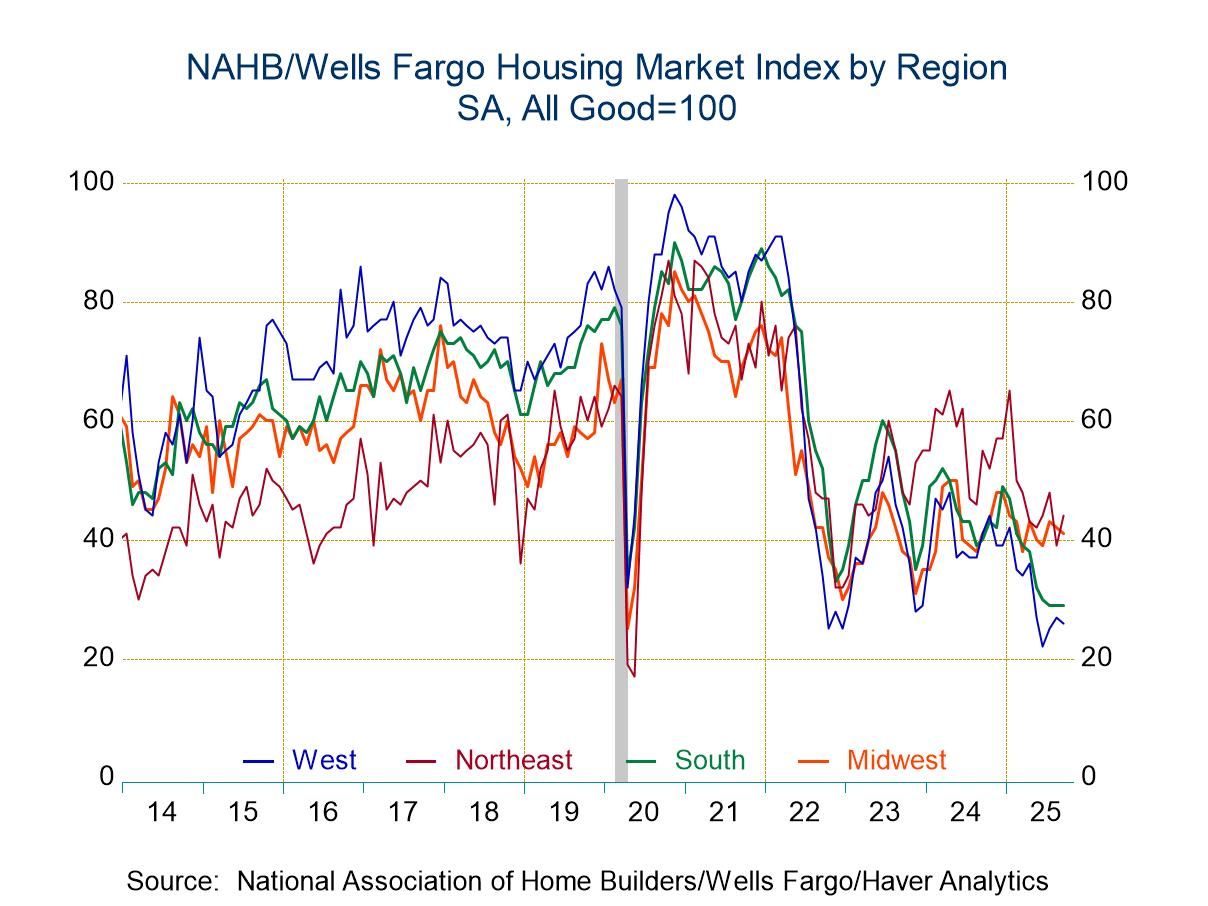

- Overall reading remains at lowest level since December 2022.

- Expectations rise; current sales steady and traffic eases.

- Higher Northeast activity offsets weakness in other regions.

