- Purchase and refinancing loan applications fell.

- Effective interest rate on 30-year fixed-rate loans fell to 7.03%.

- Average loan size eased.

- USA| Jun 18 2025

U.S. Mortgage Applications Decline in the June 13 Week

- United Kingdom| Jun 18 2025

U.K. Inflation Moderates

Inflation in the United Kingdom measured by the CPI-H measure rose by 0.1% in May as the core excluding energy, food, alcohol, and tobacco also decelerated by increasing 0.1% on the month. These slower May increases follow accelerated increases in April for both the headline and core and more modest increases in March. The sequential growth rates in the headline CPI-H show a gain of 4% over 12 months, a rise at a 4.3% annual rate over 6 months, and a 3.4% annual rate rise over 3 months. The core for the CPI-H shows a 4.2% increase over 12 months, a 4.1% annual rate increase over 6 months and another slight deceleration to 3.6% at an annual rate over 3 months. These data for the headline and the core both show that U.K. inflation has plateaued and begun to edge lower; however, the deceleration is quite slight for both the headline and for the core measures.

Inflation diffusion that measures the breadth of inflation shows a reading of 54.5% over both 12 months and 6 months, with 3-month diffusion much lower at 36.4%. Diffusion readings of 50% show inflation accelerating and decelerating with equal tendencies from period-to-period. Diffusion above 50% shows more accelerating inflation while diffusion below 50% finds more deceleration for inflation. Diffusion readings show that for 3-months compared to 6-months diffusion is significantly lower but that diffusion over 6 months (compared to 12-months) and for 12-months (compared to 12-months ago) is slightly accelerating.

The HICP measure parallels the results for the headline CPI-H with a slight inflation bulge over 6 months and significant slowing of inflation over 3 months. The agreement across the headline, and core CPI-H measures compared to the HICP is reassuring that these trends are true and not simply mercurial or the results of a particular inflation weighting scheme (since CPI-H and HICP use different weights).

Meanwhile unemployment in the U.K. has risen only slightly over the past 12 to 24 months. The recent U.K. monthly GDP reading showed a sharp slowing, but year-over-year growth is still positive headline.

The sequential chart that depicts the growth rates sequentially for timeseries of 3-month, 6-month and 12-month inflation (above) shows that part from a one month slice of those rates (which is what the table provides) the timeseries reveal that the tendency for inflation peaked across these three frequencies back in January and has since been reduced to its lowest pace since October 2024 for both 6-month and 12-month CPI-H core inflation. For the 3-month version, inflation at 3.6% is the slowest since January 2024. Three-month core inflation has slowed without increasing for four months in a row as has 12-month core inflation.

- USA| Jun 17 2025

U.S. Home Builders Index Declines in June

- Overall reading stands at lowest level since December 2022.

- All component measures fall.

- Most regional indexes retreat.

by:Tom Moeller

|in:Economy in Brief

- May IP -0.2% (+0.6% y/y), led by a 2.9% m/m decrease in utilities output.

- Mfg. IP +0.1%, reflecting m/m gains of 4.9% in auto production and 1.1% in aerospace & misc. transp. equipt. (w/ durable goods up 0.4% and nondurable goods down 0.2%).

- Mining activity edges up 0.1%, the third m/m increase in four months.

- Key categories in market groups mostly drop.

- Capacity utilization down 0.3%pt. to a four-month-low 77.4%; mfg. capacity utilization unchanged at 76.7%.

- USA| Jun 17 2025

U.S. Retail Sales Fell More than Expected in May 2025

- Sales fell a more-than-expected 0.9% m/m, led by a 3.5% decline in motor vehicle sales and a 2.0% drop in gasoline store sales.

- Sales excluding autos unexpectedly fell 0.3% m/m.

- In contrast, sales in the control group (used to estimate PCE) rebounded 0.4% m/m.

by:Sandy Batten

|in:Economy in Brief

- Sharp decline in imported fuel costs is offset by increases in other products.

- Export price decline reflects lower petroleum prices.

