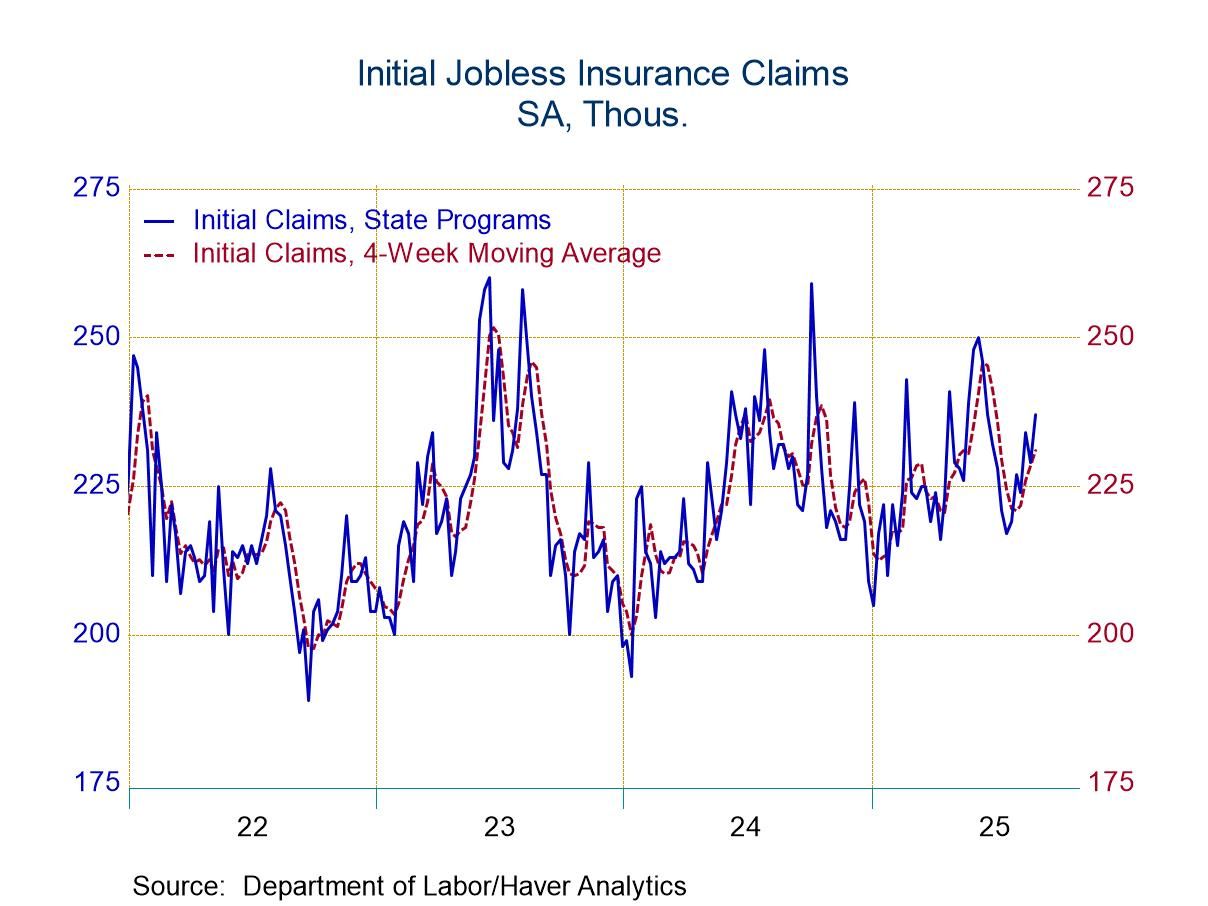

- Initial claims rose in latest week.

- Continuing claims declined.

- Insured unemployment rate holds steady.

