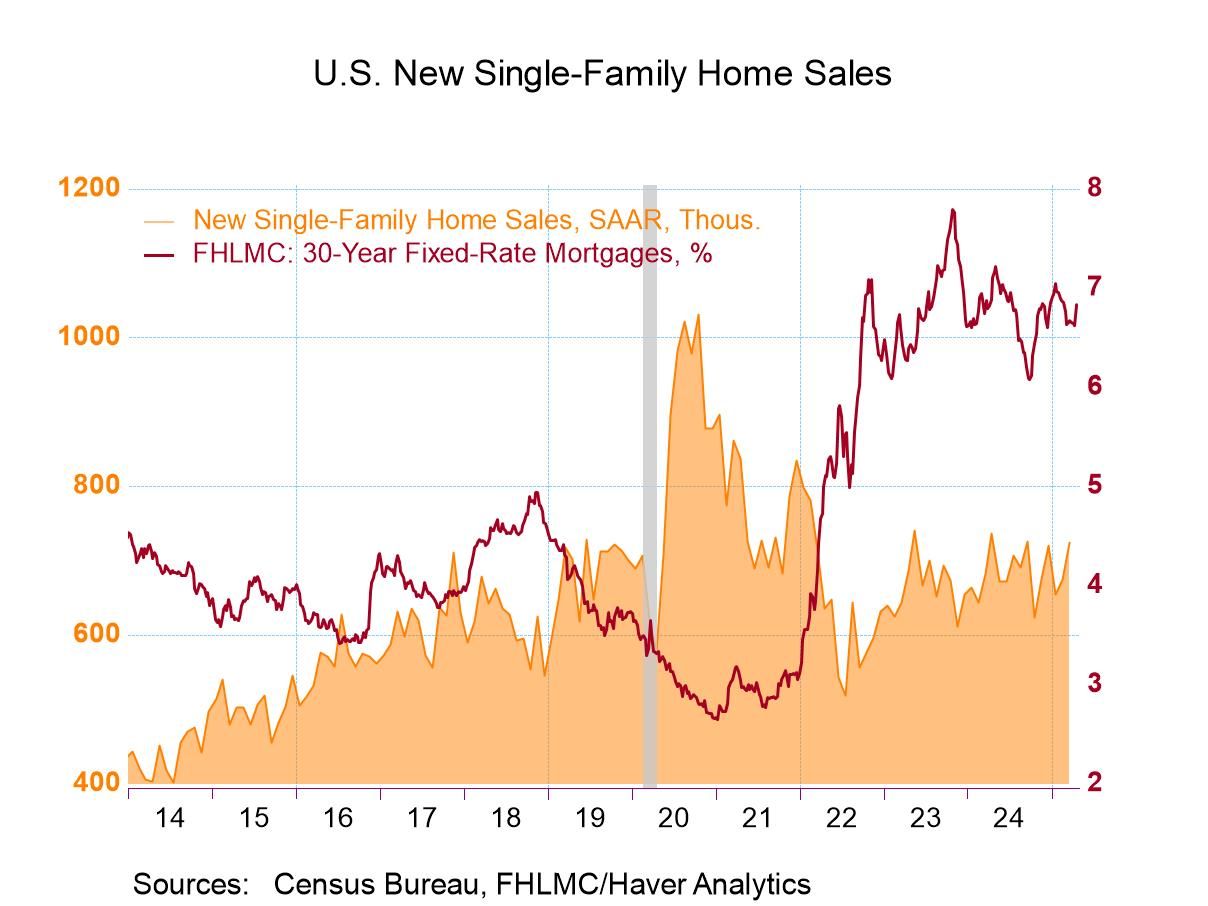

- Sales rise to highest level in six months.

- Changes in sales are mixed across the country.

- Median sales price falls to four-month low.

- USA| Apr 23 2025

U.S. New Home Sales Improve in March; Prices Weaken

by:Tom Moeller

|in:Economy in Brief

- Refinancing loans fall sharply and purchase loan applications decline as well.

- Effective interest rate increases to two-month high.

- Average loan size falls sharply.

by:Tom Moeller

|in:Economy in Brief

- USA| Apr 22 2025

U.S. Energy Prices Are Mixed in Latest Week

- Gasoline prices fall sharply again.