by:Tom Moeller

|in:Economy in Brief

- USA| Jun 17 2025

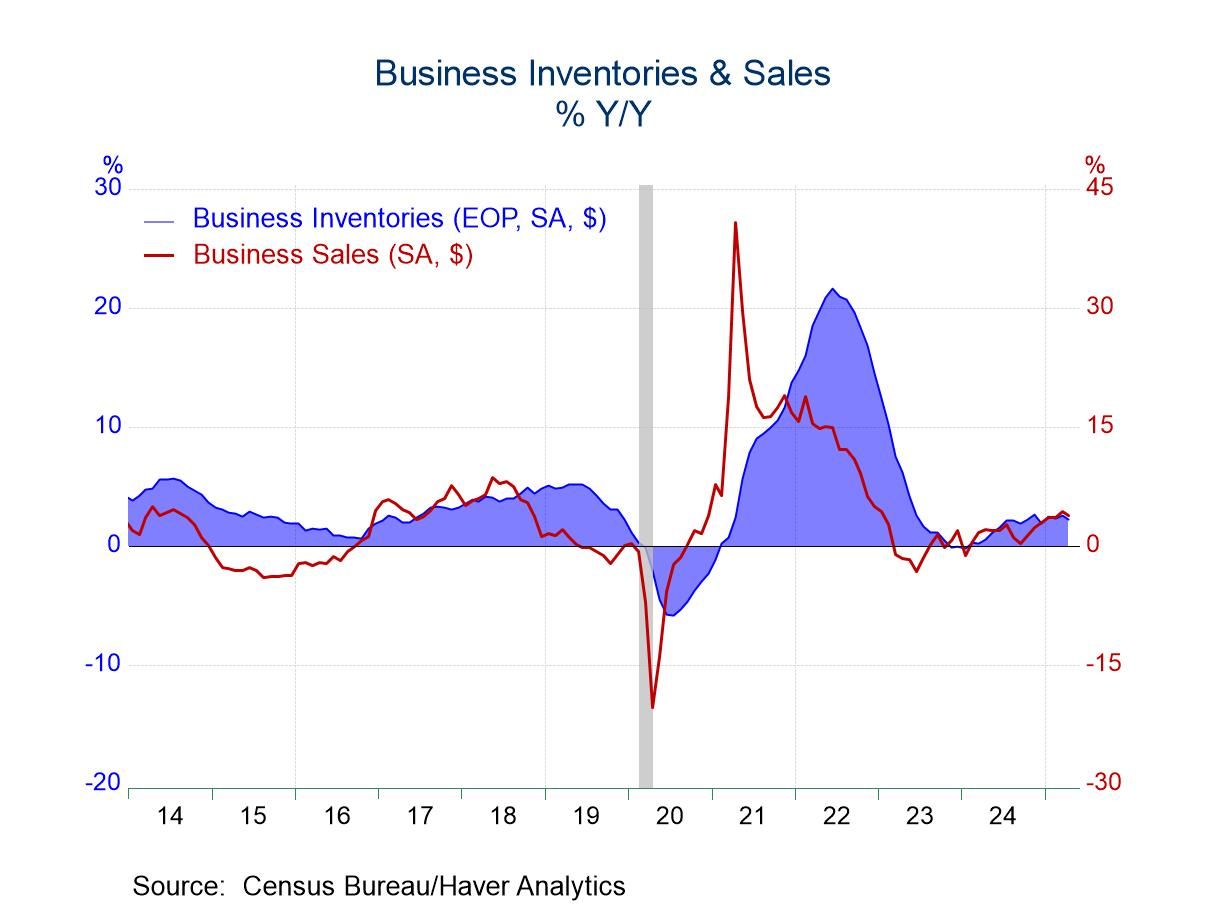

U.S. Business Inventories Unchanged in April as Sales Slipped

- Total inventories were unchanged in April from March.

- Wholesale inventories rose for the fourth consecutive month while retail and factory inventories slipped.

- Sales edged down 0.1% m/m, the first monthly decline in three months, with declines in both factory and retail sales.

- With little change in both sales and inventories, the inventories/sales ratio was unchanged in April following two consecutive monthly declines.

by:Sandy Batten

|in:Economy in Brief

- Germany| Jun 17 2025

Germany’s ZEW Survey Respondents Improve Their Assessments

Economic situation- The ZEW index for June 2025 showed significant improvement in the euro area with the index moving up to -30.7 from -42.4 in May. At that level, the queue percentile standing on data back to 1992 is at its 47.5 percentile, close to its median for the period (median occurs at a ranking of 50%). For Germany, there was an improvement from -82 in May to -72 in June; this sets its standing at about its 20th percentile, much weaker than for the euro area overall. For the United States, there was a more modest improvement in June to -17.3 from May’s -25.4; June marks a 25.8 percentile standing, roughly in the lower quartile of its historic queue of data over the last 13 years. Economic assessments for these three reporters range from quite weak to just slightly below ‘normal.’

Macro-expectations- Macroeconomic expectations became sharply stronger for Germany in June; they moved up to a +47.5 reading in June from +25.2 in May, a reading that already had improved from -14 in April. Germany is on a very hot run in terms of expectations that are improving at a much faster pace than the current economic situation. Germany’s macroeconomic expectations have a 72-percentile standing, in the top 30% of their historic queue of data, quite a solid result. This contrasts sharply with the United States where there was also an improvement in June to -41.9 from -48.2 in May. The U.S., like Germany, had undergone a substantial improvement in May compared to April since April's reading had been -71.5. However, the June reading for the U.S. improved month-to-month by only a modest amount and has only an 8.5 percentile standing, the lower 10% of its historic queue of data.

Inflation expectations- Inflation expectations remain weak in the euro area and in Germany in June while they've grown to be quite strong in the United States. Germany saw slight increases in inflation expectations in the month, but they are still at weak levels and the 20- to 25-percentile region on a queue-standing basis. For the U.S., inflation expectations have cooled slightly from a reading of 75.8 in April to 70.7 in May, to 60 in June, a clear de-escalation of inflation expectations; however, still leaving a high 81.1 percentile standing for inflation expectations in the U.S.

Short-term rate expectations- Short-term interest rate expectations in the euro area rose after falling back in May; in the U.S., they edged only slightly higher after also having stepped back in May. However, both the U.S. and the euro area have extremely weak queue standings, both of them in the lower 15-percentile of their respective ranges. Short-term interest rates simply are not expected to rise, and they obviously are more likely to be cut on readings like these.

Long-term rate expectations- Long-term expectations for Germany and the United States show German expectations have waffled, moving from 23.3 in April, down to 6.9 in May and bouncing back to 16.8 in June to produce a queue standing in its 22nd percentile. In the U.S., long-term rate expectations were at 48.5 in April; they fell to 32.1 in May and rebounded to 39.0 in June to reach a queue standing at its 43.6 percentile, slightly below its median standing for the period (remember that median standings occur at a queue percentile standing of 50%).

Stock market outlooks remain weak- Stock market expectations show weak standings everywhere. The euro area saw a marginal technical improvement in June compared to May; Germany saw a small improvement in June compared to May, whereas May had seen a more significant increase compared to April. The U.S. continues to log negative readings for equities. Germany and the euro area show standings for the stock market in their respective 15-percentile ranges, whereas the United States’ reading is in its 7th percentile. All of those readings are weak.

- of2700Go to 68 page