- Europe| Sep 04 2025

Monetary Union Retail Sales Ease as Vehicle Sales Pop

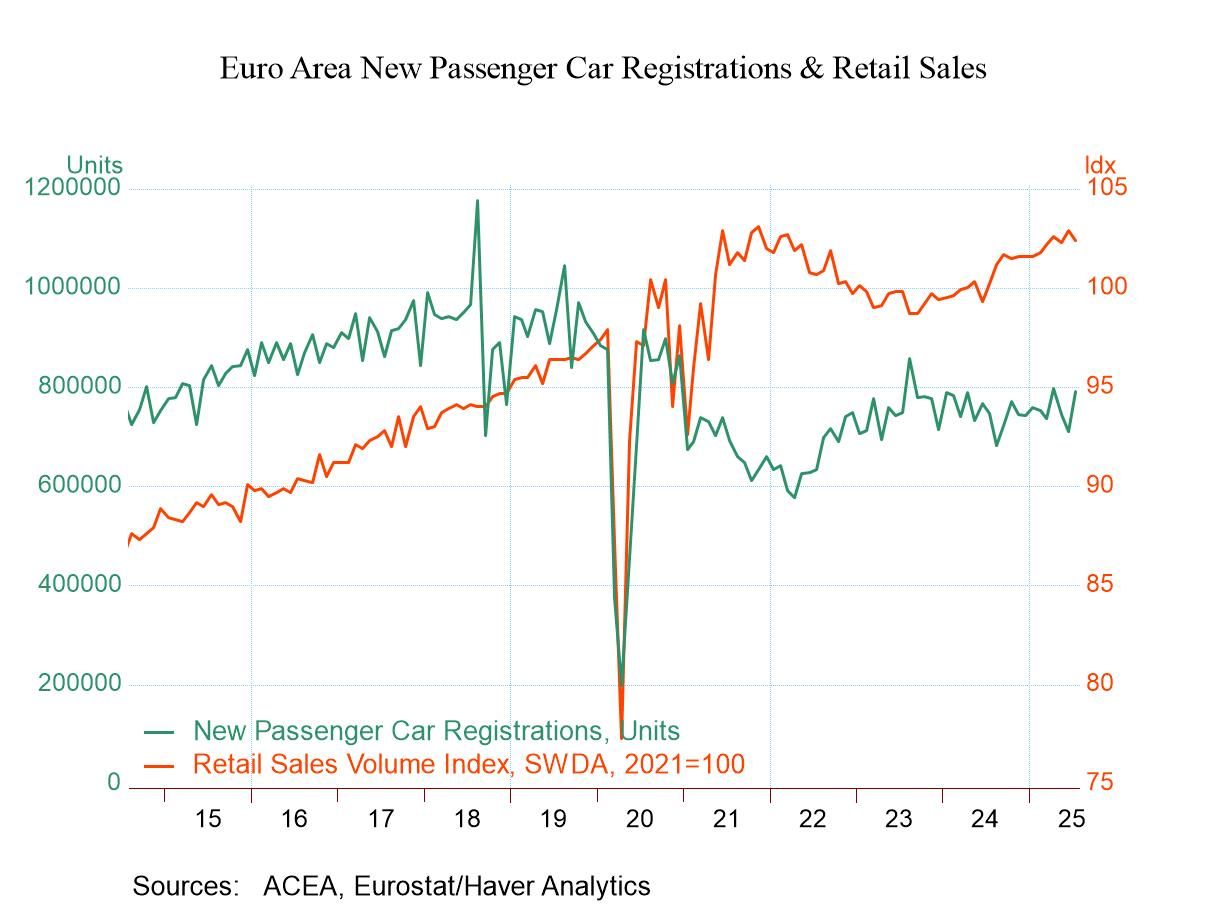

Retail sales volume in the euro area fell by 0.5% in July after rising by 0.6% in June. The three-month percent change is -0.8% at an annual rate; over six months real retail sales volumes are rising at a 1.6% annual rate and over 12 months they're rising at a 2.2% annual rate. The slowdown in retail sales volume growth has been steady from 12-months to 6-months to 3-months.

For motor vehicle registrations, the patterns are much choppier with an 11.5% increase in registrations in the EU in July after a drop of 4.6% in June, and a larger drop in May. Over 3 months monetary union motor vehicle registrations are falling at a 3.4% annual rate, after rising at an 8.7% annual rate over 6 months; over 12 months that gain is cut to a 5.9% annual rate. There's no clear trend here for motor vehicle registrations, except to note that over 3 months conditions are much weaker and that is mostly driven by June and May because July was quite strong. In the big picture, vehicle sales have been flat and moving sideways for quite some time in the monetary union- since COVID registrations are lower on balance by 10.5% even with the spike in sales in July.

Individual countries show quite different results. Germany is showing persistent deceleration in retail sales volume growth from 12-months to 6-months to 3-months, culminating in negative numbers for growth over 3 months and 6 months. For Denmark, a country that's not part of the single currency union, there's a hint of a slowdown with growth rates of 3.4% over 12 months and 3.6% over 6 months to give way to a 1.2% rate of increase annualized over 3 months. Both Sweden and Norway show real retail sales volumes in a slippage mode as growth rates ease over 6 months compared to 12 months and then ease again over 3 months compared to 6 months. For Sweden, the 3-month growth rate is a negative result at -5.7% at an annual rate.