- USA| Sep 16 2025

U.S. Home Builders Index Holds Steady in September

by:Tom Moeller

|in:Economy in Brief

- USA| Sep 16 2025

U.S. Import and Export Prices Unexpectedly Rose in August

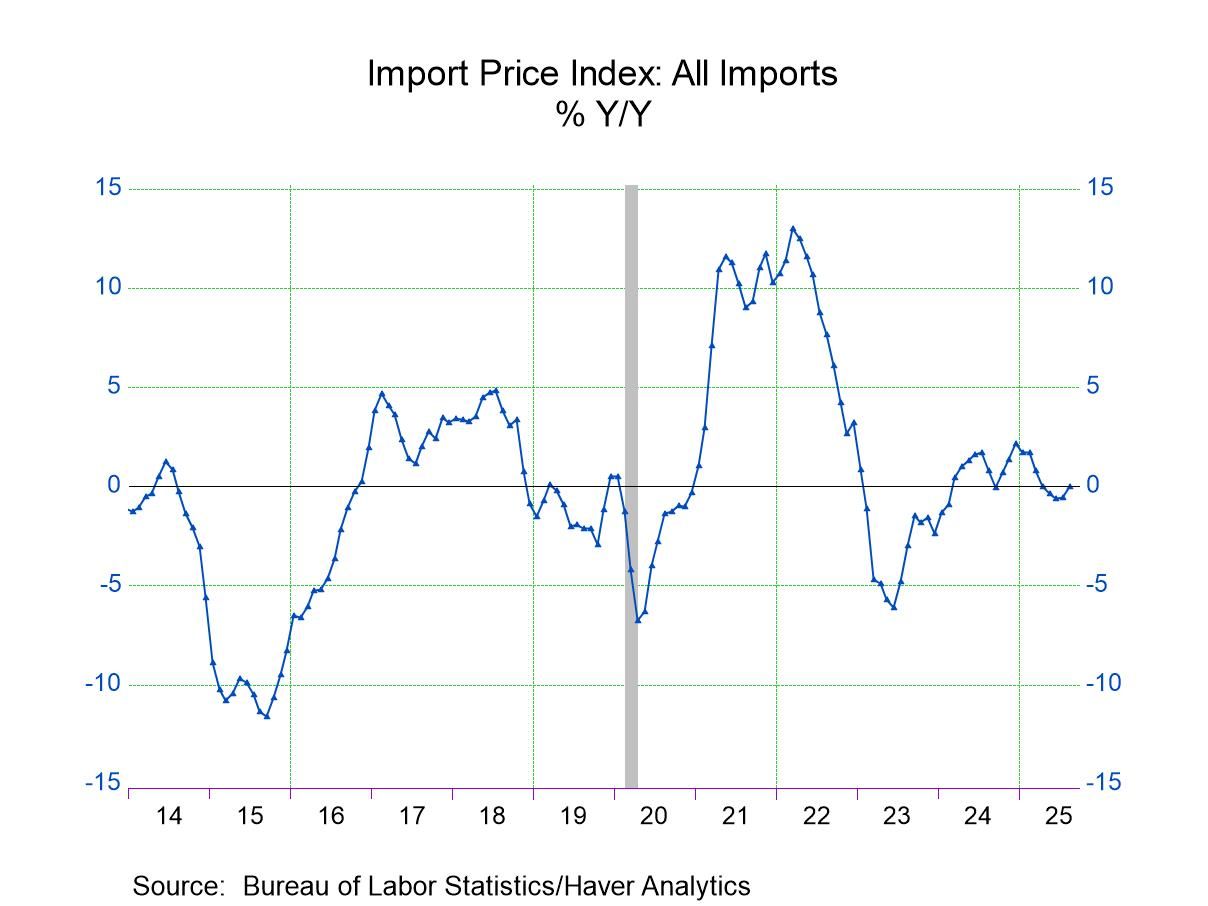

- Import prices rose 0.3% m/m in August against expectations of a small decline.

- The August increase was due to higher prices for nonfuel imports as prices for fuel imports fell for the first time in three months.

- Export prices also rose 0.3% m/m against expectations of a small decline, reflecting higher prices for nonagricultural exports.

