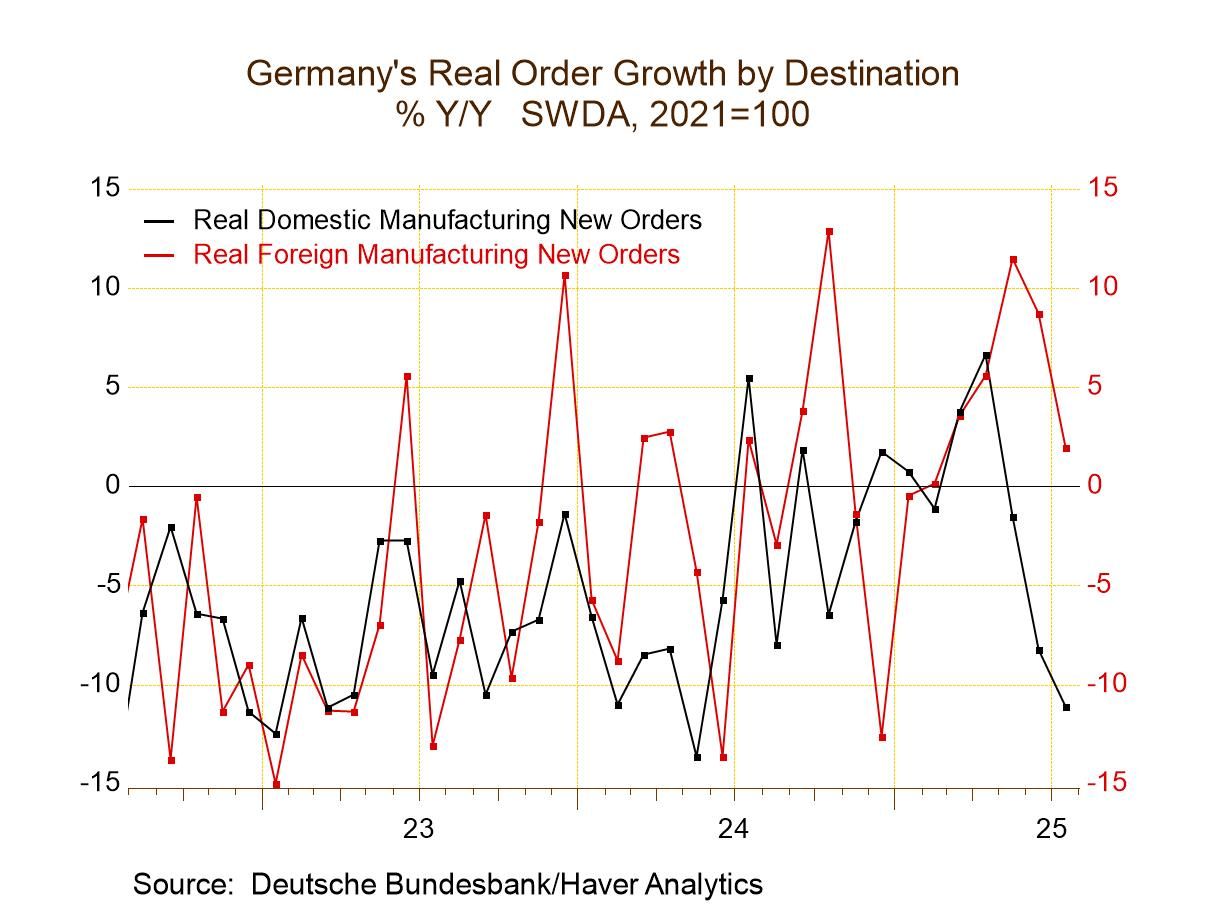

Germany's factory orders declined for the third straight month in July. Real new orders fell 2.9% month-on-month in July, against expectations for a small increase. The drop was sharper than a 0.2% decrease in June; foreign orders declined 3.1% in July, as orders from the euro area contracted 3.8%, and orders from outside the euro area fell by 2.8%. These metrics suggest that demand both inside and outside the euro area remains weak. Domestic orders dropped 2.5% in July, an exact offset to their gain in June. When ranked on growth rates over the last 30 years, all three sector growth rates are below their medians (below a ranking of 50%). However, when ranked on the real index number level, total orders rank at their 55.6 percentile, foreign orders rank at their 79.5 percentile and domestic orders rank at their 15.2 percentile. All-in-all it’s an unimpressive report.

Orders sequentially and QTD: Sequential trends are ambivalent but still clearly weak. Sequential growth rates do not show a clear acceleration/deceleration pattern. But for total, foreign and domestic real orders, both 3-month and 12-month growth rates are negative (one exception: foreign orders over 12 months). Domestic orders show negative growth over 6 months as well. Quarter-to-date growth rates are negative for all sectors.

Sales trends: Real sales are mixed in July, rising 0.9% overall on declines in two sectors: consumer durables and intermediate goods. Sector sales mostly maintain growth as manufacturing sales are positive based on growth rates over 12 months, 6 months, and 3 months. Consumer goods and intermediate goods sales show deceleration and ongoing contraction. Consumer durable goods and intermediate goods show QTD declines. On the manufacturing & mining to total, manufacturing and capital goods show index standings above their respective 50% on 30 years of data. That also shows above-median growth rates on annual data along with consumer goods and consumer nondurable goods.

Industrial confidence: Industrial confidence measures for Germany, France, Italy, and Spain, the four largest EMU members, show improved (but still net negative readings) in July compared to June. Over three months and six months, Germany and Italy show some improvement; France still shows steady deterioration. Spain shows improvement over 3 months and it is only slight improvement. The queue standings for the industrial reading over 30 years of data show Spain with an above-median reading in July. Germany and France are exceptionally weak and Italy has been weaker only 26% of the time based on the queue standing measure. Not only are German orders and demand weak and faltering but the broad EU Commission measures of industrial confidence show broadly weak readings for the largest economies in the EMU.

Global

Global