In the quarter to date - and this is an early calculation since it's July - the monetary union is starting off with a negative growth rate of -1.2% at an annual rate for total retail sales volumes; this is affected strongly by a -6.5% annual rate reported by Germany, the largest economy and the euro area. There are positive growth rates on a quarter-to-date basis for the rest of the reporters in the table. The Netherlands logs a 21.9% annual rate increase; that strength has at least as much to do with the weak second quarter base as with surging sales in July.

Checking on the performance of sales back to January 2020 when COVID first appeared, total sales volume in the euro area are up 5.1% over that five-year span. Sweden logs no increase, Germany logs an increase of 2.1%, Norway logs an increase of 4.6%, with Denmark up by 4%. The strongest increases on this broad basis come from Spain with an 8.1% increase and the Netherlands with a 7.2% overall increase. Even so, for a five-year period, none of these growth rates are impressive. Clearly the European Monetary Union has been in a dead spot having a difficult time recovering from COVID, dealing with the war, and all of its displacement involving Russia and Ukraine, as well as the aftermath of the inflation from COVID, and what has been an ongoing restrictive monetary policy from the European Central Bank.

- USA| Sep 03 2025

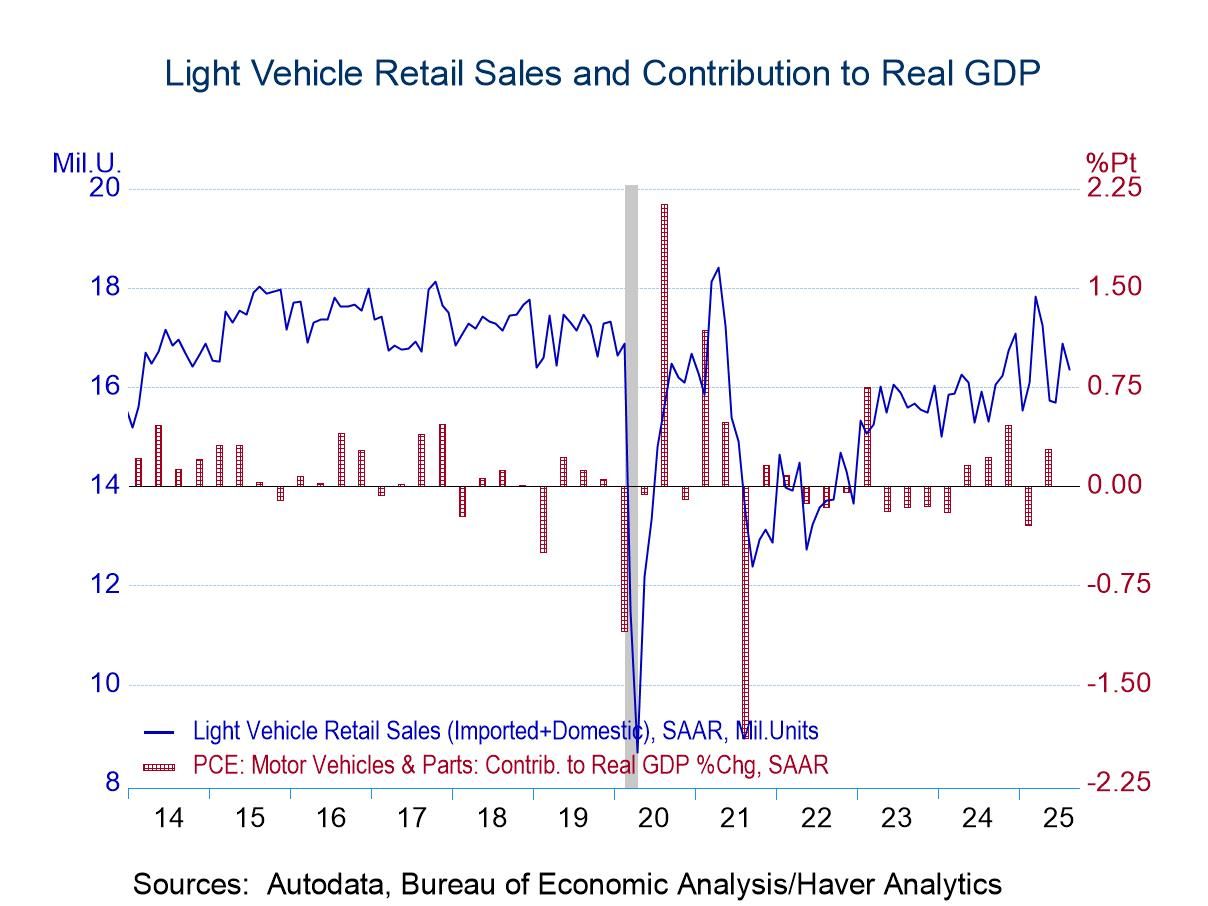

U.S. Light Vehicle Sales Ease in August

- Light truck sales decline while auto purchases improve.