by:Sandy Batten

|in:Economy in Brief

- USA| Sep 16 2025

U.S. Business Sales and Inventories Rose in July

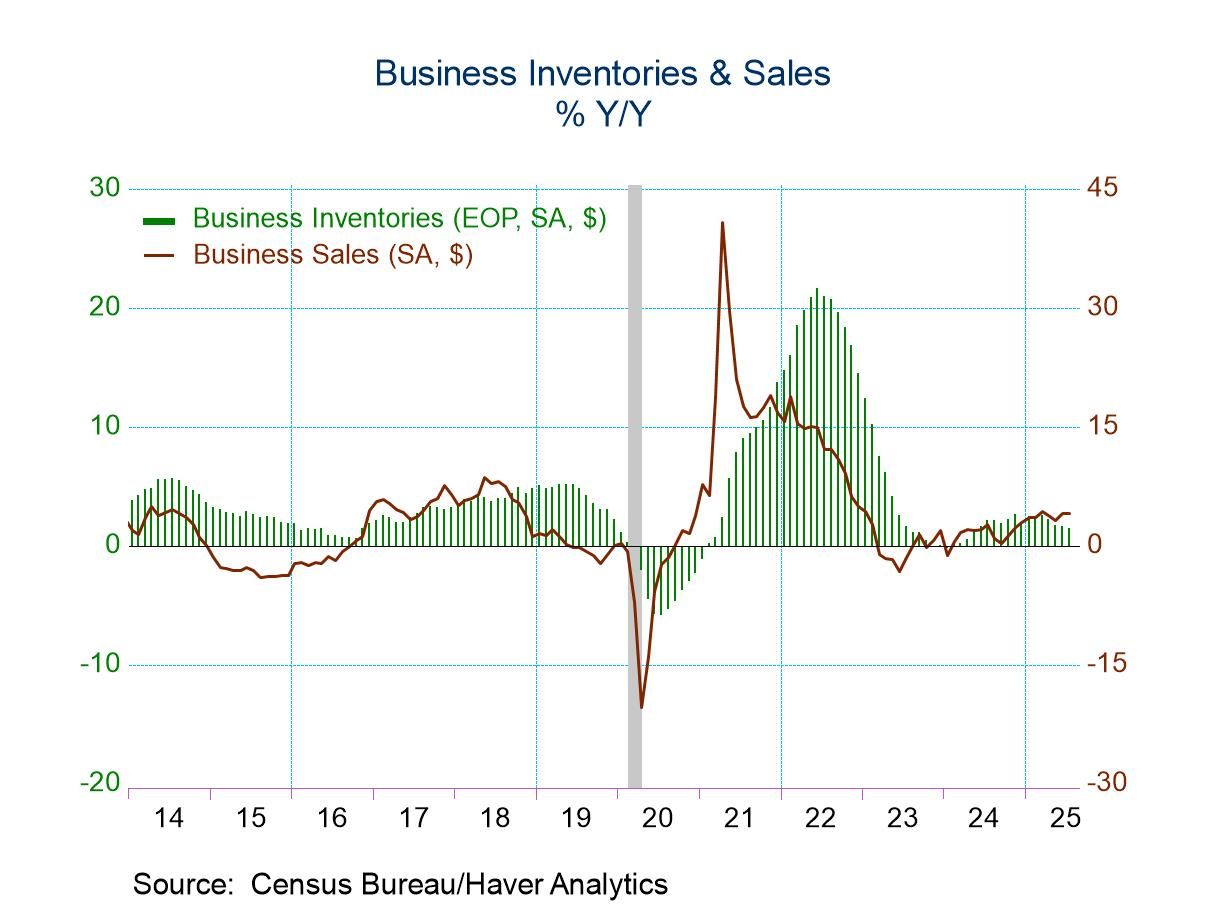

- Total business inventories increased 0.2% m/m in July with increases across sectors.

- Total business sales climbed 1.0% m/m in July, their largest monthly gain since February.

- With sales advancing more than inventories, the inventory/sales ratio fell to 1.37, its lowest reading since July 2022.

