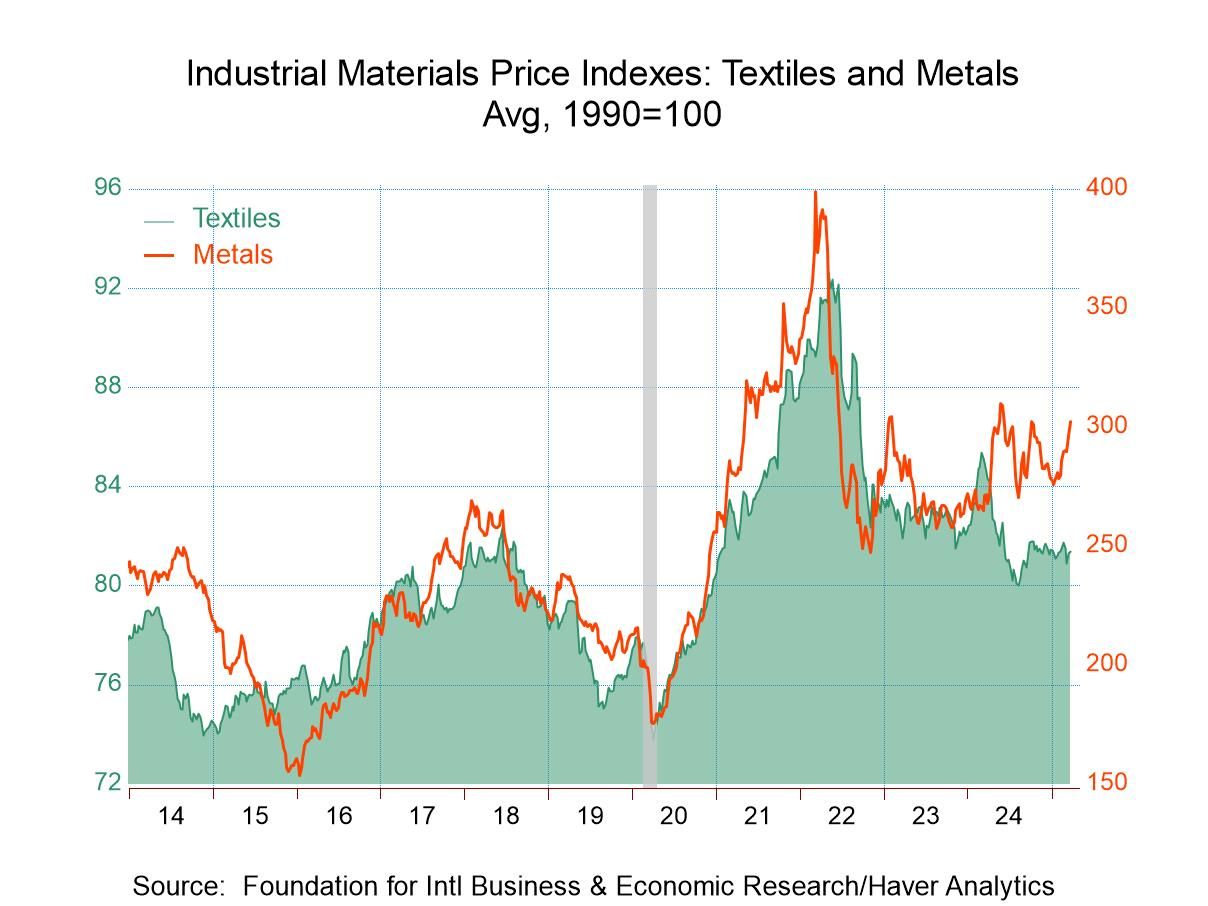

- Metals prices surge.

- Lumber prices strengthen.

- Crude oil costs decline.

by:Tom Moeller

|in:Economy in Brief

- France| Mar 21 2025

INSEE Manufacturing and Services Steady-to-Weaker

The INSEE industry climate index settled lower in March at 95.9, down from 97.0 in February. The index is lower than its year-ago value of 102.1 and since 2001 it has been this low or lower only 7.5% of the time. Despite the sense of some stability in manufacturing in the tabular data for the last year, the chart (of data since 2014) and the table’s own presentation of the queue standing reveals manufacturing to be at a relative weak standing in March.

Manufacturing production expectations have a 34.4 percentile standing but did improve slightly from the February reading of -14.8. The recent trend of production weakens on the month to a lower quartile standing at its 23.7 percentile. The personal likely trend, which is the reading for each respondent gives to the prospects for his own industry, ticked higher in March to a 40.5 percentile standing. That is better than the percentile for industry over all but still below the level that marks the historic median – a standing at the 50th percentile.

Orders and demand as well as foreign orders and demand each weakened. They each have standing at or below their respective 20th percentile around the lower one-fifth of all historic readings. In addition, the March reading for orders and demand are substantially weaker than they were a year ago and the slippage has been worse for foreign orders.

In contrast, inventory level show few changes and are similar to their year-ago readings and close to their historic median.

Prices have moved to lower readings in recent months. However, price trends and level readings are higher than they were a year ago. In terms of rankings, the own likely price trend is at a 61.5 percentile standing, above its historic median while the manufacturing price level has a relatively weak 36.1 percentile standing.