- Domestic and import sales decline.

- Imports' market share steadies.

by:Tom Moeller

|in:Economy in Brief

- USA| Sep 03 2025

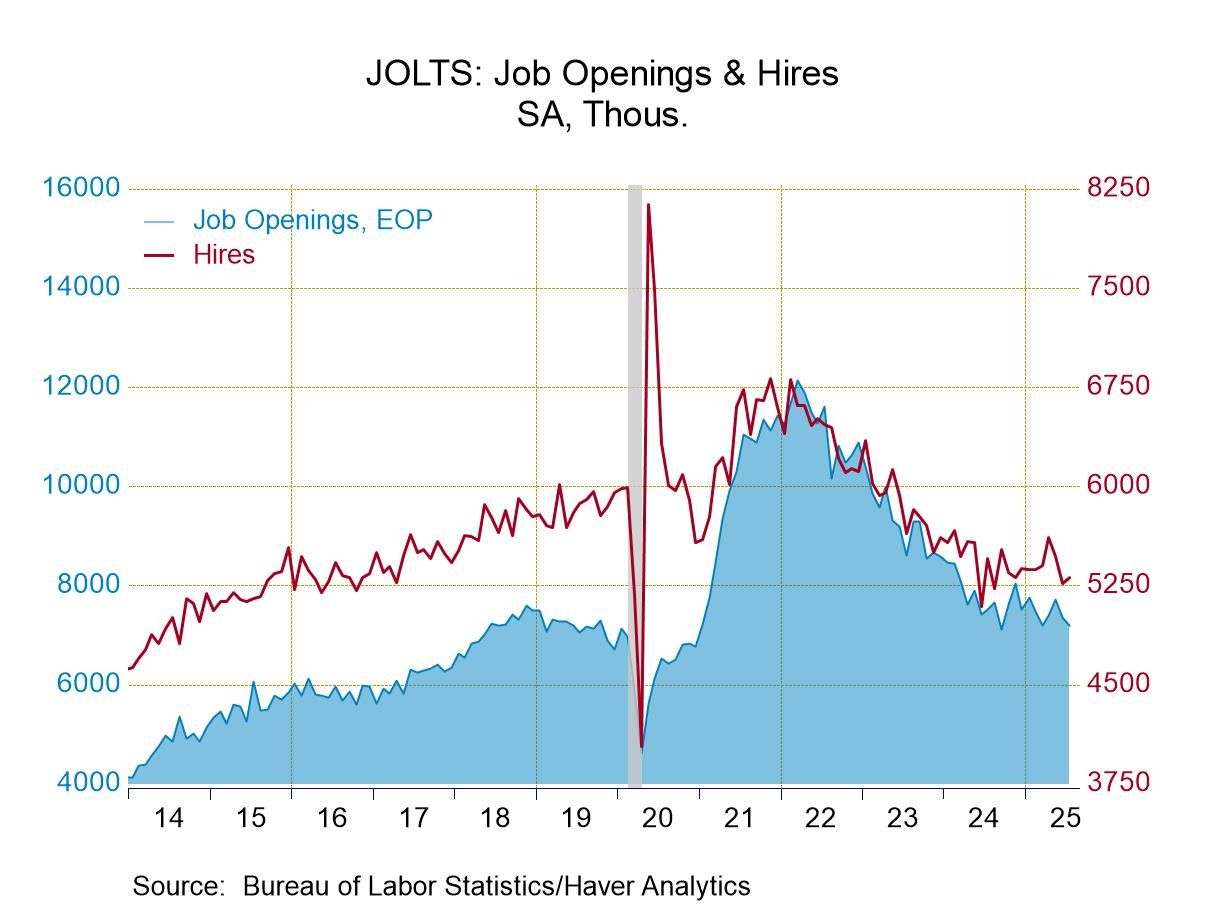

U.S. JOLTS – Job Openings Decline While Hiring Improves in July

- Job openings fall for second straight month.