by:Sandy Batten

|in:Economy in Brief

- Europe| Sep 16 2025

Finalized EMU IP Shows More Strength

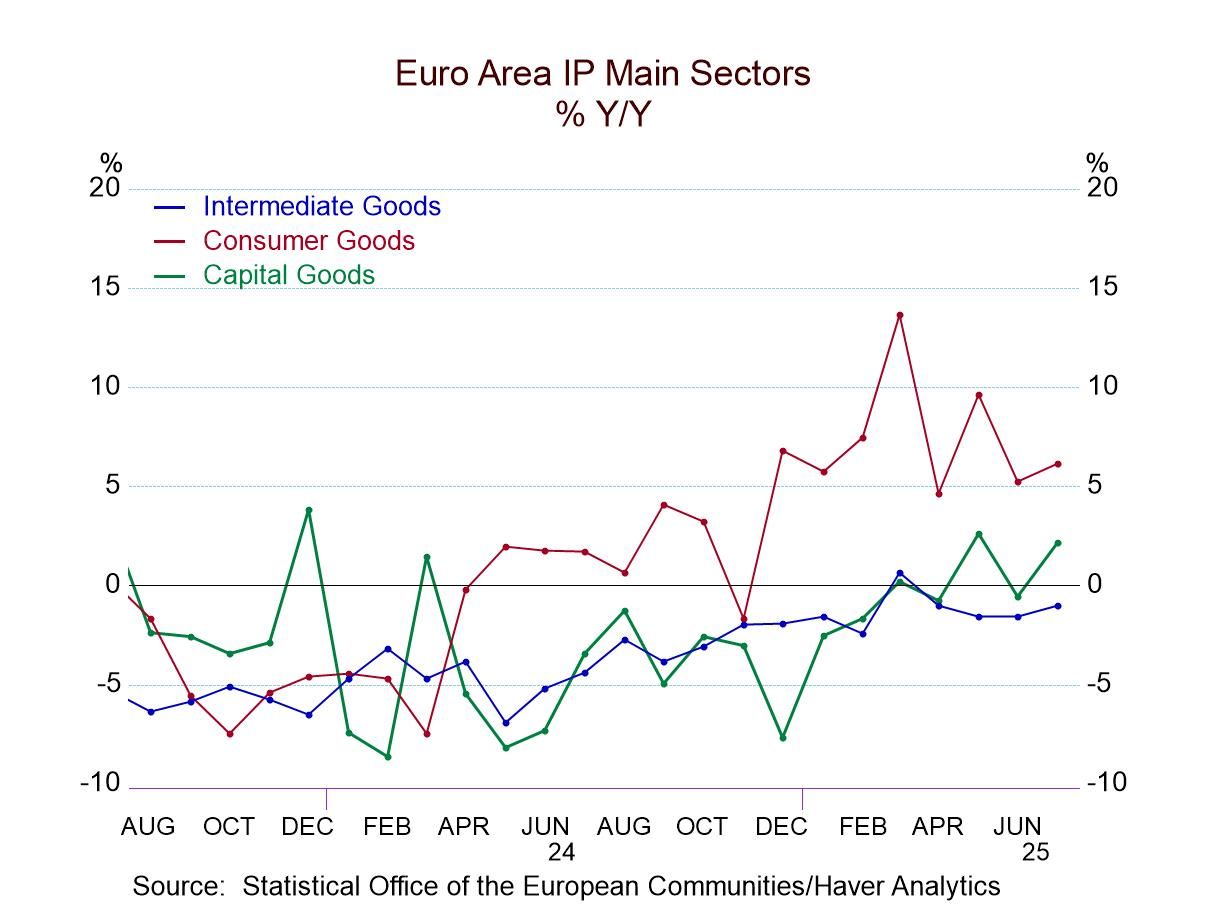

The finalized version for EMU industrial production in the European Monetary Union in July showed that much better than preliminary data had suggested. Overall output rose 0.3% in July, but output in manufacturing on the month rose by 0.7%. Consumer goods output rose by 1.4% on the month with consumer durables output up by 1.1% and nondurables output up by 1.5%. Intermediate goods output rose by 0.5% with capital goods output rising by 1.3%. All of these are very solid numbers.

The median result for reporting European Monetary Union members had shown a decline of 0.6% for manufacturing output. And, of course, the problem with that is that it's a median among countries without weights being applied to account for size. Germany, for example, showed an increase in output in July of 2.2% in its manufacturing sector, France showed a decline of 1.6%, Italy showed an increase of 1.4%, with Spain showing a rise of 3.8%. That's three of the largest 4 monetary union members showing solid increases in output.

Sequential data showed that output is holding up quite nicely with growth 2.2% over 12 months, up 3.1% at an annual rate over six months and up by 2.5% in an annual rate over three months. For manufacturing, the results are roughly the same, with a 2.1% gain over 12 months, 3.5% annualized over six months and 2.4% annualized over three months.

The quarter-to-date numbers showed that output is developing nicely in the third quarter with overall output up at a 1.2% annual rate as of July, the first month in the quarter with that growth rate representing annualized growth in July over the second quarter average; manufacturing output on the same basis is up at a 2.6% annual rate. All the sector growth rates are positive as well QTD except for intermediate goods.