Global| Mar 20 2025

Global| Mar 20 2025Charts of the Week: Reversal of Fortunes

US equity markets have underperformed relative to global peers in recent weeks, as investor sentiment has deteriorated in response to weaker-than-expected growth data and growing concerns about the Trump administration’s economic policies (chart 1). The administration’s renewed push for tariffs, alongside fiscal expansion and tighter immigration policies, has fuelled stagflation fears, compounding the uncertainty surrounding the Fed’s next steps. This week, the Fed opted to keep its policy rate on hold but acknowledged rising downside risks by revising its GDP growth forecast lower, signalling caution about the economic outlook despite lingering inflation concerns. Foreign capital flows into US assets and their impact on the strong dollar are also showing signs of softening, as trade tensions and policy unpredictability raise questions about long-term US economic stability (chart 2). Meanwhile, global imbalances remain entrenched—China and Germany continue to run high savings rates, while the US remains structurally dependent on external capital to finance its deficits (chart 3). Trump’s efforts to rebalance trade through protectionist measures may struggle to overcome these deeper economic realities, particularly as demographic trends reinforce the service-oriented nature of the US economy and constrain China’s transition to a consumption-driven model (chart 4). Other central banks are also caught in this evolving landscape—wage growth is slowing in Europe, but lingering inflation risks suggest that rate-cutting cycles could remain uneven (chart 5). For China, where the property market downturn has been a major drag on growth, recent policy measures have offered signs of stabilization, but the road to recovery also remains uncertain (chart 6). With the US economy at risk of slowing more sharply than anticipated, central bank policies finely balanced, and China’s long-term growth trajectory still in question, the coming months could prove pivotal in determining whether global financial markets find their footing or remain mired in volatility.

by:Andrew Cates

|in:Economy in Brief

- USA| Mar 20 2025

U.S. Existing Home Sales Rebound in February

- Sales remain up from September low.

- Sales patterns vary from state-to-state.

- Median sales price recovers m/m.

by:Tom Moeller

|in:Economy in Brief

- USA| Mar 20 2025

U.S. Current Account Deficit Narrows in Q4 2024

- Goods deficit widens to nearly largest in three years. Services surplus increases to largest in five years.

- Balance on primary income returns to positive territory.

- Secondary income balance turns slightly less negative.

by:Tom Moeller

|in:Economy in Brief

- USA| Mar 20 2025

U.S. Philly Fed Manufacturing Index Slides Again in March

- The headline index posted a second consecutive decline to a still positive 12.5.

- Shipments and orders fell markedly though remained positive.

- In contrast, employment jumped to 19.7, the highest reading since October 2022.

- Expectations six months ahead collapsed, falling to 5.6, its lowest reading since January 2024.

by:Sandy Batten

|in:Economy in Brief

- Weekly claims are trending up.

- Continuing claims rise and also are trending higher.

- Insured unemployment rate is steady.

by:Tom Moeller

|in:Economy in Brief

- Germany| Mar 20 2025

German PPI Inflation Settles Down

German PPI inflation fell by 0.2% in February for the headline series, ‘PPI excluding construction.’ The drop marks a string of declines in German headline PPI inflation. For the PPI excluding energy, inflation rose by 0.1% in February after a 0.1% rise in January and no change in December. This is a clear winning streak for German inflation trends at the producer level.

Inflation results from 12-months to 6-months to 3-months show German headline PPI inflation decelerating steadily and somewhat aggressively from an increase of 0.8% over 12 months to a -0.6% annual rate over six months to a -2.5% annual rate over three months. For the PPI excluding energy, German inflation is up 1.5% over 12 months, which eases to a 0.5% annual rate over six months, and then stabilizes but accelerates slightly at a 0.7% annual rate over three months. The performance and behavior of headline inflation obviously shows a great deal more weakness than in the PPI excluding energy. But both are well-behaved.

Oil price trends Brent oil prices declined by 10% over the previous year and have declined by 8% over the most recent 12 months. Over six months they're falling at a 9% annual rate, but then over the last three months they've been increasing at a 9.5% annual rate. Monthly Brent oil prices fell slightly in December, fell by 3.8% in February, but rose by 6.5% in between, during the month of January. The oscillation in oil prices makes it just a little bit difficult to nail down the impact of oil prices on the inflation numbers, but generally oil has been weak and there has only been a slight amount of pressure from oil recently compared to past trends.

German PPI component trends German PPI components are not seasonally adjusted; they generally show inflation is relatively stable. For consumer prices, the 12-month, 6-month and 3-month pace is just under 3%. For investment goods, inflation is accelerating slightly from 2% over 12 months to a 4.2% annual rate over three months. Intermediate goods display growth rates for inflation that fluctuate between -0.9% at an annual rate over six months to +1.4% at an annual rate over three months. The PPI trends compare to CPI trends that are really quite flat with the headline CPI between 2.5 and 2.2% at an annual rate across horizons and the CPI excluding energy at a pace of expansion between 2.4% and 2.7%.

All-in-all German inflation appears to be contained and at a relatively low level. This should be a report that the European Central Bank is pleased with.

- of2700Go to 95 page