- Hiring improves after two consecutive months of sharp decline.

- Separations fall, quits ease but layoffs rise slightly.

by:Tom Moeller

|in:Economy in Brief

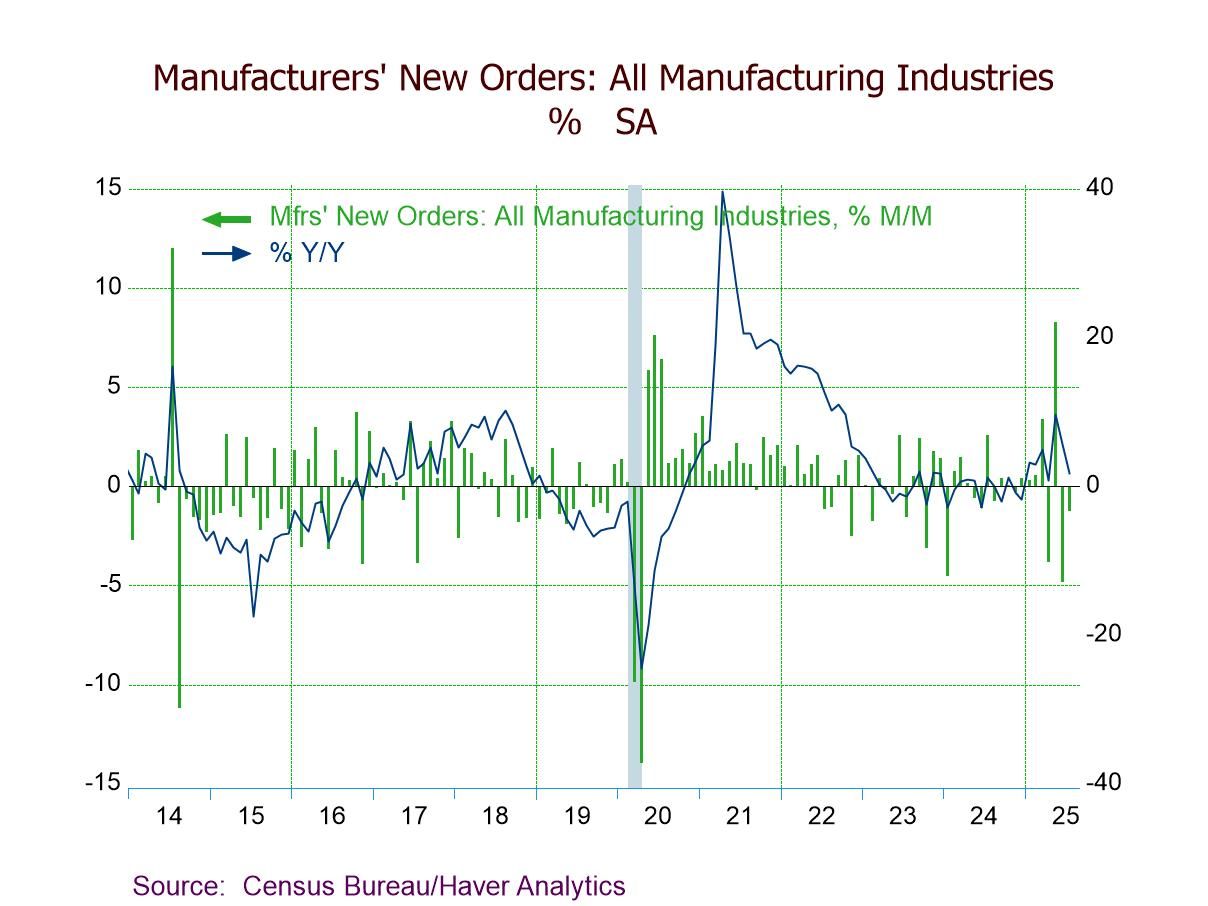

- Headline: -1.3% m/m; +1.6% y/y, the smallest y/y gain in three months.

- Durable goods orders (-2.8%) down, but nondurable goods orders (+0.3%) and shipments (+0.9%) both up three straight months.

- Transportation equipt. orders -9.5% m/m, w/ a 32.7% drop in nondefense aircraft & parts orders.

- Unfilled orders unchanged after two successive m/m increases.

- Inventories +0.3%, the third consecutive m/m rise.