Percentile queue standings rank current growth rates among past historic growth rates (back to 2007) and on this basis, overall production growth has a 63.3 percentile rank, manufacturing has a 60.1 percentile rank, consumer goods IP is extremely strong with a 98.2 percentile rank, pushed ahead by nondurables that have a 98-percentile rank. Consumer IP growth is held back somewhat by consumer durables that have only a 45.9 percentile ranking, below its median for the previous period. Intermediate goods and capital goods also have below-median rankings (rankings below 50%) at the 43.6 percentile for intermediate goods and 42.2 percentile for capital goods. Still, none of the sectors is particularly weak; being at the 42nd percentile or better means that the shortfall from the median is not extreme and the weighted average for overall production and for manufacturing still stands in its 60th percentile or better.

As we look down the column to look at country-specific manufacturing readings, we find that there are only 4 of 13 reporting monetary union members with manufacturing output below its median in July. And those countries are Finland, the Netherlands, Luxembourg, and Greece, all moderate to small-sized economies.

On balance, the performance the monetary union output in July is quite solid. And these readings are joined by an August reading for IP in the United States that showed a surprising positive turn on the month. It's too soon to say that conditions globally are improving faster or more than had been expected; however, there is a whiff of that in the air despite some sour readings on job growth in the United States.

Asia| Sep 16 2025

Asia| Sep 16 2025Economic Letter from Asia: Decisions, Decisions

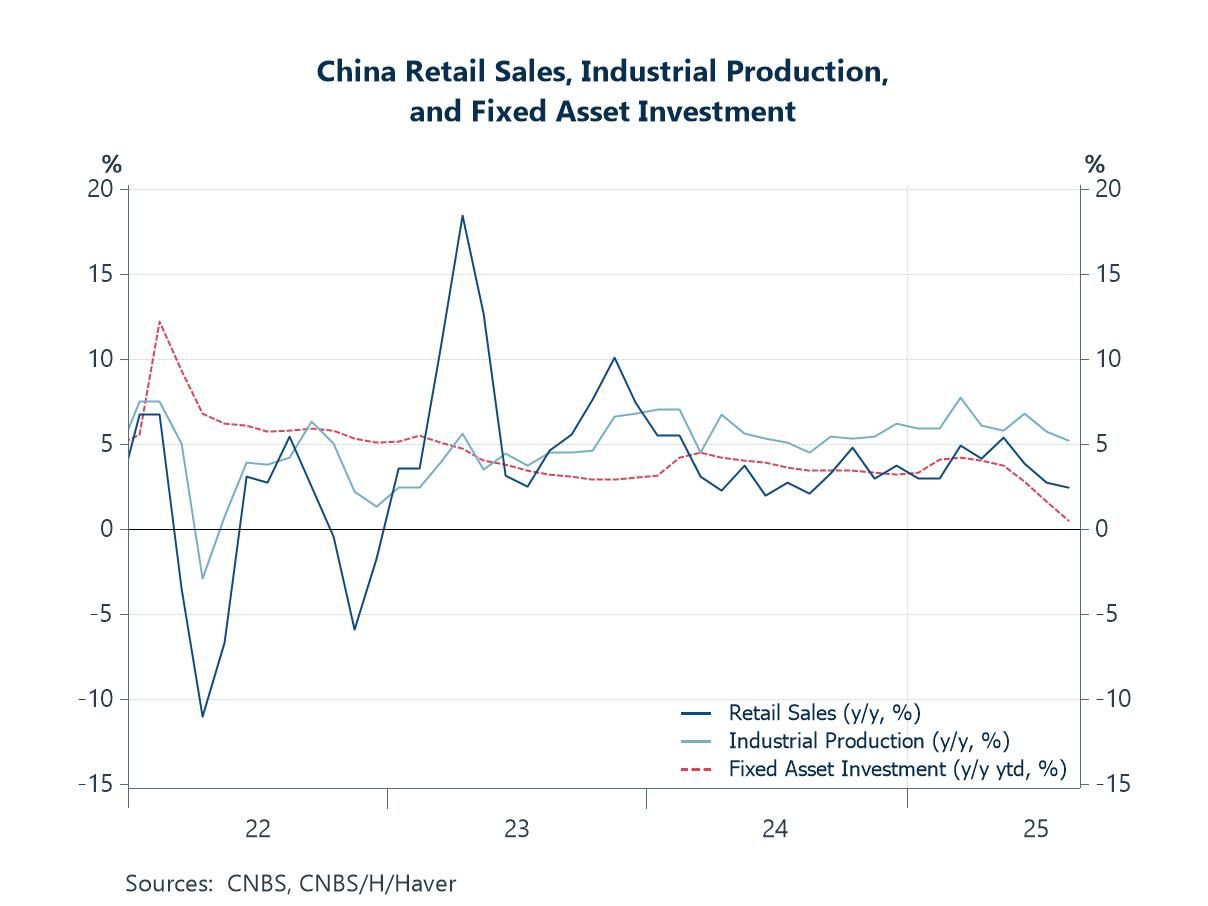

This week, we examine a broad set of key developments, from China’s disappointing August data and structural economic challenges to a flurry of central bank decisions across Japan, Taiwan, and Indonesia. China’s latest data disappointed again, reinforcing concerns that US trade tariffs are starting to bite as the front-loading boost fades (chart 1). More broadly, China continues to struggle with its transition toward a more consumption-driven economy (chart 2). Recent figures show little sign of this pivot, with trade remaining resilient while consumption still lags.