- Crude oil prices edge higher.

- Natural gas costs decline further.

by:Tom Moeller

|in:Economy in Brief

- Denmark| Apr 22 2025

Danish Confidence Drops to 2-Year Low; Inflation Concerns Remain Elevated

Danish confidence slipped to -17 in April from -15.5 in March, continuing a slide that extends back to late-2023. The weakness accelerated in late-2024 especially with the conclusion of the U.S. elections.

On data back to late 1995, the consumer confidence indicator for Denmark ranks in its lower 3.7 percentile. Confidence has been higher than this most of the time over this period.

The financial situation over the past 12 months ranked at a weak 7.3 percentile standing, but for the next 12 months an even weaker 1.4 percentile reading is in place. The existence of U.S. tariffs and pushback for Europe to carry more of its own defense burden seem to be adversely impacting Danish sentiment. There may also be some anxiety stemming from President Trump’s stated desire to have Greenland, a semi-autonomous Danish territory, become part of the United States.

The general economy has a confidence ranking at its 13.8 percentile over the last 12 months, but that drops to an all-time low ranking of zero for the next 12 months. All these respondents backed down in April compared to their March readings. The ‘expected’ financial conditions response fell by the most.

In sharp contrast, consumer prices for the last 12 months carried a 92.7 percentile standing; for the next 12 months, that pushes back up to the 98.6 percentile. Meanwhile, unemployment concerns, while ticking lower, have a standing at their 84.6 percentile higher since 1995 less than 16% of the time.

The environmental readings show the favorability of the time to purchase or save for the next or last 12 months (four metrics) all generate readings below their respective median (below a standing of 50%. The time to purchase readings are the weakest in this group.

However, the general financial situation for households currently holds above its historic standing at a reading with a 54.5 percentile standing. But that reading eroded last month.

- Metals prices weaken broadly.

- Lumber & rubber prices fall.

- Crude oil prices remain soft.

by:Tom Moeller

|in:Economy in Brief

Global| Apr 17 2025

Global| Apr 17 2025Charts of the Week: From Blue to Red

U.S. policy decisions have sparked a sharp rise in financial market volatility in recent weeks, reflecting mounting investor unease about the global economic outlook. Consensus forecasts for growth in 2025 have been revised down significantly, while inflation expectations—particularly in the US—have moved higher, highlighting the stagflationary risks associated with the sweeping tariff measures introduced in early April (Charts 1 and 2). Although these actions have since been partially rolled back, the broader shift toward protectionism is already disrupting global trade flows and could soon feed through to consumer prices, compounding the challenge for central banks already struggling with sticky inflation. In parallel, measures of financial market stress have climbed to multi-month highs as investors reassess risks in an increasingly fragmented and uncertain environment (Chart 3). Business sentiment has also deteriorated notably, with this week’s Empire State Manufacturing Survey showing a collapse in forward-looking expectations (Chart 4). Adding to concerns, global shipping costs have begun to rise again, raising the risk that renewed supply chain frictions will put upward pressure on goods inflation across advanced economies (Chart 5). Finally, in China, hopes for stabilization in the property sector are fading. Despite some recent stabilisation in house prices, real estate investment continues to contract sharply, suggesting that structural headwinds remain firmly in place (Chart 6). Taken together, this week’s charts point to a fragile global economy contending with greater protectionism, rising inflation risks, weakening business confidence, and subdued demand—all of which are reinforcing the ongoing malaise in investment sentiment.

by:Andrew Cates

|in:Economy in Brief

- Single-family starts plunge; multi-family weakens as well.

- Starts decline in West & South.

- Permits rise modestly after several months of decline.

by:Tom Moeller

|in:Economy in Brief

- USA| Apr 17 2025

U.S. Philly Fed Manufacturing Index Plunged in April

- The headline index plunged to -26.4 in April from 12.5 in March.

- This is the lowest reading since April 2023.

- Both shipments and orders fell markedly.

- Prices paid rose further while employment indicators fell markedly.

- In contrast, after having fallen significantly since January, expectations six months ahead edged up in April.

by:Sandy Batten

|in:Economy in Brief

- of2693Go to 78 page