- USA| Sep 03 2025

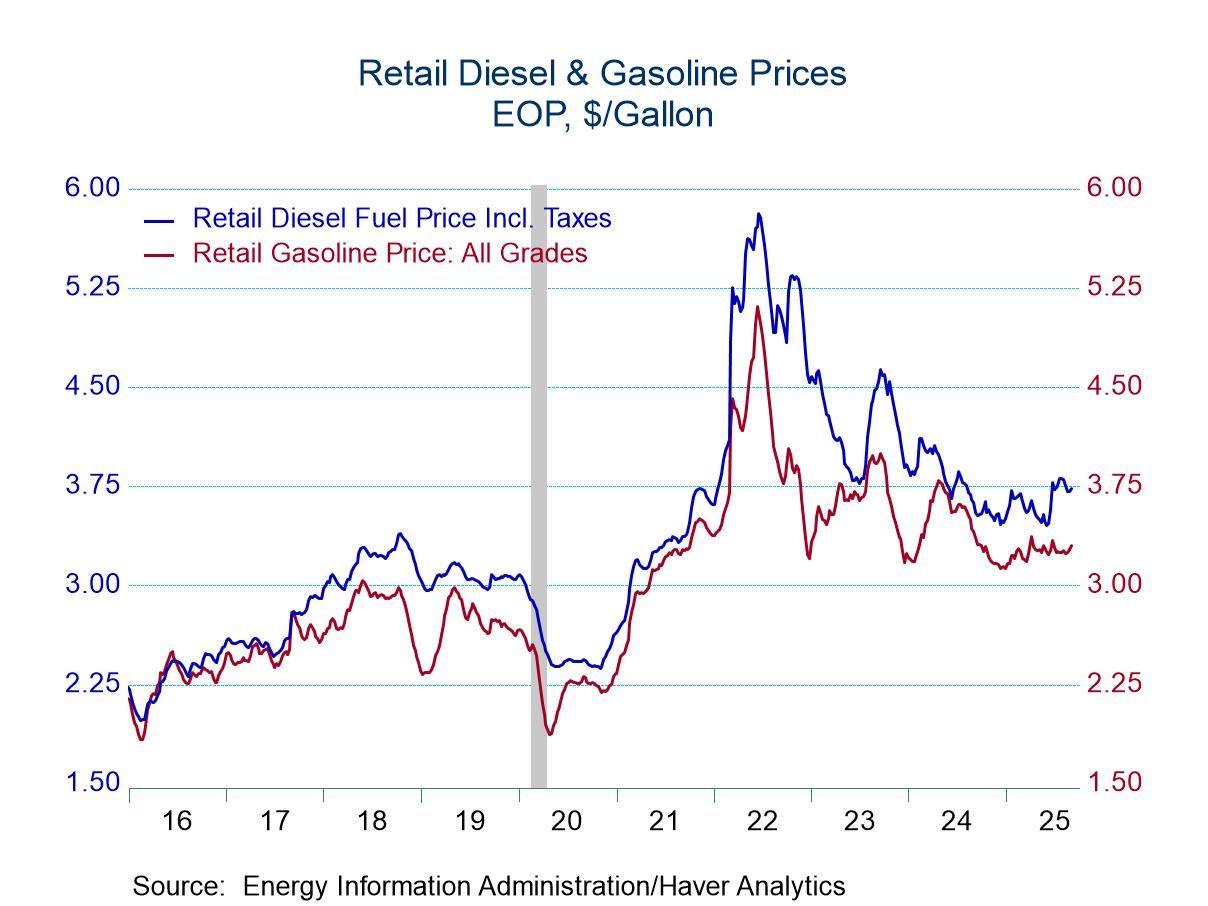

U.S. Gasoline & Crude Oil Prices Rise Last Week

- Gasoline prices increase to highest level in four weeks.

- Crude oil prices recover after earlier declines.

- Natural gas prices at early-June low.