In Japan, the Bank of Japan (BoJ) will decide on interest rates during a central bank-heavy week, following key decisions from the Fed and the Bank of England (chart 3). The BoJ is widely expected to hold its policy rate steady for now as the country navigates a period of political uncertainty after Prime Minister Ishiba’s recent resignation. Still, there has been some good news: the Cabinet Office estimates that Japan’s output gap turned positive for the first time in two years, although figures differ across methods and sources (chart 4).

Turning to Taiwan, uncertainty remains in the semiconductor sector as US tariffs loom. However, major Taiwanese producers’ substantial US investments may position them for exemptions (chart 5). Finally, in Indonesia, Bank Indonesia’s policy decision is also due this week on Wednesday. While the door to monetary easing remains open, the timing of any move is unclear. Meanwhile, Indonesian asset prices fell again after the removal of one of its long-serving Finance Ministers (chart 6), with her successor’s plans raising renewed concerns about fiscal discipline.

China China’s latest monthly data releases disappointed again, showing a further slowdown in growth. This has strengthened investor concerns that US trade tariffs are finally starting to weigh on the economy as earlier front-loading effects fade. Year-on-year growth in retail sales and industrial production fell to their lowest levels in about a year, while fixed asset investment was nearly flat (chart 1). Property prices also extended their multi-year decline. In response to the weakening outlook, calls for additional policy support have grown, though several measures have already been announced. For instance, domestic consumption may get another boost as the government’s new personal consumer loan interest rate subsidy program takes effect this month. If realized, this would follow the one-off lift from the earlier durable goods subsidy program.

