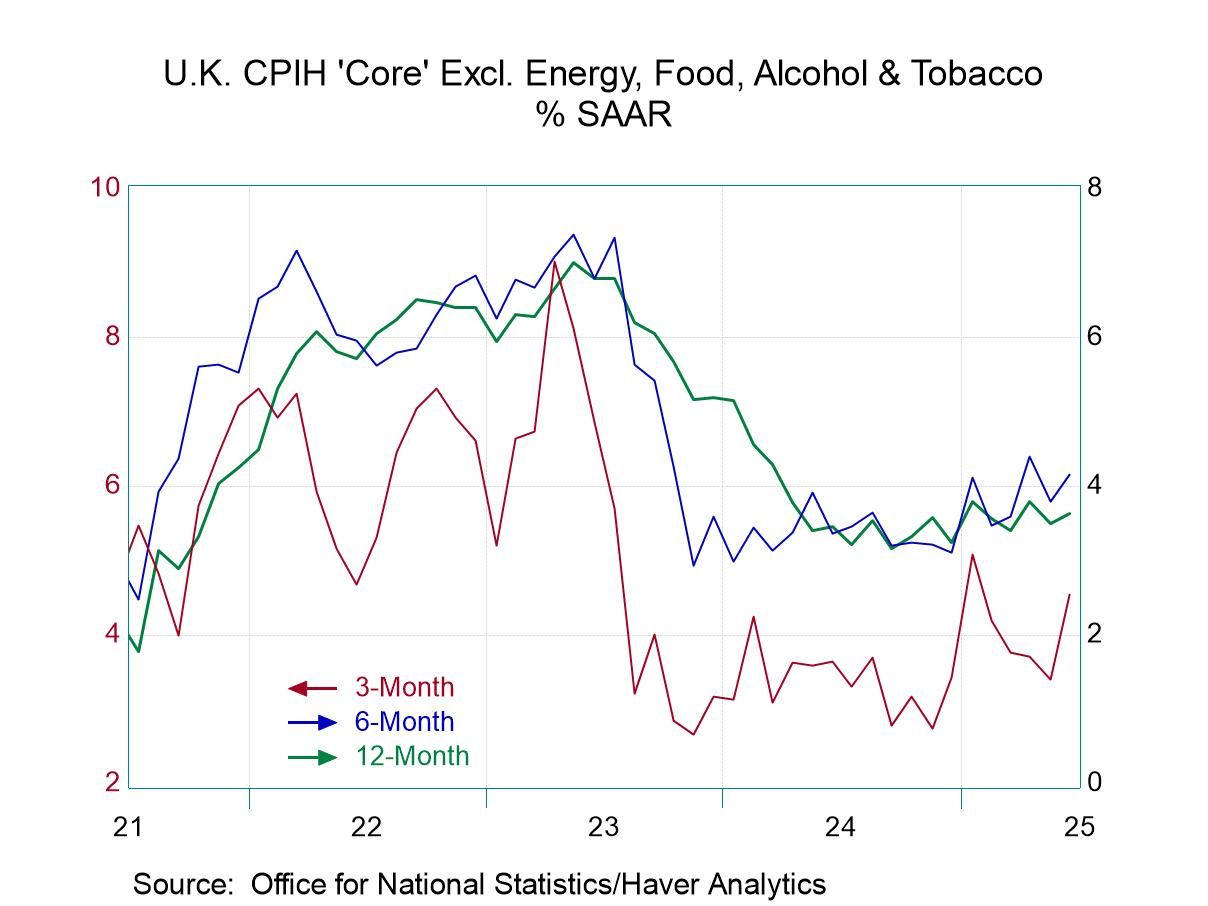

Sequential inflation The sequential inflation rate from 12-months to six-months to three-months shows the headline at 4.1% over 12 months, 4.2% over six months and 4.3% over three months, a very slight acceleration, but clearly inflation that is over 2 percentage points above the target set by the Bank of England across the entire span. The core rate for the CPIH is up 4.3% over 12 months, up at a 4.4% annual rate over six months and looks slightly muted at 4.2% over three months. Again, we are looking at a solid inflation overshoot that is more than 2 percentage points above the target set by the Bank of England.

Inflation breadth In the month of June, inflation accelerated in 45% of the categories, the same proportion as in May; however, in April acceleration occurred in 54% of the categories. These sequential data show that over three months inflation in the U.K. accelerated across 54% of the categories, the same proportion as over six months although both of those marks were below the 63% acceleration breadth logged over 12 months. The data clearly show that there isn't any deceleration to any great extent in play over any of these horizons and that the monthly data offer only a modicum of solace for June and May.

The far-right hand column evaluates current inflation rates year-over-year compared to where they have been since January 2000, monthly. The comparison is a ranked percentage of the current inflation rate vs. this history. For example, the current CPIH 12-month inflation rate of 4.1% sits at the 88.6 percentile of its historic queue of data. This tells us that inflation has been this high or higher, less than 12% of the time over this period, clearly marking the 4.1% growth rate as high and as substantial by historic experience. The CPIH core has a slightly higher standing and it's 89th percentile. Looking across the components, all but two have rankings over this 50%. Rankings that are above 50% place them above their medians for the period. The exceptions here, are a 26.5 percentile standing for restaurants & hotels inflation where prices are running at 2.6%, and transportation where prices are running at 1.6%. Furniture, household equipment & maintenance prices have a 56.2 percentile standing, only marginally above the category’s historic median. After that, there's only one category in its 60th percentile, two categories in their 70th percentile and the rest are higher.

Summing up Needless to say, the U.K. has an entrenched inflation problem. It's lodged in the headline; it's lodged in the core; it's lodged across most of the commodity categories! The Bank of England simply has work to do and there isn't much evidence that the BOE is making any progress; in fact, the trends seem to suggest that there may be much more work to do.