by:Tom Moeller

|in:Economy in Brief

- USA| Sep 03 2025

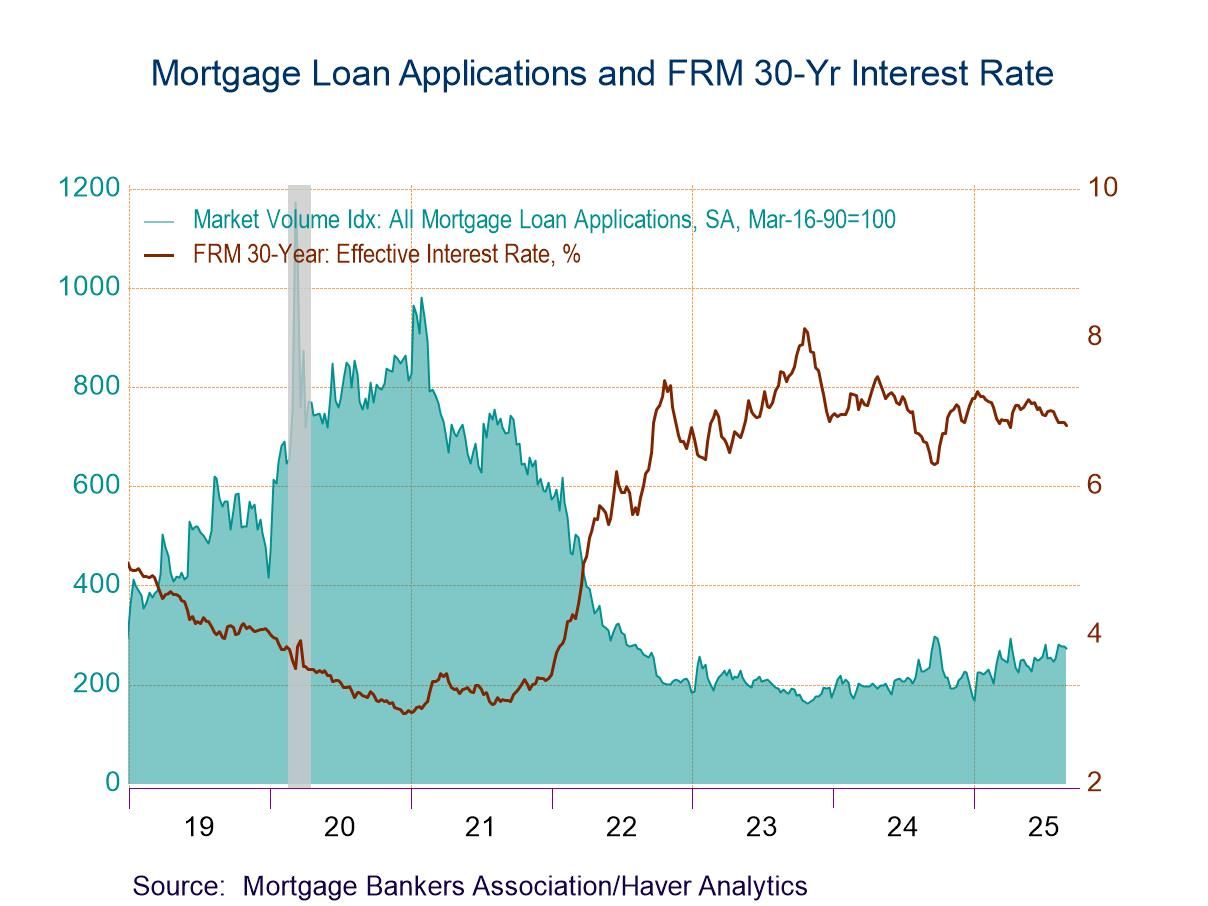

U.S. Mortgage Applications Declined in Latest Week

- Purchase applications dropped while loan refinancing edged up.

- Fixed-interest rate on 30-year loan holds at a 4-month low.

- Average loan size edged up.