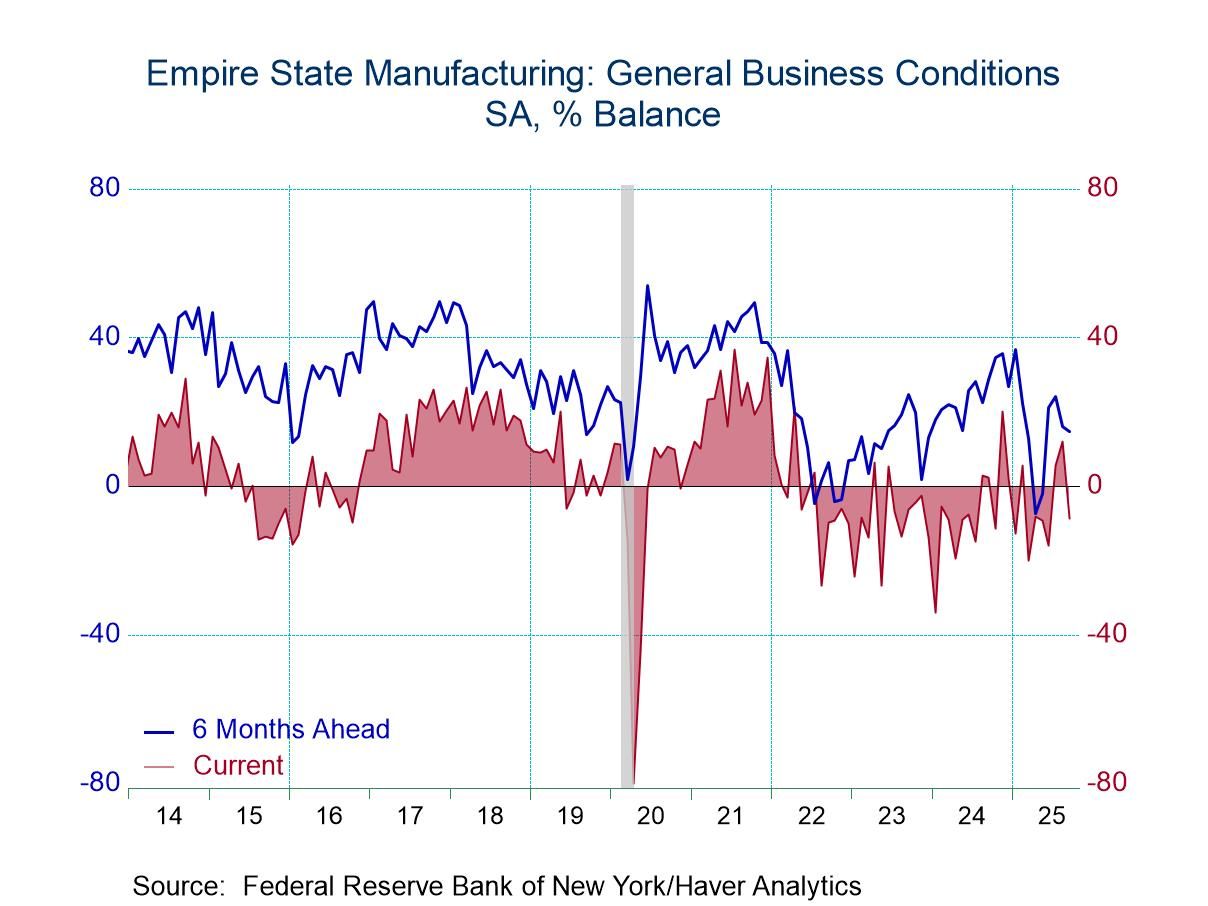

- First negative reading logged in three months.

- New orders & employment decline.

- Prices paid & received weaken.

- Six-month outlook ahead dims.

by:Tom Moeller

|in:Economy in Brief

- Europe| Sep 15 2025

EMU Trade Surplus Expands But Stays on Lower Trend Pace

In the wake of U.S. tariff implementation, we, of course, look for evidence of the impact of that action on global trade performance. In the July trade report for the EMU, there is little direct evidence of a draconian impact on trade in the EMU that coincides with changes in U.S. trade policy. Of course, the EMU picture is of the external trade of that community with the world and not just the United States. But such dire predictions had been made of the impact of U.S. tariff policy that it is very worthwhile to note that such cataclysm has not appeared. Has there been some trade impact? Certainly! Has there been some increases in uncertainty? Yes. But nothing has brought global trade to a screeching halt. In fact, the Baltic Dry goods index shows a rise in trade volumes since early 2025. The current level is comparable to or higher than 2024 and last persistently stronger in 2022.

The euro area trade surplus at 5.3bln euros is higher in July than in June but is much weaker than its 3-month, 6-month, and 12-month averages. In round numbers, the 3-month average is €8bln, the 6-month average is €15bln and the 12-month average is €13bln. So, July runs at less than half the pace of the 12-month average. That may be evidence of U.S. tariff impact.

The overall balance sees disproportionately large-looking effect because it is smaller…smaller than what? Well, the manufacturing surplus is at 27bln euros in July, up by 3bln euros from June, about 3bln euros below the 3-month average of 30bln euros and about 8bln euros below the 12-month average. An eight billion drop on a level of 35bln seems smaller than and eight billion euro drop on 13 bln…but eight billion euros are eight billion euros- but that is only 2.2% of total exports. How we view relativity is important. Is that the draconian U.S. tariff impact?

The nonmanufacturing deficit in the EMU is almost unchanged by month or on any average (at minus 22bln euros).

Growth rates for manufacturing exports show contraction and a worsening trend from 12-months to 6-months to 3-months. This is not so for nonmanufacturing exports that log a strong double-digit rise over three months. EMU manufacturing imports show very steady slow growth with modest decay… not so for nonmanufacturing imports that log strong double-digit gains over three months.

