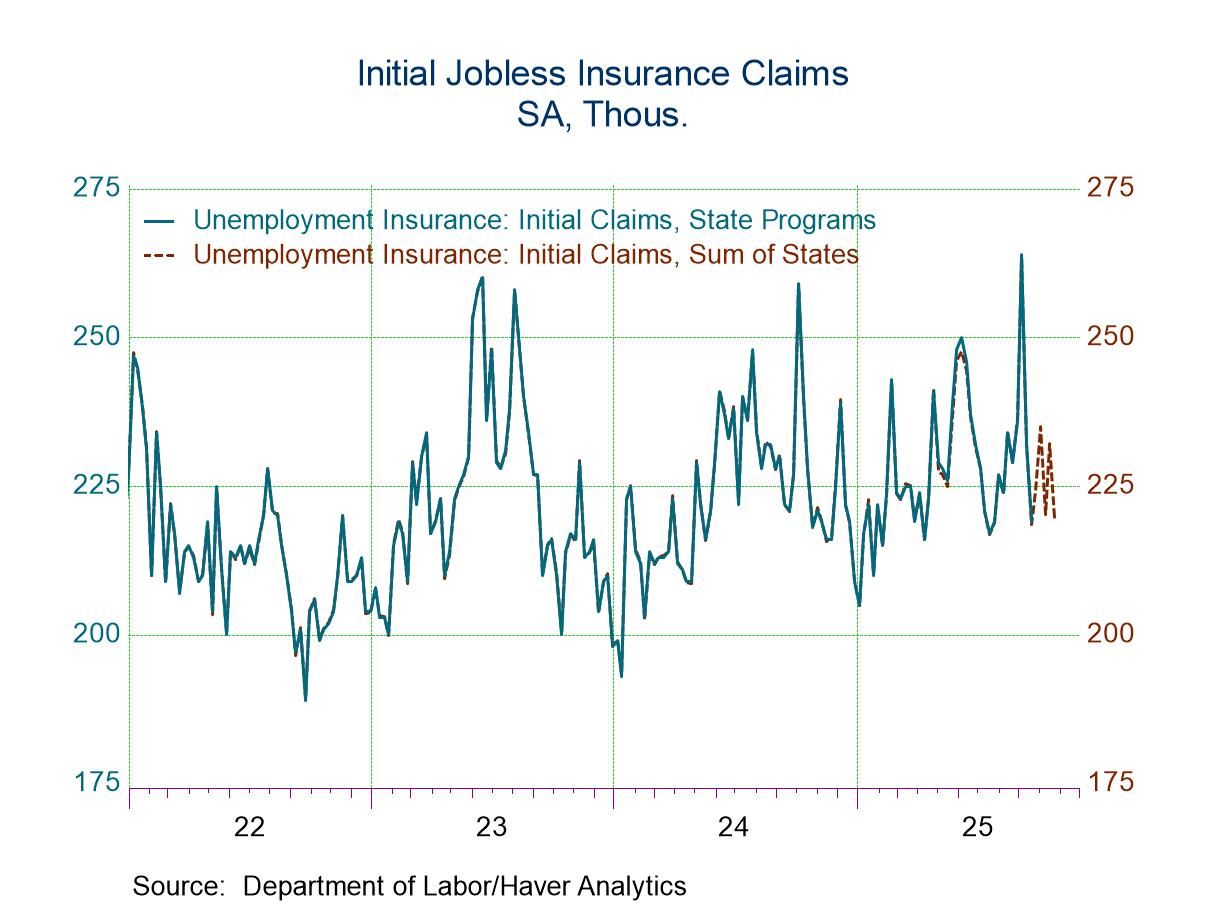

This week, we review key developments across several Asian economies as the year nears its close. On balance, many of investors’ and policymakers’ worst fears did not materialize. Despite US tariffs, regional exports have shown resilience (chart 1), partly supported by stronger intra-Asia trade, even as exports to the US declined in some cases.

In China, factors including importer front-loading, stronger exports to non-US markets, and government efforts to boost consumption—albeit with potentially one-off effects—have kept the economy on track to meet its 5% growth target this year (chart 2), barring a substantial slowdown in Q4. In Japan, political uncertainty has eased following Prime Minister Takaichi’s rise, though her pro-growth, pro-loose monetary stance has contributed to further yen weakness (chart 3). India, while still likely Asia’s fastest-growing major economy this year, has seen trade setbacks (chart 4) as US–India discussions continue, though recent progress suggests a deal may be near.

However, not all developments in Asia have avoided worst-case outcomes. For example, the Philippines, which has already been hit by a string of storms this year, continues to reel from the effects of Typhoons Fung-wong and Kalmaegi. These storms have highlighted corruption in the Philippines’ flood control systems, rattling investors and pressuring the peso (chart 5), in a manner reminiscent of the rupiah’s decline during Indonesia’s political turmoil earlier this year. In Thailand, political uncertainty continues ahead of general elections eyed at next March, while the expected full return of Chinese tourists has yet to materialize (chart 6).

Trade in Asia For Asia, the year has ultimately not played out as bleakly as investors once feared, particularly on the trade front. Despite US President Trump’s tariffs and a persistent backdrop of uncertainty, export performance in several Asian economies has proven more resilient than expected. This is most clearly reflected in export growth readings for China and key Southeast Asian economies (chart 1), which have remained firm—and at times exceeded expectations—even as China’s shipments to the US fell sharply. Much of this resilience reflects a redirection of exports toward other markets, often within the region. India, however, has seen more limited gains, with exports in US dollar terms struggling to materially surpass last year’s levels.

Asia

Asia