Global| Sep 03 2025

Global| Sep 03 2025S&P Composite PMIs Improve in August

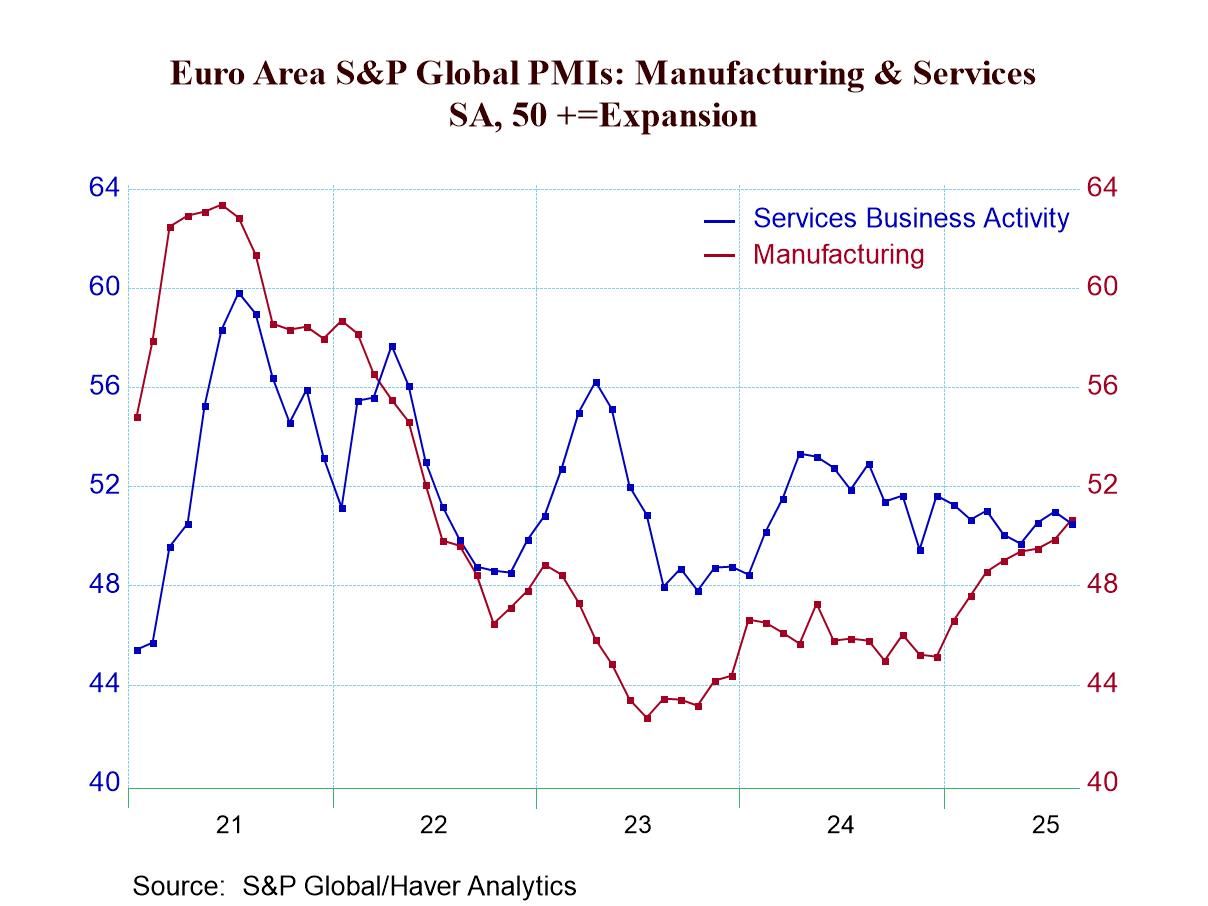

The S&P composite PMIs in August have advanced broadly with only four of 25 reporters showing weaker conditions in August compared to July. In July 13 of these same reporters showed worsening conditions and in June 12 reporters showed worsening conditions. August is a marked turnaround for this survey. One caveat is that the U.S .data in this report continued to use the preliminary services estimate because the final U.S. estimate is not yet available.

Over three months compared to six months, 9 of 25 reporters show worsening conditions. Over six months compared to 12 months, 12 of 25 reporters showed worsening conditions. Over 12 months compared to a year ago, 15 reporters out of 25 showed worsening conditions. There has been a progression in terms of the breadth for reporting countries that are showing improvement in addition the overall average. It has improved slightly from 51.7 over 6 and 12 months to 51.9 over 3 months. The medians have improved from 51.1 over 12 months to 51.5 over 6 months to 51.6 over 3 months, a slightly clearer progression toward better results. Still, both of them are on fairly thin margins of improvement. However, June to August the averages and medians show a little bit more movement and a little more progression to better readings.

The statistic that is perhaps most encouraging is the one about the percentage of reporters that are weaker in August; only 16 were weaker compared to July; in July 52% were weaker compared to June, but in June 48% were weaker compared to May. Looking at the broader progressive period, 39.1% are weaker over 3 months, 52.2% are weaker over 6 months compared to 39.1% weaker over 12 months. The proportion of reporters weakening over these horizons is moderate on the order of 40% to 50%- tending to readings below 50%.

The queue percentile standings show only 8 reporters out of 25 have standings below their median since January 2021.

The chart on top depicts separately the services business activity index for the euro area versus the euro area manufacturing PMI. While the services readings have been relatively stable - perhaps trending slightly to weakness from earlier in the year - manufacturing PMIs have been improving consistently and strongly. At first it was thought that this was manufacturing activity that was ramping up to try to create output to export before U.S. tariffs went into effect, but since the tariff deadline has come and gone, manufacturing has continued to stay strong and to further strengthen. This is an unexpected and impressive trend.

- of2700Go to 45 page