Country level trends By country, German exports show growth rate erosion, French exports show acceleration, Italy shows a slowdown but at a still-strong double-digit pace for three months. Finland, Portugal, and Belgium show exports in a state of decline or weakness- mostly decline. The United Kingdom, not an EU member, shows an erratic trend but with 3-month export growth in double digits. There is some export weakness here to be sure but nothing that looks very severe.

On the import side, German imports melt down to a 3-month low annualized pace of +0.1%. French imports speed up to a 6.6% pace over 3 months. The U.K. looks at positive- if irregular- import growth.

- USA| Sep 12 2025

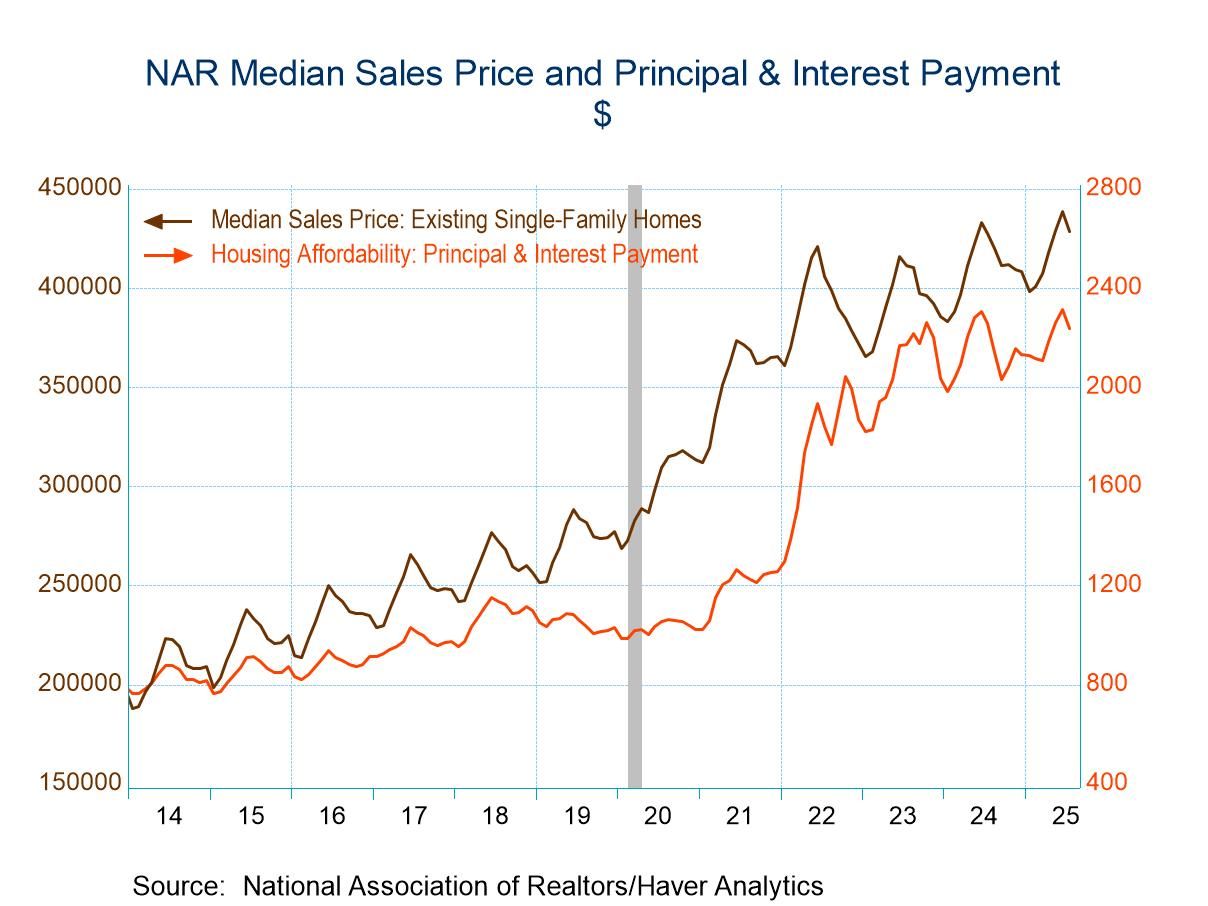

U.S. Housing Affordability Improves in July

- Home prices & mortgage rates slip.

- Median income edges higher.

- Affordability increases across country.

by:Tom Moeller

|in:Economy in Brief

- of2693Go to 34 page